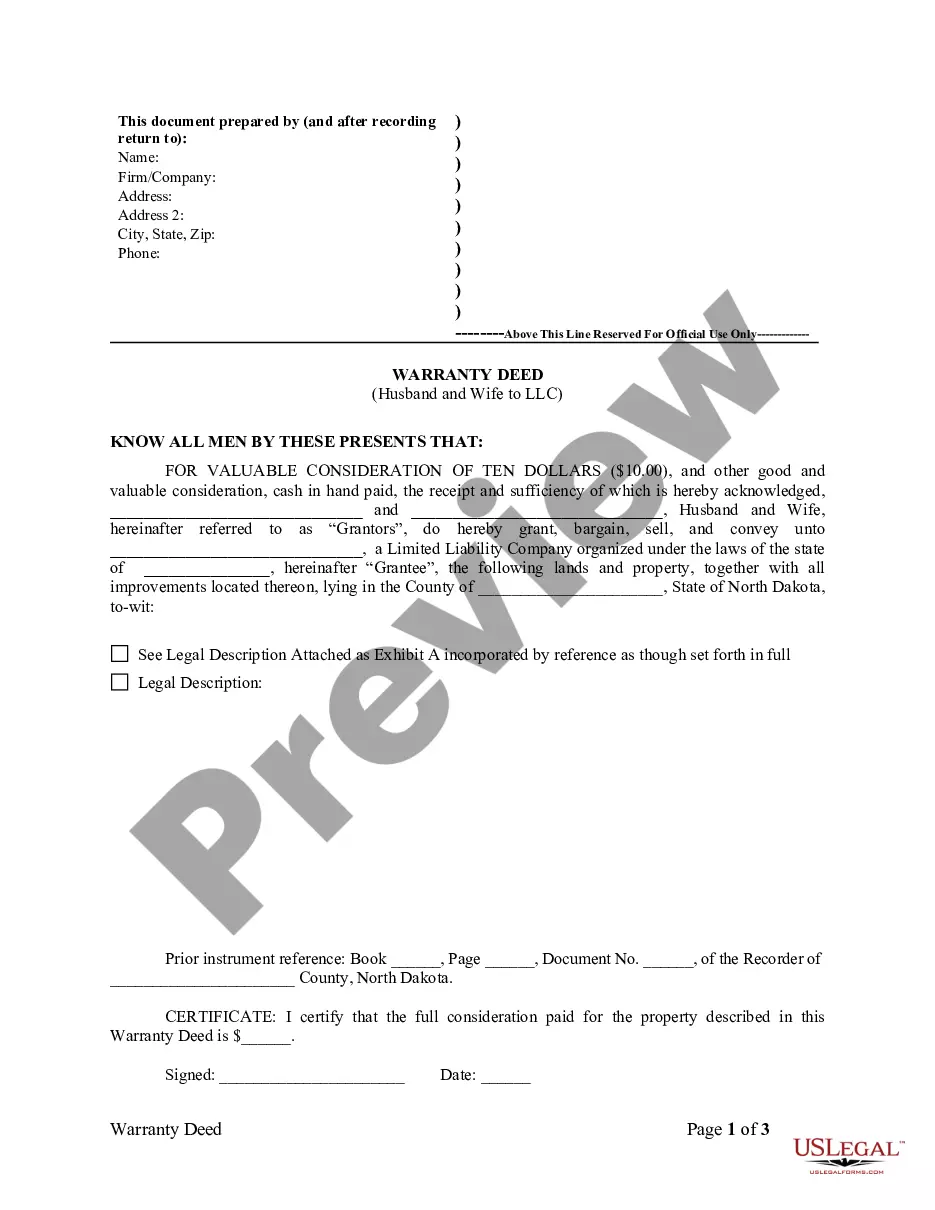

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

North Dakota Warranty Deed from Husband and Wife to LLC

Description

How to fill out North Dakota Warranty Deed From Husband And Wife To LLC?

Avoid pricey lawyers and find the North Dakota Warranty Deed from Husband and Wife to LLC you want at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax files. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables users with step-by-step tips on how to obtain and fill out every template.

US Legal Forms customers merely need to log in and get the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines listed below:

- Make sure the North Dakota Warranty Deed from Husband and Wife to LLC is eligible for use in your state.

- If available, read the description and use the Preview option before downloading the sample.

- If you are sure the template fits your needs, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you are able to complete the North Dakota Warranty Deed from Husband and Wife to LLC by hand or with the help of an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

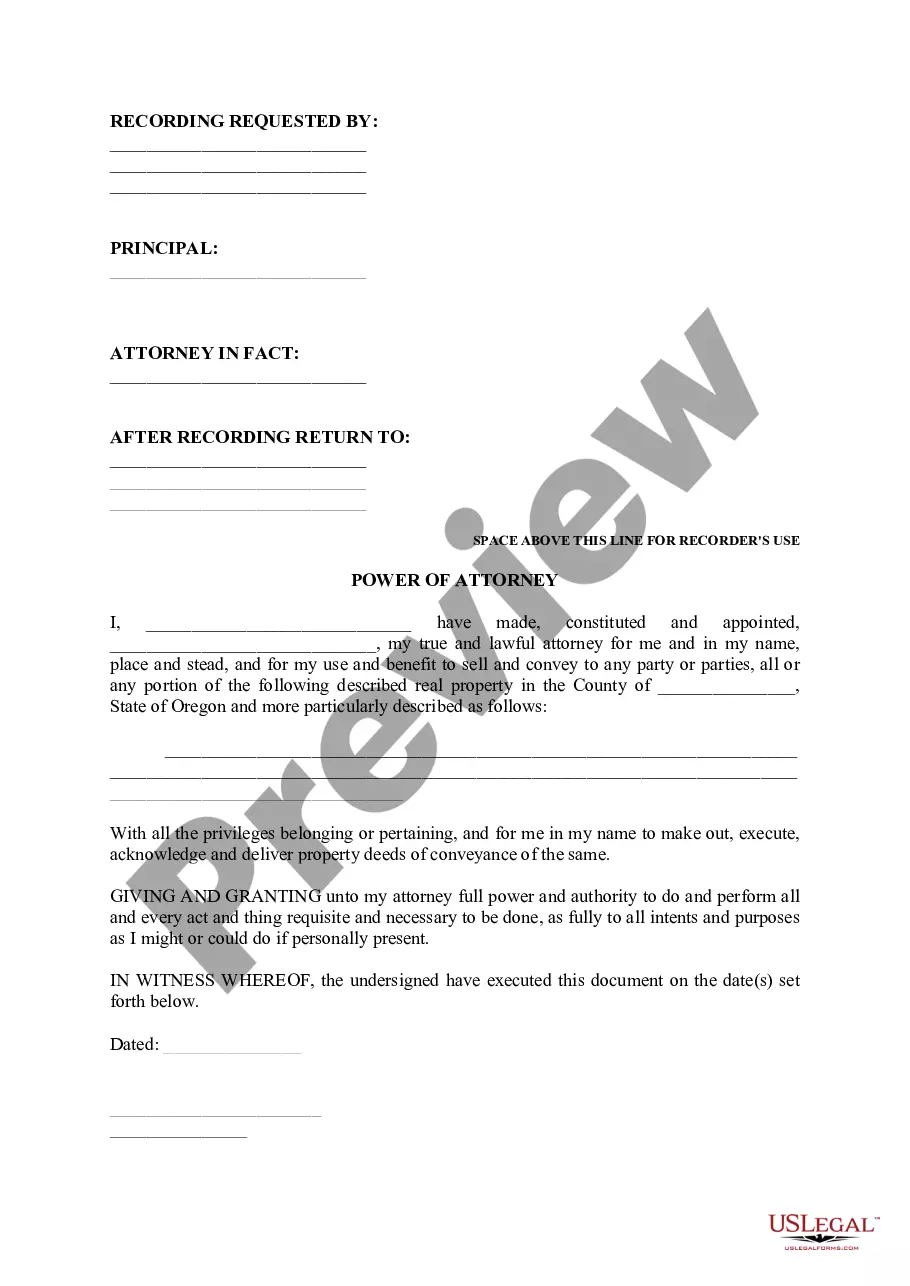

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Quitclaim deeds, therefore, are commonly used to transfer property within a family, such as from a parent to an adult child, between siblings, or when a property owner gets married and wants to add their spouse to the title. Married couples who own a home together and later divorce also use quitclaim deeds.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee.Warranty deeds ensure that the grantor has the right to sell the property, and guarantees that there are no liens or encumbrances against the land.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Quitclaim Deeds are used when the transfer of ownership in the property does not occur as the result of a traditional sale.Under a warranty deed, if it turns out that the property is not what the seller promised or there's an uncleared lien or other block to the title, the buyer can sue the seller and recover damages.