New Hampshire Conditional Waiver and Release of Lien Upon Progress Payment

Understanding this form

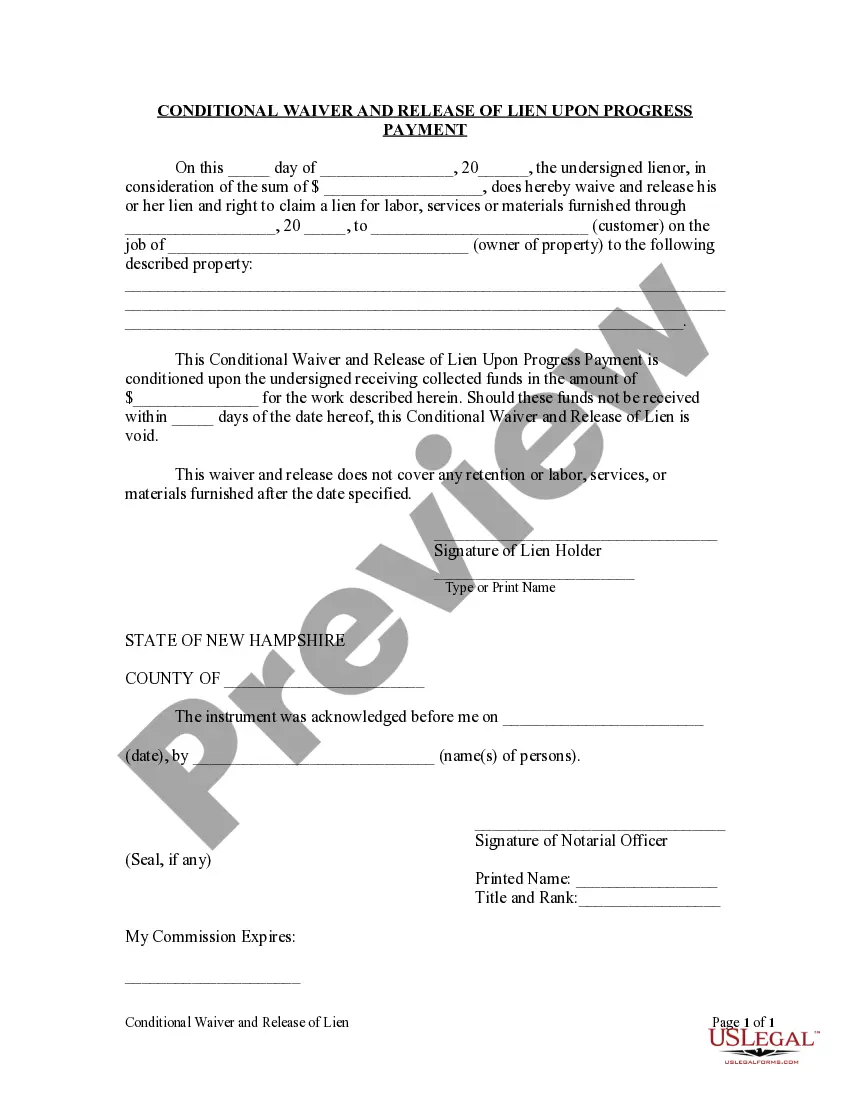

The Conditional Waiver and Release of Lien Upon Progress Payment form is a legal document used by lienors to waive their right to claim a lien for labor, services, or materials provided to property owners. This form is typically used when a lienor receives payment for ongoing work. It protects the property owner by ensuring that they are not subject to future lien claims for payments already made. Unlike general lien waivers, this form is conditional upon the lienor receiving the specified payment within a set timeframe.

What’s included in this form

- Date of waiver and release

- Amount of payment received in exchange for the waiver

- Description of labor, services, or materials provided

- Customer and property owner information

- Condition for waiver related to payment collection

- Signature of the lien holder

Situations where this form applies

This form should be used when a contractor, subcontractor, or supplier wants to waive their lien rights in exchange for progress payments received for work completed up to a specific date. It is essential for instances where there is a need to provide assurance to property owners that no further claims will be made for work that has already been fully paid for.

Who needs this form

- Contractors providing services or materials

- Subcontractors and suppliers involved in construction projects

- Property owners wishing to secure a clean title free from liens

- Any party looking to formalize a waiver related to a progress payment

Completing this form step by step

- Enter the date of the waiver and release.

- Specify the amount of payment received.

- Detail the description of the labor, services, or materials provided.

- Fill in the names of the customer and the property owner.

- Indicate the deadline for payment collection.

- Sign and print the name of the lien holder at the end.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Not specifying the correct date or amount of payment.

- Failing to provide a detailed description of the work performed.

- Not indicating the payment collection deadline.

- Skipping the signature of the lien holder.

Benefits of completing this form online

- Convenient access to legal templates from anywhere.

- Easy to fill out and customize for specific needs.

- Reliable guidance provided by licensed attorneys.

- Options for secure online notarization, if required.

Looking for another form?

Form popularity

FAQ

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Name of Claimant. This is the name the party to be paid, and the party who will be signing the lien waiver document. Name of Customer. Job Location. Owner. Maker of the Check. Amount of the Check. Check Payable To. Exceptions.

Signing an unconditional lien waiver is enforceable even before you get paid. This means that if you sign an unconditional lien waiver before receiving the money and the property owner ends up not paying up, you have already waived your lien rights because you signed the unconditional lien waiver.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

LIen waivers are not required to be notarized. The primary times that a document needs to be notarized is if it is going to be filed with the county recorder or it is an affidavit. There are some other documents that often use notarization, but lien...

The undersigned makes this Waiver specifically for the benefit of the Owner and the Owner's lender, and any other person or entity with a legal or equitable interest in the Property.

Conditional lien waivers are conditioned upon something (typically the receipt of payment).The party receiving payment maintains its right to file a lien until the check is actually cashed; the party making payment will never face double payment (paying the party they hired and also being faced with a lien).

Conditional lien waivers are provided by contractors or suppliers before they've been paid. The key language to look for in these documents is upon payment of an amount, the vendor releases their right to file a lien on the work provided up until a certain date.