New Mexico Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

About this form

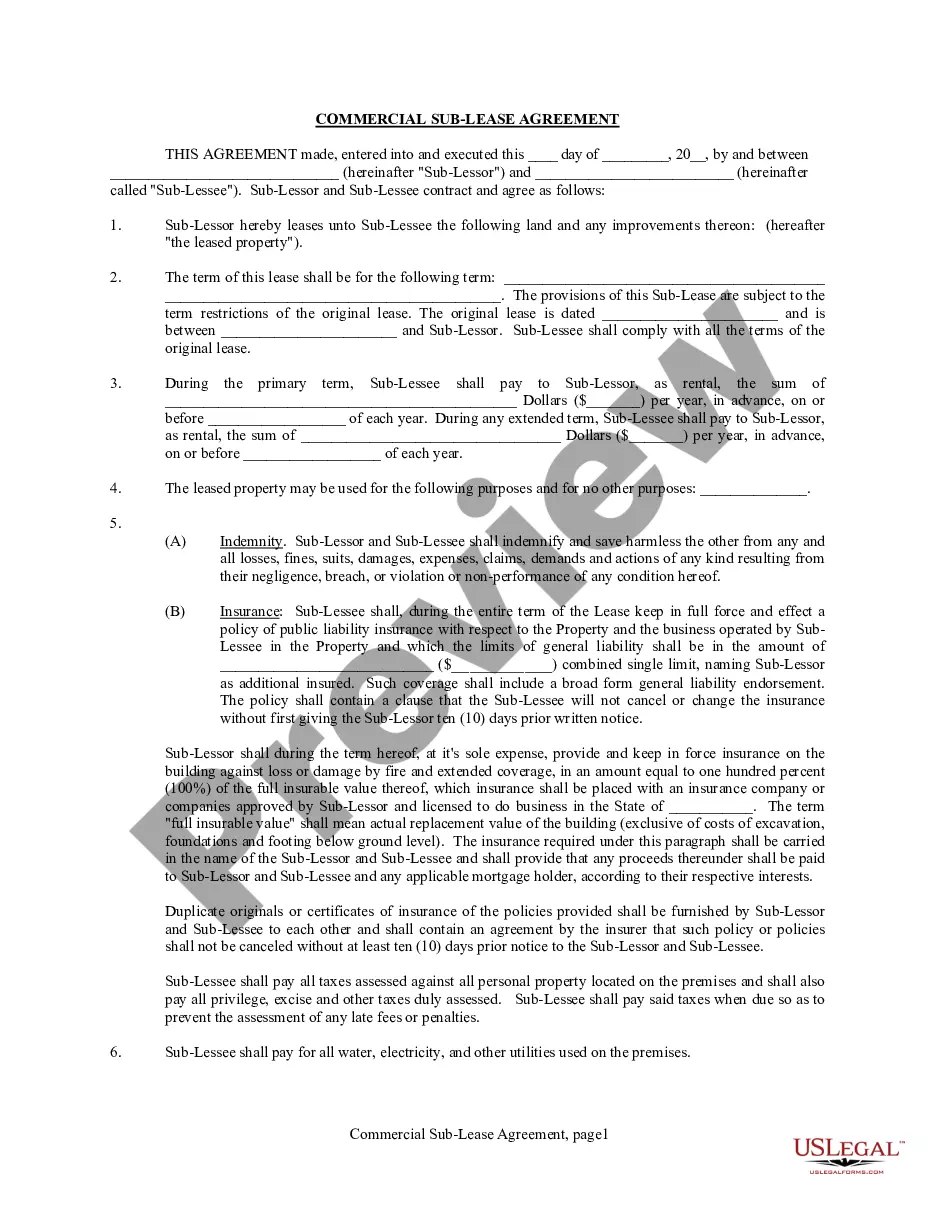

The New Mexico Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines a borrower's promise to repay a loan, with commercial property being used as collateral. This form differs from standard promissory notes as it specifically addresses secured loans, ensuring that the lender has recourse in case of default. It is designed for parties engaging in financial transactions related to real estate in New Mexico.

Main sections of this form

- Borrower's promise to pay the principal amount plus interest to the lender.

- Specified interest rate applicable to unpaid principal.

- Details on monthly payments, including due dates and total payment amounts.

- Provisions for prepayment options and conditions.

- Consequences of late payments and borrower default.

- Legal obligations secured by a mortgage or deed of trust.

When to use this form

This form should be used when a borrower is obtaining a loan for commercial purposes and intends to secure the loan with commercial real estate. It is applicable in situations where the borrower may need to make structured payments over time while leveraging their property as collateral, which provides additional security to the lender.

Who should use this form

- Borrowers seeking financing for commercial property activities.

- Lenders offering loans secured by commercial real estate.

- Real estate investors entering into financing agreements.

- Business owners looking to secure loans for business expansion using property as collateral.

Instructions for completing this form

- Identify the parties involved, including the borrower(s) and lender.

- Specify the loan amount, including the principal and interest rate.

- Set clear terms for monthly payments, including the due date and amount.

- Include any prepayment options and late fee structures as applicable.

- Sign and date the document, ensuring all parties receive a copy for their records.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly define the loan amount or interest rate.

- Not specifying the exact due date for monthly payments.

- Neglecting to include terms for late charges or prepayment options.

- Omitting signatures from all parties involved in the agreement.

Benefits of using this form online

- Convenience of downloading and printing from home or office.

- Easy customization to fit specific loan terms and conditions.

- Access to legal forms drafted by licensed attorneys for compliance assurance.

- Time-saving process without the need to visit a lawyerâs office.

Looking for another form?

Form popularity

FAQ

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the maker or issuer) promises in writing to pay a determinate sum of money to the other (the payee), either at a fixed or determinable future time or

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Simple Promissory Note. Student Loan Promissory Note. Real Estate Promissory Note. Personal Loan Promissory Notes. Car Promissory Note. Commercial Promissory note. Investment Promissory Note.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

There are four significant types of promissory notes in India. A personal note is the kind of promissory note that an individual should seek when lending money to family members or close relatives. A commercial note is the type of promissory note that is signed between a borrower and a financial institution.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.