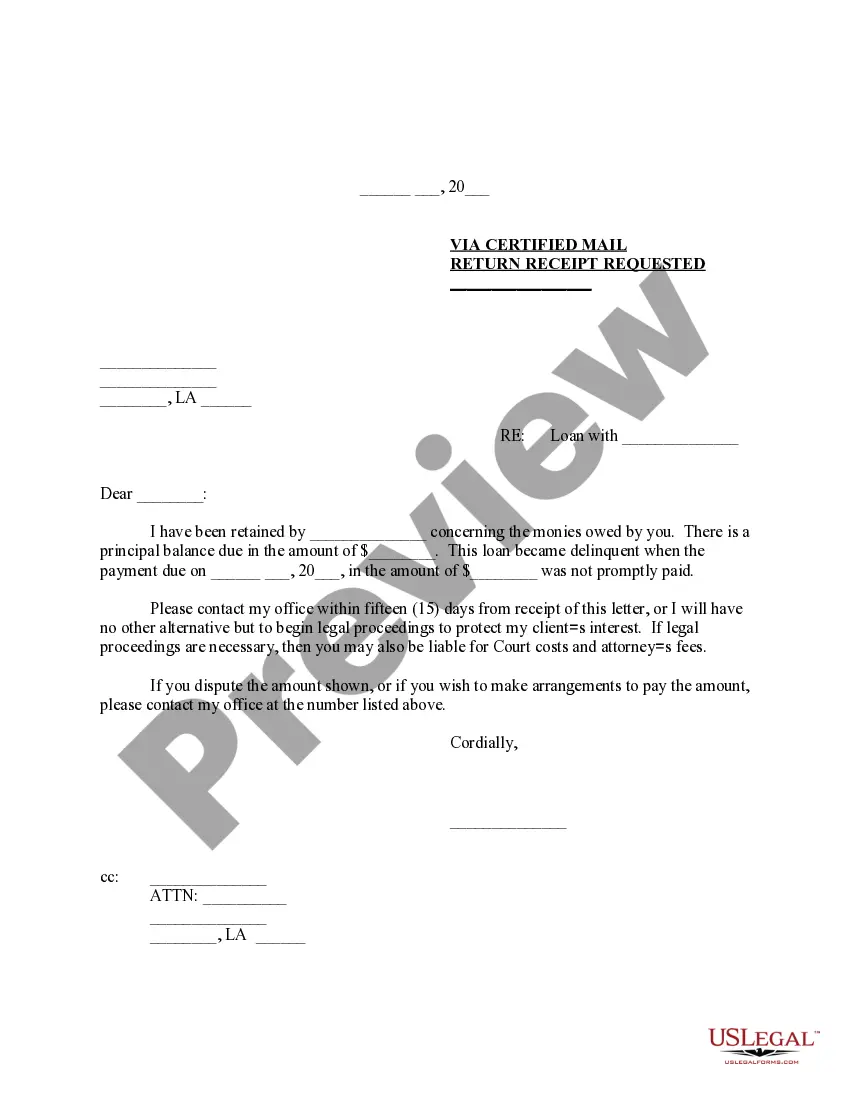

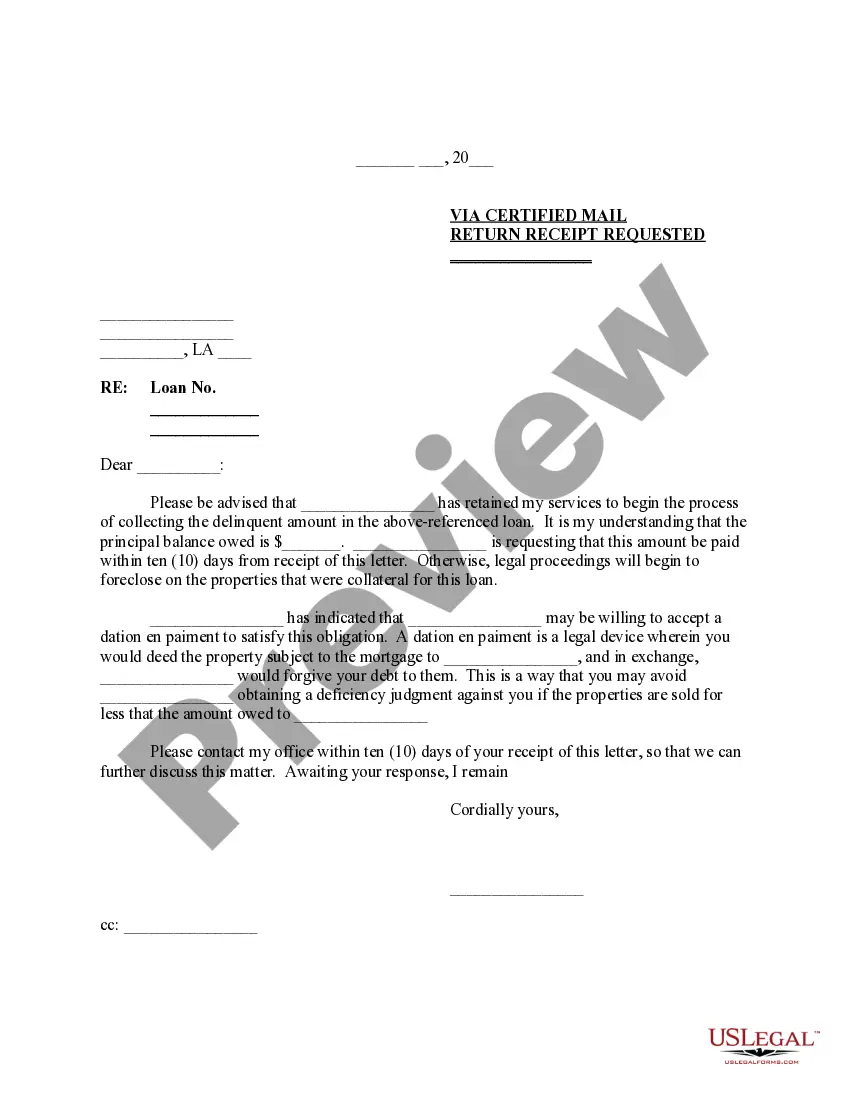

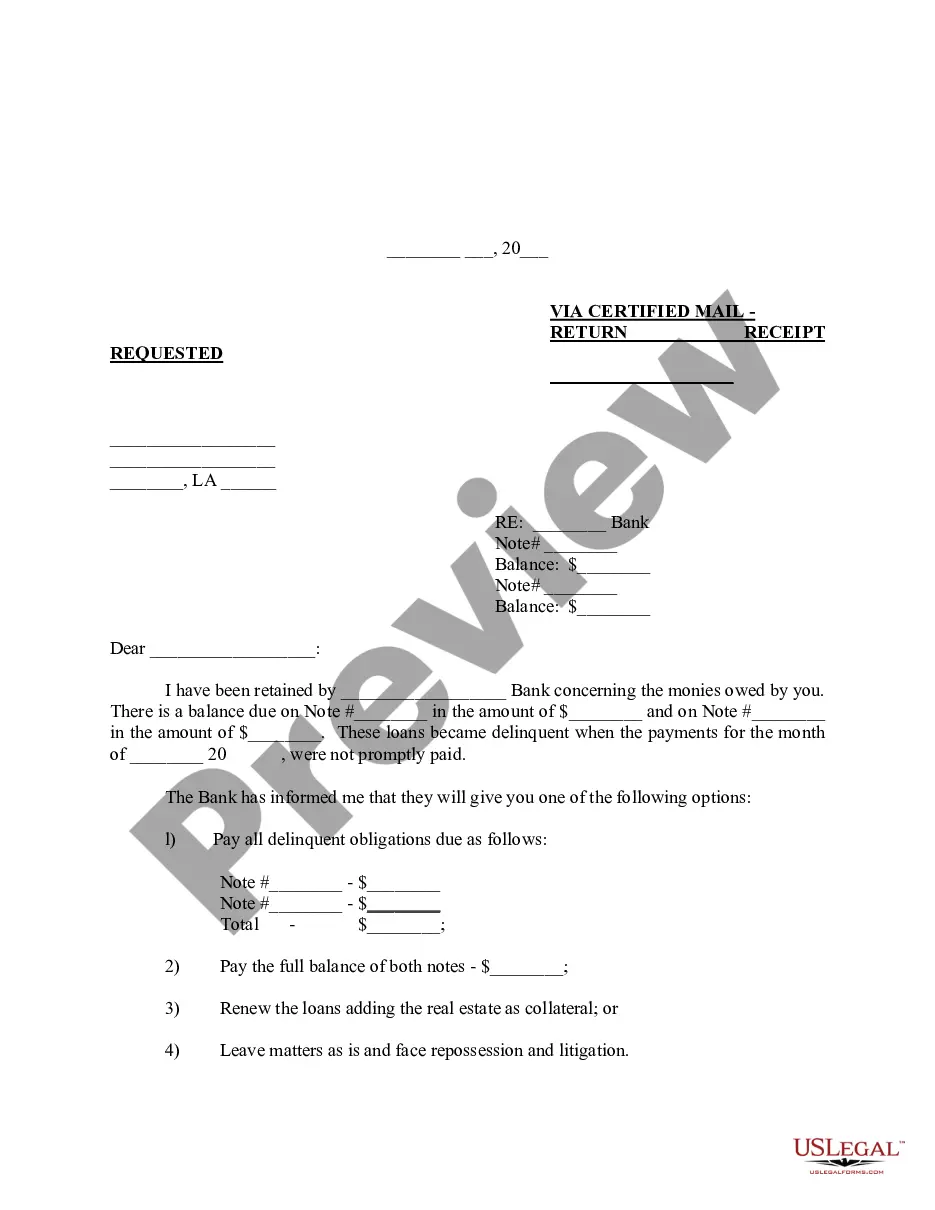

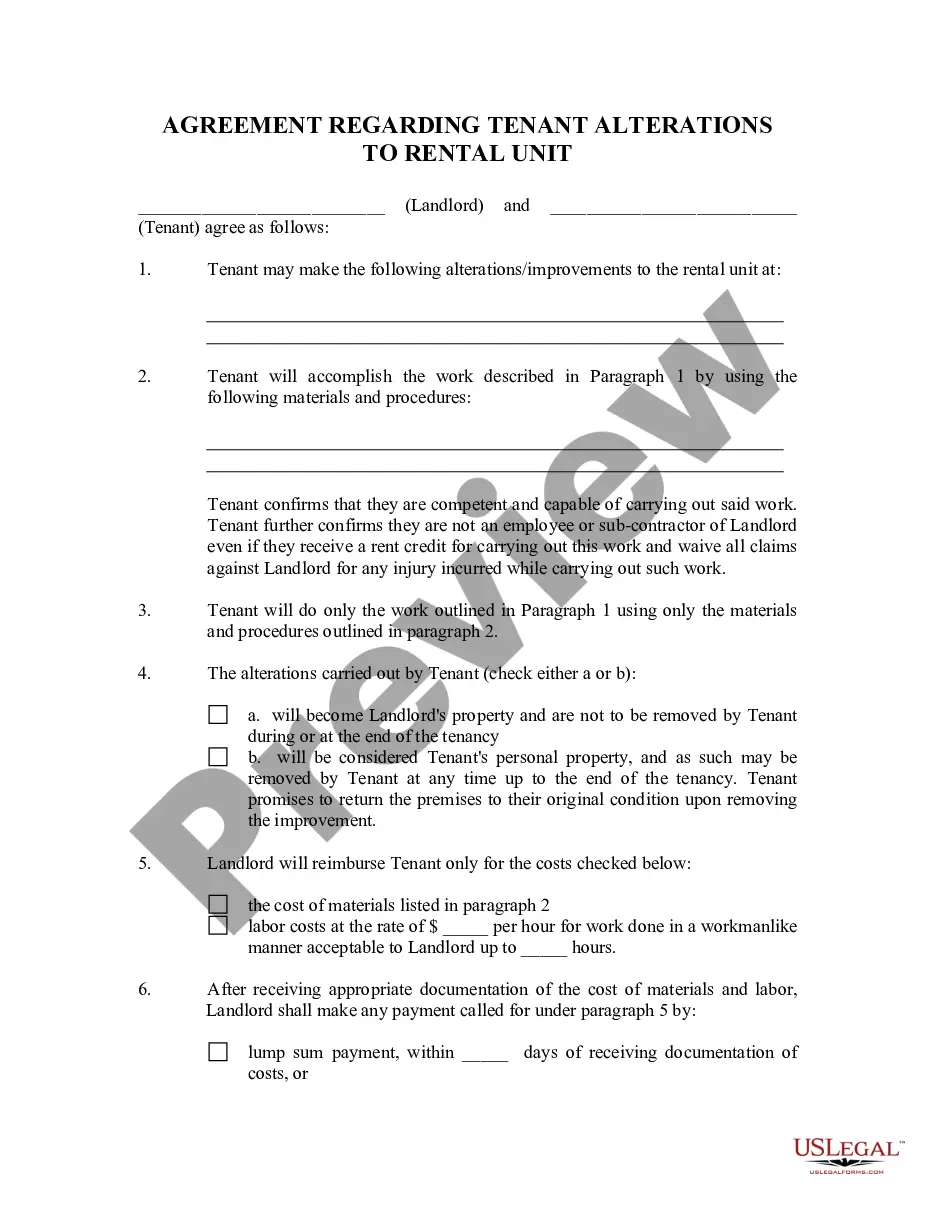

Louisiana Demand Letter - Repayment of Promissory Note

Description

How to fill out Louisiana Demand Letter - Repayment Of Promissory Note?

Searching for Louisiana Demand Letter - Repayment of Promissory Note example and completing them can be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the accurate example tailored for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It is genuinely that straightforward.

Choose your plan on the pricing page and create an account. Decide whether you want to pay by card or via PayPal. Save the example in your preferred format. You can now print the Louisiana Demand Letter - Repayment of Promissory Note template or complete it using any online editor. Don’t worry about making errors because your form can be used and submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the example.

- Your stored templates are kept in My documents and are available at all times for future use.

- If you haven’t registered yet, you should create an account.

- Review our extensive instructions on how to acquire the Louisiana Demand Letter - Repayment of Promissory Note example in a few minutes.

- To obtain a relevant example, verify its relevance for your state.

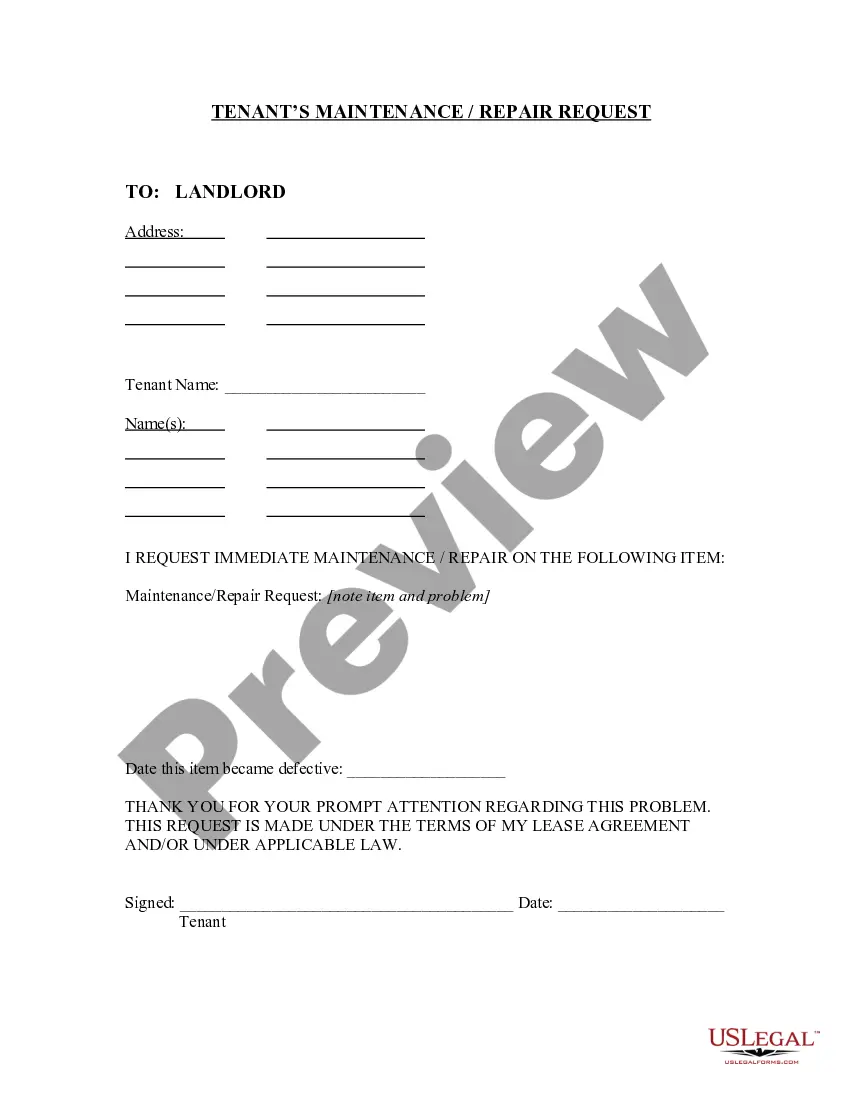

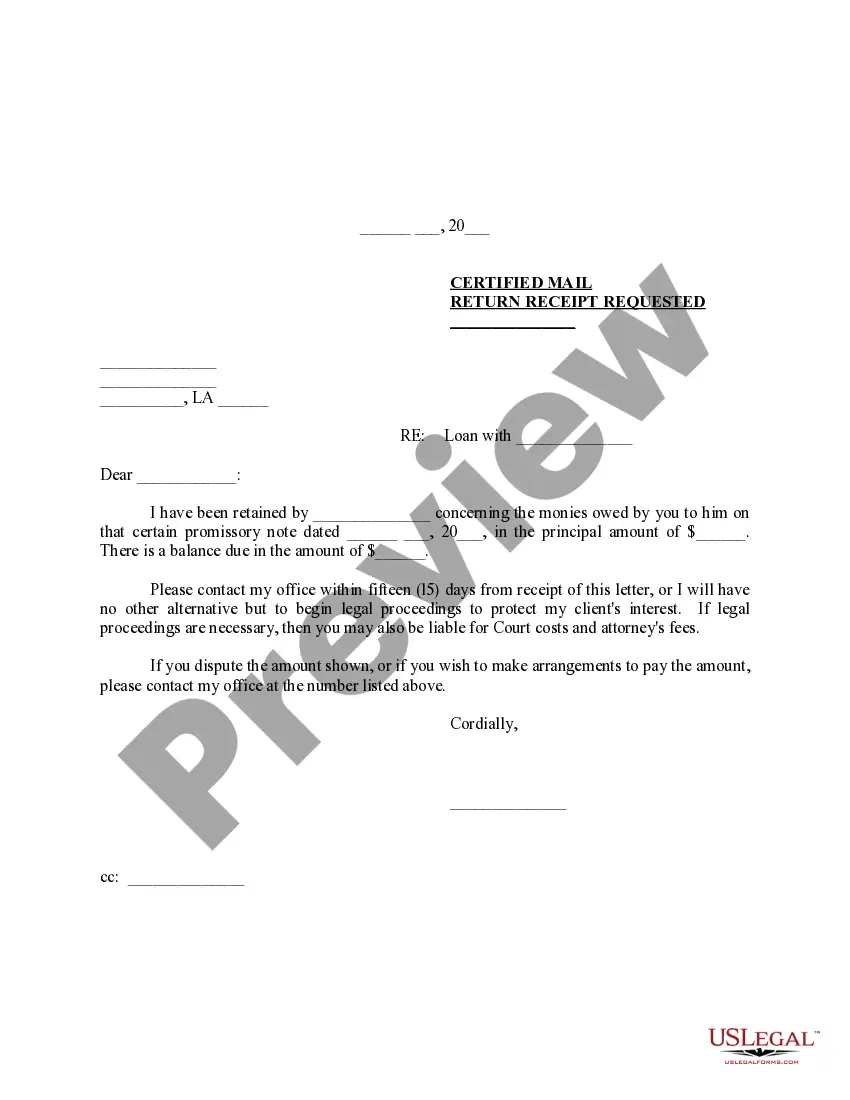

- View the example using the Preview option (if available).

- If there’s a description, read it to understand the specifics.

- Click on Buy Now button if you have found what you are looking for.

Form popularity

FAQ

Writing an on-demand promissory note involves including key elements such as the principal amount, interest rate, and payment terms. Clearly state that the note is payable on demand, ensuring both parties understand the expectations. A well-structured Louisiana Demand Letter - Repayment of Promissory Note makes compliance easier and establishes clear communication lines. You can leverage uslegalforms for templates and guidance in creating your document.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

Use a letterhead. Outline the facts/story leading up to the demand letter in a chronological manner. State the legal basis for your claim. State how you will pursue legal action if your demand is not met, and include a timeline within which the demand is to be met.

The lender can file a civil suit for recovering the money he owed through promissory note or loan agreement. He can do so under Order 37 of CPC which allows the lender to file a summary suit. He can file this suit in any high court, City Civil Court, Magistrate Court, Small Causes Court.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

The date of the letter. The names of the borrower and lender. The original amount of the loan. The date of the promissory note and any reference number or account number it contains. The payment schedule that was agreed upon.

Promissory Notes In addition to the amount and the signature, any interest charged for the amount may also be stipulated in the note, as well as the name of the payee. If a promissory note has a date on it and the date has passed, that note can also be considered to be payable on demand.

Place a signature beside the paid in full notation. The lender must sign and date the front of the promissory note beside the paid in full notation. The date the lender includes on the promissory note should be the date on which the borrower made the final payment on the loan.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

A written, signed, unconditional promise to pay a certain amount of money on demand at a specified time.The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.