The Kentucky Petition-Order to Dispense with Administration (Surviving Spouse/Children/Preferred Creditor) is a legal document used in Kentucky probate proceedings. It is a petition by a surviving spouse, children, or preferred creditors to dispense with administration of the estate of the deceased person. The petition must include information about the deceased, their assets, creditors, and heirs. The petition also must be accompanied by an affidavit of the surviving spouse, children, or preferred creditors, which must be verified by the petitioners. If the court grants the petition, the estate will be distributed according to the deceased person's will, if one exists, or according to Kentucky's intestacy laws. There are two types of Kentucky Petition-Order to Dispense with Administration (Surviving Spouse/Children/Preferred Creditor): A Small Estate Petition and a Regular Estate Petition. The Small Estate Petition is used when the total value of the estate is less than $50,000, or if there are no debts or creditors. The Regular Estate Petition is used when the estate is valued at more than $50,000, or if there are debts or creditors.

Kentucky Petition-Order to Dispense with Administration (Surviving Spouse/Children/Preferred Creditor)

Description

Key Concepts & Definitions

Petition Order to Dispense with Administration: A legal request filed in probate court to avoid the formal administration of a deceased's estate, usually applicable when the assets are minimal or below a certain threshold defined by state laws. This process can simplify legal proceedings and reduce costs and time involved in estate settlement.

Step-by-Step Guide

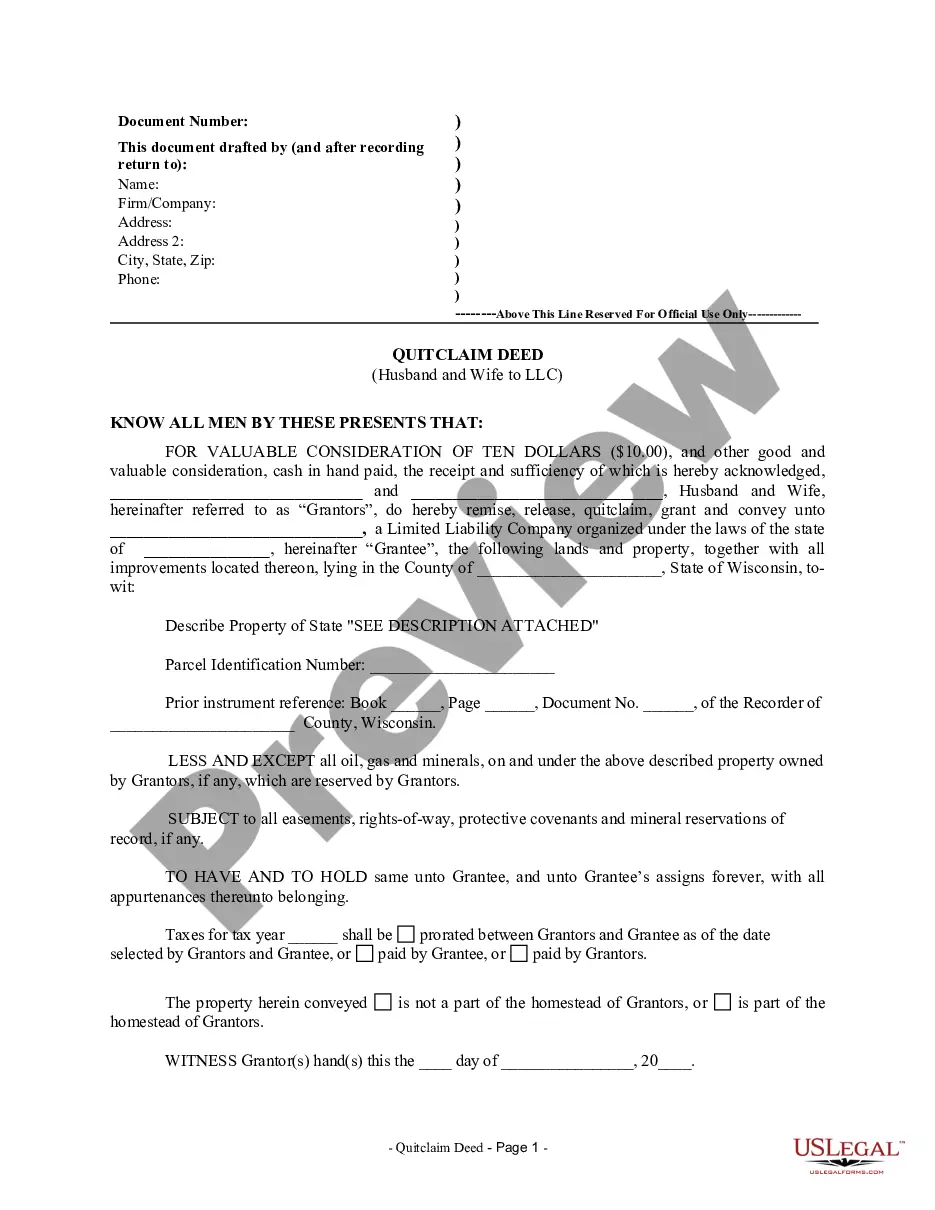

- Determine Eligibility: Verify that the estate meets the specific criteria for your state regarding minimal assets and liabilities.

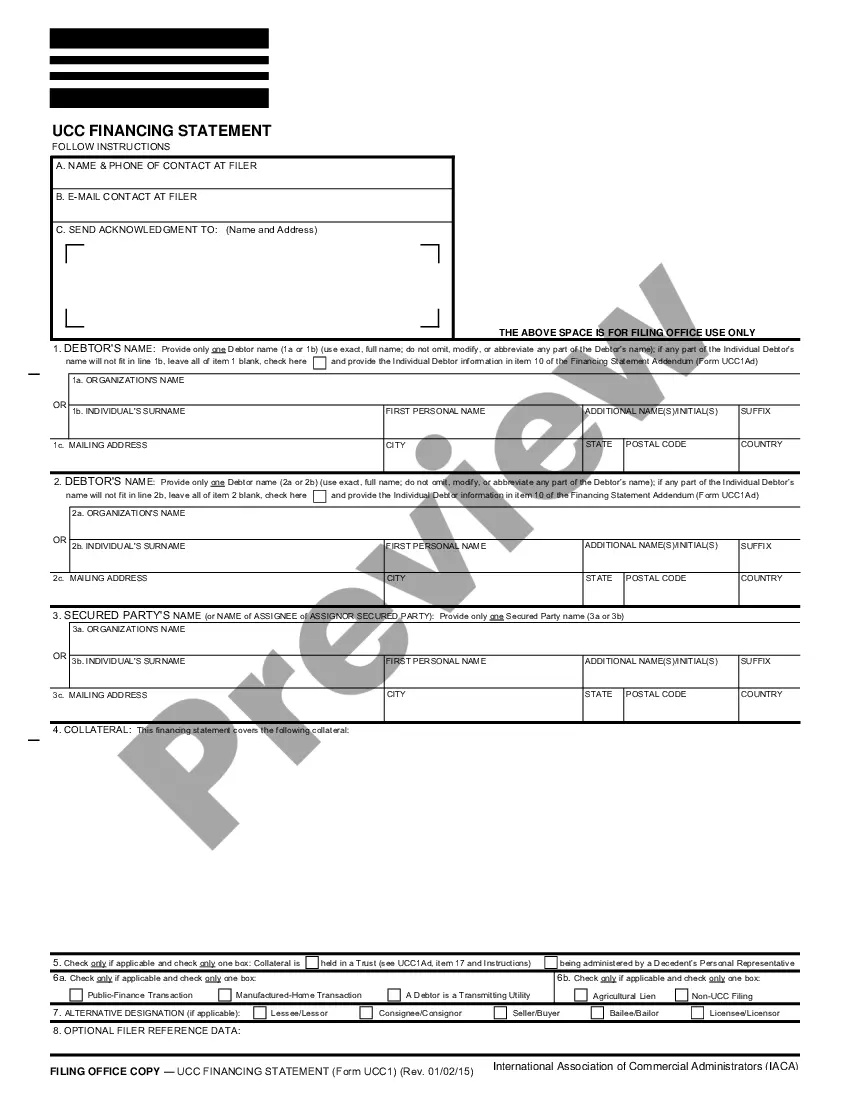

- Prepare the Petition: Gather necessary documents such as death certificate, list of assets, and debts of the estate. Draft the petition, often using a form provided by local court.

- File the Petition: Submit the petition to the probate court along with any required filing fees.

- Notify Interested Parties: Inform all potential heirs and creditors about the petition as mandated by state laws.

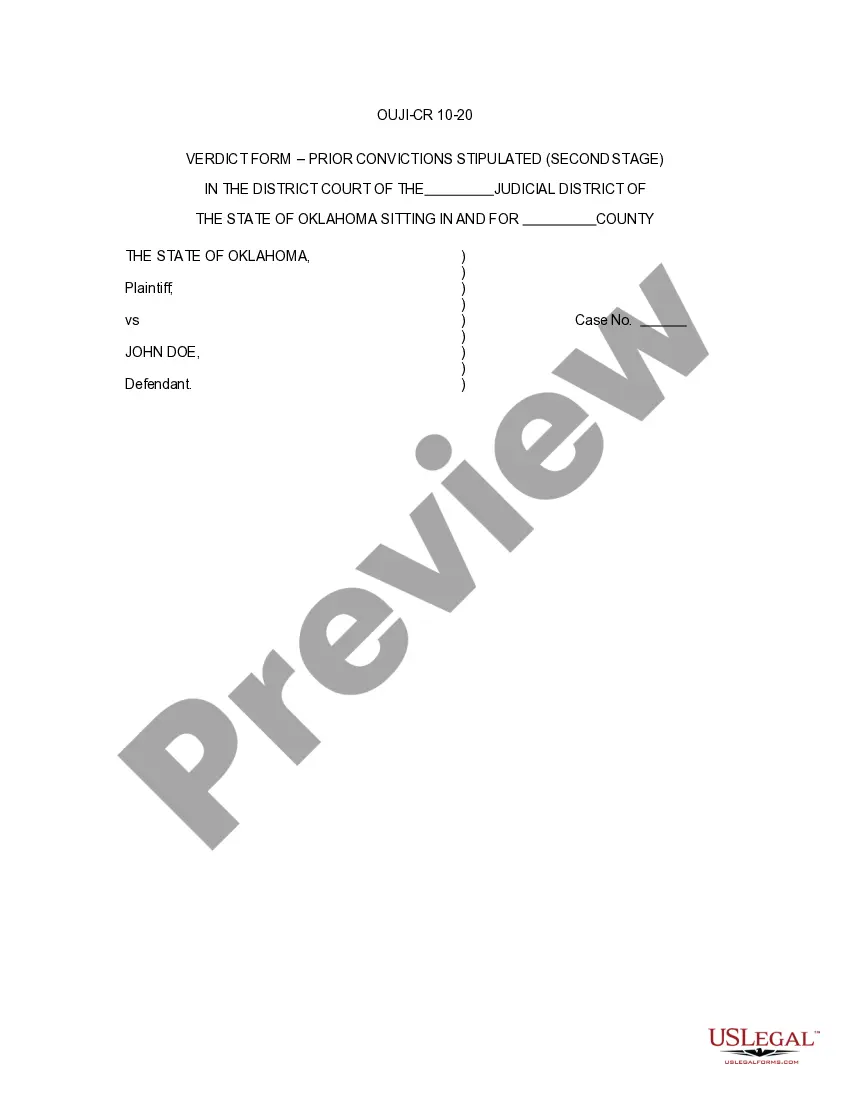

- Attend Court Hearing: If required, attend the hearing where the judge reviews the petition. Answer any questions posed by the court.

- Receive Court Decision: Await the court's decision to approve or deny the petition. If approved, carry out the distribution of assets as directed.

Risk Analysis

- Legal Risks: Improper filing could lead to rejection of the petition or legal challenges from heirs or creditors.

- Financial Risks: Potential for missed debts or claims which might surface after the dispensation is finalized.

- Compliance Risks: Non-compliance with state laws can result in penalties or legal complications.

Key Takeaways

Filing a petition order to dispense with administration can streamline the process of settling an estate that has minimal assets. It's crucial to understand state-specific requirements and prepare adequately to mitigate associated risks.

Common Mistakes & How to Avoid Them

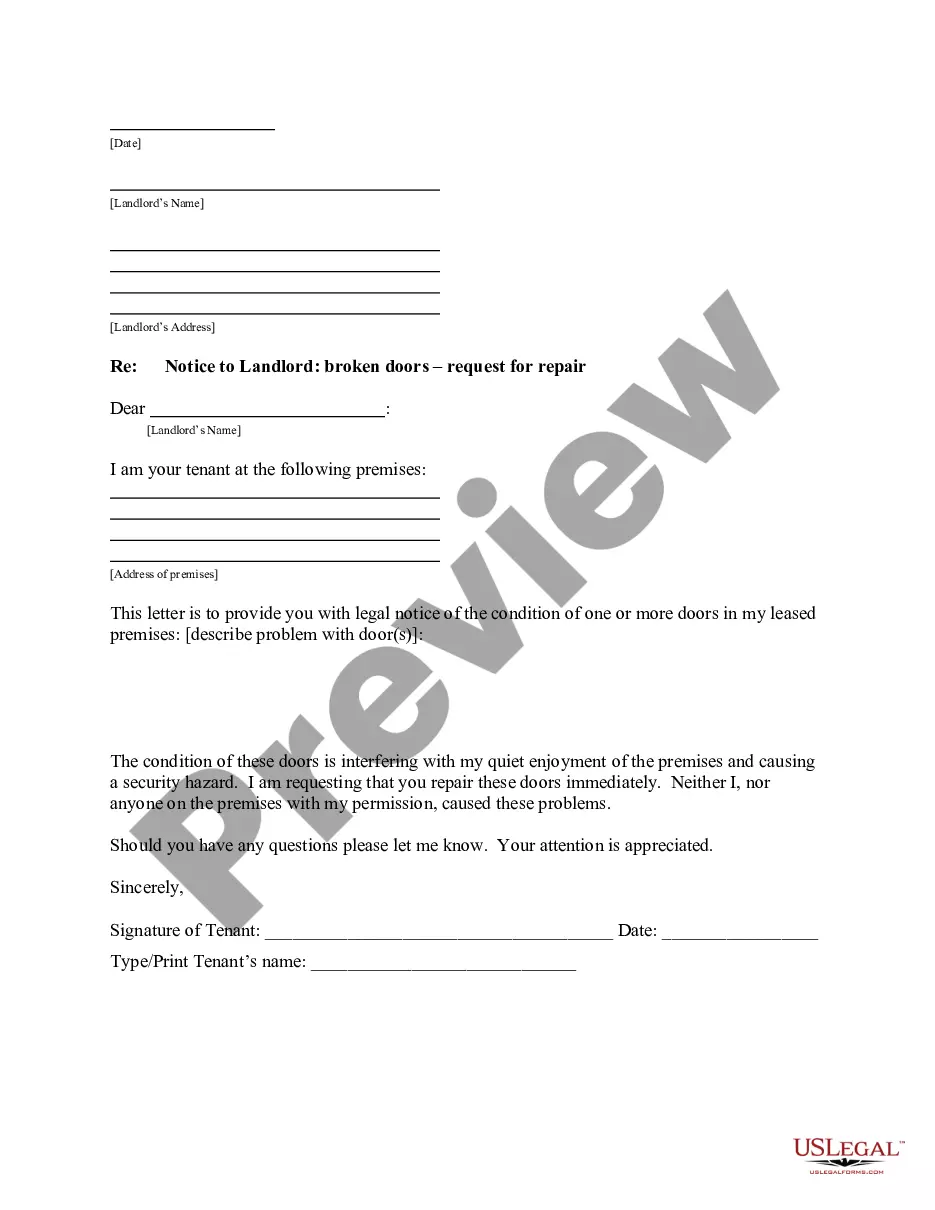

- Incomplete Documentation: Ensure all the required documents are accurately completed and submitted.

- Notifying Parties: Failure to properly notify all interested parties can lead to legal complications. Adhere strictly to the notification requirements of your state.

- Understanding State Laws: Each state has different thresholds and requirements for dispensing with administration. Consult with a legal expert to ensure compliance.

FAQ

- What is the asset threshold for filing this petition? - The threshold varies by state, typically defined as being 'small enough' not to warrant full probate.

- Is a lawyer required to file a petition order to dispense with administration? - While not always mandatory, consulting a lawyer is advisable to navigate state laws and ensure accurate filing.

- How long does the process take? - The duration can vary, but typically it is quicker than formal probate, ranging from a few weeks to several months.

How to fill out Kentucky Petition-Order To Dispense With Administration (Surviving Spouse/Children/Preferred Creditor)?

Drafting formal documents can be quite an ordeal unless you have access to convenient fillable templates.

With the US Legal Forms online collection of formal papers, you can be assured about the blanks you choose, as all of them comply with federal and state laws and are validated by our professionals.

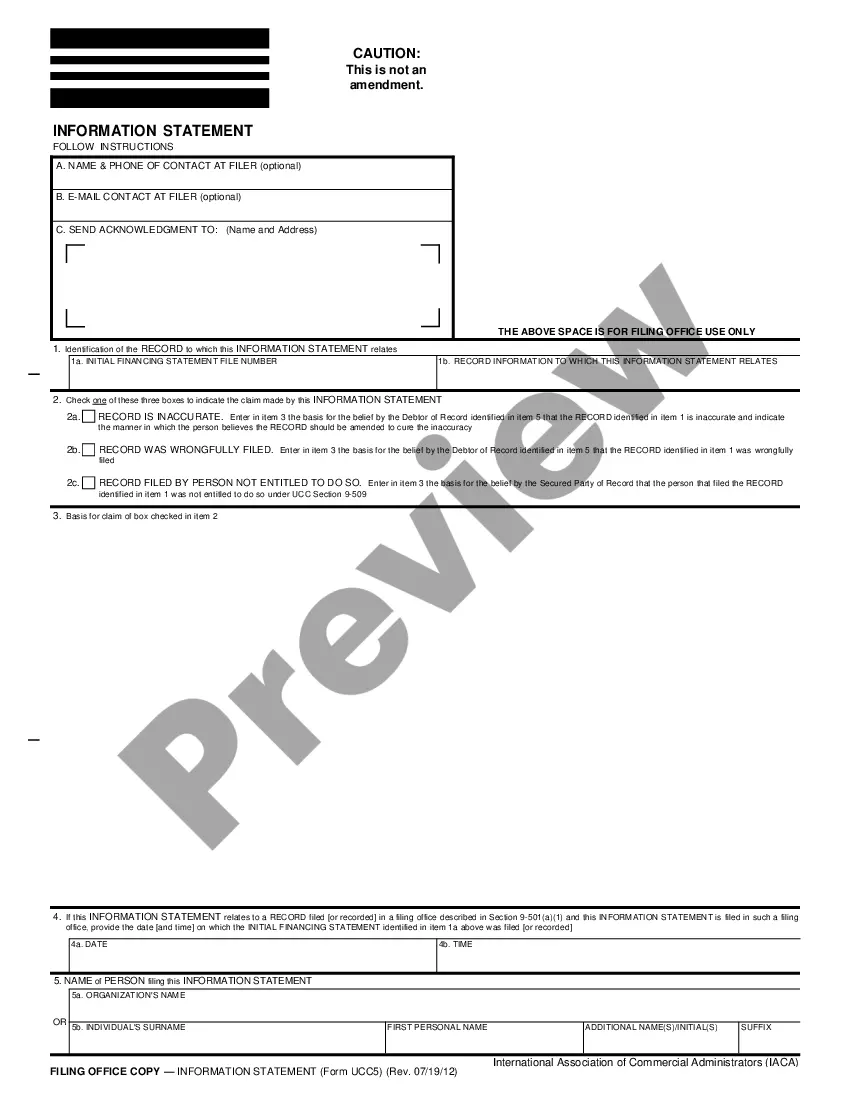

However, even if you are a newcomer to our platform, the signup process with a valid subscription will only take a few moments. Here’s a brief guide for you: Document compliance verification. You should thoroughly examine the content of the document you wish to ensure it meets your needs and complies with your state laws. Previewing your form and reviewing its general summary will assist you in doing just that.

- If you require to finalize the Kentucky Petition-Order to Dispense with Administration (Surviving Spouse/Children/Preferred Creditor), our service is the ideal place to retrieve it.

- Acquiring your Kentucky Petition-Order to Dispense with Administration (Surviving Spouse/Children/Preferred Creditor) from our collection is as easy as 1-2-3.

- Previously authorized members with an active subscription merely need to Log In and press the Download button after locating the appropriate template.

- Following this, if needed, they can select the same blank from the My documents section of their account.

Form popularity

FAQ

KRS §395.450. This is known as dispensing with administration. A Petition to Dispense With Administration, which is form AOC-830, may be filed whether a person dies with or without a will, by the follow- ing individuals in the following priority: Surviving Spouse.

California law does allow creditors to pursue a decedent's potentially inheritable assets. In the event an estate does not possess or contain adequate assets to fulfill a valid creditor claim, creditors can look to assets in which heirs might possess interest, if: The assets are joint accounts.

Although there is no statute that requires an estate to stay open for any particular length of time, estates generally do have to stay open for a minimum of six months. This is because KRS Chapter 396 states that creditors of estates have six months to file claims.

All creditors that wish to be paid from the estate are required to file a claims against the estate within 180 days (6 months) from the date the personal representative is appointed. Valid debts can be paid after the six months are up.

(1) Administration of the estate of a person dying intestate may be dispensed with by agreement if there are no debts owing by the estate; all persons beneficially entitled to the personal estate have agreed in writing that there shall be no administration; and either there are no claims or demands due the estate, or

Ing to the Kentucky law on oral contracts, or verbal agreements, debt collection agencies have five years since the last action on the debt to put forward a suit (KRS 413.120). However, the Kentucky law on written contracts allows creditors fifteen years to sue a Kentucky resident.

Also, creditors may have the ability to open the estate if the family refuses to do so. KRS 395.040(2) provides that if no person related to a decedent applies for administration within sixty days of the decedent's death, the probate court has the discretion to grant administration to a creditor or any other person.

A Kentucky small estate affidavit, legally titled the 'Petition to Dispense with Administration' or Form AOC-830, can be used to avoid the hassles of probate while distributing the assets of a small estate.