Michigan Closing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A closing statement is the final opportunity in a legal trial for both parties' attorneys to present their arguments to the jury before they deliberate on a verdict. It summarizes the evidence and testimony presented during the case and aims to convincingly argue each side's position.

Step-by-Step Guide to Creating an Effective Closing Statement

- Summarize the Case: Begin by summarizing the key points and evidence presented during the trial, reinforcing the narrative your side has built.

- Address Key Evidence: Highlight important evidence that supports your arguments, and address any counterpoints raised by the opposing side.

- Emotional Appeal: While remaining professional, use emotional appeal to strengthen your argument and engage the jury's sympathies.

- Call to Action: Conclude with a strong call to action, urging the jury to consider the justice and implications of their decision based on the evidence provided.

Risk Analysis of Ineffective Closing Statements

Ineffective closing statements can lead to a lack of clarity and fail to persuade the jury, potentially resulting in an unfavorable outcome. Risks include:

- Losing credibility if the evidence is misrepresented.

- Failing to address key points, which might leave jurors confused.

- Over-emphasizing emotional appeal which might seem manipulative to jurors.

Common Mistakes & How to Avoid Them

- Overloading Information: Avoid overwhelming the jury with too much information. Stick to the most compelling evidence.

- Neglecting the Opposition: Always address and counter arguments presented by the opposing counsel to cover all bases.

- Lack of Practice: Insufficient rehearsal can lead to a disorganized delivery. Practice your statement multiple times before the actual closing.

Key Takeaways

A strong closing statement is crucial in persuading the jury and achieving a favorable outcome. It should be clear, concise, and well-structured, summarizing the case effectively while also addressing counterpoints and highlighting the key evidence.

How to fill out Michigan Closing Statement?

Access any variation from 85,000 legal records including Michigan Closing Statement online with US Legal Forms.

Each template is prepared and updated by state-licensed attorneys.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to gain access to it.

Once your reusable template is downloaded, print it out or save it to your device. With US Legal Forms, you’ll consistently have immediate access to the suitable downloadable template. The platform provides access to documents and categorizes them to enhance your search efficiency. Utilize US Legal Forms to acquire your Michigan Closing Statement swiftly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Closing Statement you need to utilize.

- Browse the description and preview the sample.

- Once you’re confident that the template is what you require, simply select Buy Now.

- Select a subscription plan that suits your budget best.

- Establish a personal account.

- Complete the payment with one of two suitable methods: by credit card or through PayPal.

- Select a format for downloading the file; two formats are available (PDF or Word).

- Download the document to the My documents tab.

Form popularity

FAQ

To close an estate account, begin by gathering all necessary documents, including the Michigan Closing Statement, which outlines the transactions of the estate. Ensure all debts and taxes are settled before distributing any remaining assets. Afterward, formally notify the bank or financial institution to close the account and obtain written confirmation. Using platforms like USLegalForms can simplify the documentation process needed for this important step.

Yes, in Michigan, wills become public records once they are filed with the probate court. This means anyone can access these documents, but there are some limitations on who can view sensitive details. If you need to check a will's contents, consider requesting it through the appropriate court. Utilizing a Michigan closing statement can help you understand the financial implications associated with the estate.

Closing an estate in Michigan involves several steps to ensure all debts and taxes are settled. First, you should gather all necessary documents, including the Michigan closing statement, to track financial transactions. You may also need to file a formal petition with the probate court to initiate the process. Using professional legal forms can simplify this process and help structure your submissions accurately.

To request court documents in Michigan, you typically need to visit the court where the case was filed. You may submit a request form in person or online, depending on the court’s policies. Additionally, you will need to provide specific information about the case, such as the case number and names of the parties involved. For a comprehensive approach, consider using Michigan's closing statement template to ensure accurate documentation.

Michigan statutes provide no specific requirements an executor must meet, and you are free to name any adult that you trust as your executor. The court must appoint that person unless someone else challenges your choice of executor and there is clear evidence that he or she is incompetent or unsuitable to serve.

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who's familiar with local probate procedure .

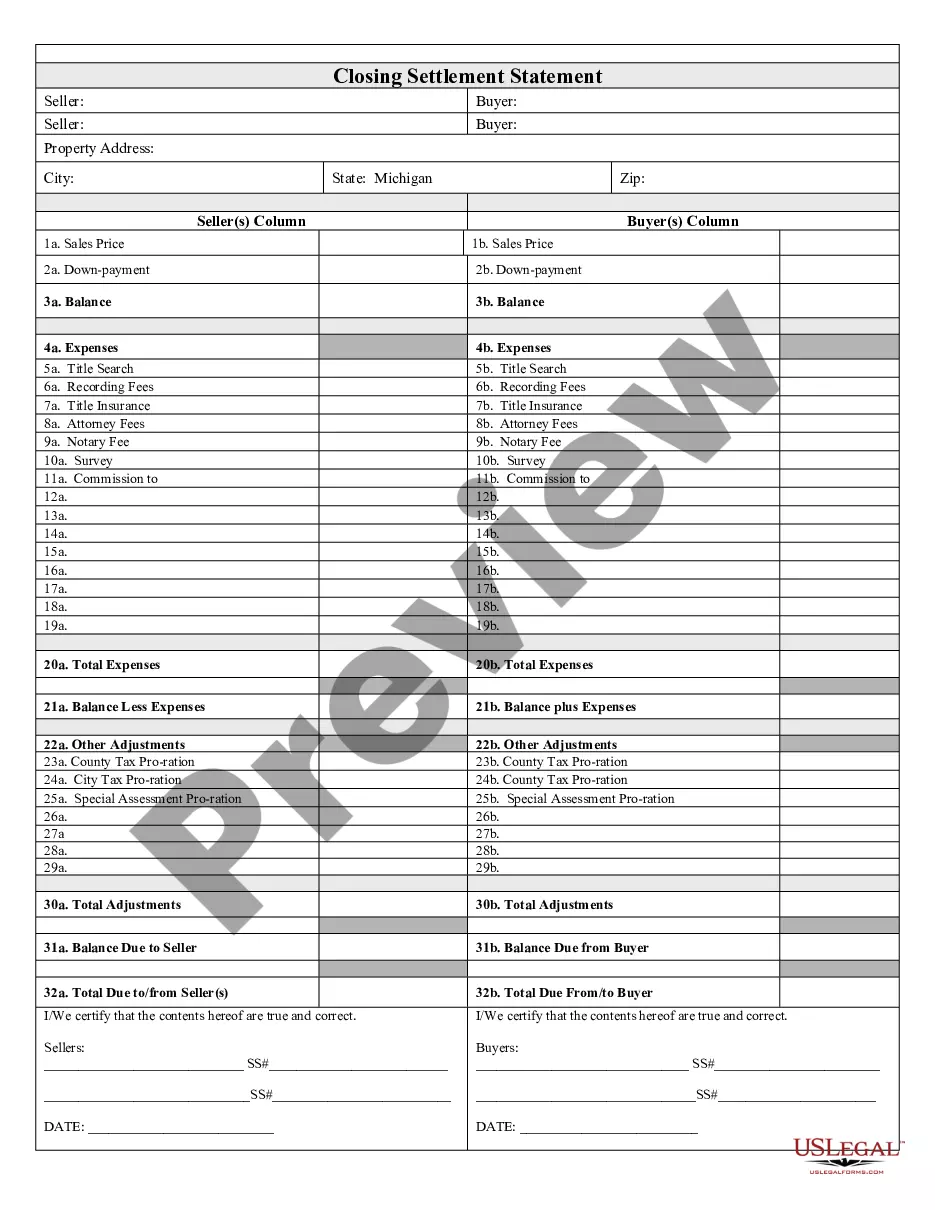

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)