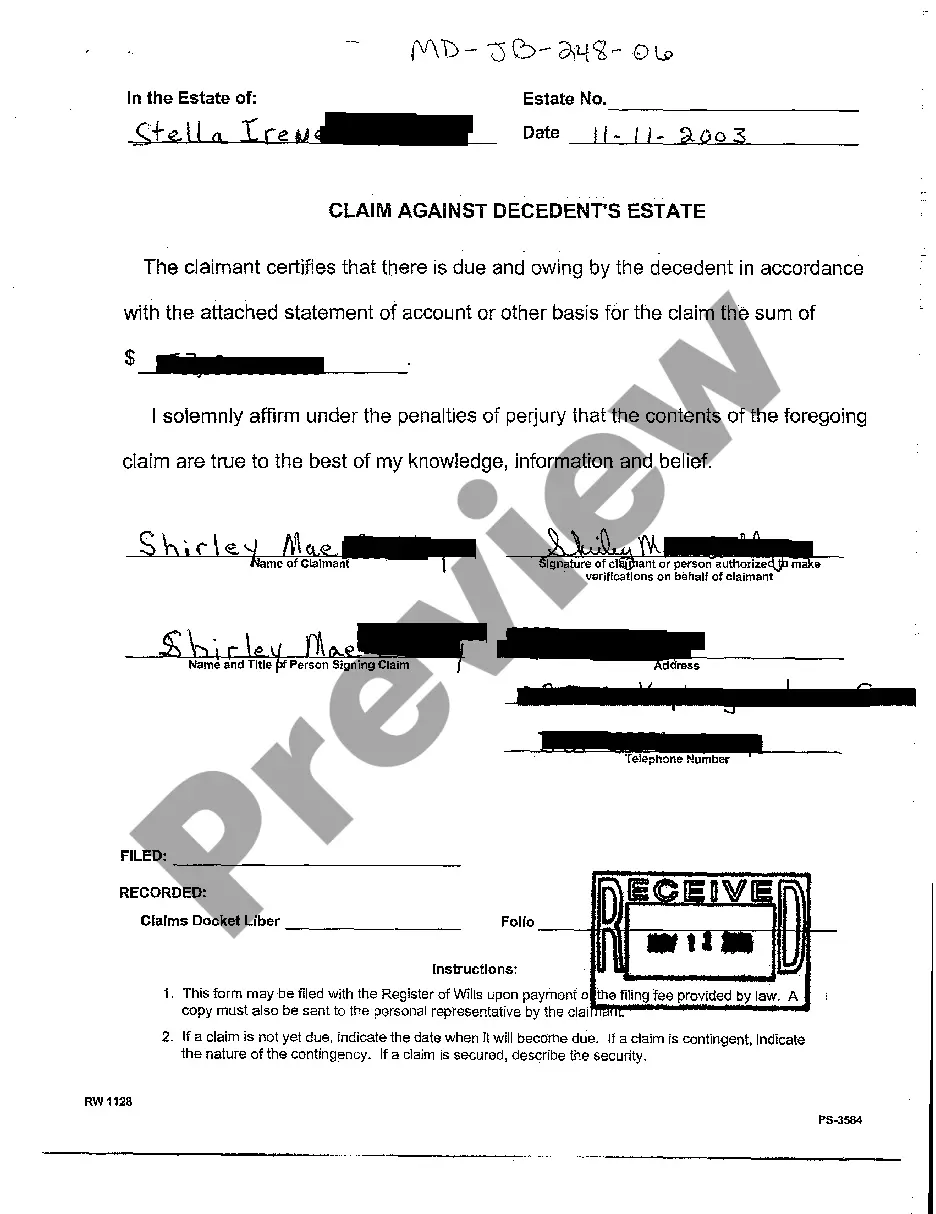

Maryland Claims Against Decedent's Estate for Personal Care

Description

How to fill out Maryland Claims Against Decedent's Estate For Personal Care?

Welcome to the most significant legal files library, US Legal Forms. Here you will find any example including Maryland Claims Against Decedent's Estate for Personal Care forms and save them (as many of them as you want/need to have). Prepare official papers with a couple of hours, instead of days or weeks, without spending an arm and a leg on an lawyer. Get your state-specific form in a couple of clicks and be confident knowing that it was drafted by our qualified legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maryland Claims Against Decedent's Estate for Personal Care you require. Due to the fact US Legal Forms is online solution, you’ll always have access to your downloaded templates, no matter the device you’re utilizing. Locate them within the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check our guidelines listed below to get started:

- If this is a state-specific form, check out its validity in your state.

- See the description (if available) to learn if it’s the proper example.

- See a lot more content with the Preview option.

- If the document meets your needs, just click Buy Now.

- To make your account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the template in the format you need (Word or PDF).

- Print out the file and fill it with your/your business’s info.

When you’ve filled out the Maryland Claims Against Decedent's Estate for Personal Care, send it to your lawyer for confirmation. It’s an additional step but an essential one for making certain you’re totally covered. Join US Legal Forms now and get access to thousands of reusable examples.

Form popularity

FAQ

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

A claimant may make a claim against the estate, within the time allowed for presenting claims, (1) by serving it on the personal representative, (2) by filing it with the register and serving a copy on the personal representative, or (3) by filing suit.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

Submit your claim directly to the probate court and serve a copy on the personal representative. If you file a formal claim and the personal representative rejects it, you can file suit against the estate within three months of the rejection.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.