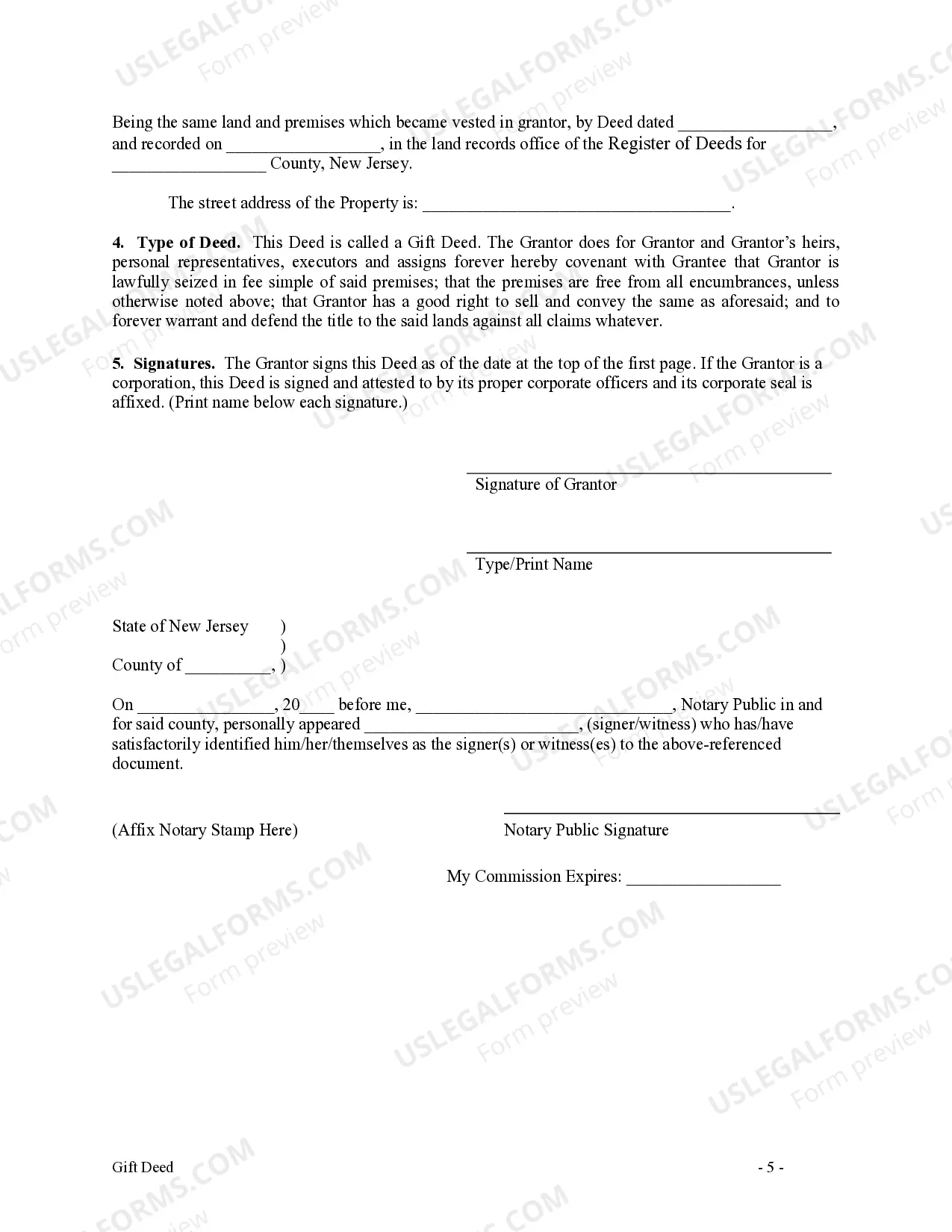

New Jersey Gift Deed for Individual to Individual

Description

How to fill out New Jersey Gift Deed For Individual To Individual?

US Legal Forms is actually a special platform to find any legal or tax document for submitting, such as New Jersey Gift Deed for Individual to Individual. If you’re tired with wasting time searching for suitable samples and spending money on record preparation/lawyer charges, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s benefits, you don't need to download any software but just select a subscription plan and register your account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Gift Deed for Individual to Individual, check out the instructions below:

- Double-check that the form you’re considering is valid in the state you need it in.

- Preview the form and look at its description.

- Simply click Buy Now to reach the sign up webpage.

- Pick a pricing plan and proceed registering by providing some info.

- Select a payment method to finish the sign up.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, complete the document online or print it. If you are unsure regarding your New Jersey Gift Deed for Individual to Individual template, contact a attorney to check it before you send or file it. Start hassle-free!

Form popularity

FAQ

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

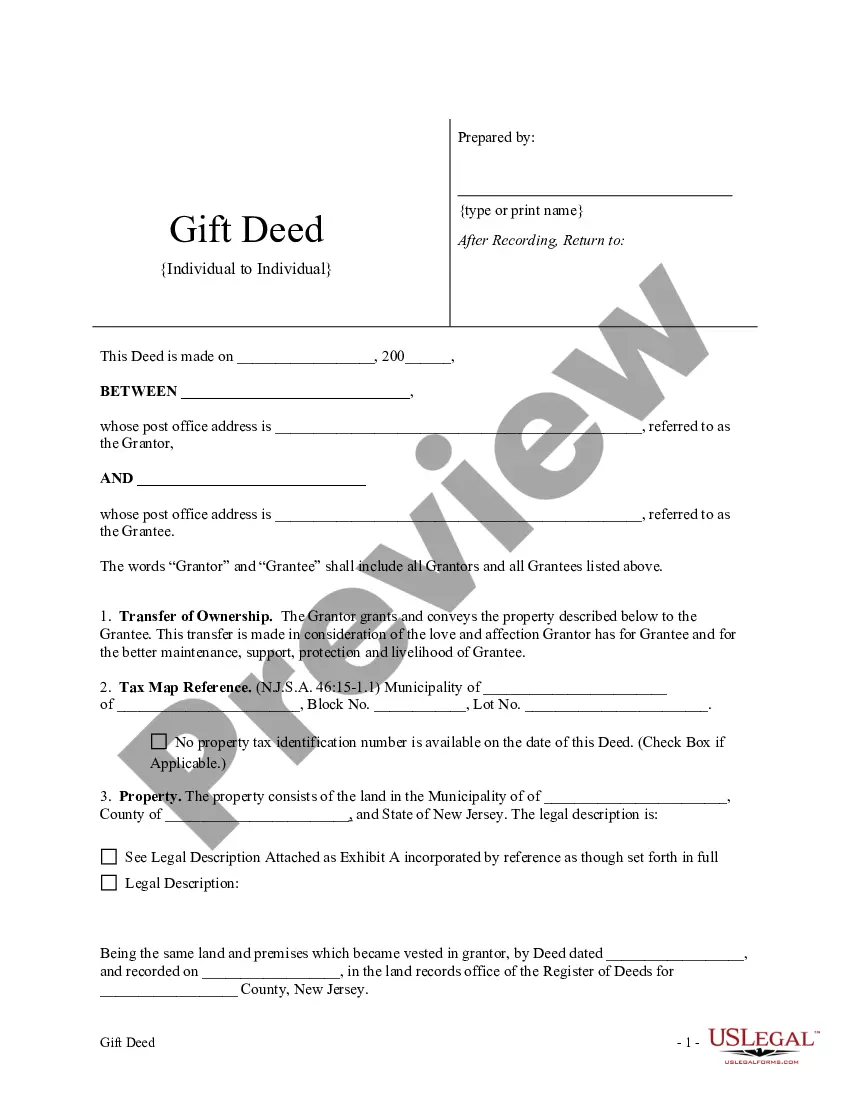

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

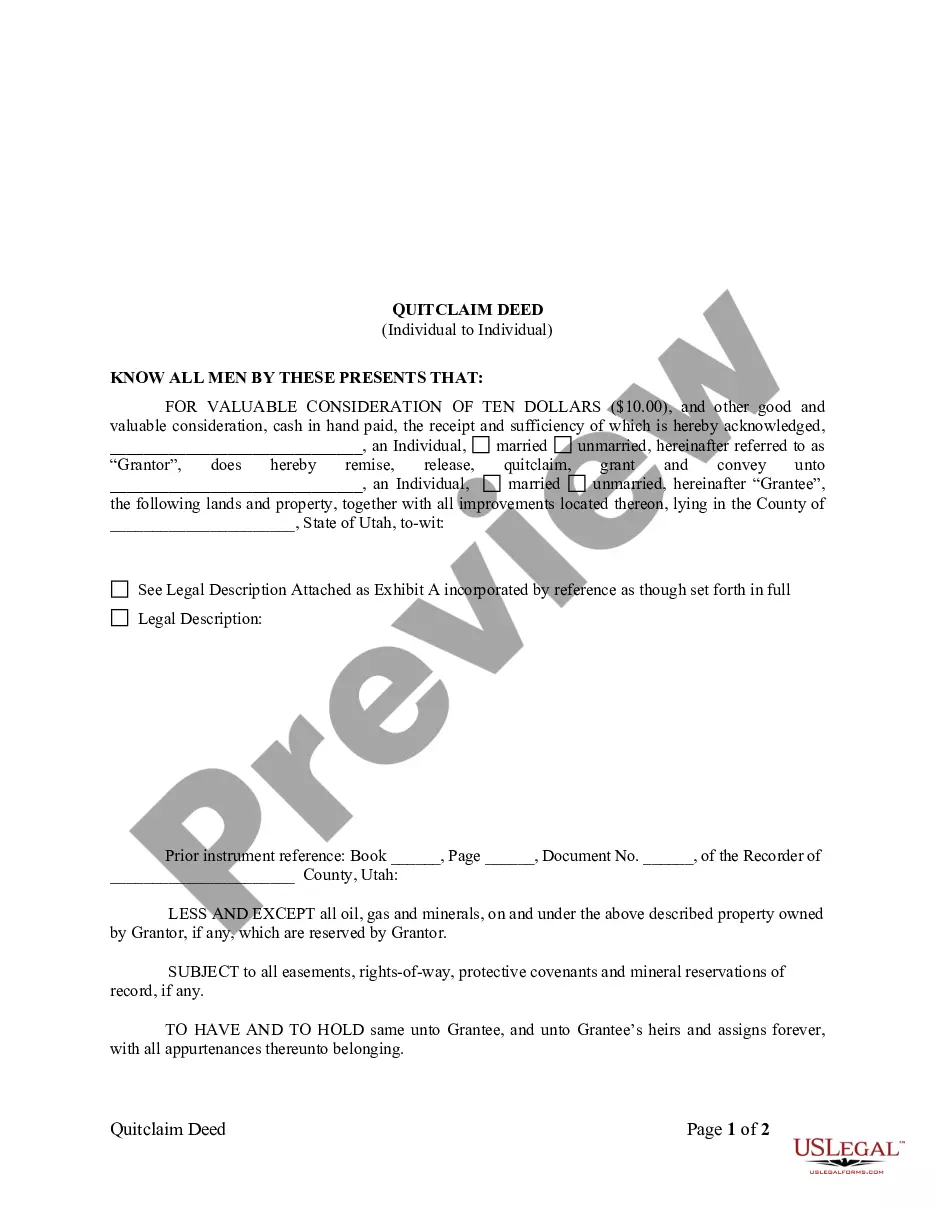

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee), typically between family members or close friends. Gift deeds are also used to donate to a non-profit organization or charity.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

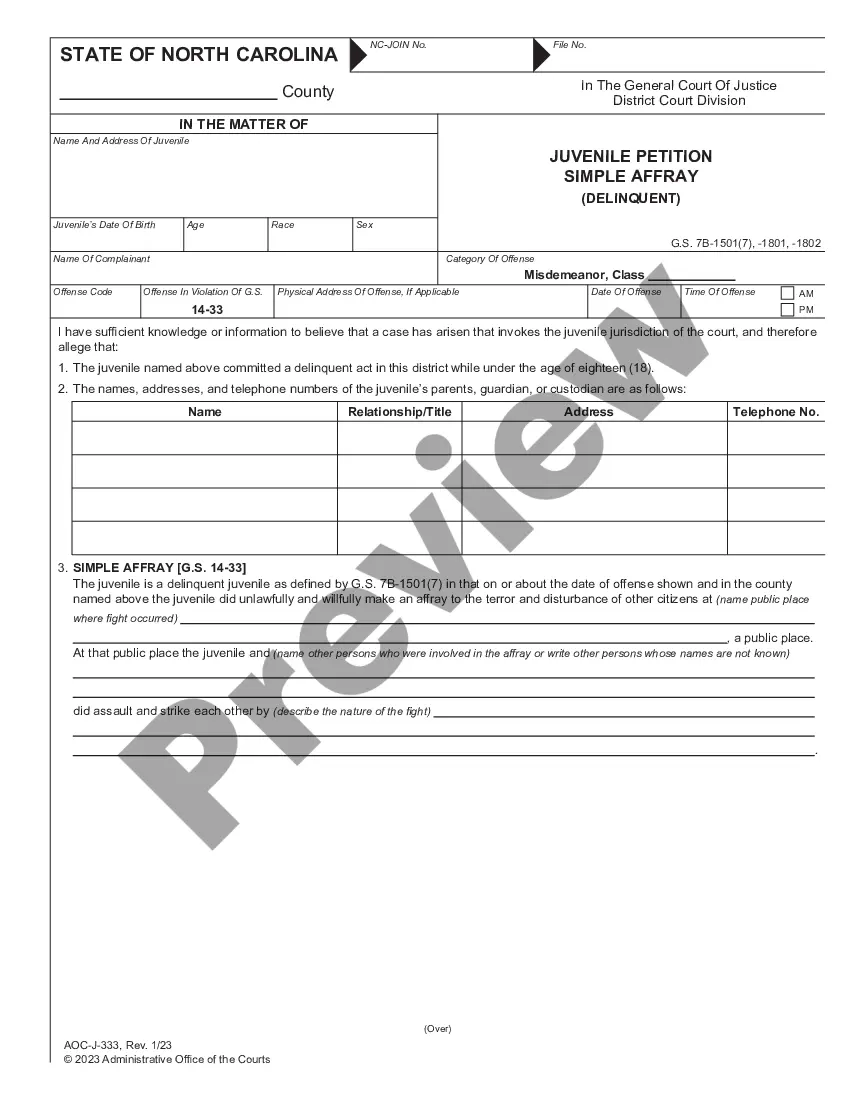

Any person of sound mind, and above the age of 18 can be a witness. any least two witnesses should attest in the gift deed . - Since, the said property is self acquired property of your grandfather , then he is having his right to gift you without the interfere of any other legal heirs like your father etc.

For the purpose of making a gift of immovable property, the transfer must be registered, signed by or on behalf of the donor, and attested by at least two witnesses. The stamp duty, calculated on the basis of the market value of the property (differing from state to state), must be paid at the time of registration.

1. Your friend can execute a registered Gift Deed to the person to whom she intends to gift. 2.So, for the gift to be valid, you must transfer the property voluntarily, without consideration, and it must be accepted by your friend during your lifetime while you are capable of giving.