The North Carolina Bankruptcy Information Sheet --Revised:10/2005) is a document providing detailed information about filing for bankruptcy in the state of North Carolina. The document includes instructions on how to file for bankruptcy, the different types of bankruptcy available, the costs associated with filing, and other important information. The document is divided into two sections: an Introduction and a Bankruptcy Information Sheet. The Introduction section provides a brief overview of filing for bankruptcy and the Bankruptcy Information Sheet provides more detailed information about filing for bankruptcy in North Carolina. The sheet has been revised in October 2005 and provides information on the three types of bankruptcy available in North Carolina: Chapter 7, Chapter 11, and Chapter 13. It also provides a summary of the costs involved in filing for bankruptcy, as well as a list of documents needed to complete the process. Additionally, the document contains a list of resources and contacts for those seeking additional information.

North Carolina Bankruptcy Information Sheet --Revised:10/2005)

Description

How to fill out North Carolina Bankruptcy Information Sheet --Revised:10/2005)?

How much duration and resources do you typically allocate for composing official documents.

There’s a better method to obtain such forms than engaging legal professionals or spending countless hours searching the internet for an appropriate template. US Legal Forms is the leading online repository that offers expertly crafted and validated state-specific legal documents for any intention, such as the North Carolina Bankruptcy Information Sheet --Revised:10/2005).

Another benefit of our service is that you can retrieve previously downloaded documents that you securely store in your profile in the My documents tab. Access them at any time and re-complete your documents as often as you need.

Conserve time and energy preparing official documents with US Legal Forms, one of the most reputable online services. Join us today!

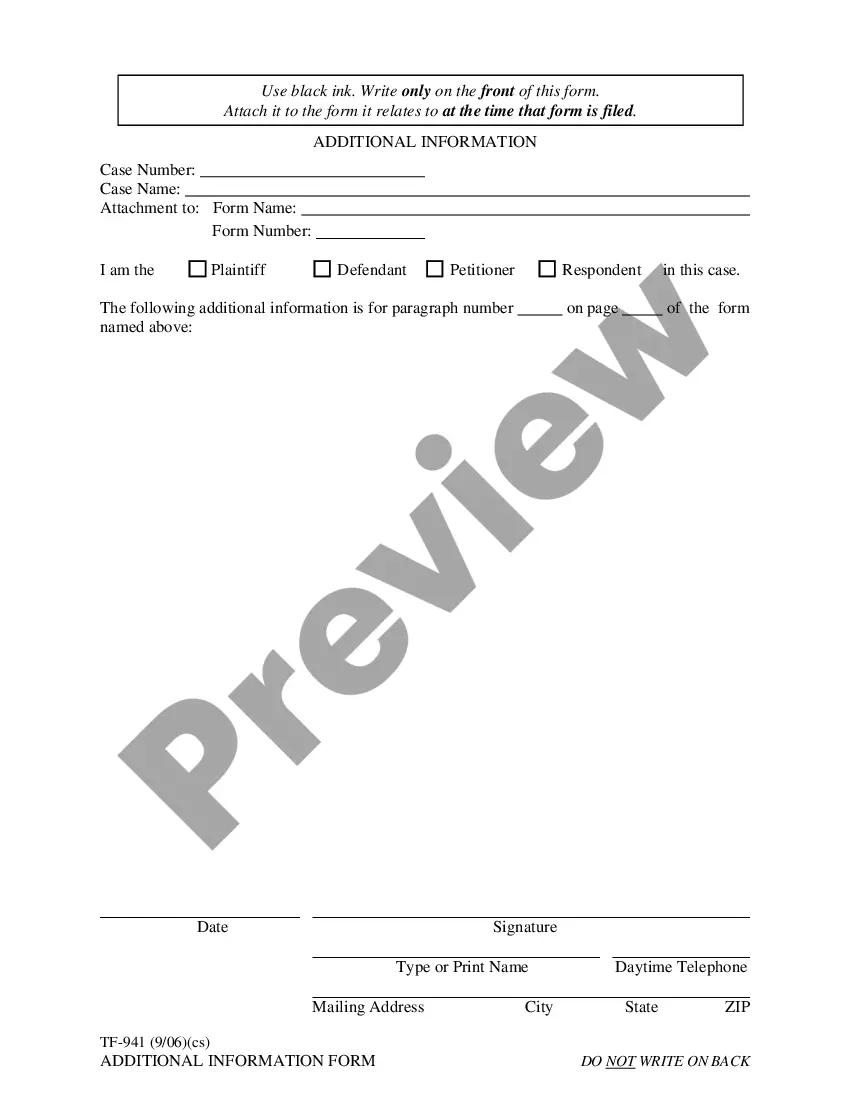

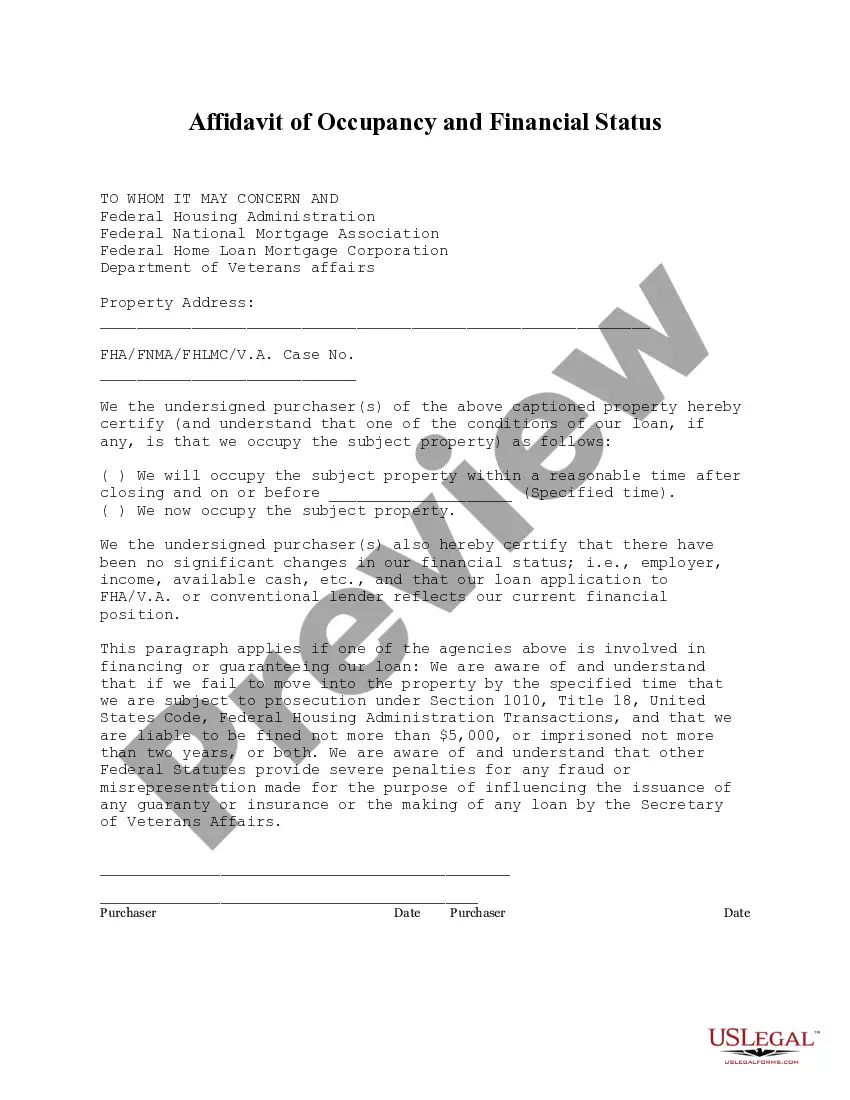

- Review the document content to ensure it fulfills your state criteria. To do this, examine the document description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search feature at the top of the page.

- If you already possess an account with us, Log In and download the North Carolina Bankruptcy Information Sheet --Revised:10/2005). If not, proceed to the following steps.

- Click Buy now once you identify the correct document. Select the subscription plan that best fits your needs to access our library’s complete offerings.

- Create an account and pay for your subscription. You can complete a transaction with your credit card or through PayPal - our service is entirely trustworthy for that.

- Download your North Carolina Bankruptcy Information Sheet --Revised:10/2005) onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

Bankruptcy wipes out many bills, like credit card balances, overdue utility payments, medical bills, personal loans, and more. You can even get rid of a mortgage or car payment if you're willing to give up the house or car that secures the debt.

If you earn less than the median income for North Carolina, you're on your way to filing Chapter 7. For a household of two people, income less than $50.7k qualifies. For three people, it's $55k and for a household of four, the income level is $63.7k. If you earn more than this, you might still qualify for Chapter 7.

A Chapter 7 bankruptcy can take four to six months to do, from the time you file to when you receive a final discharge ? meaning you no longer have to repay your debt. Various factors shape how long it takes to complete your bankruptcy case. You will have to take care of some tasks before you file.

North Carolina Bankruptcy Means Test The court first looks at your household's monthly income and compares it to the median income in North Carolina. If your income exceeds the income limits for filing for bankruptcy, then the court considers your disposable income after monthly expenses.

The downsides to filing for bankruptcy include losing assets of value, damaging your credit and having difficulties acquiring loans in the future. The upsides include keeping your property, no longer receiving calls from collections and getting an opportunity to regain control of your financial life.