New Mexico Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

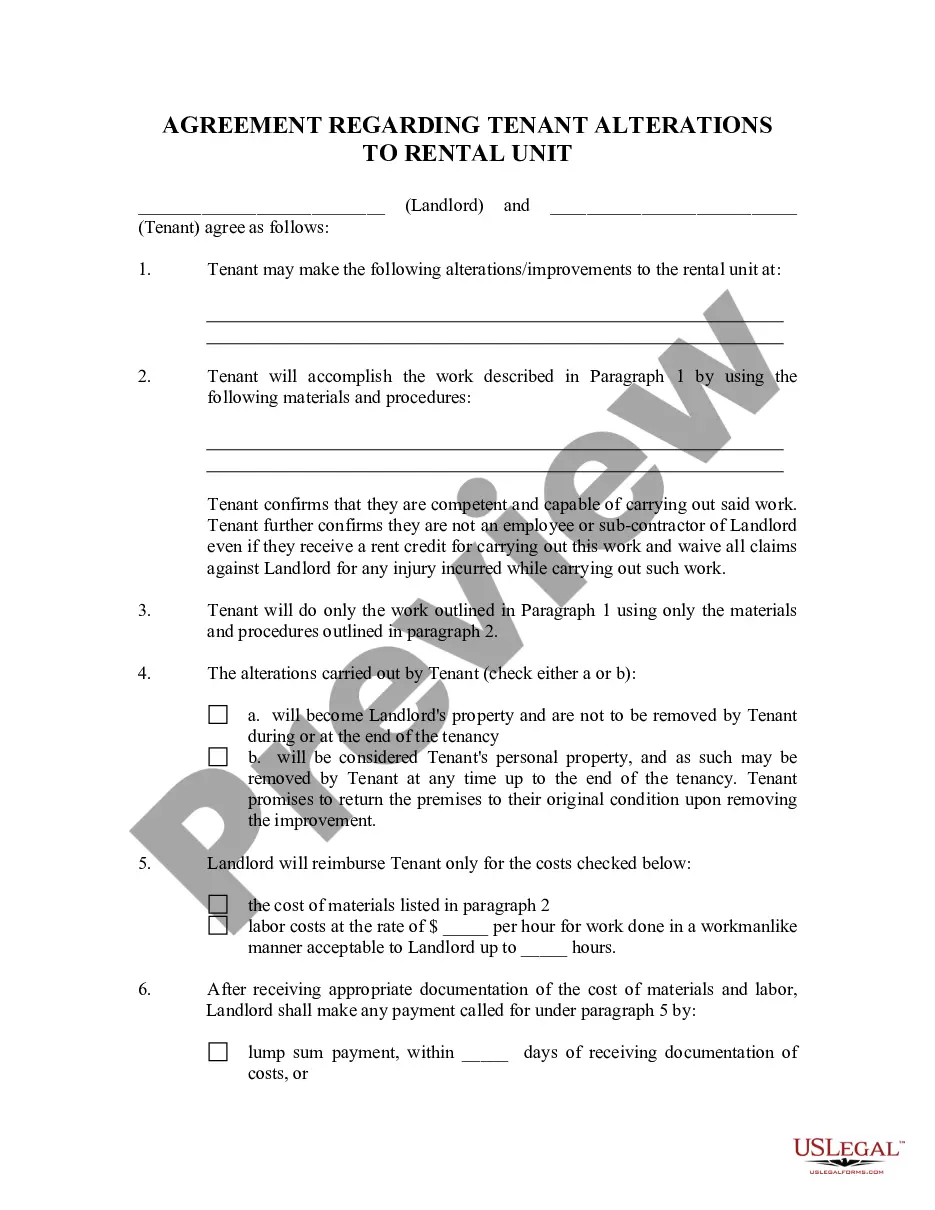

How to fill out New Mexico Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

US Legal Forms is really a special system where you can find any legal or tax form for filling out, including New Mexico Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. If you’re sick and tired of wasting time searching for ideal samples and spending money on file preparation/lawyer fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s benefits, you don't have to download any application but simply choose a subscription plan and sign up an account. If you have one, just log in and find an appropriate template, save it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need New Mexico Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children, take a look at the recommendations below:

- check out the form you’re looking at is valid in the state you want it in.

- Preview the example its description.

- Click Buy Now to reach the register page.

- Choose a pricing plan and keep on registering by entering some information.

- Choose a payment method to finish the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure concerning your New Mexico Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children sample, speak to a legal professional to review it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

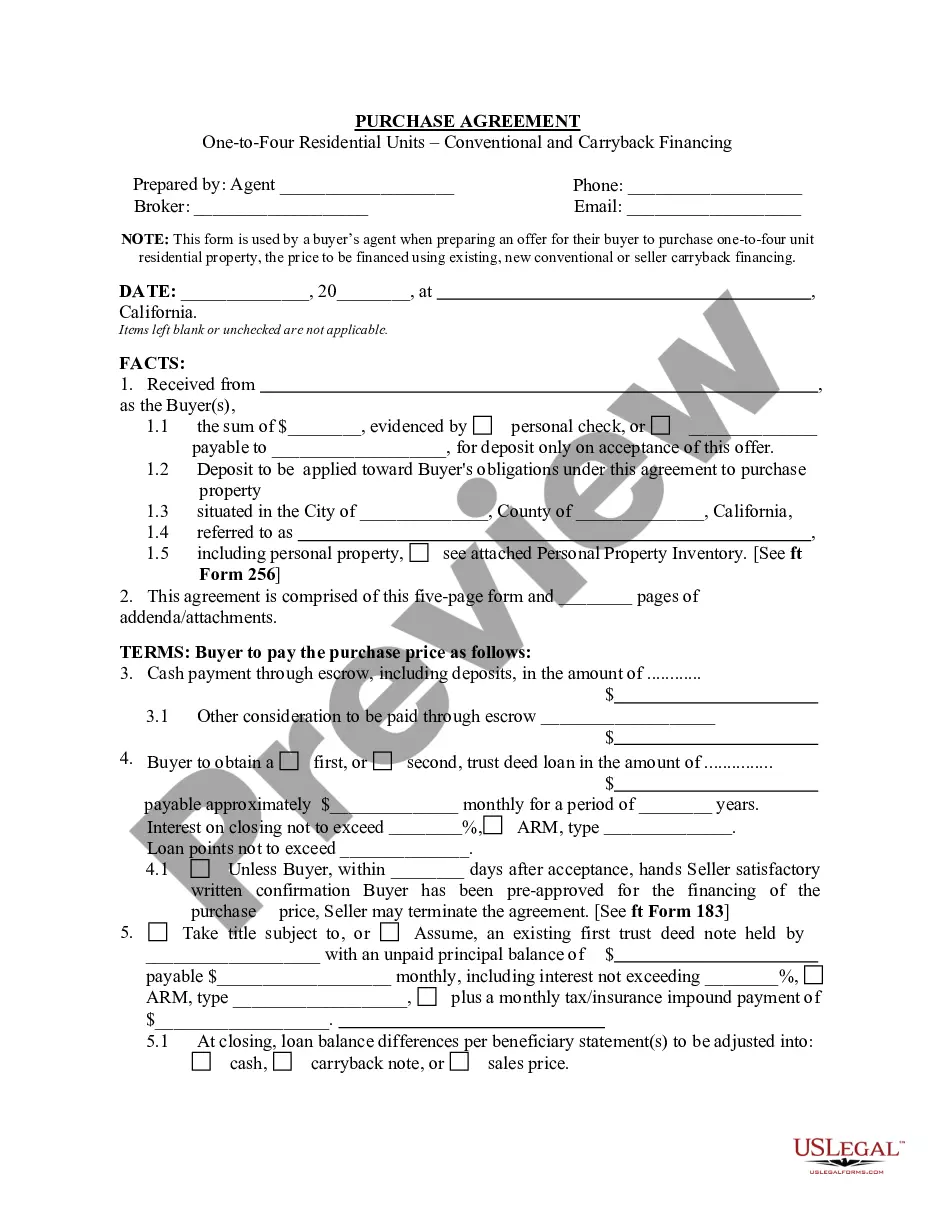

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

If this is how you feel, then you should set up a living irrevocable trust fund. This type of trust can be set up to begin dispersing funds when certain conditions are met. There is no stipulation that you cannot be alive when that happens. You can place cash, stock, real estate, or other valuable assets in your trust.

Decide whether you need a shared trust or an individual trust. Decide what items to leave in the trust. Decide who will inherit your trust property. Choose someone to be your successor trustee. Choose someone to manage property for youngsters. Prepare the trust document.

Living Trust Like a will, a trust will require you to transfer property after death to loved ones.Unlike a will, a living trust passes property outside of probate court. There are no court or attorney fees after the trust is established. Your property can be passed immediately and directly to your named beneficiaries.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.