Louisiana Owner's or Seller's Affidavit of No Liens

Overview of this form

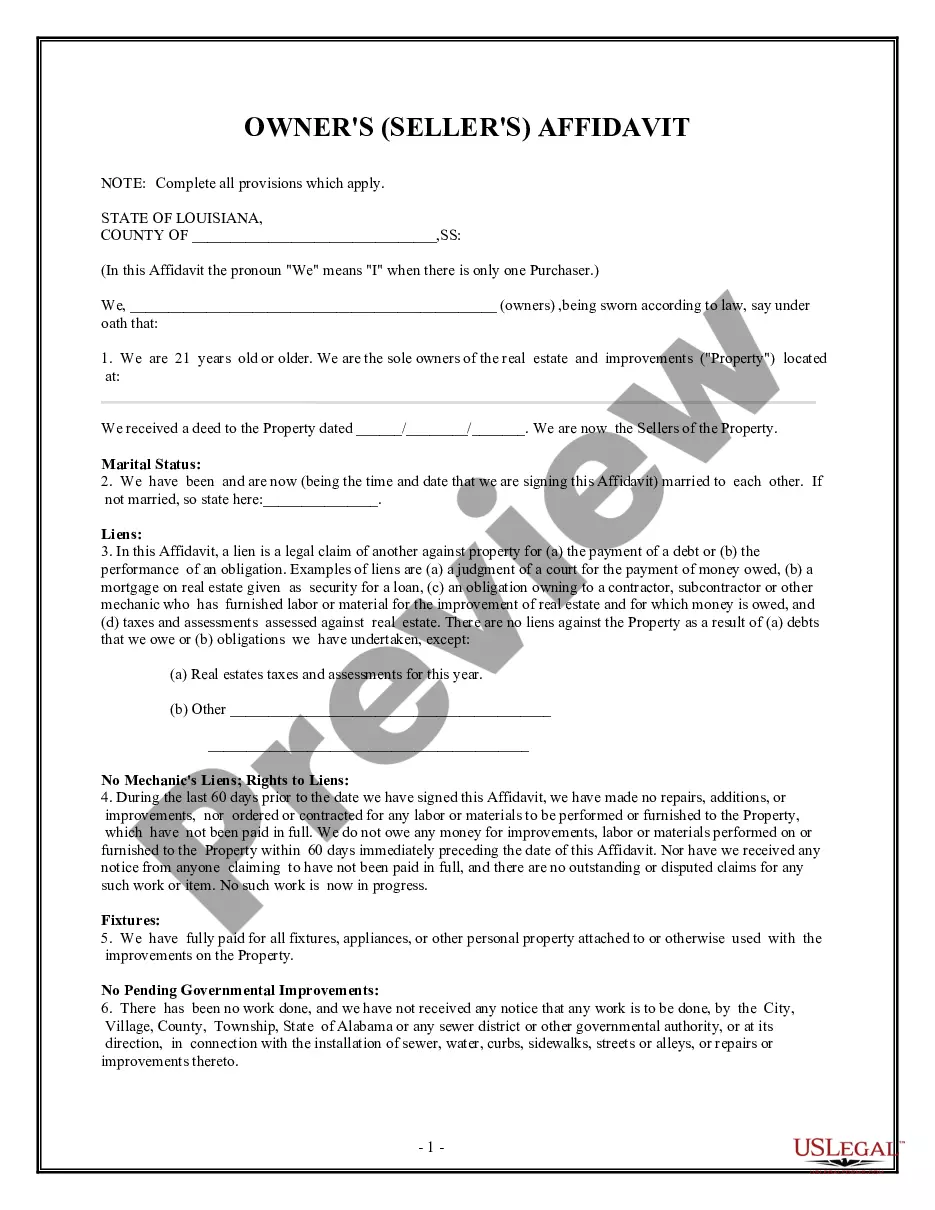

The Owner's Affidavit of No Liens is a legal document that sellers sign during the closing of a property sale. This form certifies that the sellers are the sole owners of the property, that there are no existing liens against it, and that they have fulfilled any related obligations. It is a critical part of the closing process that ensures the buyer receives clear title to the property. Unlike other forms related to property transactions, this affidavit specifically addresses the absence of liens and verifies the ownership status of the sellers.

Form components explained

- Identification of the property being sold.

- Confirmation of the sellers' ownership and marital status.

- Declaration of the absence of debts and liens against the property.

- Certification that no improvements or repairs have been made without payment.

- Assurances regarding pending governmental improvements and notices.

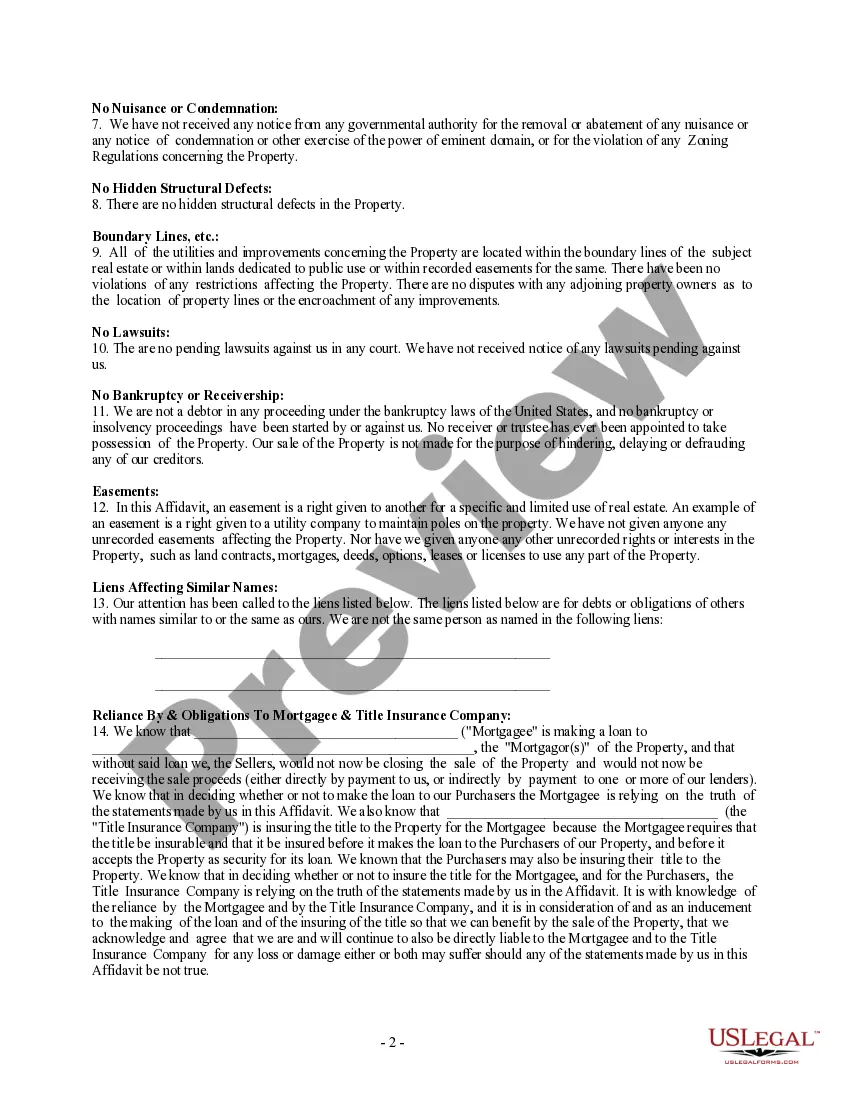

- Acknowledgment of potential reliance by mortgagees and title insurance companies on this affidavit.

Common use cases

This form is used during the closing process for the sale of real estate. Sellers should complete and sign the Owner's Affidavit of No Liens if they are transferring ownership of a property and need to certify that no liens or encumbrances affect the property. It is particularly important when the buyer is obtaining financing, as lenders require confirmation of clear title prior to issuing a mortgage.

Who needs this form

This affidavit should be used by:

- Property sellers who are closing a real estate transaction.

- Married couples selling their home.

- Individuals involved in selling a property who need to assert that there are no existing liens.

- Real estate professionals assisting clients with property transactions.

Steps to complete this form

- Identify the sellers and the property by entering the relevant information at the top of the affidavit.

- Confirm your age and ownership status by signing where indicated.

- Detail any exceptions to the absence of liens, if applicable, particularly regarding taxes or assessments.

- Complete sections related to mechanics liens, improvements, and any governmental notices received.

- Sign and date the affidavit before a notary public to ensure its validity.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to fully complete all applicable sections of the affidavit.

- Not obtaining a notarization, which is often required for legal validity.

- Omitting details about liens or encumbrances that could affect the property.

- Providing inaccurate information which could lead to legal complications.

What to keep in mind

- The Owner's Affidavit of No Liens is crucial for confirming clear title during a property sale.

- It is essential that sellers complete this form accurately to avoid legal issues.

- The affidavit must be notarized to ensure its enforceability.

- Be aware of local regulations that may impact the use of this form in Louisiana.

Looking for another form?

Form popularity

FAQ

The general warranty deed is the standard instrument for home sales. Your notarized warranty deed is proof of ownership, and that the grantor transferred complete and clear title to you. A quitclaim deed also proves full land ownershipif the person who conveyed the interest to you had full ownership.

Most states now have additional tools available for free property title searches. You can find these on your state government sites under "county assessor." You will have to select your county, and you can then search through the listed properties.

Buyers don't like buying a house with a lien on it, so creditors know that putting a lien (or encumbrance) on a property is a cheap way of collecting what they are owed, sooner or later. Liens are part of the public record. Liens stay with the property when it is sold, but remains on the previous owner's credit report.

In most states, you can typically search by address with the county recorder, clerk, or assessor's office online. The search for liens is free, though you may have to pay a small fee for a copy of the report, which will vary by county.

The buyer is entitled to a purchaser's lien which he can foreclose on the property being reconveyed to the seller. The lien is for the amount of payments made on the purchase price, plus expenditures made to improve the property and to pay taxes and insurance premiums. Montgomery v.

A statement showing that your balance is paid in full. Your canceled promissory note. A certificate of satisfaction. Your canceled mortgage or deed of trust.

A purchaser's lien is an equitable remedy that may arise when a purchaser makes a payment (such as a deposit) toward the purchase price under a contract of purchase and sale.

The title search performed in the prelim title discovers whether or not there are any liens against the title, which would typically be placed by a lender on the property. They also may have you sign a document stating that there are no liens that are not recorded. If there are not, just sign it. Bingo.

How long does a judgment lien last in California? A judgment lien in California will remain attached to the debtor's property (even if the property changes hands) for ten years.