North Carolina Request that Contracting Body Provide Copy of Payment Bond and Contract Covered by Bond - Individual

What this document covers

The Request that Contracting Body Provide Copy of Payment Bond and Contract Covered by Bond is a legal document designed for individuals entitled to bring an action or those who are defendants in an action on a payment bond. This form allows the requester to formally ask the contracting body for a certified copy of the payment bond and the associated construction contract. This differs from other legal forms by focusing specifically on bonds related to construction projects and the obligations that come with them.

When to use this form

You should use this form when you are entitled to seek information about a payment bond related to a construction project, either as a potential claimant or as a defendant in a legal action. This request can be critical if you need to verify the bond and contract details before pursuing legal action or resolving disputes related to payment under the bond.

Intended users of this form

- Individuals who have a legal entitlement to bring a claim related to a payment bond.

- Defendants in actions involving payment bonds.

- Contractors or suppliers seeking clarification on payment arrangements for a construction project.

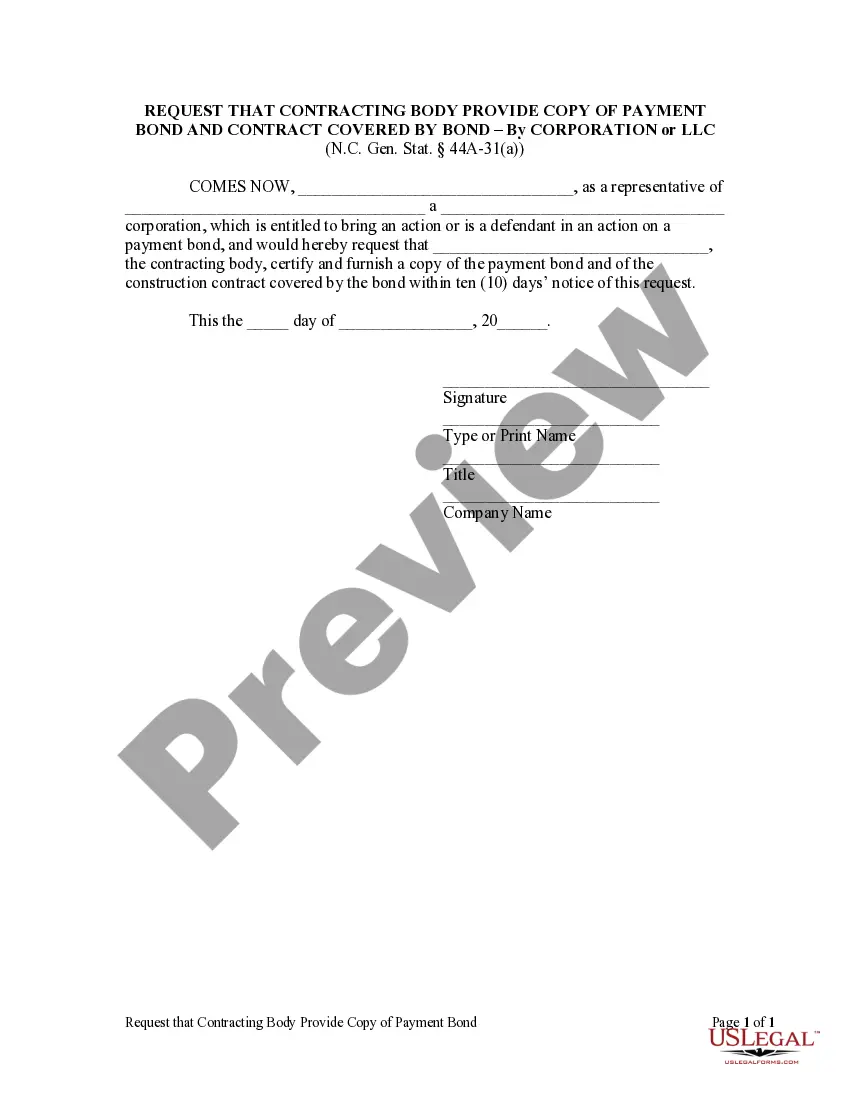

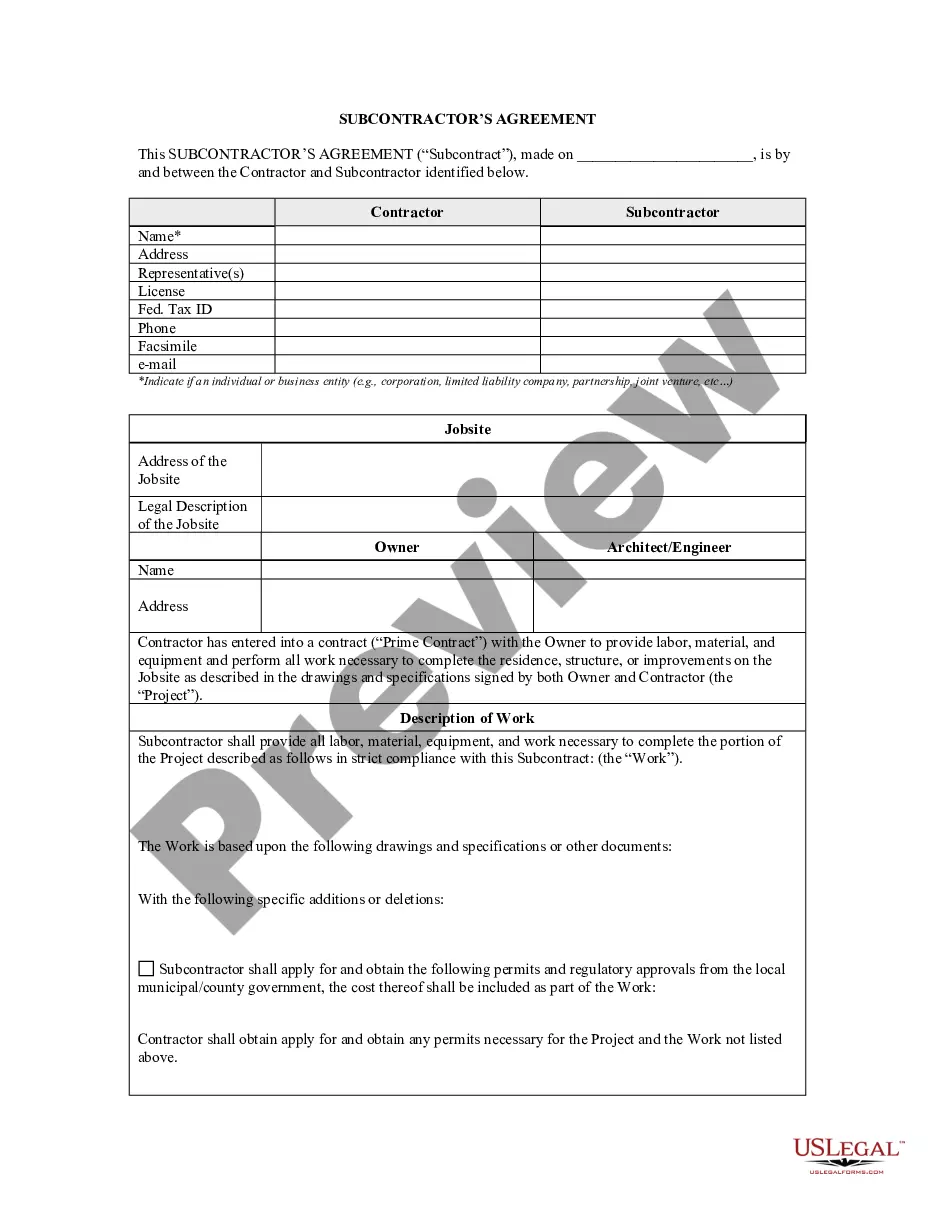

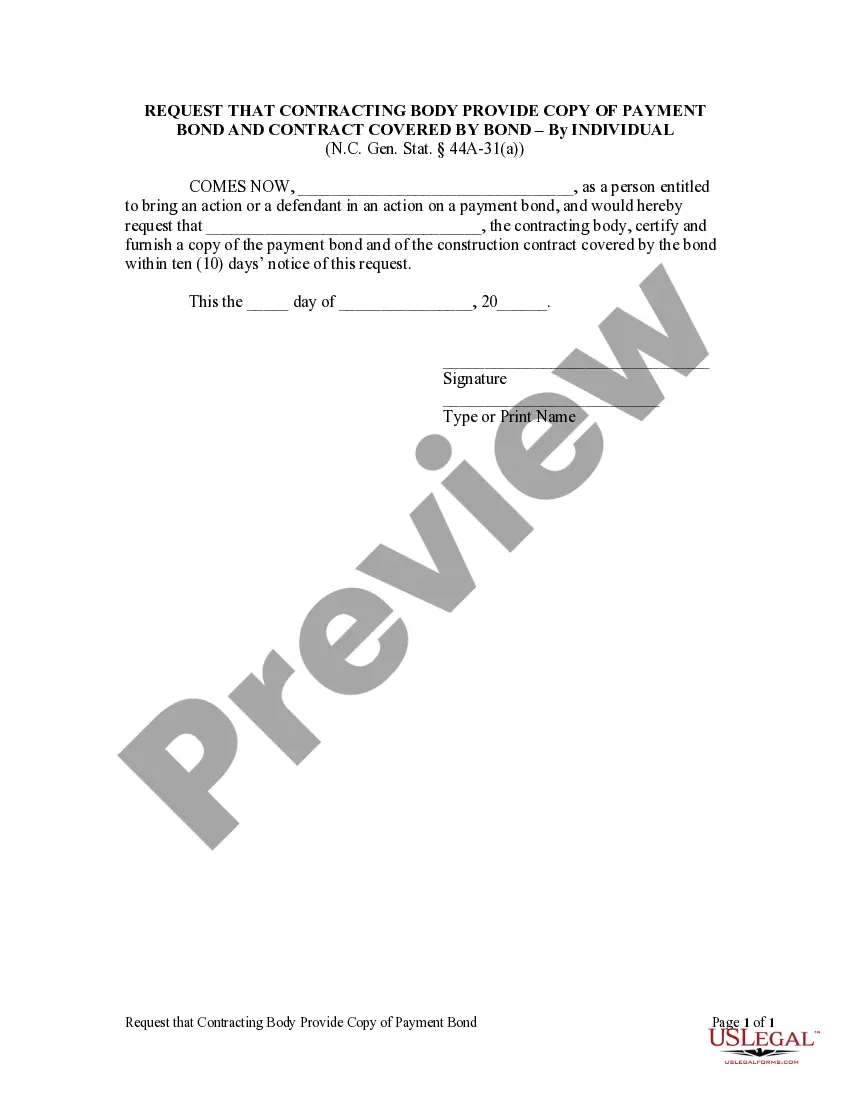

Completing this form step by step

- Fill in your name and details as the requester who is either a claimant or defendant.

- Identify the contracting body you are addressing and provide their official name.

- Clearly state your request for a certified copy of the payment bond and construction contract.

- Enter the date when you are completing the request.

- Sign the form and print your name for clarity.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide accurate identification information.

- Not addressing the request to the correct contracting body.

- Leaving out the signature or date of the request.

- Not specifying the nature of the request clearly.

Why use this form online

- Immediate access to a legally compliant template tailored to your needs.

- Edit the form easily to fit your specific situation.

- Reliable guidance provided by legal professionals to ensure accuracy.

Looking for another form?

Form popularity

FAQ

In the construction industry, the payment bond is usually issued along with the performance bond. The payment bond forms a three-way contract between the Owner, the contractor and the surety, to make sure that all subcontractors, laborers, and material suppliers will be paid leaving the project lien free.

Introduction. A project owner receives a bid bond from a contractor as a part of the supply bidding process. A bid bond provides a guarantee that a winning bidder will take up the contract as per the terms at which they bid. A bid bond ensures compensation to the bond owner if the bidder fails to begin a project.

The contractor who wins the bid is given a contract for the project. A bid bond serves as a guarantee that the contractor who wins the bid will honor the terms of the bid after the contract is signed.A bid bond compensates the owner for the cost difference between the initial contractor's bid and the next-lowest bid.

The surety company will give the Principal (the person who is bonded) a chance to satisfy the claim. If the Principal fails to satisfy the claim, the surety company will step in and satisfy the claim. The surety company will then go to the Principal for repayment of satisfying that claim.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.

The Performance Bond secures the contractor's promise to perform the contract in accordance with its terms and conditions, at the agreed upon price, and within the time allowed. The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment.

The cost of a performance bond usually is less than 1% of the contract price; however, if the contract is under $1 million, the premium may run between 1% and 2%. Bonds may be more costly, depending upon the credit-worthiness of the contractor. Labor and material payment bonds are companions to the performance bond.

In most cases, a contractor will need to obtain both a payment bond and a performance bond. In these cases, the contractor will often purchase payment and performance bonds together in a so-called P&P bond package. The contractor will apply for a surety bond premium quote through a surety or surety bond broker.