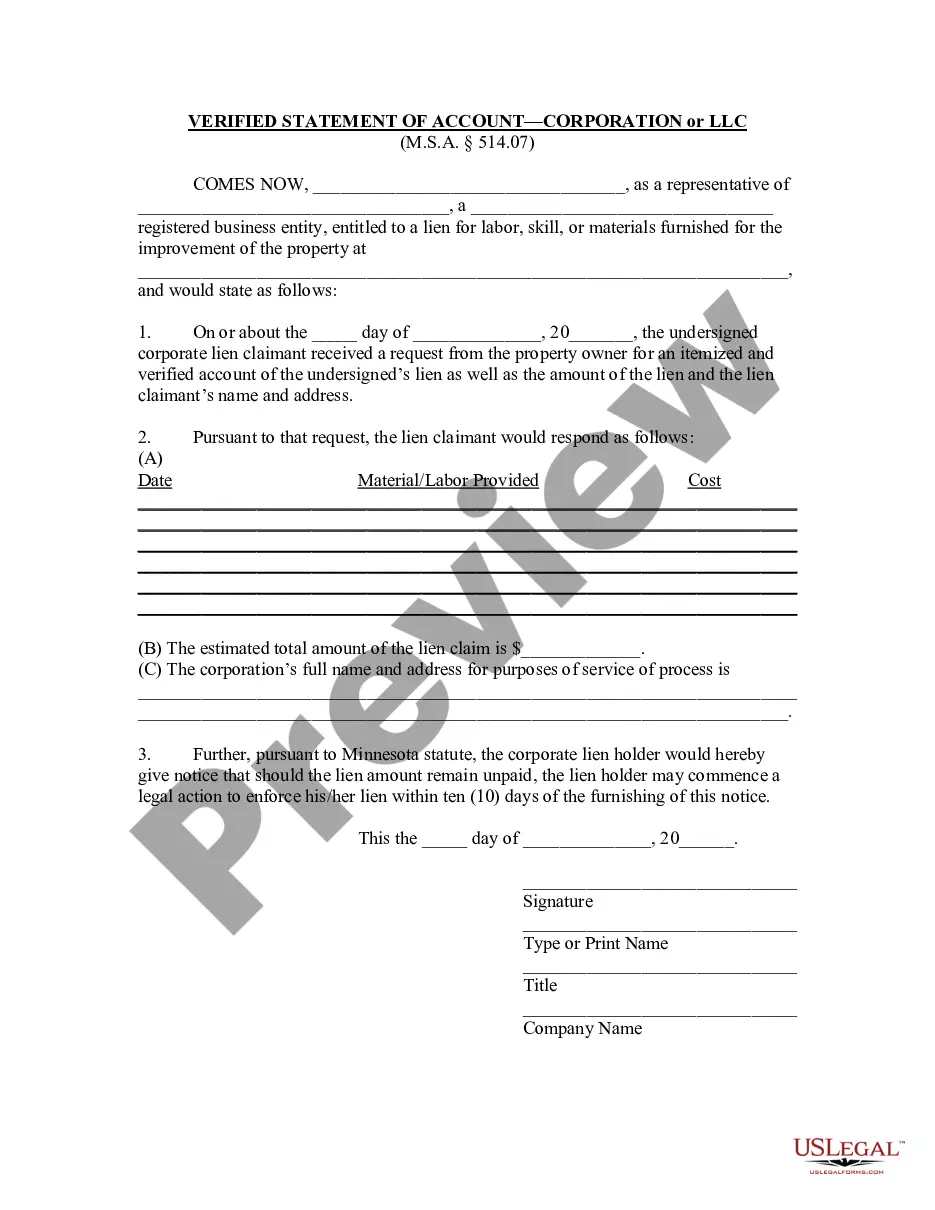

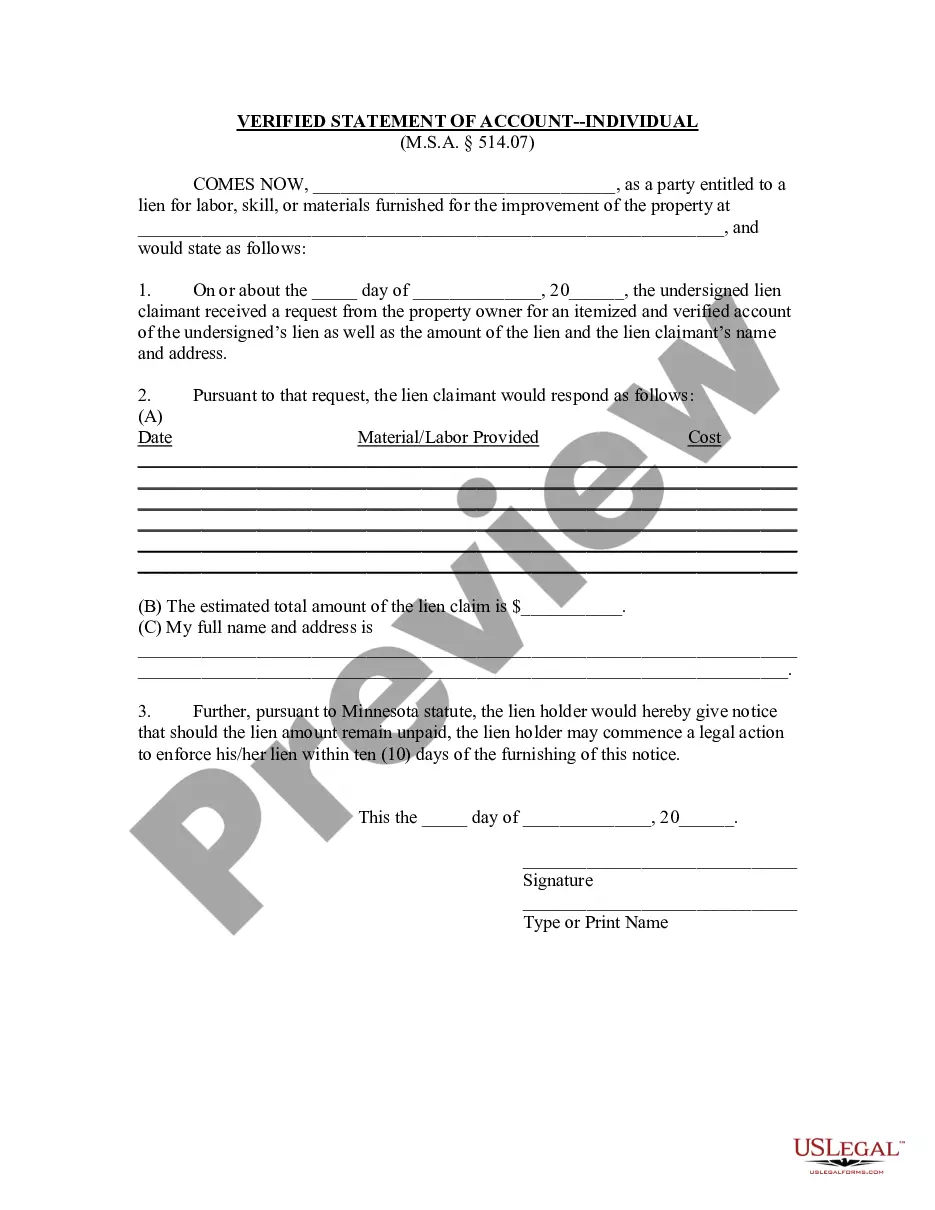

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

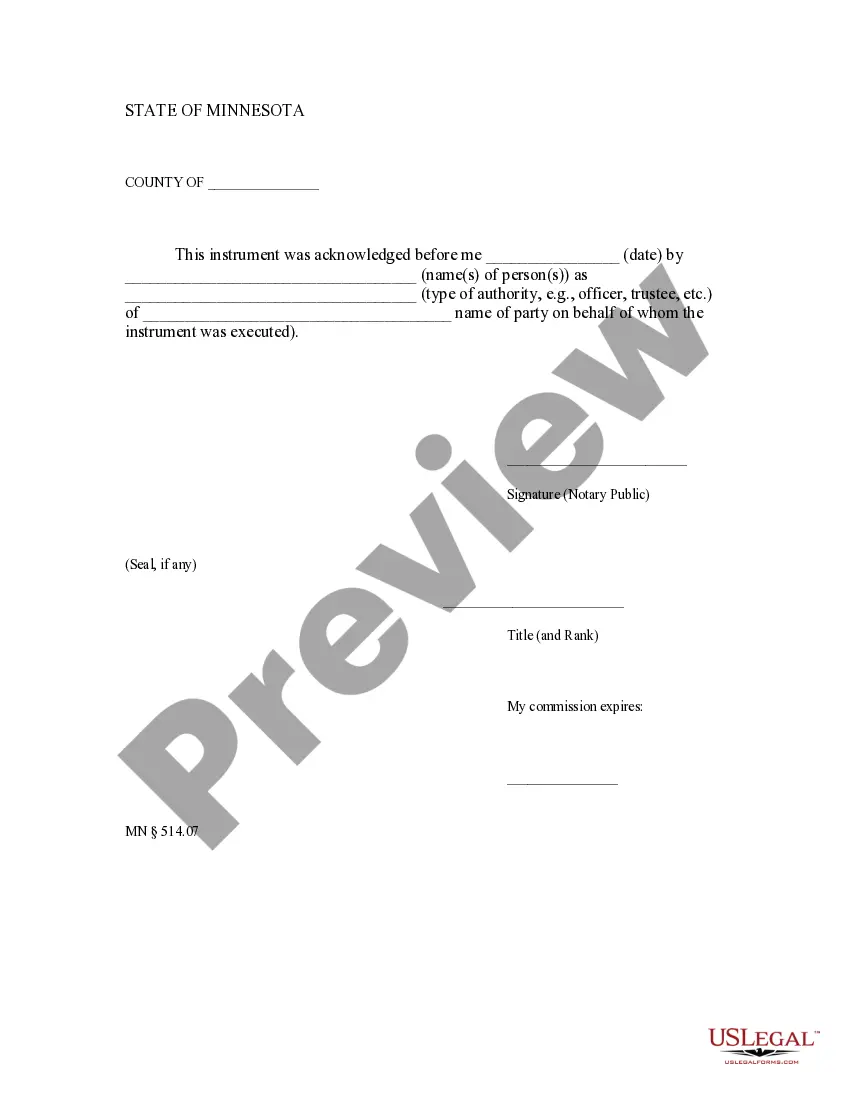

Minnesota Verified Statement of Account - Corporation or LLC

Description

How to fill out Minnesota Verified Statement Of Account - Corporation Or LLC?

Obtain any version of 85,000 lawful documents like the Minnesota Verified Statement of Account - Corporation or LLC online through US Legal Forms. Each template is created and revised by attorneys licensed in the state.

If you possess a subscription already, Log In. After reaching the form’s page, click on the Download button and navigate to My documents to access it.

If you haven't subscribed yet, follow the instructions below.

With US Legal Forms, you will always have immediate access to the correct downloadable template. The service provides you with documents and organizes them into categories to make your search easier. Utilize US Legal Forms to acquire your Minnesota Verified Statement of Account - Corporation or LLC quickly and effortlessly.

- Verify the state-specific requirements for the Minnesota Verified Statement of Account - Corporation or LLC you intend to use.

- Review the description and preview the template.

- Once you confirm the template is what you require, simply click Buy Now.

- Select a subscription plan that genuinely fits your budget.

- Establish a personal account.

- Make a payment in one of two suitable methods: by card or through PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Yes, as an LLC owner in Minnesota, you are required to file an annual report. This report includes your Minnesota Verified Statement of Account - Corporation or LLC, which provides updated information about your business. Filing this report is important to maintain your LLC's active status and to comply with state regulations. You can simplify this process by using platforms like US Legal Forms, which offer resources and templates to assist you.

To find out who owns an LLC in Minnesota, visit the Minnesota Secretary of State's business entity search page. By entering the LLC's name, you can retrieve ownership details, including the registered agent and principal office information. This process is straightforward and allows you to access the Minnesota Verified Statement of Account - Corporation or LLC, which can provide further insights into the entity's status.

You can obtain a copy of your LLC paperwork by requesting it from the Minnesota Secretary of State. They provide access to official documents, including articles of organization and amendments. For a more streamlined process, consider using services like US Legal Forms, which can help you navigate the complexities of obtaining the Minnesota Verified Statement of Account - Corporation or LLC efficiently.

To locate your LLC documents, start by visiting the Minnesota Secretary of State's website. There, you can search for your LLC by name to access various documents, including your formation papers. If you need a more detailed account, consider using the Minnesota Verified Statement of Account - Corporation or LLC for comprehensive information. This will ensure you have all the necessary documentation for your records.

Yes, an LLC in Minnesota requires a tax ID number to conduct business legally. This number, also known as an Employer Identification Number (EIN), is essential for tax purposes and hiring employees. You can apply for a Minnesota tax ID number through the IRS website. Having this number will also help you maintain compliance with the Minnesota Verified Statement of Account - Corporation or LLC.

Even if you are the sole member of your LLC, having an operating agreement is still a good idea. This document can help formalize your business structure and protect your personal assets. It also provides clarity regarding management and financial matters. You can utilize the US Legal Forms platform to easily draft an operating agreement that suits your single-member LLC.

Yes, an LLC can exist without an operating agreement in Minnesota, but it is not advisable. Without this document, your LLC may face challenges in governance and decision-making. Moreover, the absence of an operating agreement can lead to misunderstandings or conflicts among members. To avoid these issues, consider using US Legal Forms to create a comprehensive operating agreement tailored to your needs.

Minnesota does not mandate that LLCs have an operating agreement. Nevertheless, it is a wise step to create one, as it provides clarity and structure for your business operations. A well-drafted operating agreement can address important aspects such as profit distribution and management procedures. You can easily find templates and guidance on the US Legal Forms site to help you draft this crucial document.

In Minnesota, an operating agreement is not legally required for an LLC. However, having one is highly beneficial as it outlines the management structure and operational guidelines of your business. This document can help prevent disputes among members and clarify each member's rights and responsibilities. For more information on creating an operating agreement, consider using the resources available on the US Legal Forms platform, which can simplify the process.

A Minnesota tax ID is not the same as an Employer Identification Number (EIN). The tax ID is specific to the state and is used for state tax purposes, while the EIN is issued by the IRS for federal tax identification. If you are forming a corporation or LLC, it is important to obtain both, as the Minnesota Verified Statement of Account - Corporation or LLC may require both identifiers for accurate reporting. Uslegalforms can assist you in obtaining these numbers efficiently.