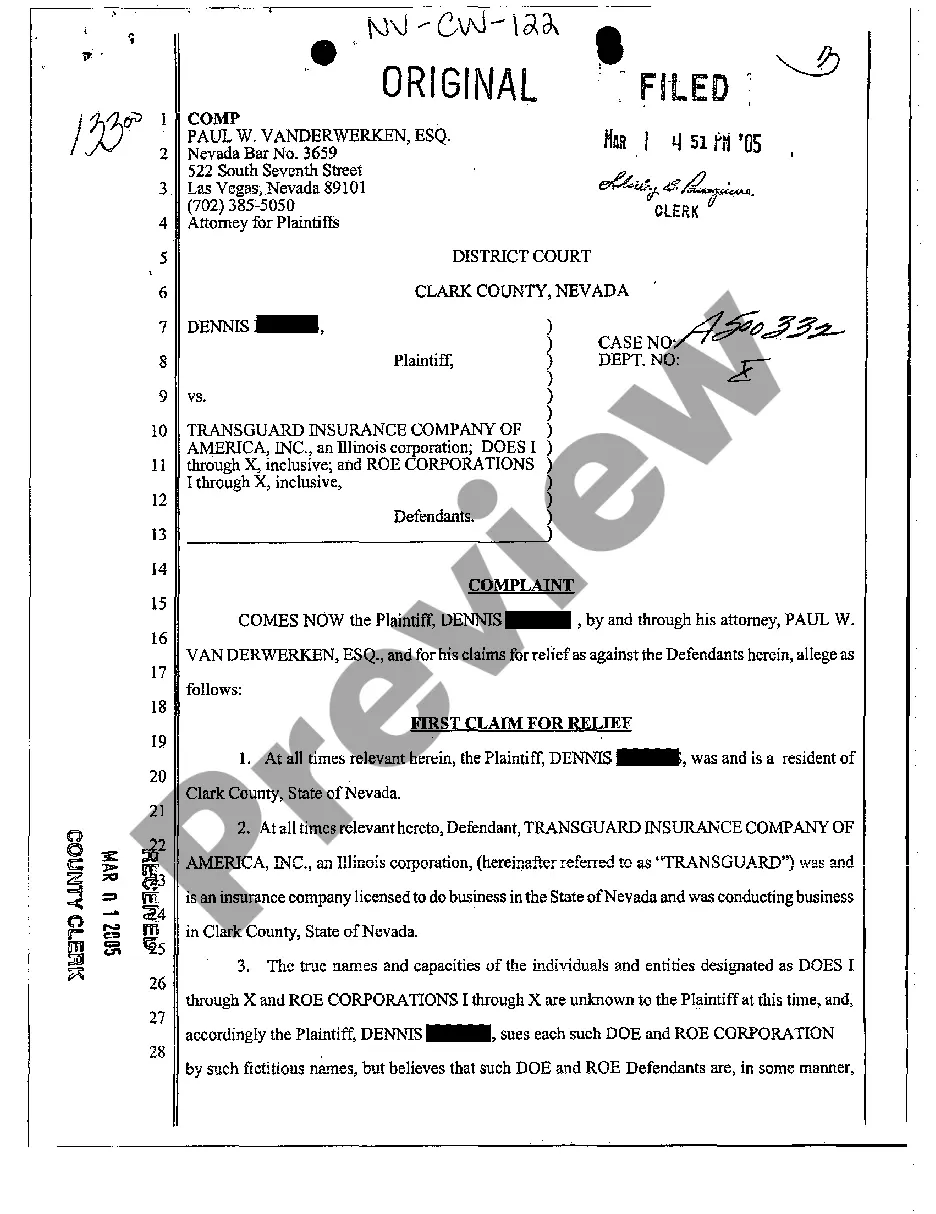

Nevada Complaint - Breach of Automobile Insurance Policy

Description

How to fill out Nevada Complaint - Breach Of Automobile Insurance Policy?

Among numerous paid and free samples that you find on the web, you can't be certain about their accuracy. For example, who made them or if they are qualified enough to deal with what you need those to. Always keep relaxed and use US Legal Forms! Find Nevada Complaint - Breach of Automobile Insurance Policy templates made by skilled attorneys and prevent the costly and time-consuming process of looking for an lawyer and then paying them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access your earlier downloaded files in the My Forms menu.

If you are utilizing our platform the first time, follow the instructions below to get your Nevada Complaint - Breach of Automobile Insurance Policy fast:

- Ensure that the file you discover is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and paid for your subscription, you may use your Nevada Complaint - Breach of Automobile Insurance Policy as many times as you need or for as long as it stays valid where you live. Change it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Receives and processes consumer complaints. The CDI toll-free hotline number is: 1-800-927-HELP (4357). Be aware that when you file a formal complaint the CDI contacts your insurance company, tells them about your complaint, and gets their side of the story.

A breach of insurance contract can also make an insurance company liable for bad faith. The insurance company owes the insured a duty of good faith and fair dealing. Often, an insurance will act in bad faith in failing to pay the claim.

Insurance companies in Nevada have 80 working days to settle a claim after it is filed. Nevada insurance companies also have specific timeframes in which they must acknowledge the claim and then decide whether or not to accept it, before paying out the final settlement.

It is standard to receive your first contact with the insurance adjuster within one to three days of filing the claim. If an adjuster needs to look at the damage, it can take a couple more days.

Most states give you two to three years to settle your car accident insurance claim. If you file after the statute of limitations has passed, the court will reject your claim, even if you are only a few days late. This harsh response is based on the reality that as time passes, memories fade and records get lost.

Most auto accident insurance claims can be resolved with the insurance company without a lawsuit being filed.Very few cases actually go to trial, with most car accident cases settling out of court. The best way to understand why this happens is to look at the benefits of settlements as opposed to jury trials.

Using the Financial Ombudsman Service All insurers must be covered by the rules of the financial watchdog, the Financial Conduct Authority (FCA). This means that if you have a complaint about an insurer, you can take it to the Financial Ombudsman Service.

On average, the typical settlement can take up to six weeks for processing. This is due to a number of factors and may vary from one case to another.

The CDI toll-free hotline number is: 1-800-927-HELP (4357). Be aware that when you file a formal complaint the CDI contacts your insurance company, tells them about your complaint, and gets their side of the story.