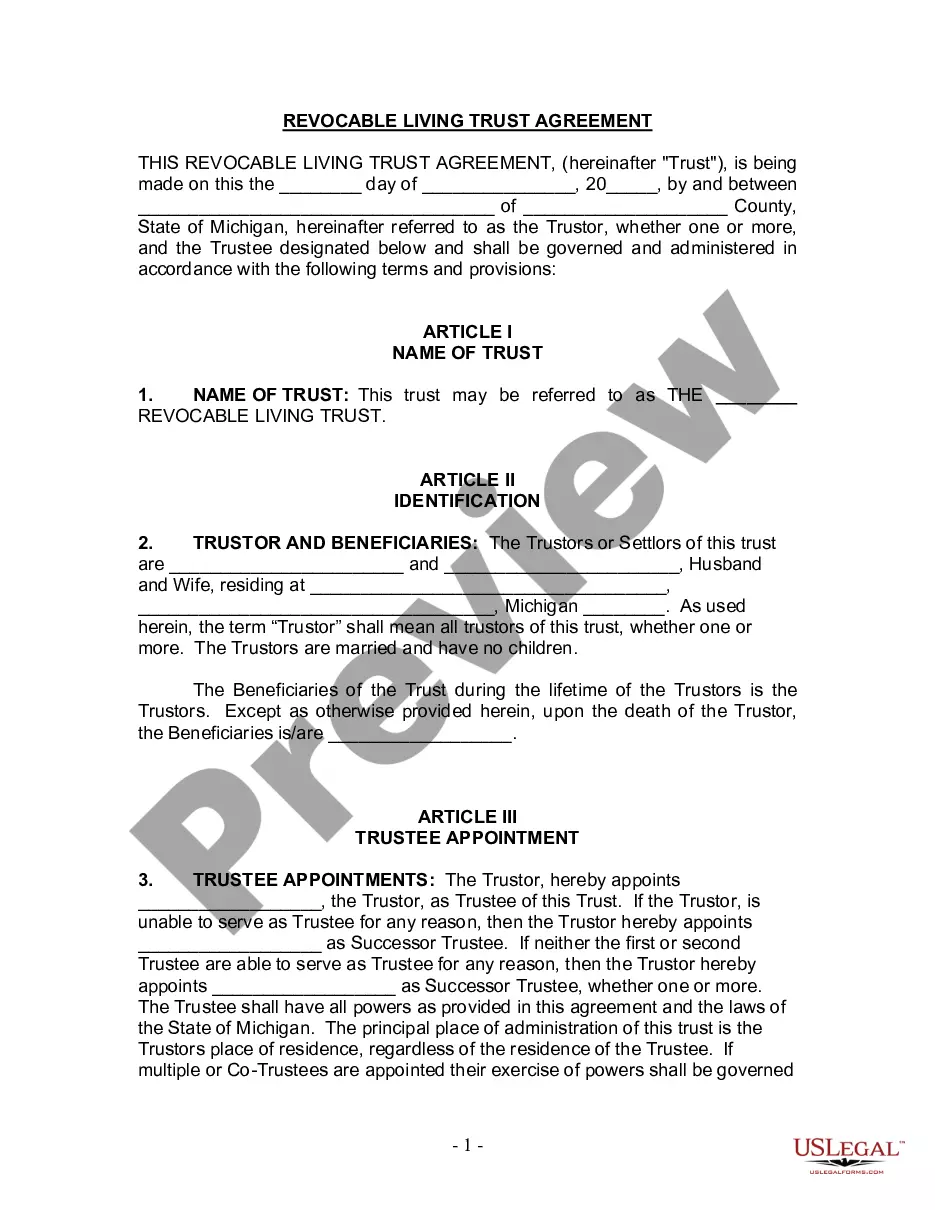

Michigan Living Trust for Husband and Wife with No Children

Description

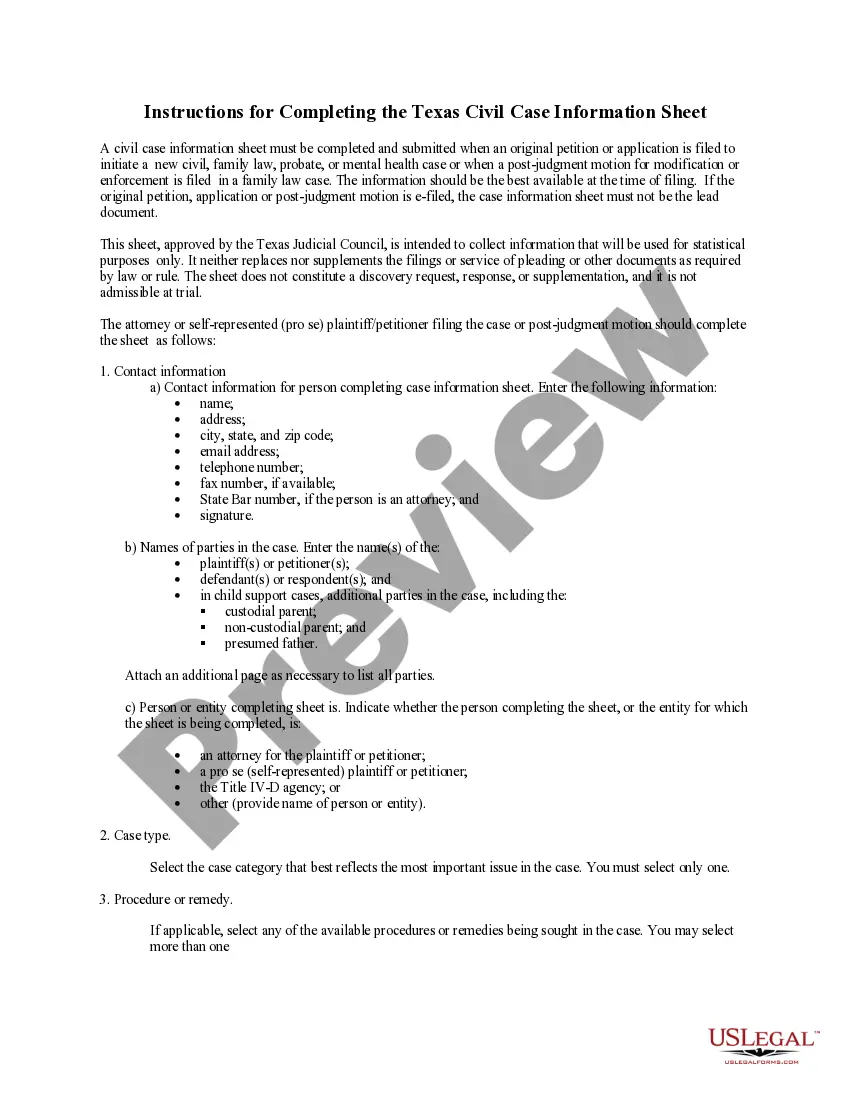

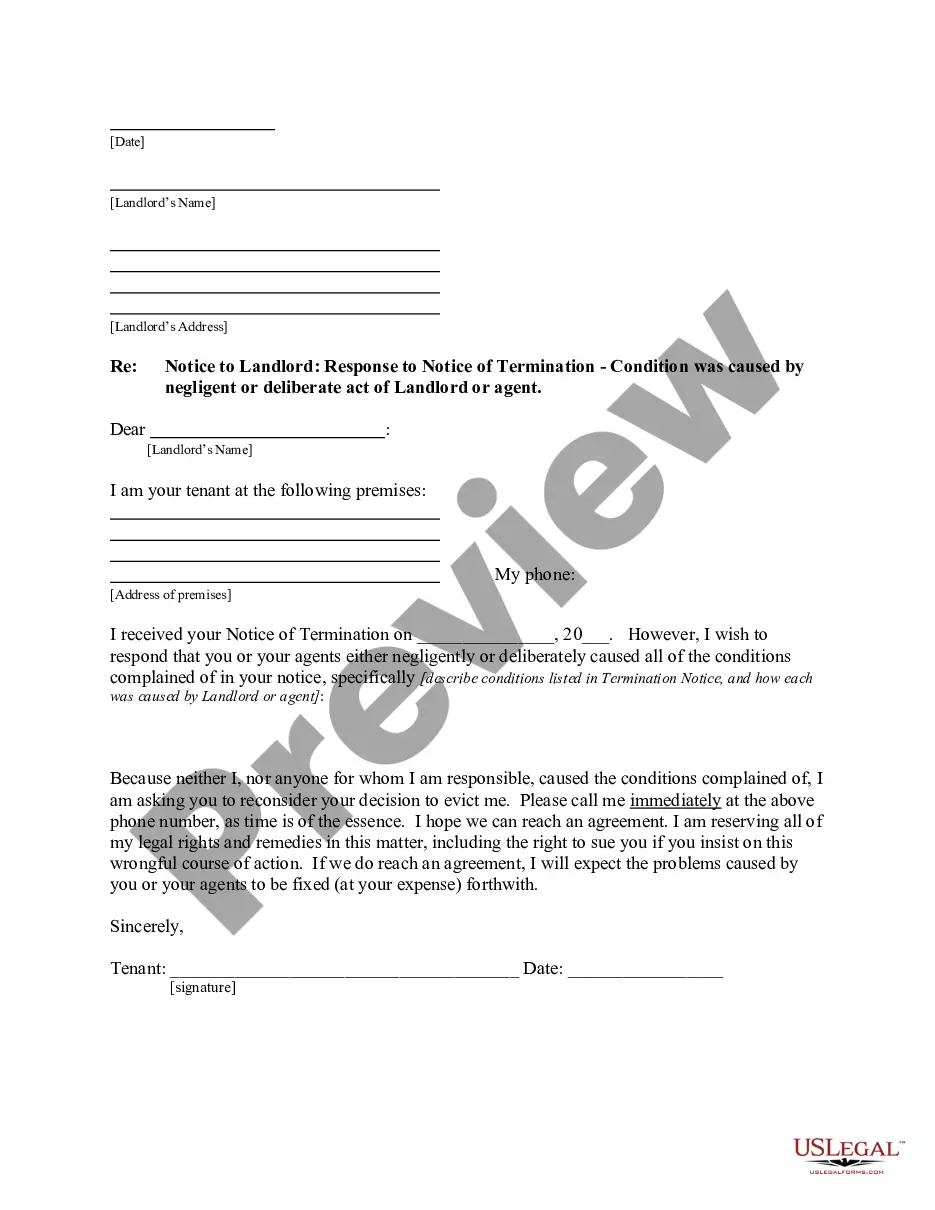

How to fill out Michigan Living Trust For Husband And Wife With No Children?

Have any form from 85,000 legal documents including Michigan Living Trust for Husband and Wife with No Children online with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Living Trust for Husband and Wife with No Children you want to use.

- Read description and preview the sample.

- When you’re sure the sample is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by credit card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The platform gives you access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Michigan Living Trust for Husband and Wife with No Children fast and easy.

Form popularity

FAQ

If a person dies without a will in the state of Michigan, or dies intestate, then the person's assets are divided in accordance with Michigan intestacy laws.If the deceased person has no surviving parents or descendants, then the surviving spouse is the sole heir.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Parents If the person who died has no surviving spouse or civil partner, and no children over 18, their parents are considered their next of kin. 4. Siblings If the person who died had no living spouse, civil partner, children or parents, then their siblings are their next of kin.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Your mother's next of kin is her eldest child. The term "next of kin" is most commonly used following a death. Legally, it refers to those individuals eligible to inherit from a person who dies without a will. Surviving spouses are at the top of the list, followed by those related by blood.

"Heir" means, except as controlled by MCL 700.2720, a person, including the surviving spouse or the state, that is entitled under the statutes of intestate succession to a decedent's property.