Massachusetts Warranty Deed to Child Reserving a Life Estate in the Parents

What is this form?

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that transfers ownership of property from parents to their child while allowing the parents to retain a life estate. This means that the parents can continue to live in and use the property during their lifetime, after which full ownership will pass to the child. Unlike standard warranty deeds, this form specifically includes a reservation for life estate, providing continued rights to the parents during their lifetime.

Main sections of this form

- Parties involved: Identifies the parents as grantors and the child as the grantee.

- Property description: Contains a detailed description or attachment specifying the property being transferred.

- Life estate reservation: Clearly states the reservation of life estates for the parents, allowing them to live in the property until death.

- Legal covenants: Includes warranty covenants ensuring the grantor holds clean title to the property.

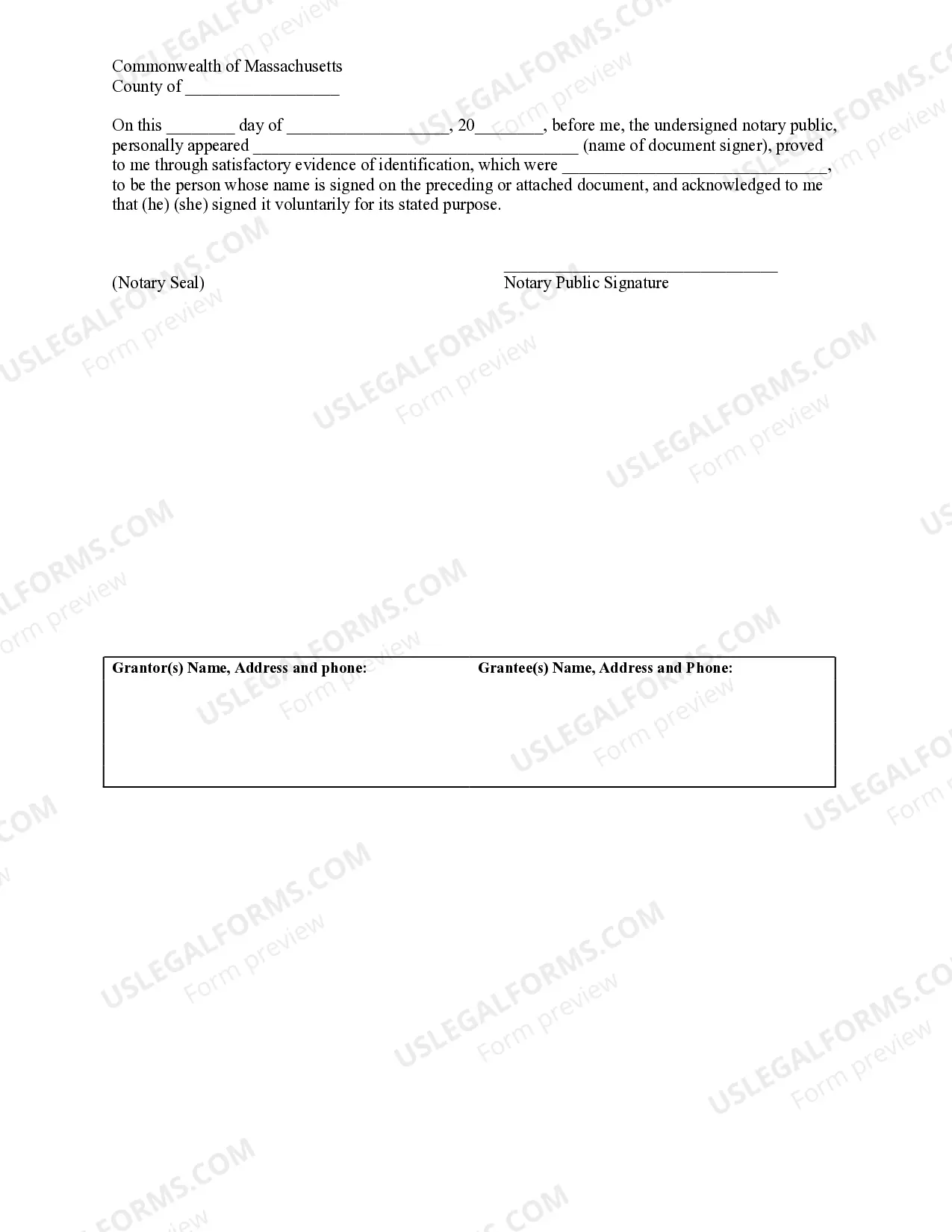

- Notarization section: Includes space for notary acknowledgment, validating the deed.

Situations where this form applies

This form is typically used when parents wish to transfer real estate to their child but want to maintain their right to use the property for the rest of their lives. This arrangement reduces potential estate taxes and clarifies property ownership while ensuring the parents have a place to live. It can also be used in estate planning to prepare for the eventual transfer of assets without the need for probate.

Who needs this form

- Parents wishing to transfer property to their child while retaining a life estate.

- Families looking to manage estate planning efficiently to avoid probate.

- Individuals seeking to clarify property ownership between family members.

How to complete this form

- Identify the parties: Write down the names of the parents and the child receiving the property.

- Specify the property: Provide a full description of the property being transferred, including location and any specific identifiers.

- Enter the consideration amount: Input the nominal consideration amount (e.g., ten dollars) to formalize the transaction.

- Complete the life estate section: Clearly indicate the retention of life estates for the parents.

- Sign and date: Ensure all parties sign and date the document, including spaces for notary acknowledgment.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not including a detailed property description, leading to ambiguity.

- Failing to specify the retention of life estates, which can create legal confusion.

- Missing signatures from all parties involved.

- Not obtaining notarization, which may impact legal enforceability.

Advantages of online completion

- Convenience: Download the form anytime, anywhere without needing a lawyer present.

- Editability: Fill out the form electronically, reducing errors and ensuring clarity.

- Cost-effective: Save on legal fees while still obtaining a professionally drafted document.

Legal use & context

- This deed is legally enforceable in Massachusetts, transferring ownership while retaining specified rights for the grantors.

- Ensure compliance with local laws regarding life estates and property transfers for validity.

What to keep in mind

- The Warranty Deed enables parents to transfer property to their child while retaining living rights for their lifetime.

- Proper completion and notarization of this form are essential to ensure its legal enforceability.

- Using this form can be a strategic part of estate planning, potentially reducing tax implications.

Looking for another form?

Form popularity

FAQ

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

With a life estate deed, the remainderman's ownership interest vests when the deed is signed and delivered (or recorded in the public record). Accordingly, the children's ownership interest in the property vested upon their father signing the deed and recording it in the public records, or the year 2000.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

Pursuant to ' 2036(a) of the IRC, the transfer of a residence with a retained life estate permits the transferee of the residence to receive a full step up in his or her cost basis in the premises upon the death of the transferor, to its fair market value on the transferor's date of death.

Example of creation of a life estate: I grant to my mother, Molly McCree, the right to live in and/or receive rents from my real property, until her death, or I give my daughter, Sadie Hawkins, my real property, subject to a life estate to my mother, Molly McCree. This means a woman's mother, Molly, gets to live in

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.