Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

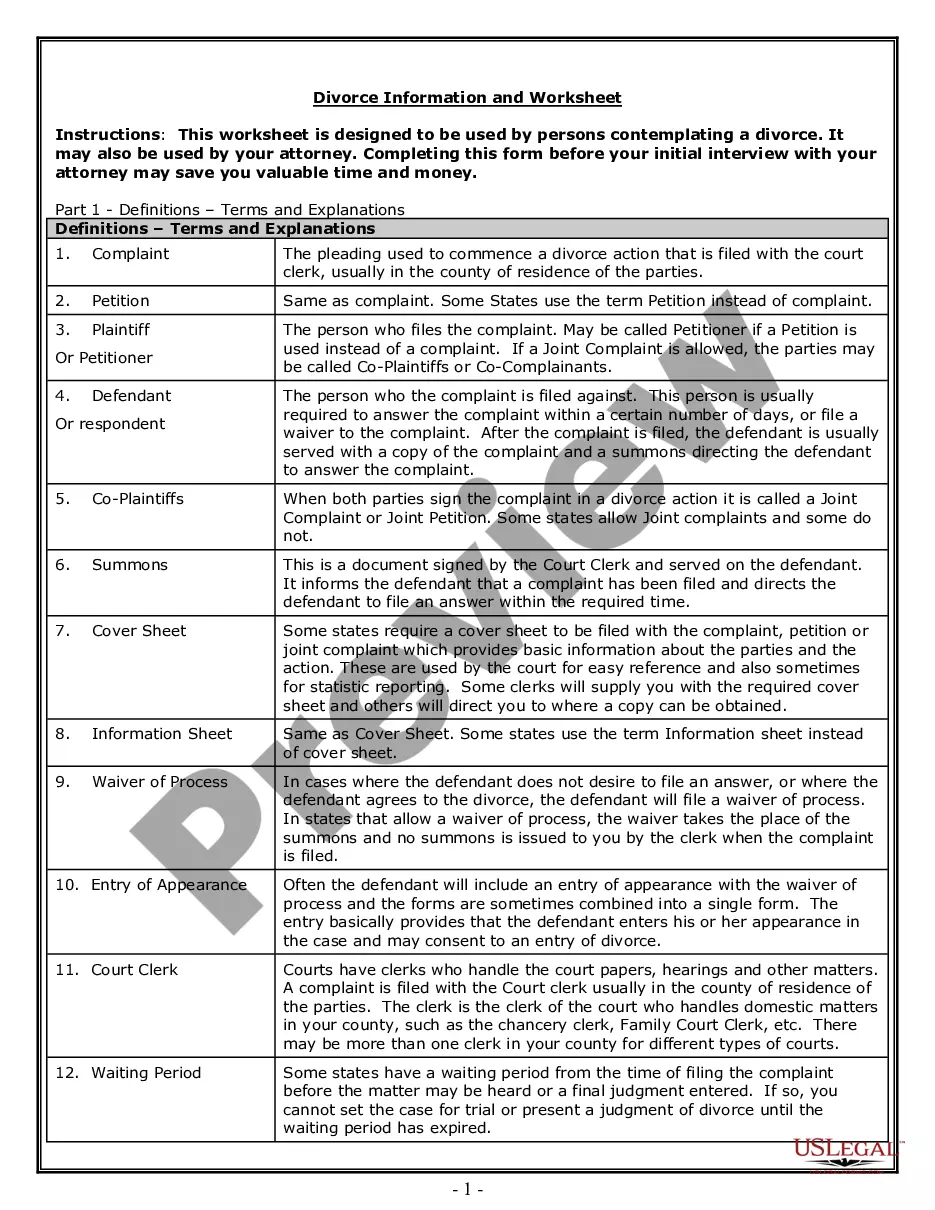

How to fill out Kansas Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Searching for Kansas Living Trust for an Individual Who is Unmarried, Divorced, or a Surviving Spouse with No Offspring paperwork and completing them can be quite challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your region in just a few clicks.

Our lawyers prepare all documents, so you merely need to fill them in. It genuinely is that straightforward.

Select your plan on the pricing page and create your account. Choose whether you prefer to pay with a card or via PayPal. Save the sample in your preferred file format. You can print the Kansas Living Trust for an Individual Who is Unmarried, Divorced, or a Surviving Spouse with No Offspring form or complete it using any online editor. No need to worry about making mistakes because your sample can be utilized and sent, and printed as many times as you wish. Explore US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the sample.

- All of your saved samples are stored in My documents and are accessible all the time for future use.

- If you haven’t registered yet, you need to sign up.

- Follow our comprehensive instructions on how to obtain your Kansas Living Trust for an Individual Who is Unmarried, Divorced, or a Surviving Spouse with No Offspring template in minutes.

- To get a qualified sample, verify its compliance for your area.

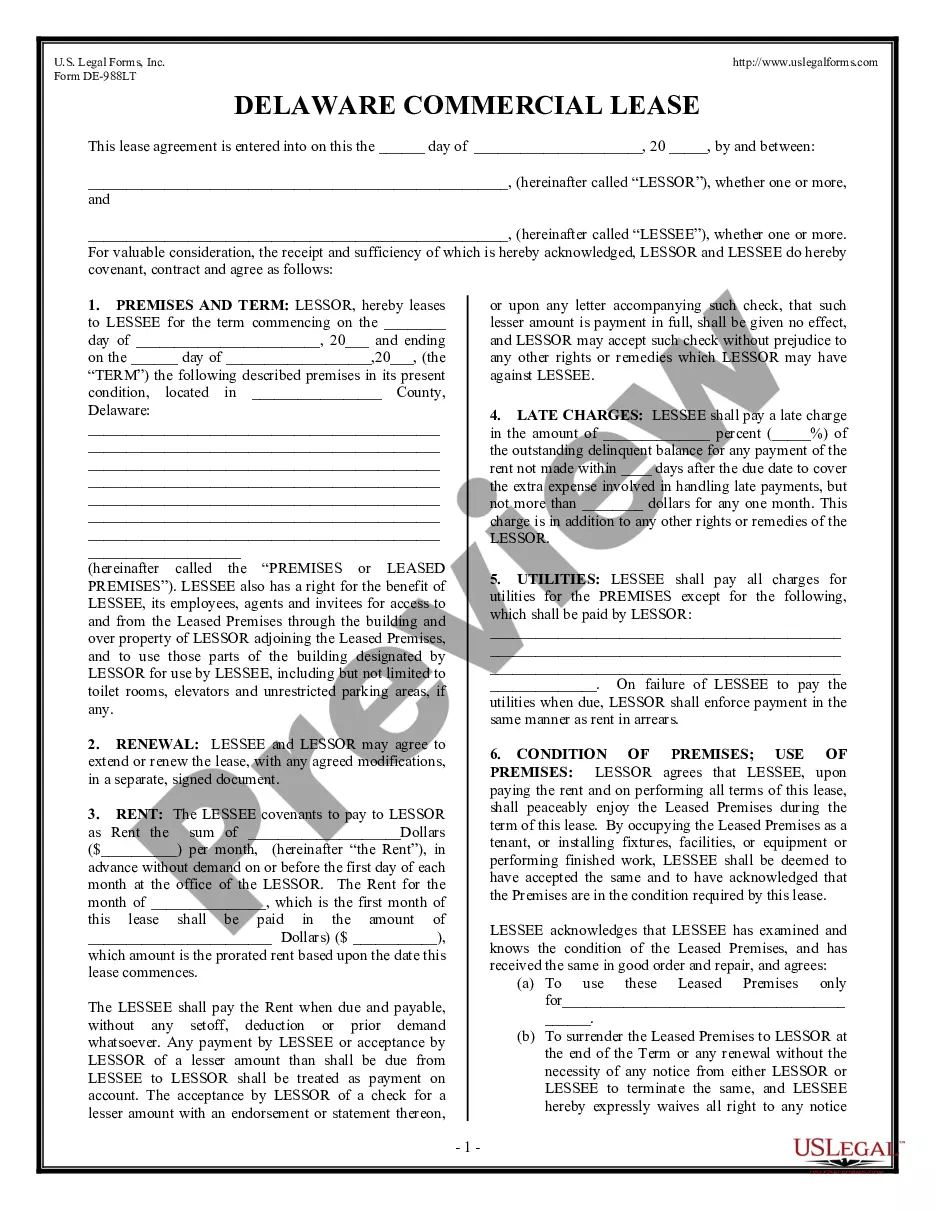

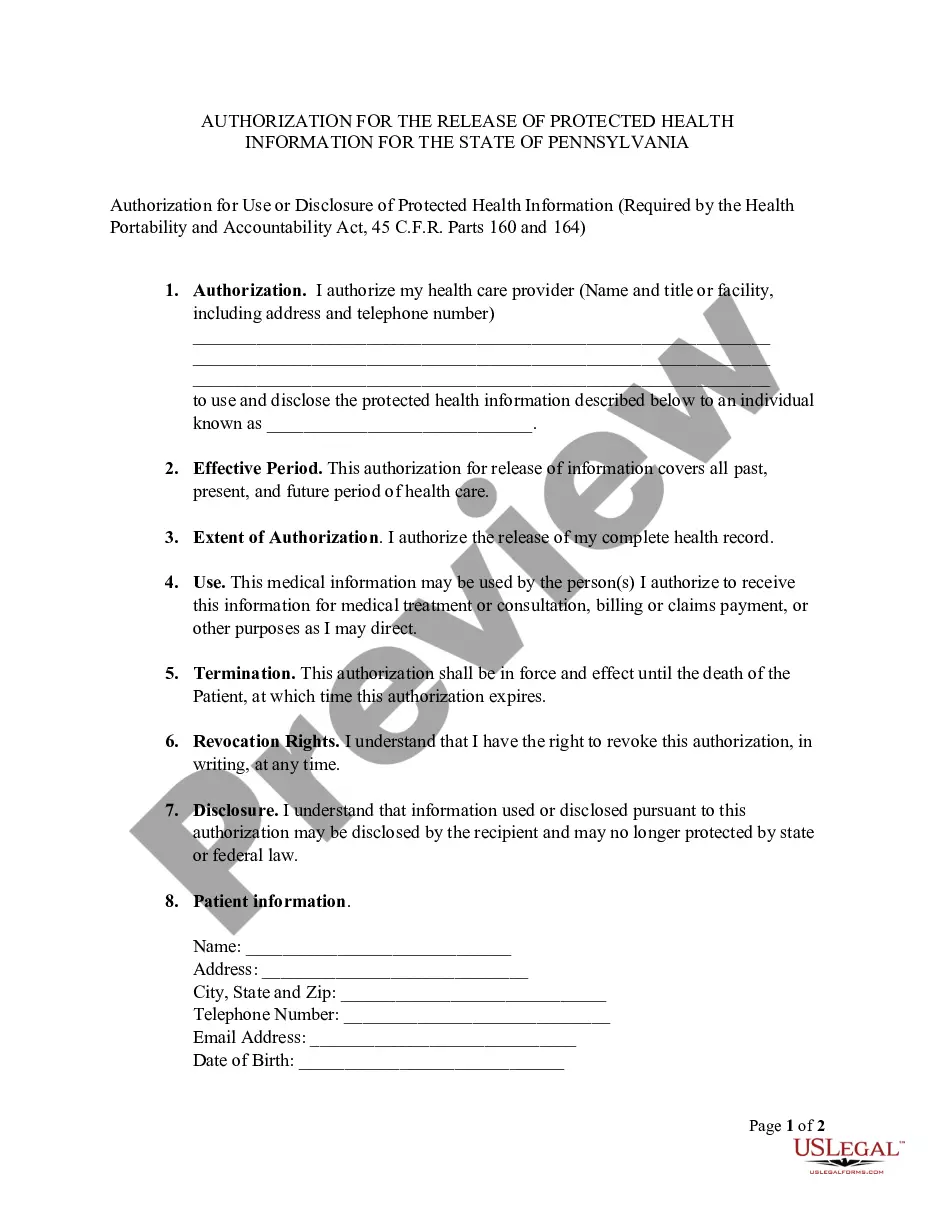

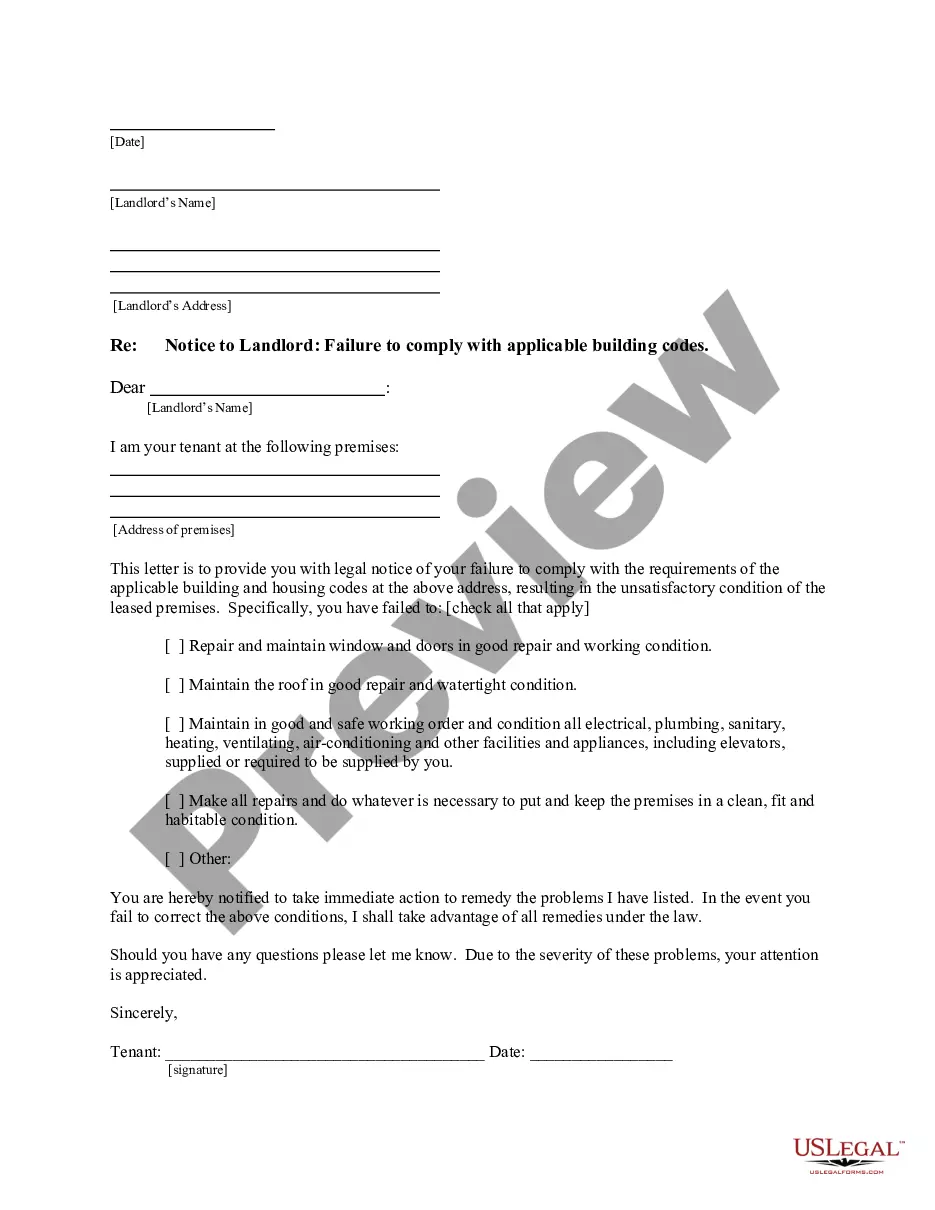

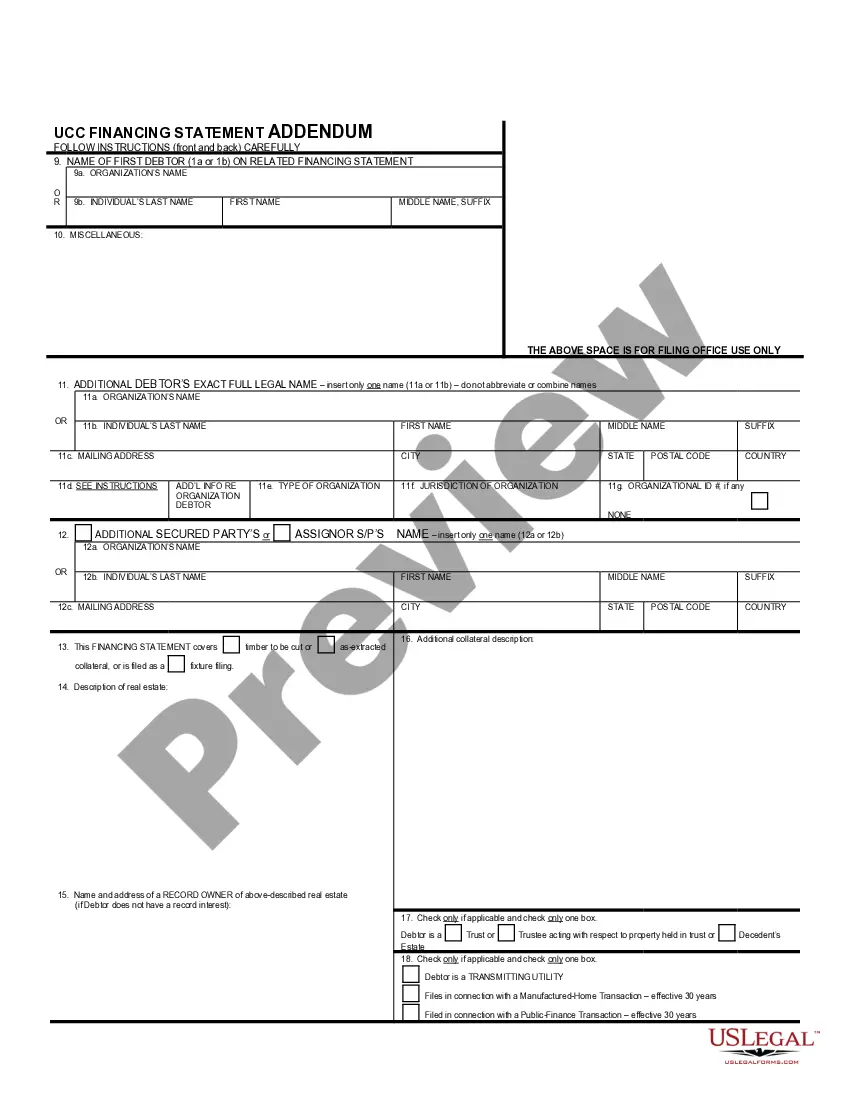

- View the sample using the Preview option (if it’s available).

- If there's a description, read it to understand the details.

- Click Buy Now if you found what you're looking for.

Form popularity

FAQ

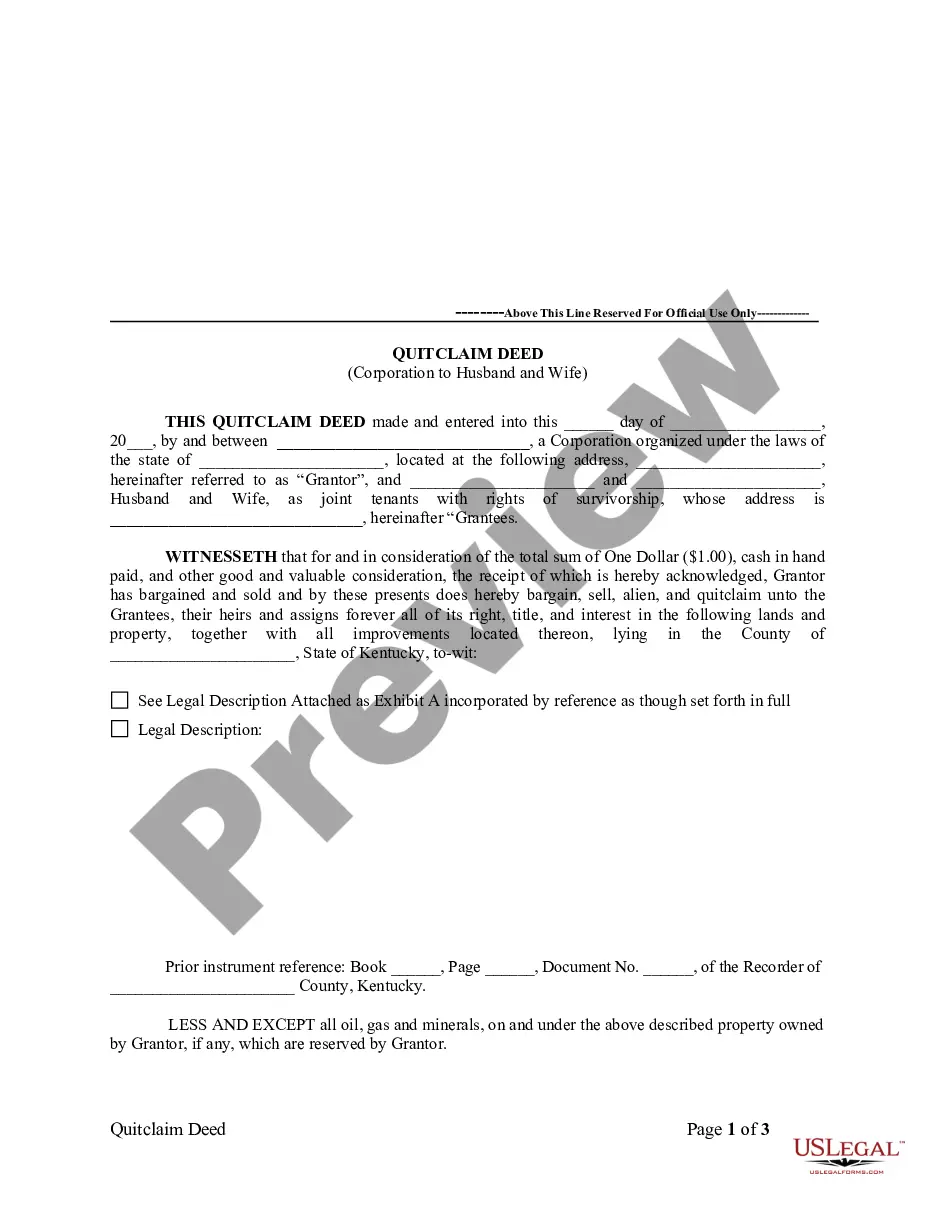

A widow’s trust is a specialized trust that helps protect and manage a widow's or widower's assets after the death of their partner. For those considering a Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, this type of trust can provide crucial financial security and ease of access to assets. It ensures that your financial needs are met while also safeguarding your estate for future generations or beneficiaries.

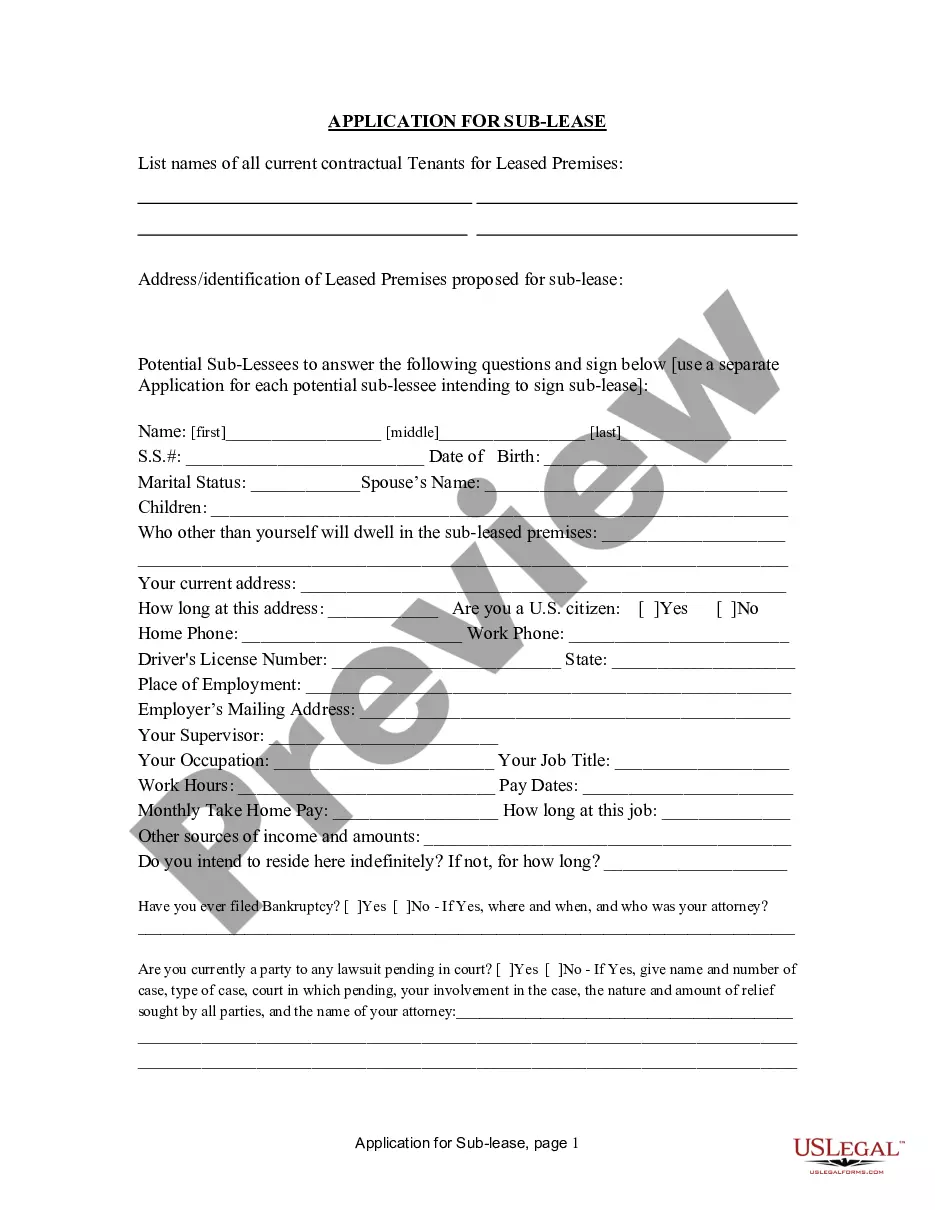

Who can create a Trust? A trust may be created by: Every person who is competent to contracts: This includes an individual, AOP, HUF, company etc. If a trust is to be created by on or behalf of a minor, then the permission of a Principal Civil Court of original jurisdiction is required.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.