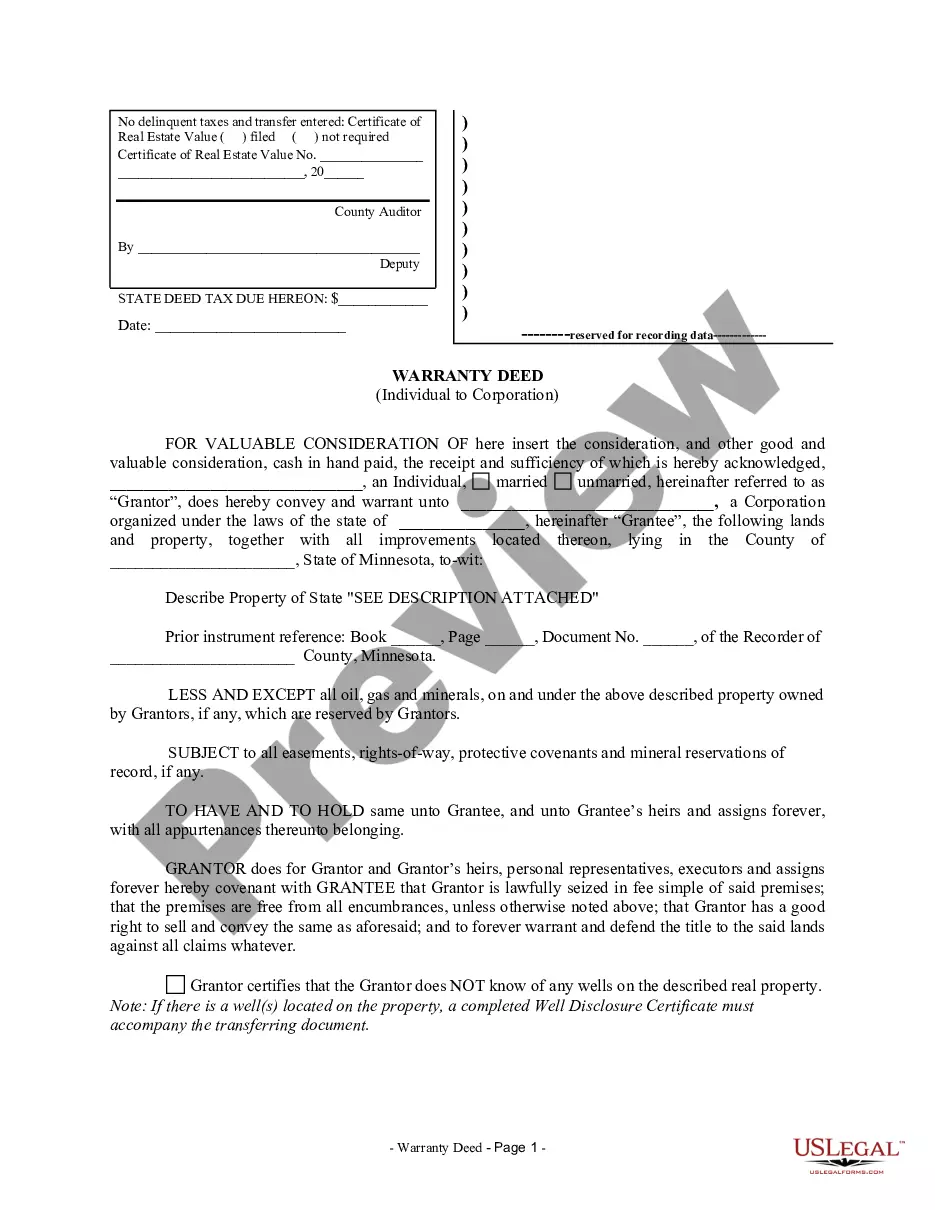

Minnesota Warranty Deed from Individual to Corporation

Description

How to fill out Minnesota Warranty Deed From Individual To Corporation?

Have any form from 85,000 legal documents such as Minnesota Warranty Deed from Individual to Corporation on-line with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have already a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Warranty Deed from Individual to Corporation you need to use.

- Read description and preview the sample.

- Once you’re sure the template is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable template. The service provides you with access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Warranty Deed from Individual to Corporation easy and fast.

Form popularity

FAQ

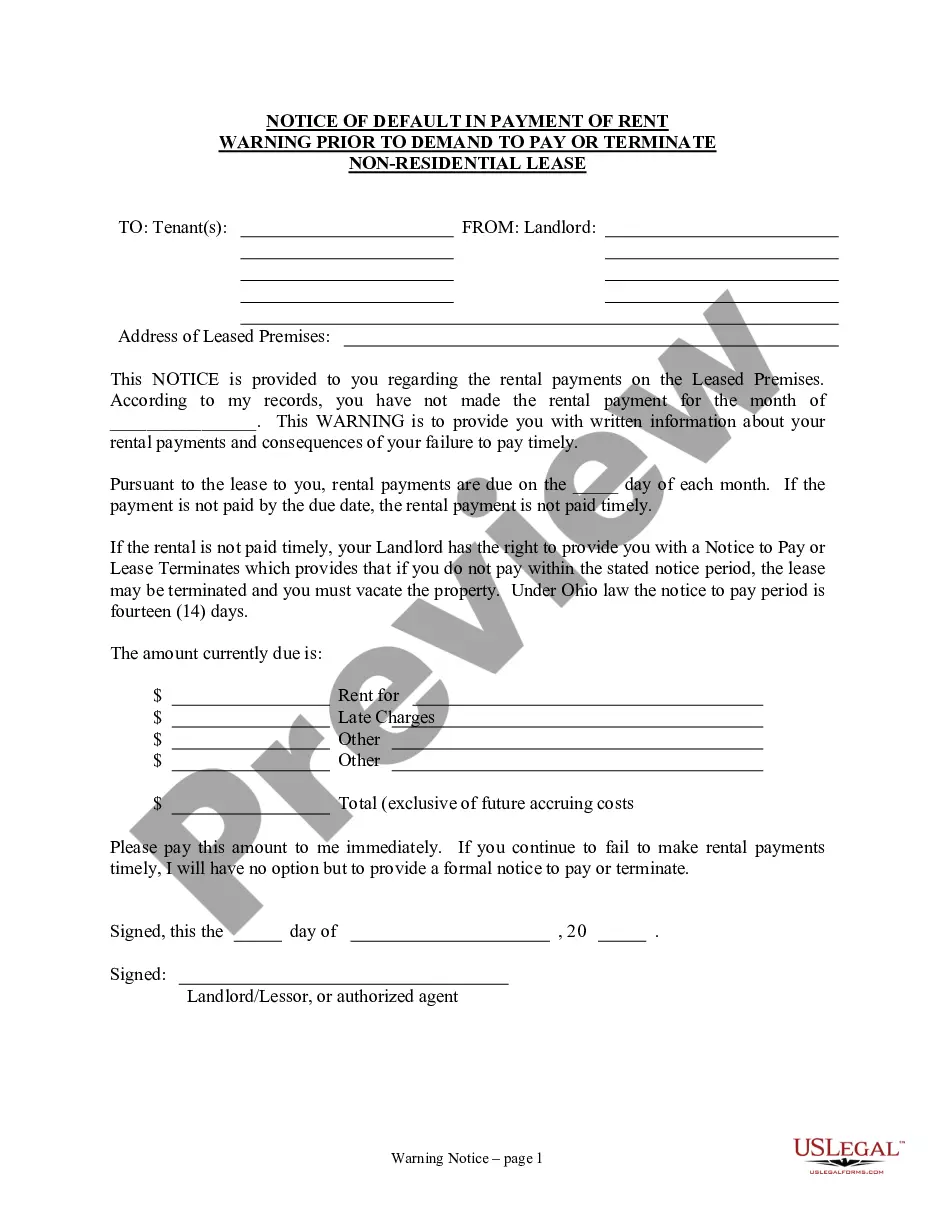

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.