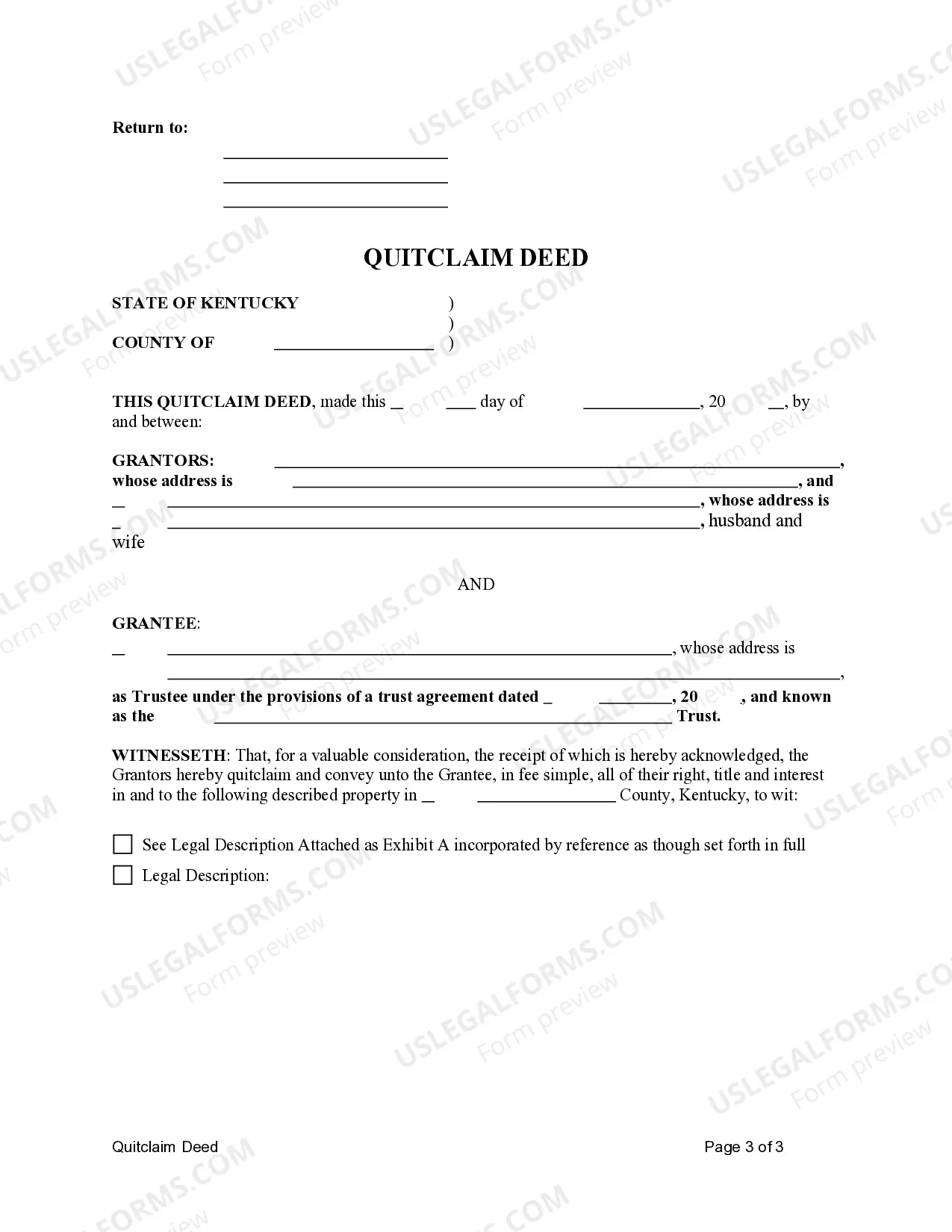

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantee is Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Kentucky Quitclaim Deed from Husband and Wife / Two Individuals to a Trust

Description

How to fill out Kentucky Quitclaim Deed From Husband And Wife / Two Individuals To A Trust?

Locating a Kentucky Quitclaim Deed from Spouse and Partner / Pair of Persons to a Trust templates and filling them out can be quite challenging.

To conserve significant time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your region in just a few clicks.

Our lawyers prepare all documents, so you merely need to complete them.

Try US Legal Forms and gain access to more than 85,000 state-specific legal and tax documents.

- Login to your account and return to the form's webpage to save the template.

- All of your downloaded templates are kept in My documents and are available at any time for future use.

- If you haven’t registered yet, you need to create an account.

- Refer to our detailed guidelines on how to obtain your Kentucky Quitclaim Deed from Spouse and Partner / Pair of Persons to a Trust form in just a few minutes.

- To obtain a valid template, verify its applicability for your region.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to understand the particulars.

Form popularity

FAQ

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

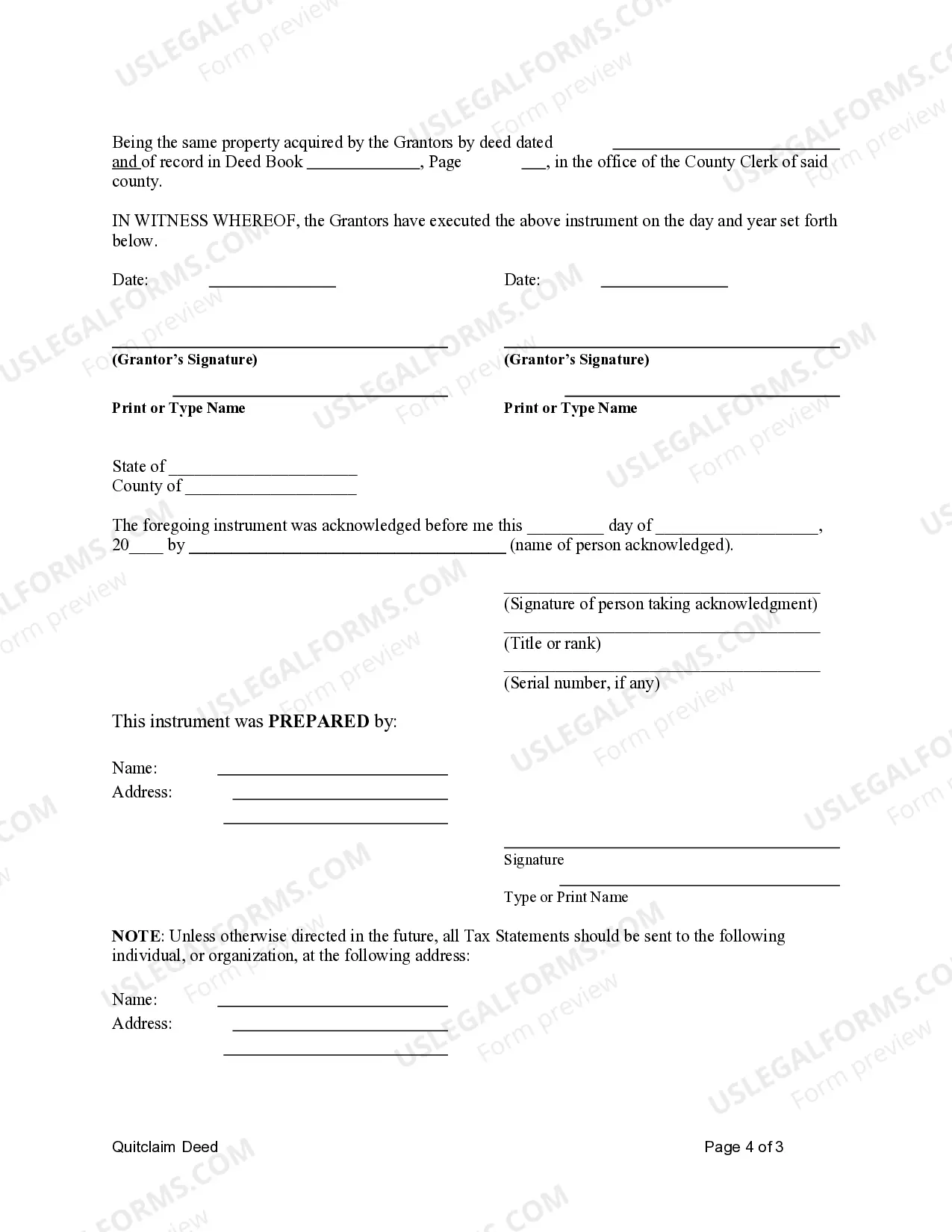

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

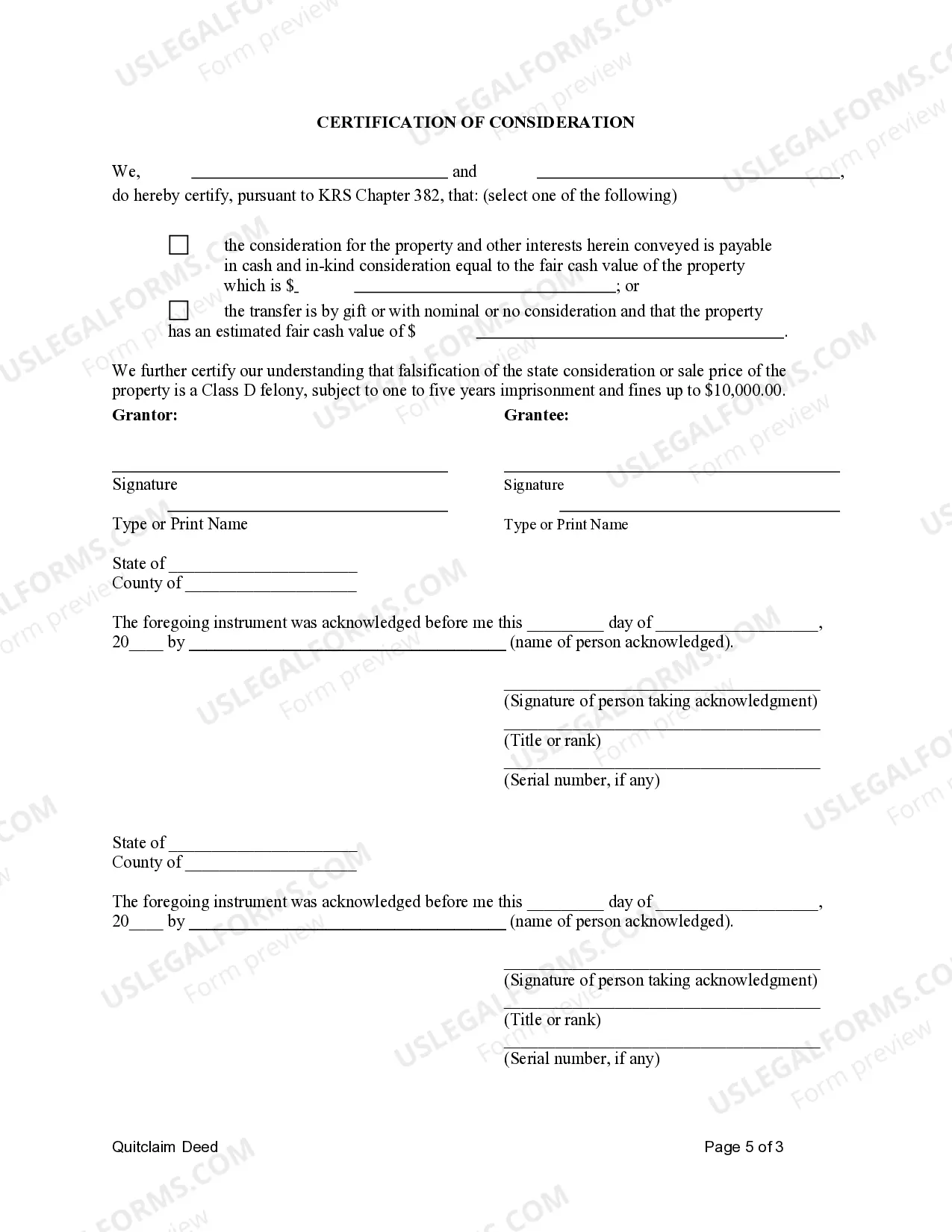

Step 1: Find your KY quitclaim form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: File the deed in the County Clerk's office of the county where the property is located, along with the consideration certificate.