Massachusetts Last Will and Testament for other Persons

What this document covers

The Last Will and Testament for other Persons is a crucial legal document that outlines how a person's assets and property will be distributed after their death. This form is designed for individuals in Massachusetts who cannot find a more specific will template to meet their needs. It allows users to specify beneficiaries, appoint personal representatives, and address guardianship for minor children, providing peace of mind in estate planning.

Main sections of this form

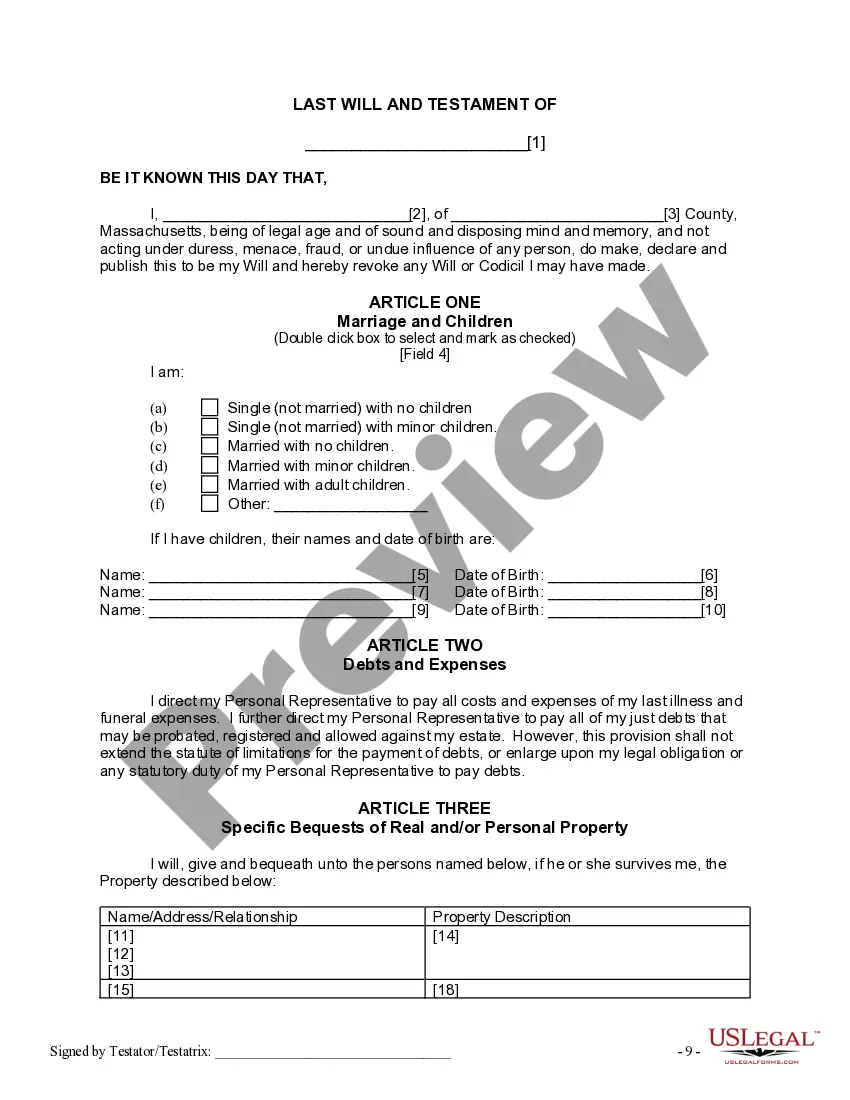

- Your personal information, including your name and county of residence.

- Marital status and details about your children, if applicable.

- Specific bequests of property to named individuals.

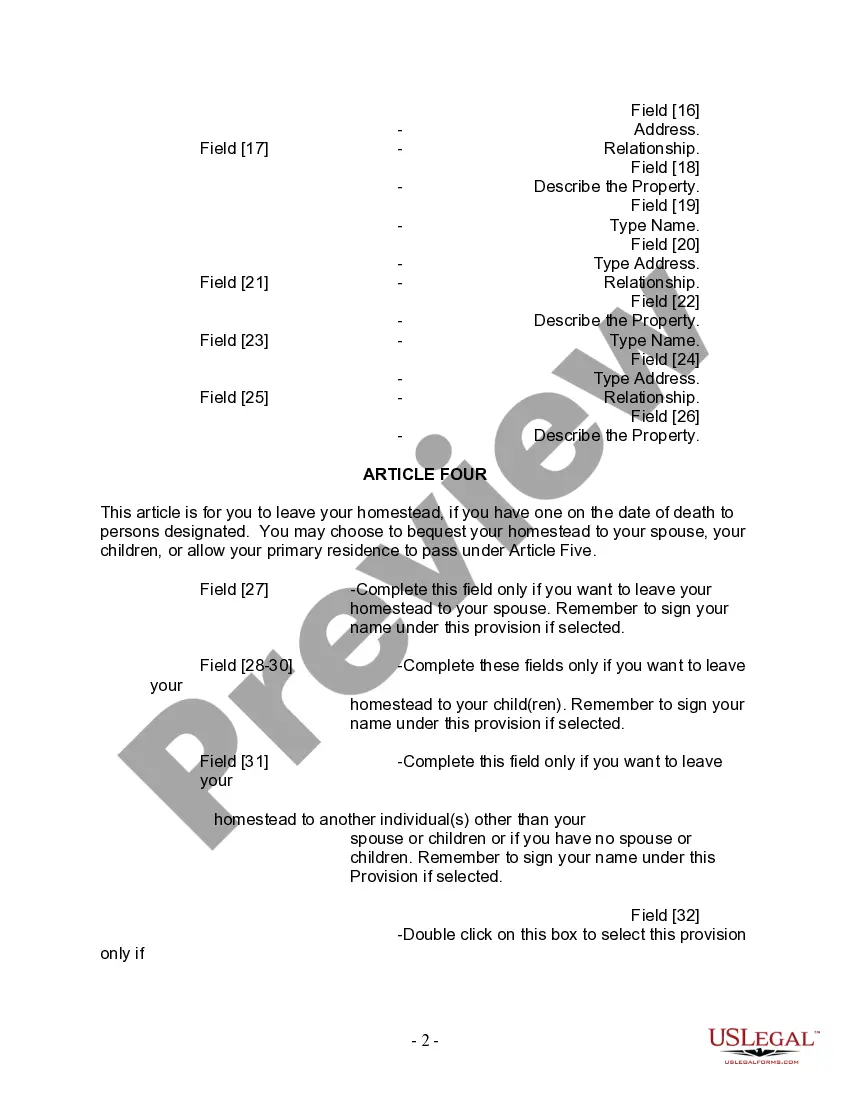

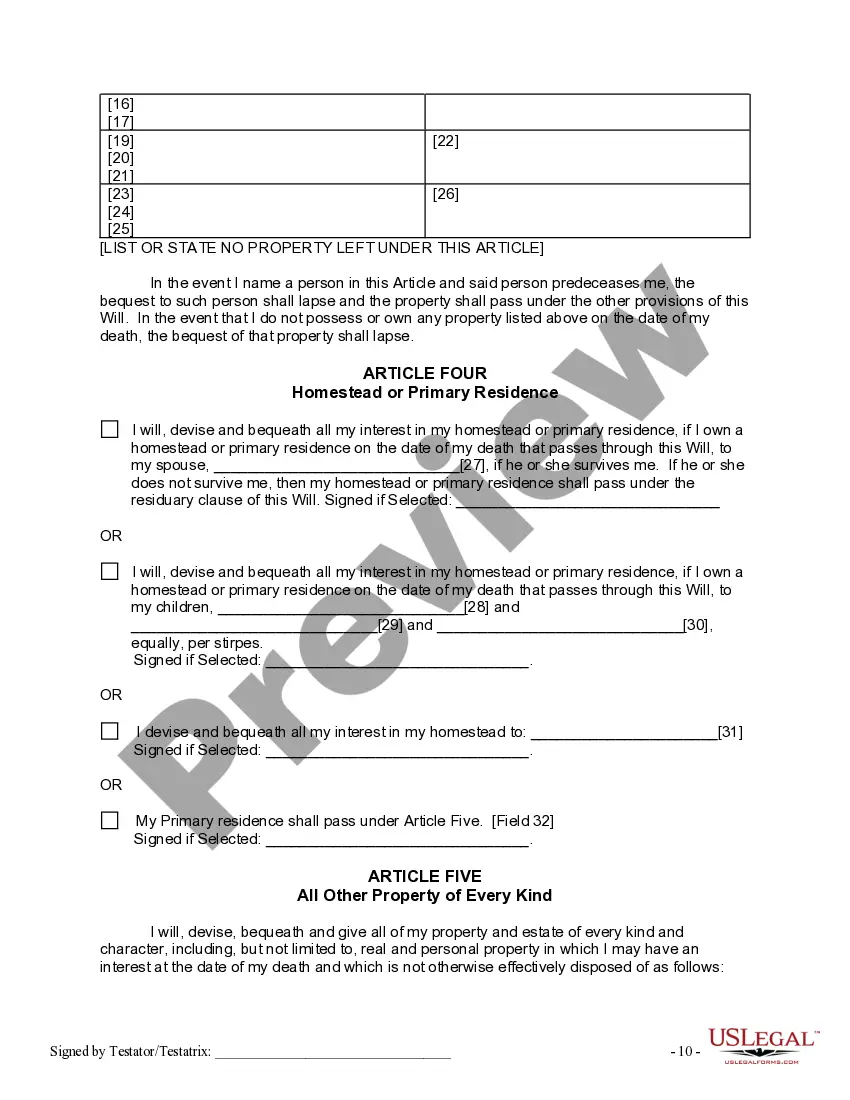

- Provisions for your primary residence or homestead.

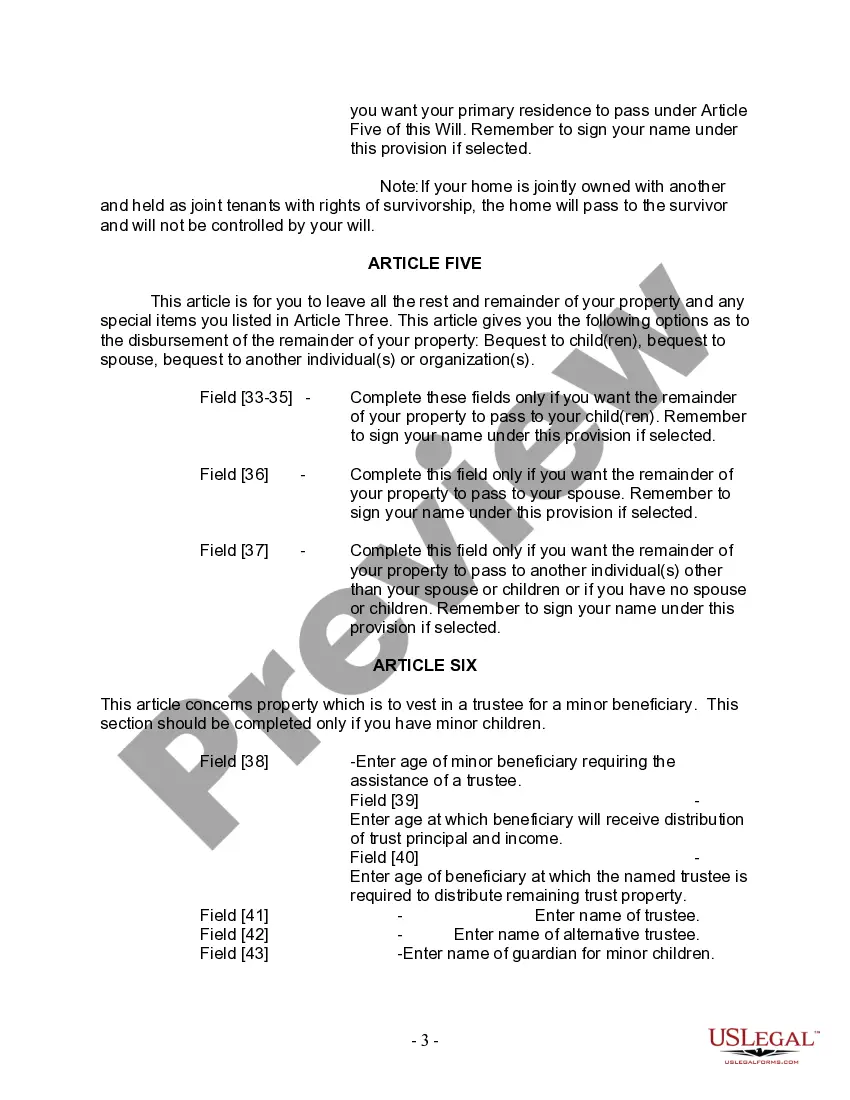

- Appointment of a personal representative to manage your estate.

- Instructions for managing assets designated for minor beneficiaries through a trustee.

Common use cases

This form is appropriate to use when you want to ensure that your property is distributed according to your wishes after your death. It is particularly useful if you do not have a previous will or are looking for a comprehensive way to manage your estate, especially if you have minor children or specific assets you wish to allocate to certain individuals.

Who needs this form

- Individuals aged 18 or older who are residents of Massachusetts.

- Anyone who wants to establish how their property should be divided upon their death.

- Parents seeking to designate guardians for their minor children in the event of their passing.

- Those without a previously executed will or who need a tailored document to reflect their current wishes.

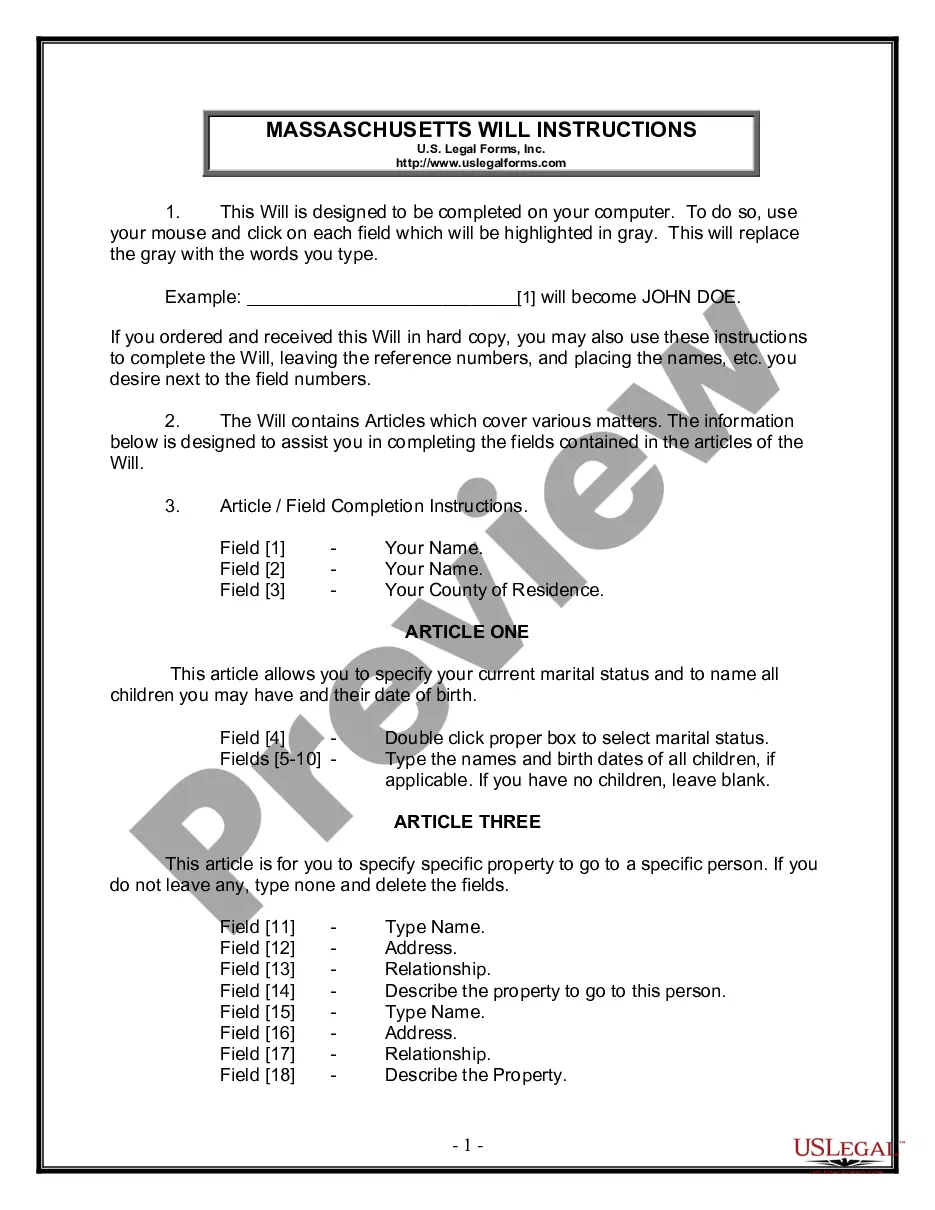

Steps to complete this form

- Start by entering your personal information, including your name and county of residence.

- Indicate your marital status and list any children, including their names and dates of birth.

- Detail any specific bequests by entering the names, addresses, and relationships of beneficiaries alongside the property descriptions.

- Choose how you want to distribute your homestead or primary residence and fill in the appropriate fields.

- Appoint a personal representative and a successor to oversee your estate after your passing.

Does this document require notarization?

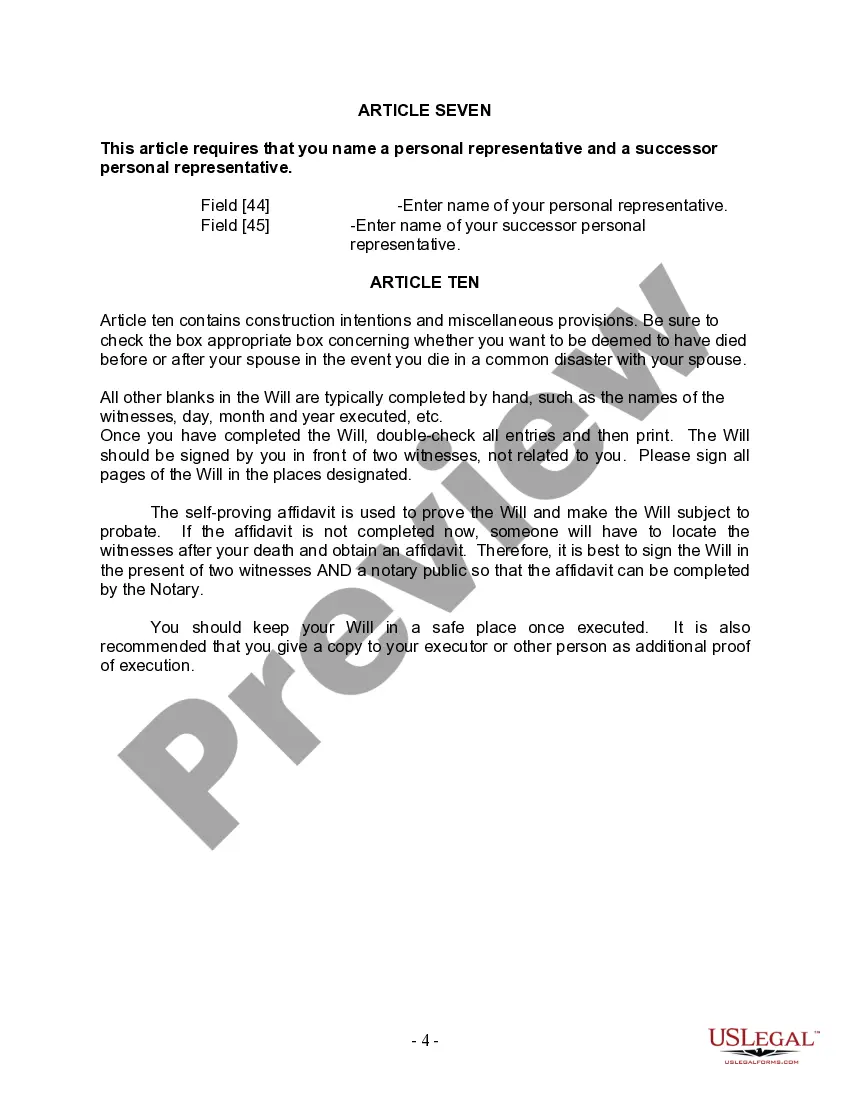

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to sign the will in the presence of witnesses, which can invalidate the document.

- Not updating the will after significant life events, such as marriage, divorce, or the birth of children.

- Leaving out important property details or failing to specify beneficiaries clearly.

- Neglecting to include a self-proving affidavit, which can complicate the probate process.

Benefits of using this form online

- Convenience of completing the form from home, allowing for edits until finalized.

- Access to a comprehensive template reviewed by licensed attorneys to ensure legal compliance.

- Ability to easily reprint or modify the document as personal circumstances change.

Looking for another form?

Form popularity

FAQ

If you are not family and were never named in a previous will, you have no standing to contest the will. If the testator (the deceased) discussed an inheritance with you previously, write down as much as you can remember. Using this, estimate the dollar value (whether money or possessions).

There must be multiple witnesses of a will in order for it to be valid. In Massachusetts, there must be a minimum of two witnesses, and in most circumstances, they should not be set to benefit from the outcome of the will.

No, in Massachusetts, it is not necessary to notarize your will to make it legal. Massachusetts does, however, allow you to make your will "self-proving." A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Technically, you can create your own will in Massachusetts. The only legal requirement is that you sign it in front of at least 2 witnesses and that those witnesses also sign the will.

When probate is granted, the will is kept by the Probate Service and any member of the public can get a copy. If you want to search for the will of a person who died recently, you can apply to the Probate Service for a standing search to be made.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.

In Massachusetts, if you are over 18 and of sound mind, and have the signatures of 2 witnesses, your handwritten will may be considered valid. However, there are some issues you should consider before deciding a handwritten will (also called holographic) is sufficient for your estate planning needs.

Obviously, the person who is named as executor or personal representative is entitled to a copy of the will. He or she is in charge of applying for probate, managing the decedent's property, and making sure the instructions in the will get carried out.

Will Probate Be Necessary? Probate court proceedings aren't always necessary. Usually, they are required only if the deceased person owned assets in his or her name alone. Other assets can probably be transferred to their new owners without probate.