Minnesota Discharge of Lien - Individual

Overview of this form

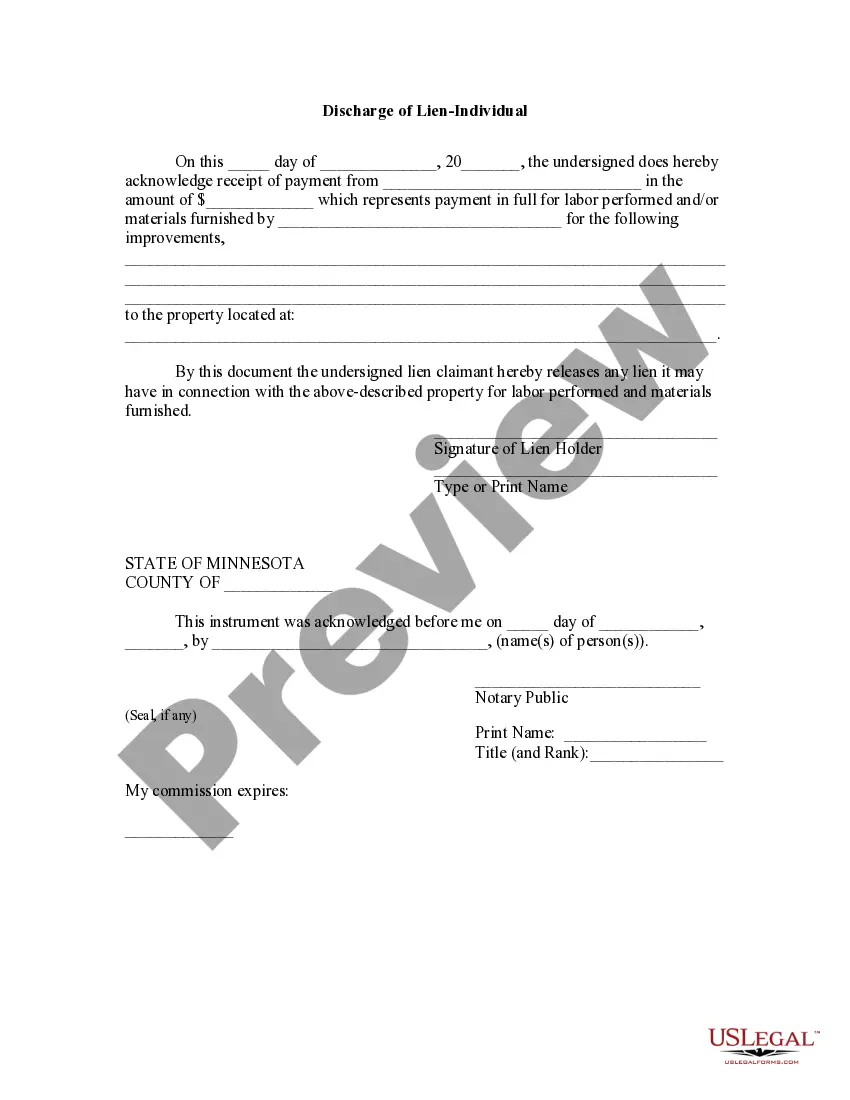

The discharge of lien form for individuals is a legal document that allows a lien holder to formally acknowledge the release of a lien after receiving full payment. This form is essential in confirming that the debtor has satisfied their obligations related to labor or materials provided for property improvements. It differs from other lien-related forms by focusing specifically on individual lien holders in Minnesota, when there is no specific state provision for the release of a lien.

What’s included in this form

- Date of payment acknowledgment.

- Name and contact information of the debtor.

- Amount paid in full.

- Description of the improvements made to the property.

- Property location details.

- Signature and printed name of the lien holder.

- Notarization section for legal validation.

Common use cases

This form should be used when a lien holder has received full payment for labor or materials provided on a specific property. It is particularly useful when the lien holder needs to formally notify the debtor and any interested parties that the lien is released, ensuring that the property is clear of any encumbrances related to the lien. Common scenarios include the completion of home renovations, landscaping, or construction work where payment has been made in full.

Who should use this form

This form can be used by:

- Individual lien holders in Minnesota.

- Contractors or subcontractors who have performed work or provided materials.

- Property owners who want to ensure that their property title is cleared of liens.

Steps to complete this form

- Enter the date of the payment acknowledgment.

- Provide the debtor's full name and contact information.

- Specify the amount that has been paid in full.

- Detail the nature of the improvements made to the property.

- Clearly state the propertyâs location.

- Have the lien holder sign and print their name.

- Complete the notarization section to validate the document.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not including all necessary details about the improvements made.

- Failing to have the form notarized, if required.

- Omitting the debtorâs full name or inaccurate information.

- Neglecting to keep a copy of the completed form for personal records.

Why complete this form online

- Convenient access to legal documents from anywhere.

- Editability to tailor the form as needed.

- Provides assurance that the form complies with legal standards.

- Saves time compared to visiting an attorney for assistance.

Looking for another form?

Form popularity

FAQ

Discharging a lien in Minnesota involves several steps, but it is manageable with the right guidance. First, you must obtain a lien release form from the entity that placed the lien, or use a template available on platforms like USLegalForms. After completing the form, file it with the appropriate county office to officially remove the lien. Following these steps will help you achieve a successful Minnesota Discharge of Lien - Individual.

You do not necessarily need a lawyer for a Minnesota Discharge of Lien - Individual. Many individuals successfully complete this process on their own, especially if their case is straightforward. However, consulting with a legal professional can provide clarity and help you avoid potential pitfalls. If you want peace of mind, consider using resources like USLegalForms, which can guide you through the lien release process.

To obtain a Minnesota Discharge of Lien - Individual, you must first gather the necessary documentation, such as proof of payment or a settlement agreement. Next, file the appropriate discharge form with the county recorder's office where the lien was originally filed. It's important to ensure that all relevant information is accurate and complete to avoid delays. For additional assistance, consider using the US Legal Forms platform, which provides templates and guidance for this process.

To file a release of lien in Minnesota, you must first obtain a lien release form from your lender or a legal resource. Once you complete the form, you need to have it signed by the lienholder. After that, you can file the release with the county recorder’s office where the original lien was recorded. This process ensures your Minnesota Discharge of Lien - Individual is officially recognized and removes any claim against your property.

Completing a lien release involves a few key steps. First, gather necessary information, such as the original lien details and the parties involved. Then, use a reliable platform like USLegalForms to access the correct lien release template. This will ensure you follow all legal requirements for a successful Minnesota Discharge of Lien - Individual.

Yes, in Minnesota, lien releases typically require notarization to be considered valid. This means that you should sign the release in front of a notary public who can verify your identity. Ensuring this step is completed will facilitate the Minnesota Discharge of Lien - Individual and protect your interests.

To record a release of lien in Minnesota, you must fill out the appropriate lien release form. After completing the form, submit it to the county recorder where the original lien was filed. This step is crucial for achieving a successful Minnesota Discharge of Lien - Individual, as it formally removes the lien from public records.