North Carolina Limited Liability Company LLC Formation Package

Description

How to fill out North Carolina Limited Liability Company LLC Formation Package?

Avoid pricey lawyers and find the North Carolina Limited Liability Company LLC Formation Package you need at a reasonable price on the US Legal Forms website. Use our simple categories functionality to search for and obtain legal and tax files. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms provides customers with step-by-step tips on how to download and complete every template.

US Legal Forms customers merely have to log in and obtain the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet should follow the guidelines below:

- Make sure the North Carolina Limited Liability Company LLC Formation Package is eligible for use in your state.

- If available, look through the description and use the Preview option before downloading the templates.

- If you’re sure the template is right for you, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, it is possible to complete the North Carolina Limited Liability Company LLC Formation Package by hand or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Reports.

If there are no issues with your filing, your LLC will be approved in 7-10 days. Once your LLC is approved, you will receive back a Certified Copy by mail or email. This confirms your LLC is now a legally formed business in the State of North Carolina.

Decide on a name for your business. Assign an agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. File state taxes. Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

If there are no issues with your filing, your LLC will be approved in 7-10 days. Once your LLC is approved, you will receive back a Certified Copy by mail or email. This confirms your LLC is now a legally formed business in the State of North Carolina.

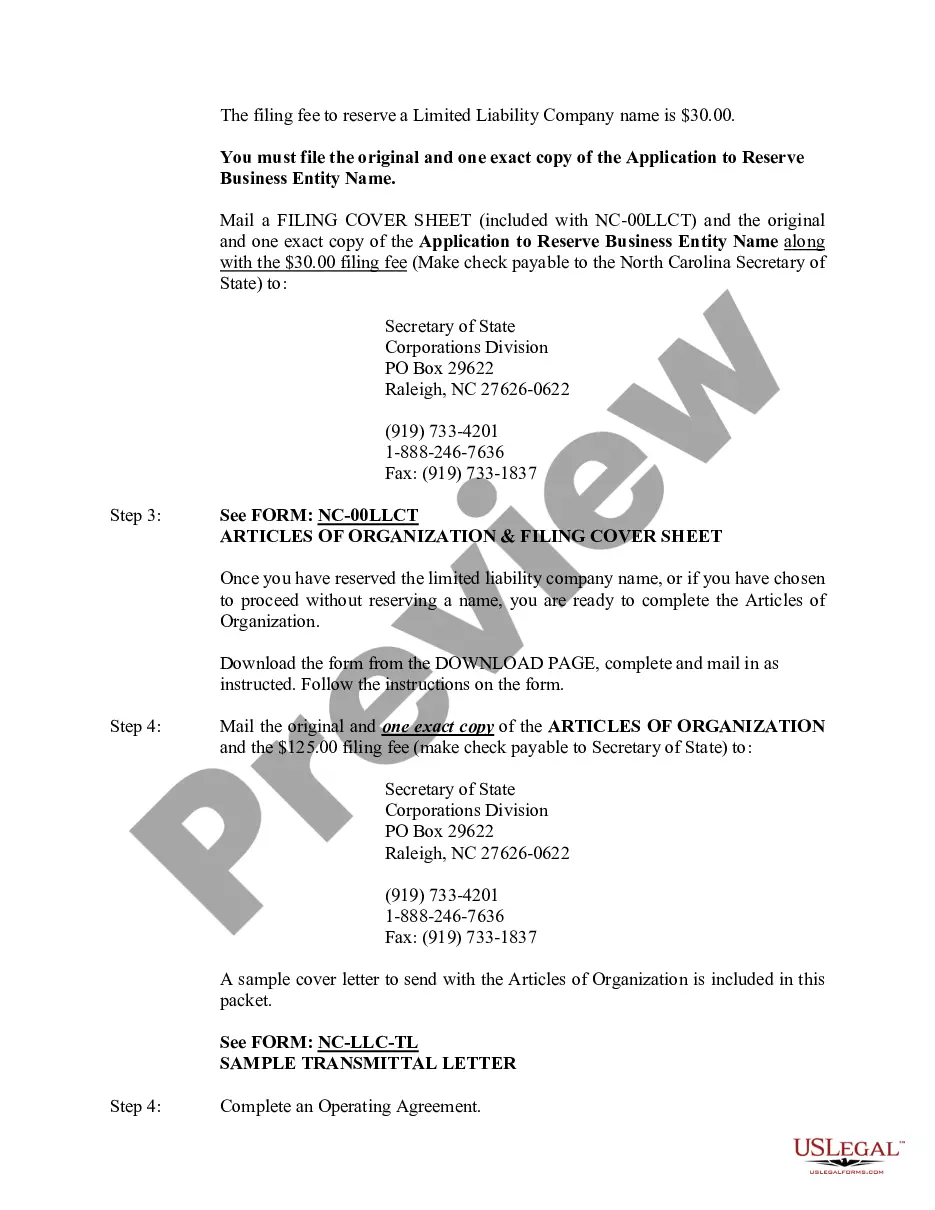

How much does it cost to form an LLC in North Carolina? The North Carolina Secretary of State charges a $125 filing fee for the Articles of Organization. It will cost $30 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

On average, the processing time, from beginning to end takes around 3-5 weeks to form an LLC. There are options to speed up the process if you're in a rush and willing to pay a fee. This is the usual processing speed, of course, the standard option depends on the state you form your LLC. On average it takes 3-5 weeks.

To form an LLC in North Carolina you will need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.

You can go to your State's Secretary of State office, (Most states have this online) and search for your LLC, if you can't find it, it may not be registered. The EIN is applied for through the IRS. You can do this through email or fax.