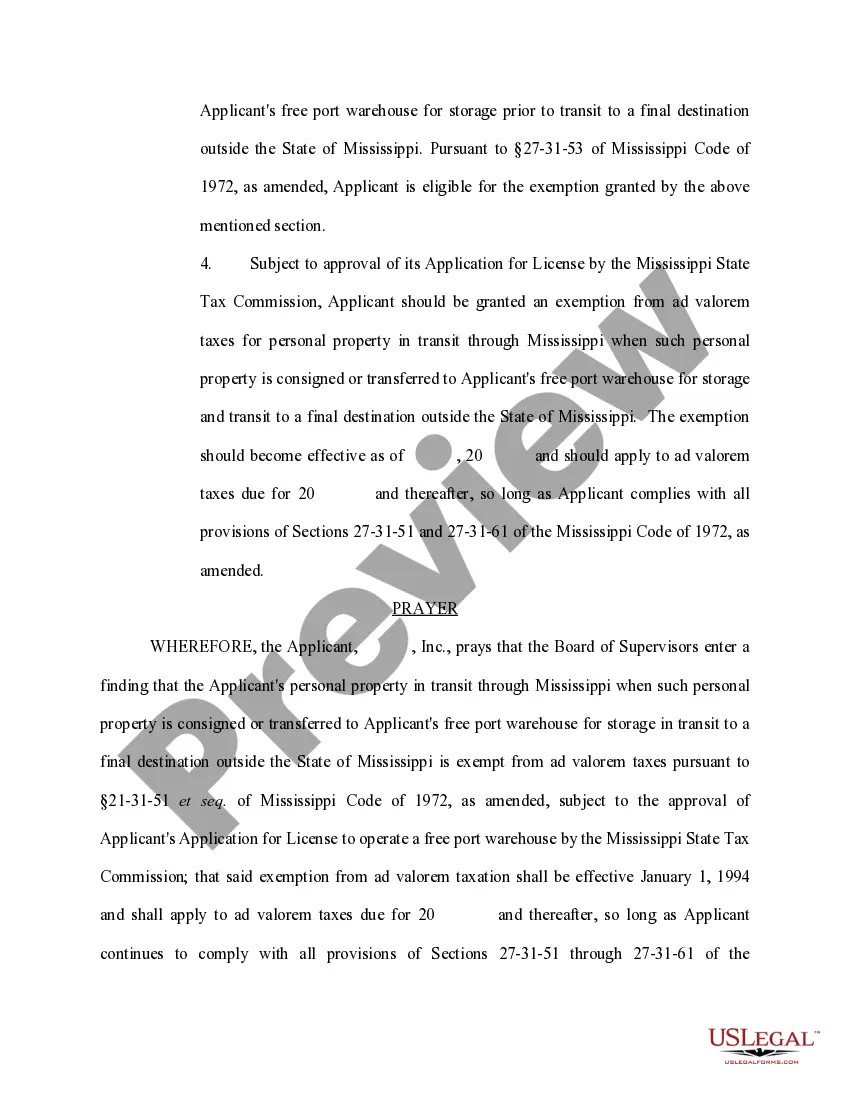

Mississippi Application for Tax Exemption Under 27-31-51

Description

How to fill out Mississippi Application For Tax Exemption Under 27-31-51?

Obtain a printable Mississippi Application for Tax Exemption Under 27-31-51 within several mouse clicks from the most complete catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of affordable legal and tax templates for US citizens and residents online starting from 1997.

Customers who already have a subscription, need to log in into their US Legal Forms account, download the Mississippi Application for Tax Exemption Under 27-31-51 and find it saved in the My Forms tab. Customers who never have a subscription must follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, review the shape to discover more content.

- As soon as you’re sure the template is right for you, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Application for Tax Exemption Under 27-31-51, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead.

How do you register for a sales tax permit in Mississippi? Business owners can register online at Mississippi's TAP website. Mississippi encourages online sellers to register and file sales tax online.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.

Since the Mississippi Department of Revenue doesn't provide resale certificates, a vendor who regularly works with resellers might put together a form that serves the same purposes. Essentially, you'll have a form to collect the buyer's name, address, and permit number.

Applications for homestead exemption must be filed between January 1 and April 1. Who is eligible for homestead exemption? Anyone owning a home in Mississippi may be eligible for homestead exemption. Contact your local Tax Assessor for further details.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.