Annual Minutes for a Massachusetts Professional Corporation

What this document covers

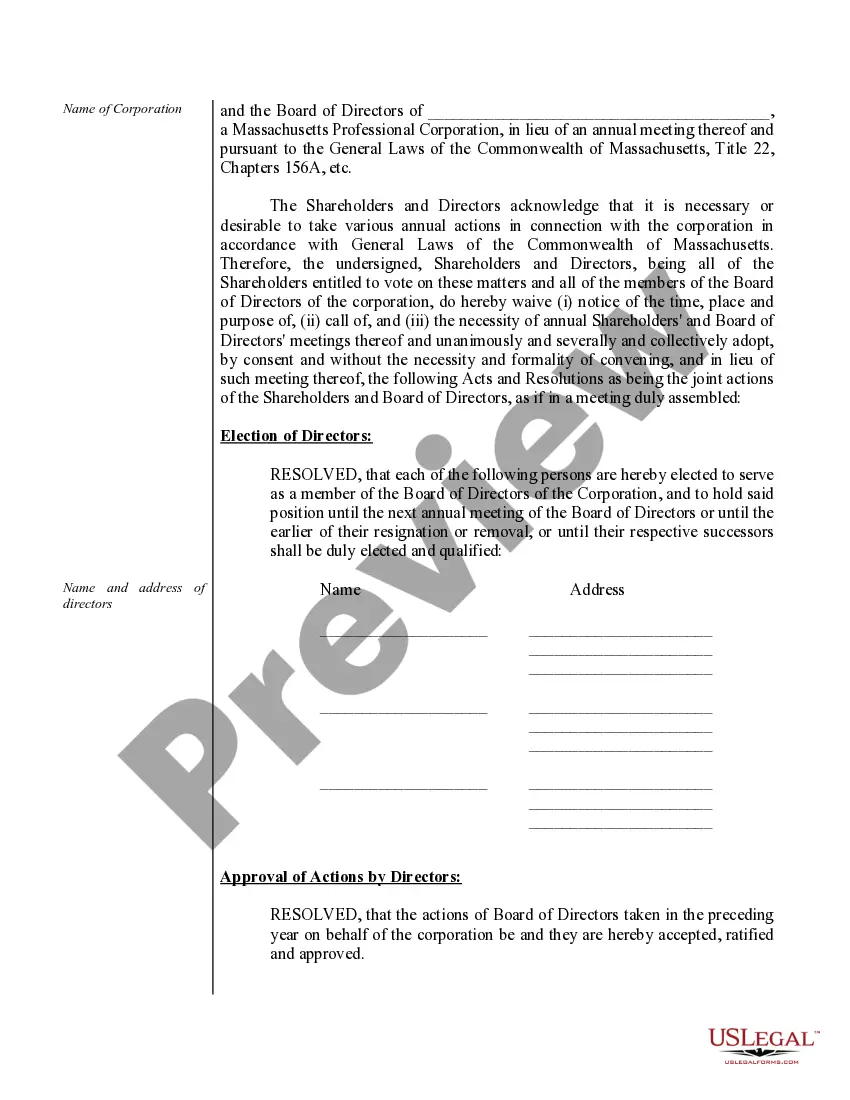

The Annual Minutes for a Massachusetts Professional Corporation is a legal document used to record the changes and organizational activities of a professional corporation over the course of a year. These minutes provide a formal account of decisions made by shareholders and the board of directors, differing from other forms by specifically accommodating the requirements set forth by Massachusetts law for professional corporations.

Form components explained

- Name of the corporation

- Name and addresses of directors

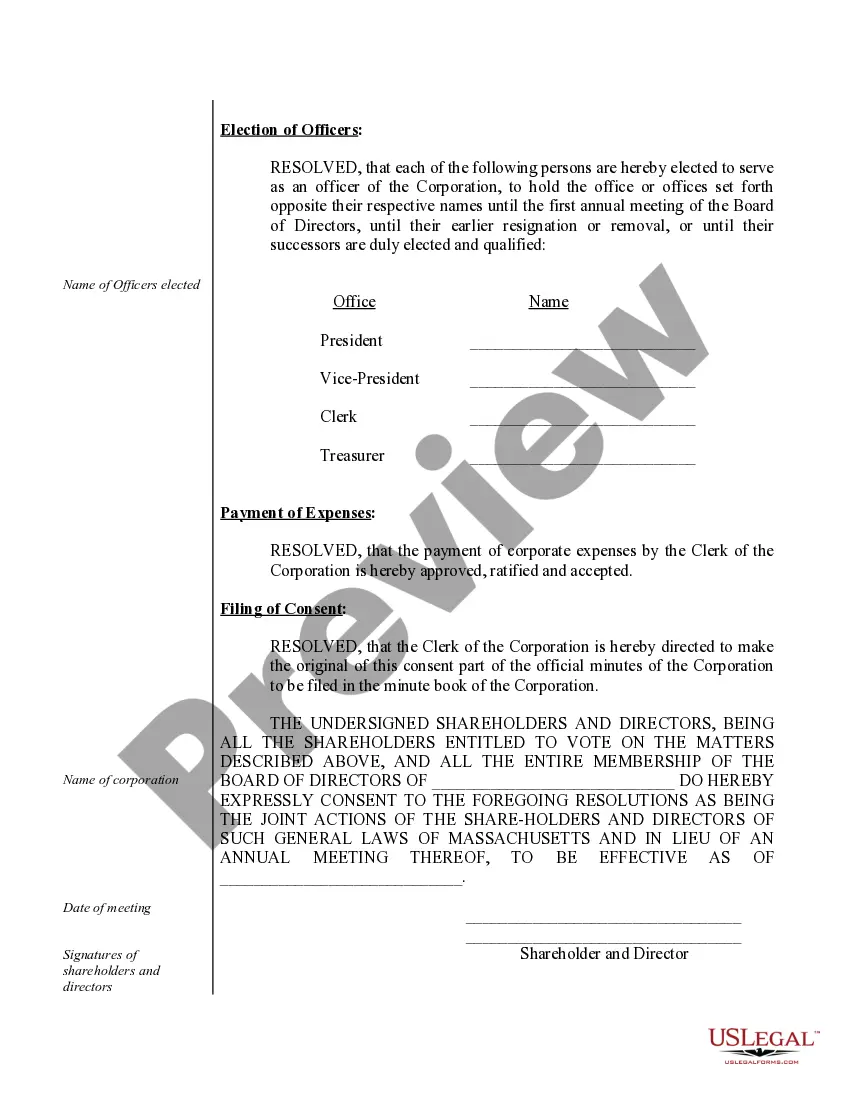

- Name of elected officers

- Date of the meeting

- Signatures of shareholders and directors

- Clerk's signature

When this form is needed

This form should be used during the annual cycle of a professional corporation when no formal meeting is held. It documents important decisions like the election of directors and officers, ratification of past actions, and approval of expenses. Use this form to ensure compliance with Massachusetts laws regarding the corporate governance process.

Intended users of this form

- Professional corporation owners in Massachusetts

- Shareholders and directors of a professional corporation

- Corporation clerks responsible for maintaining corporate records

How to prepare this document

- Enter the name of the corporation at the top of the document.

- List the names and addresses of the directors involved.

- Specify the elected officersâ names and their corresponding titles.

- Include the date when the minutes are recorded.

- Gather signatures from all shareholders and directors to validate the minutes.

- Ensure the clerk signs to finalize the document.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all necessary signatures from shareholders and directors.

- Not recording the date of the meeting accurately.

- Leaving out names or addresses of directors and officers.

- Not following state-specific rules for documentation.

Why use this form online

- Convenience of accessing the form anytime and anywhere.

- Editability to tailor the document according to your corporation's specific needs.

- Reliability of using templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

How much does it cost to form a corporation in Massachusetts? You can register your business name with the Massachusetts Secretary of the Commonwealth Corporations Division for $30. To file your Articles of Incorporation, the Massachusetts Secretary of the Commonwealth Corporations Division charges a $275 filing fee.

Top 5 Tips on Registering a Business in Massachusetts LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Massachusetts Certificate of Organization, OR you can file online. Step 2: Fill Out the Certificate of Organization. Step 3: File the Certificate of Organization.

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.

Annual reports typically include financial statements, such as balance sheets, income statements, and cash flow statements. It contains 3 sections: cash from operations, cash from investing and cash from financing..

The State of Massachusetts requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Corporations Division website. You'll need a customer ID number and PIN to access the online form.

Corporations are required to pay between $50 and $200 in government filing fees. This is in addition to the filing fees paid to the Secretary of State. Government filings are based on the type of business being incorporated and the state in which the business is incorporating.

Chairman's Letter. Business Profile. Management Discussion and Analysis. Financial Statements. Determine the Key Message. Finalize Structure and Content.