New Mexico Quitclaim Deed from Individual to Husband and Wife

Description

Definition and meaning

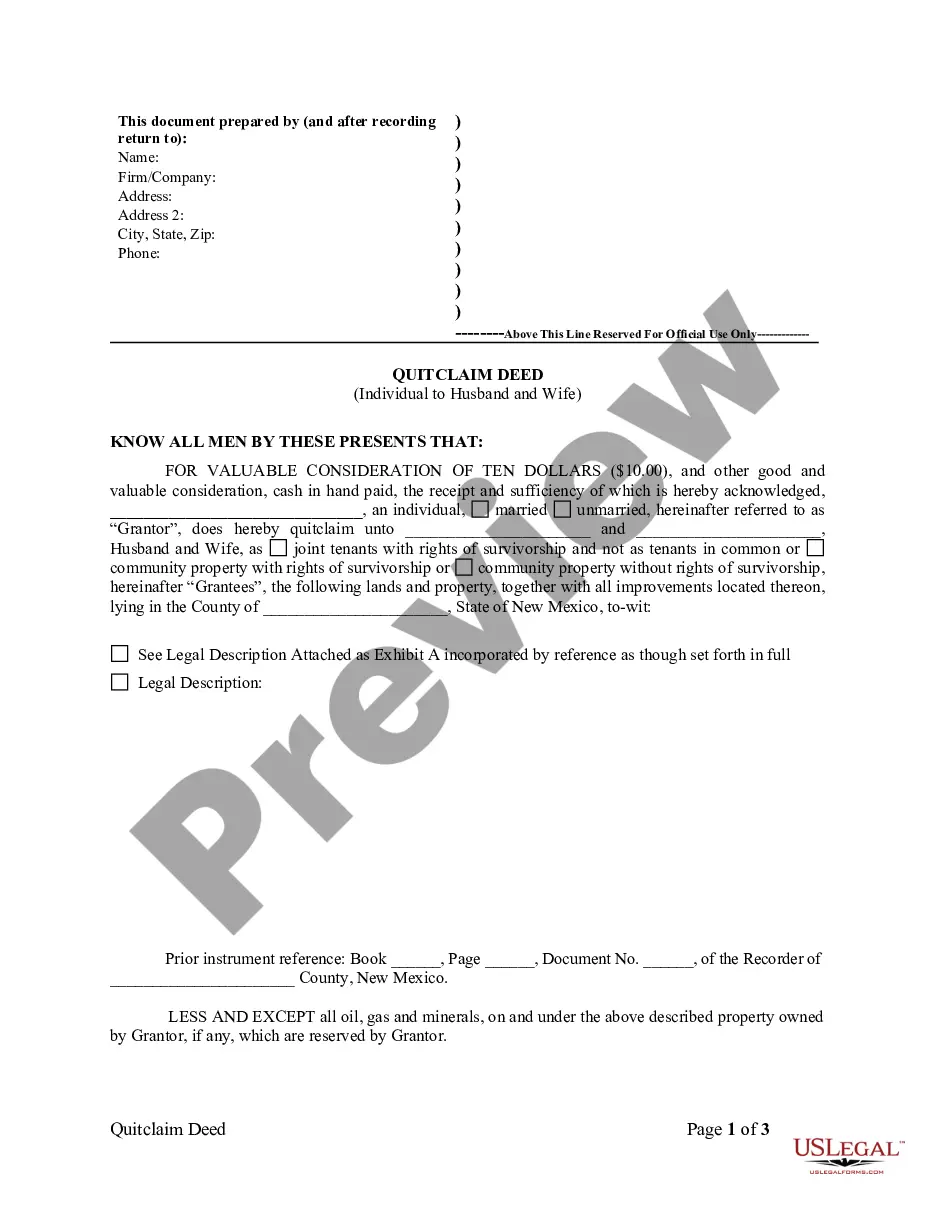

A Quitclaim Deed is a legal document that allows an individual, known as the Grantor, to transfer any interest they have in a property to another individual or individuals, referred to as the Grantees. In this specific case, the document facilitates the transfer of property from an individual to a couple (husband and wife) as joint tenants. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the Grantor holds valid ownership of the property. It simply relinquishes any claim they might have, making it important for Grantees to confirm the property’s title before acceptance.

How to complete a form

Completing a New Mexico Quitclaim Deed requires attention to detail. Follow these steps:

- Identify the Grantor: Enter the full name of the individual transferring the property.

- Identify the Grantees: List the names of both individuals receiving the property, indicating they are married.

- Property Description: Provide a thorough legal description of the property being transferred. This might be included as an exhibit.

- Consideration Amount: State the consideration amount as nominal, commonly $10.00, along with any additional valuable considerations.

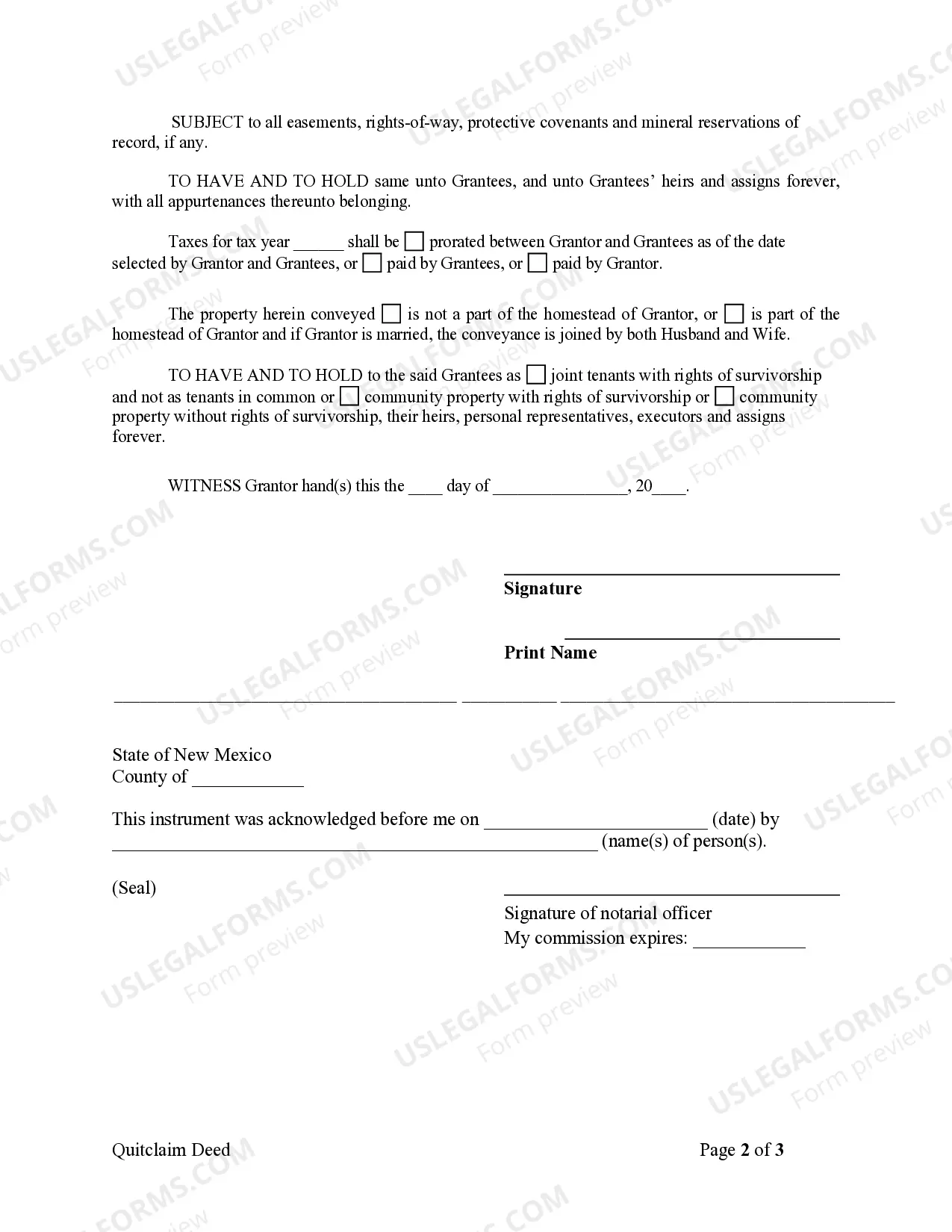

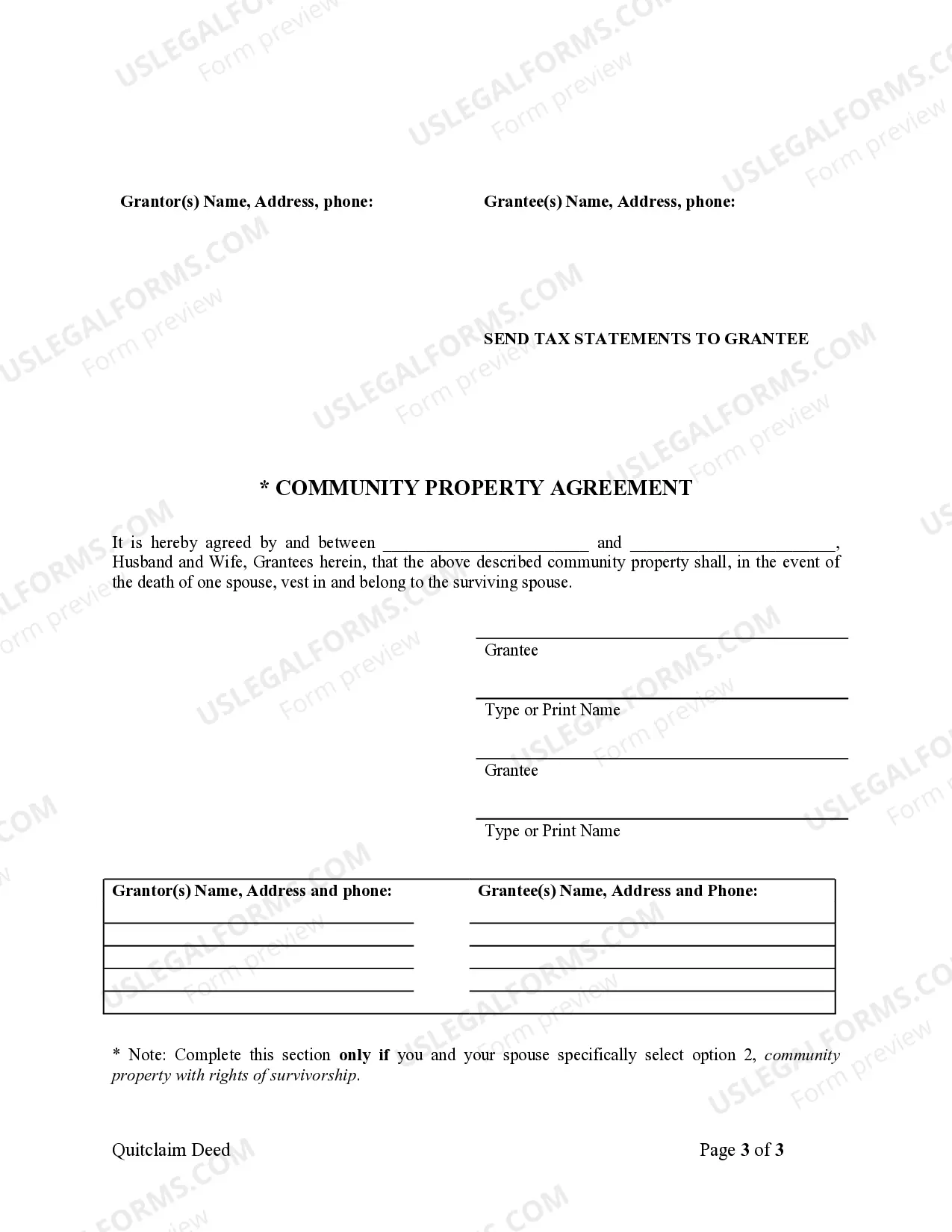

- Tax Proration: Specify whether taxes will be prorated or paid by either the Grantor or Grantees.

- Signatures: Ensure the Grantor signs and dates the document, and have it notarized.

Who should use this form

This Quitclaim Deed is ideal for individuals who are looking to transfer property ownership to a married couple, particularly when they wish to do so without the complexities associated with warranties. Common users include:

- Individuals wanting to transfer property to their spouse.

- Owners gifting property to family or friends.

- People involved in divorce settlements where property needs to be transferred.

Legal use and context

In legal terms, a Quitclaim Deed is often used when the parties involved have a reasonable expectation of ownership. While it can simplify property transfers, it carries risks since it does not confirm the Grantor's ownership. It is typically used during:

- Real estate transactions between family members.

- Property transfers associated with marriage.

- Situations where the property owner wishes to disclaim interest without affirming title validity.

Key components of the form

The New Mexico Quitclaim Deed contains several essential components that ensure its validity and clarity, including:

- Grantor and Grantee Information: Complete legal names and marital status.

- Consideration Clause: A statement regarding the nominal consideration exchanged.

- Property Description: An accurate legal description of the property being conveyed.

- Notary Acknowledgment: A verification by a notary public to uphold the document's legitimacy.

- Tax Proration Information: Details on how property taxes will be handled.

Common mistakes to avoid when using this form

When completing the Quitclaim Deed, several common pitfalls can arise, and avoiding them is crucial for a successful transfer:

- Incomplete Information: Ensure all fields, particularly names and property descriptions, are accurately filled.

- Neglecting Notarization: Remember that notarization is needed for the deed to be legally binding.

- Incorrect Legal Description: Verify the property’s legal description is precise to avoid future disputes.

- Failing to Consider Tax Implications: Clarify who will be responsible for taxes to prevent misunderstandings.

How to fill out New Mexico Quitclaim Deed From Individual To Husband And Wife?

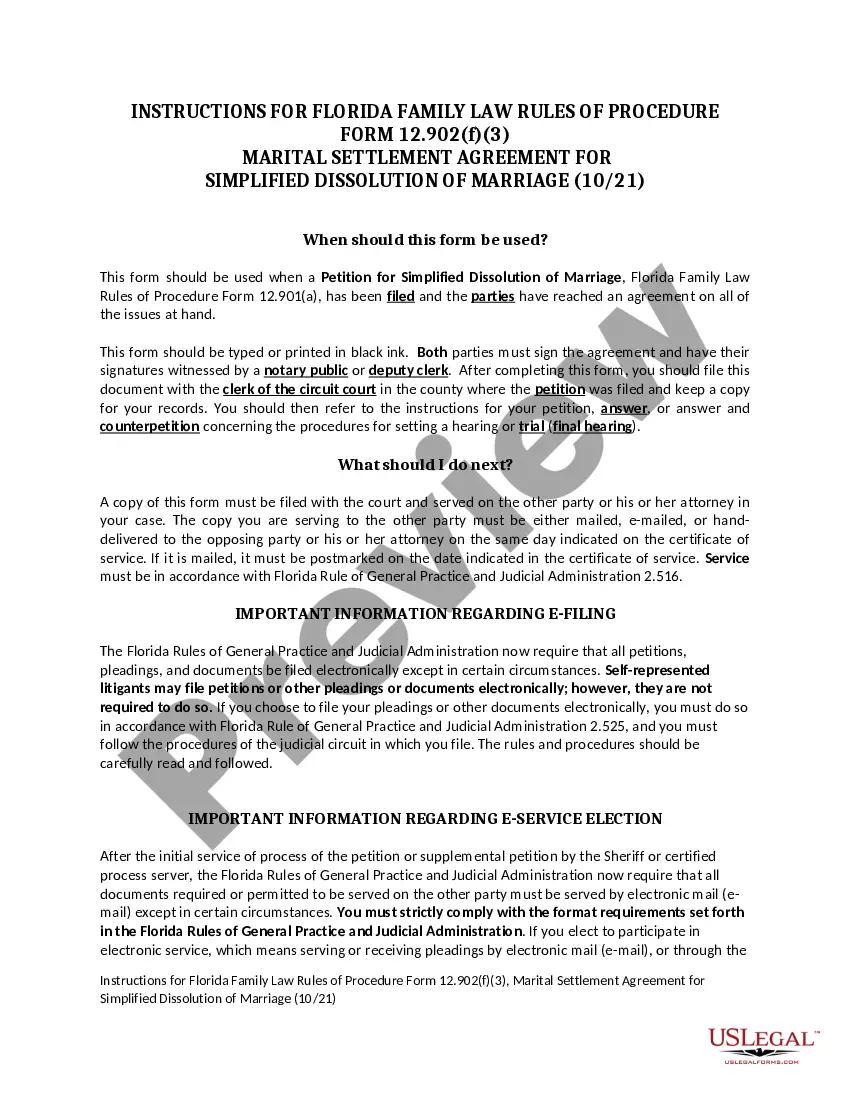

- Log in to your US Legal Forms account if you are a returning user to download the necessary form template.

- If you're new, start by previewing the available forms and their descriptions. Ensure you select the one that meets your needs and complies with New Mexico laws.

- If needed, use the search function for alternative templates until you find the correct one.

- Once you've selected your document, click the 'Buy Now' button and choose a subscription plan that suits you. Remember, account registration is required for resource access.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Download your form and save it on your device. You can also access your downloaded documents anytime from the 'My Documents' section of your profile.

In conclusion, using US Legal Forms simplifies the process of obtaining a New Mexico Quitclaim Deed from Individual to Husband and Wife. Their extensive library and expert support ensure that you can complete your legal documentation accurately. Don't wait—start your process with US Legal Forms today!

Form popularity

FAQ

Gift Tax. If you transfer property without consideration, you are effectively making a gift, regardless of whether you use a quitclaim deed or a gift deed. The Internal Revenue Service imposes federal gift tax rules to gift transactions.

Notary Public (Section 47-1-44) In New Mexico it must be signed with a Notary Public viewing the Grantor(s) signature(s). Recording A quit claim deed is required to be filed at the County Clerk's Office where the property is located along with the required recording fee(s).

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.