North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers

What this document covers

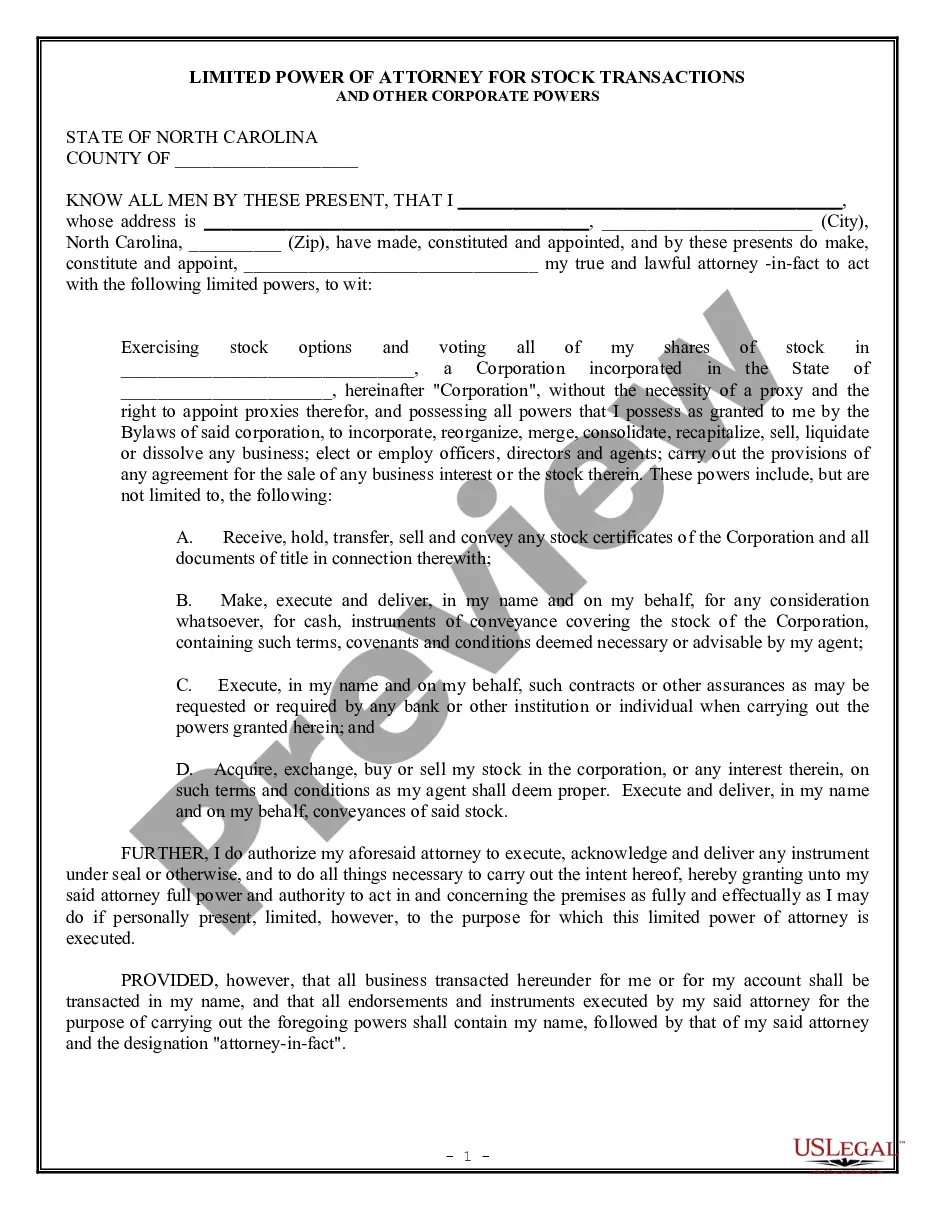

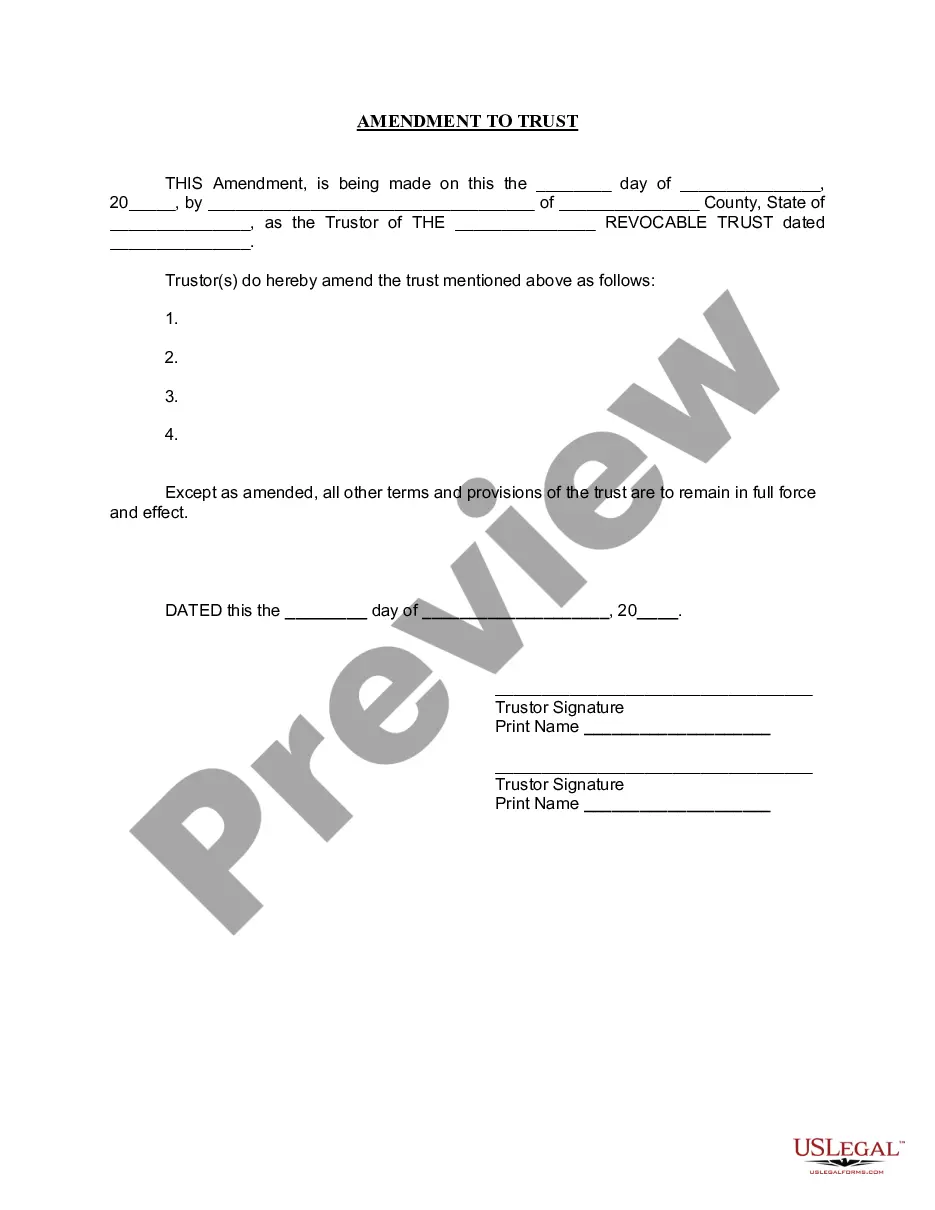

The Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that allows a shareholder to designate another person as their attorney-in-fact, granting them limited authority to vote stock and perform other corporate actions related to stock transactions. Unlike a general power of attorney, this form specifically pertains only to stock-related matters, ensuring the agent's authority is confined to those transactions without extending to personal or financial affairs.

What’s included in this form

- Principal's name and address: Identifies the individual granting the power.

- Attorney-in-fact designation: Names the appointed person to act on behalf of the principal.

- Scope of authority: Outlines the exact powers granted, focusing solely on stock transactions and corporate actions.

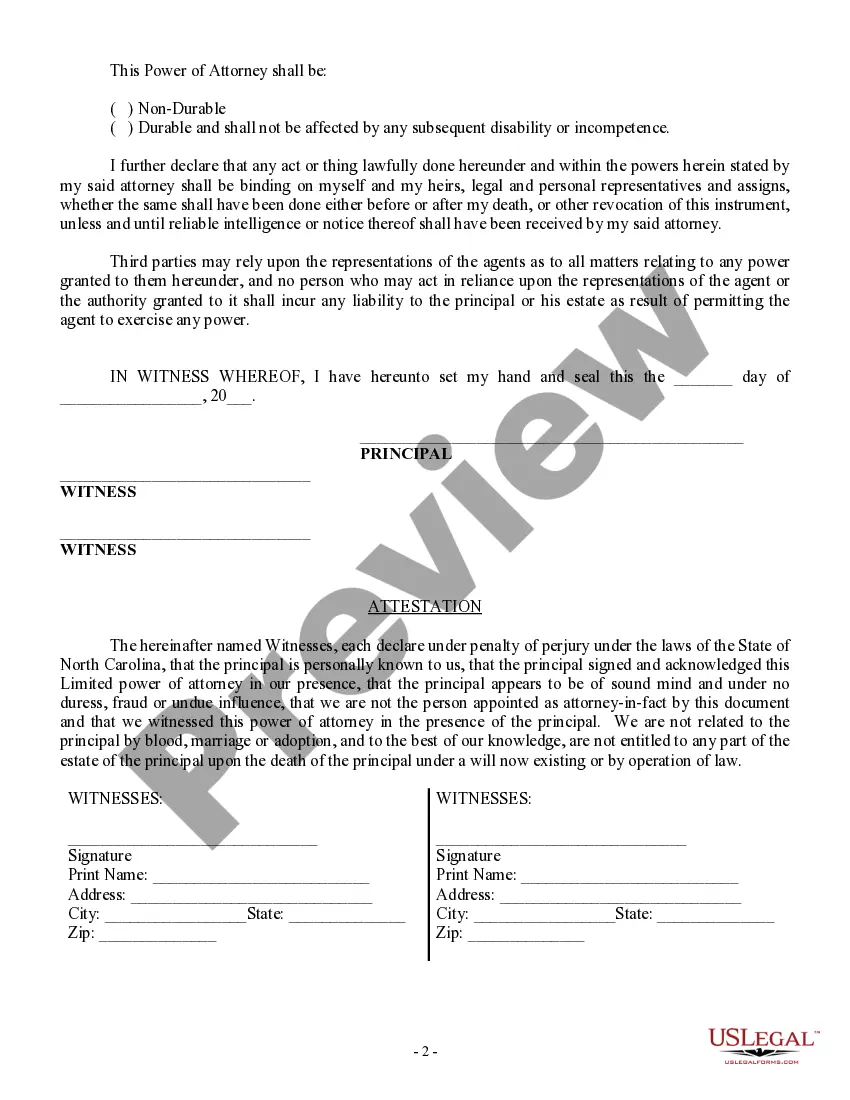

- Witness and notarization sections: Ensures the document is properly executed and legally binding with necessary signatures.

- Durability option: Indicates whether the power of attorney remains effective despite any subsequent disability of the principal.

When this form is needed

This form is useful in scenarios where a shareholder cannot personally attend corporate meetings or make important stock-related decisions. For example, if a shareholder is traveling or incapacitated, this limited power of attorney allows their designated agent to vote on stock matters, sell shares, or execute other corporate powers in their absence. It is particularly relevant during company votes, mergers, or sales, ensuring the shareholderâs interests are represented.

Who this form is for

- Shareholders in a corporation who need to delegate their voting rights.

- Individuals who are unable to attend corporate meetings due to personal or professional commitments.

- Those involved in significant stock transactions who require trusted representation for decision-making.

- Persons seeking to maintain control over their stocks while designating another individual to act on their behalf.

Steps to complete this form

- Identify the principal: Fill in the full name and address of the individual granting the power.

- Designate the attorney-in-fact: Include the name of the person being given power over stock transactions.

- Specify the corporation: Clearly state the name of the corporation related to the stock in question.

- Outline the powers granted: Include specific actions the attorney-in-fact can take regarding the stocks.

- Sign and date: The principal must sign the document in the presence of two witnesses who will also sign.

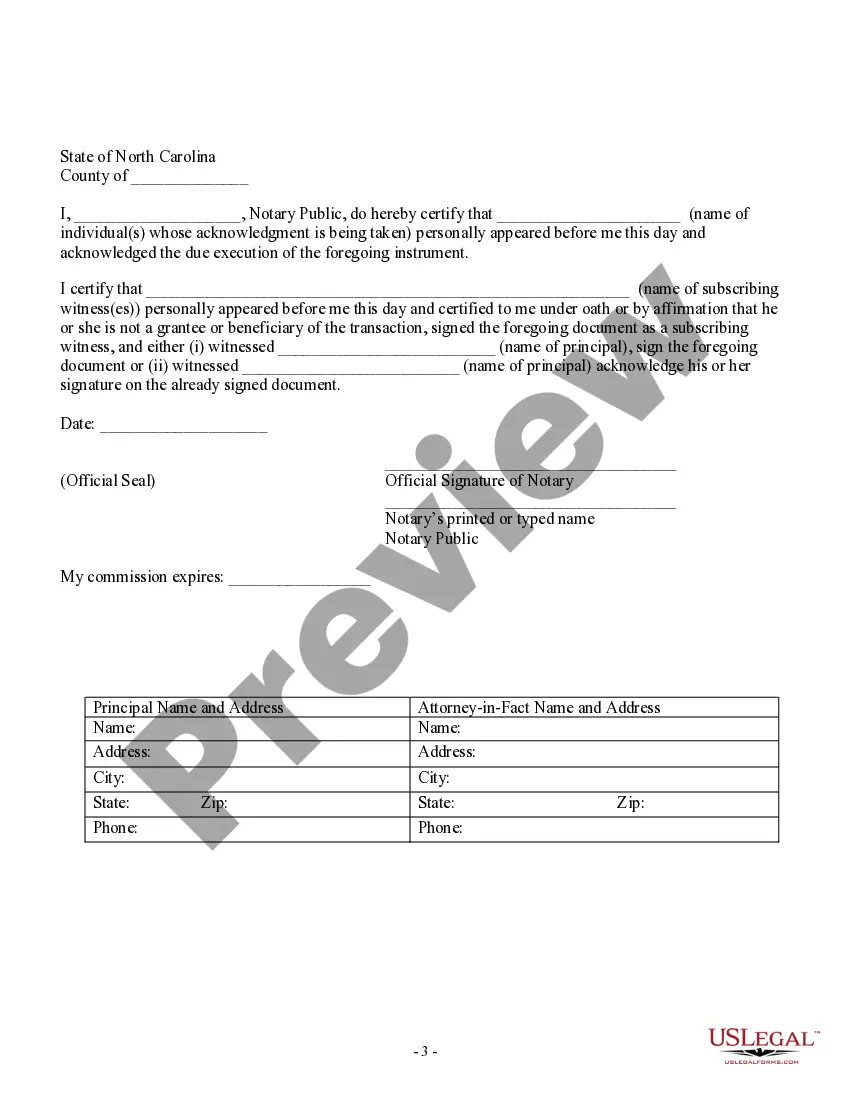

- Complete notarization if necessary: Depending on local law, a notarization may be needed for further verification.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to have the document signed by two witnesses as required by North Carolina law.

- Not specifying the exact powers granted, leading to confusion about the agent's authority.

- Omitting the name of the corporation, making the form unclear.

- Not dating the form, which may lead to questions about its validity.

- Forgetting to consider whether the power of attorney should be durable or non-durable.

Benefits of completing this form online

- Convenience: Download and complete the form from anywhere, at any time.

- Editability: Easily make changes to the document before finalizing and signing.

- Reliability: Utilize attorney-drafted templates that adhere to legal standards, ensuring compliance.

- Time-saving: Quickly assess and fill out the necessary information without hassle.

Looking for another form?

Form popularity

FAQ

A Power of Attorney is a legal document which appoints another person to act on your behalf in matters of finance and property.A Limited Power of Attorney differs from an Enduring Power of Attorney, which is intended to continue after you have lost physical or mental capacity to manage your own financial affairs.

Non-Durable Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Medical Power of Attorney. Springing Power of Attorney. Create Your Power of Attorney Now.

Recording. One of the most welcomed changes in the NC Uniform Power of Attorney Act is that it does not require durable POAs to be recorded with the Register of Deeds.The full POA does not need to be recorded.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

A Power of Attorney is a legal document which appoints a person (the Attorney-in-Fact, AIF) to act on your behalf. A durable Power of Attorney authorizes your AIF to act on your behalf even if you become incapacitated and unable to handle matters on your own.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.