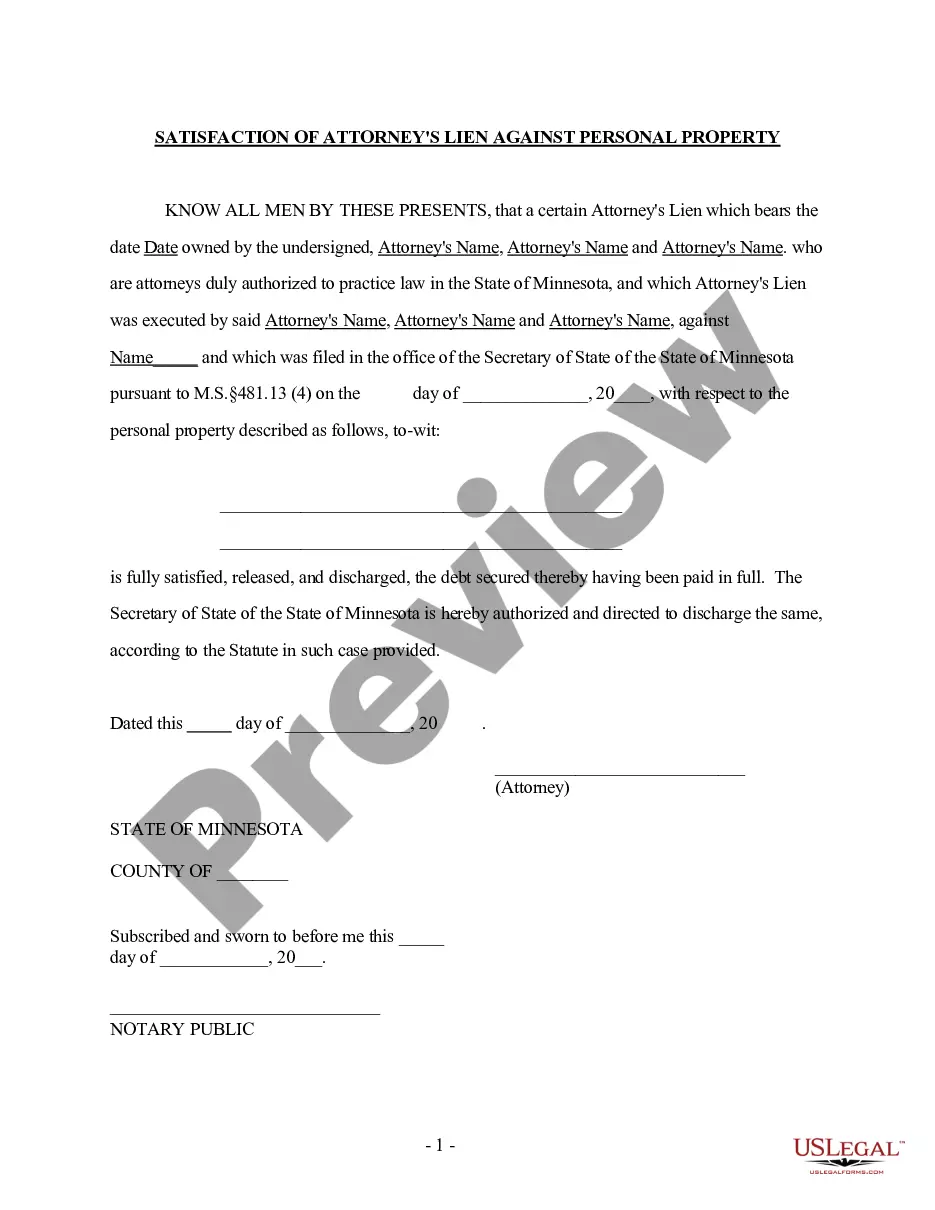

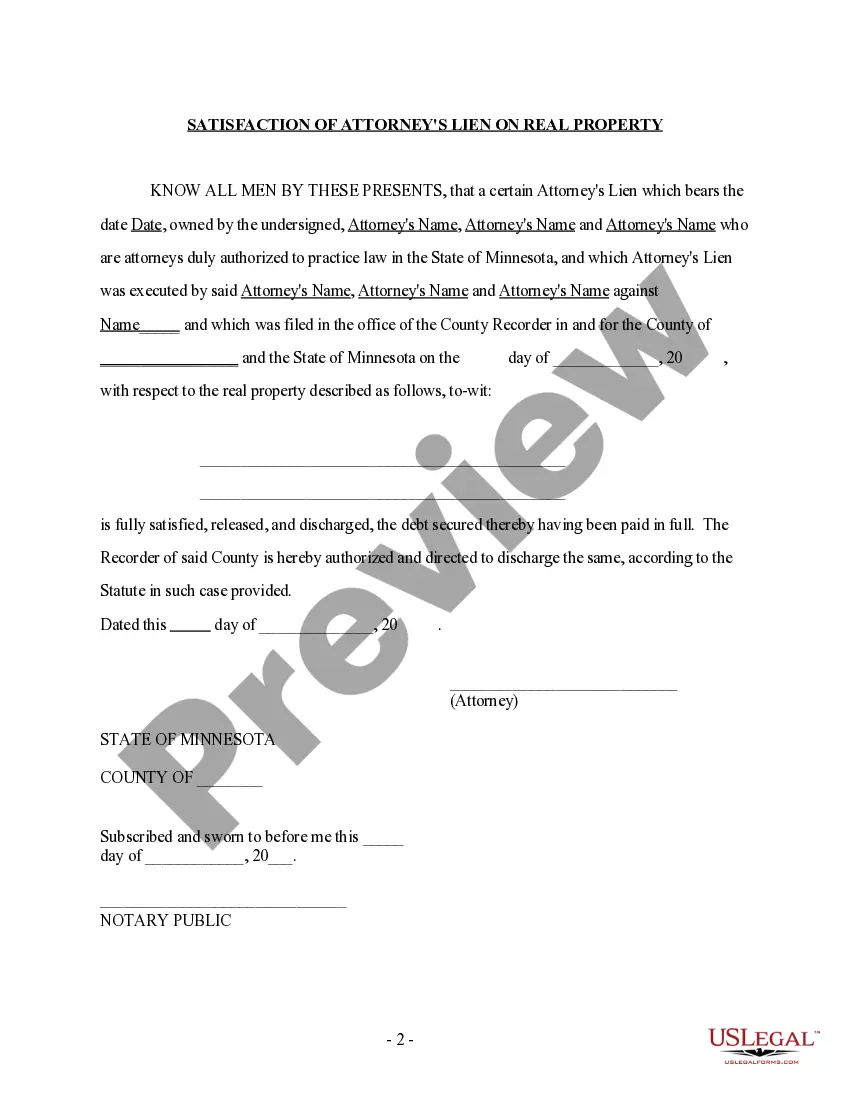

Minnesota Satisfaction of Attorney's Lien Against Personal Property

Description

How to fill out Minnesota Satisfaction Of Attorney's Lien Against Personal Property?

Have any template from 85,000 legal documents such as Minnesota Satisfaction of Attorney's Lien Against Personal Property online with US Legal Forms. Every template is drafted and updated by state-accredited lawyers.

If you have already a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Satisfaction of Attorney's Lien Against Personal Property you need to use.

- Look through description and preview the sample.

- Once you are sure the template is what you need, click on Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by credit card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable template. The platform provides you with access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Satisfaction of Attorney's Lien Against Personal Property fast and easy.

Form popularity

FAQ

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

A type of attorney's lien under which a lawyer acquires an interest in a judgment awarded to the client. This may mean that the lawyer can eventually claim a portion of any money paid to the client due to the judgment. The lien arises because the client's failure to pay for legal services. See Retaining lien (compare).

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.