Kansas Letter from Landlord to Tenant Returning security deposit less deductions

Definition and meaning

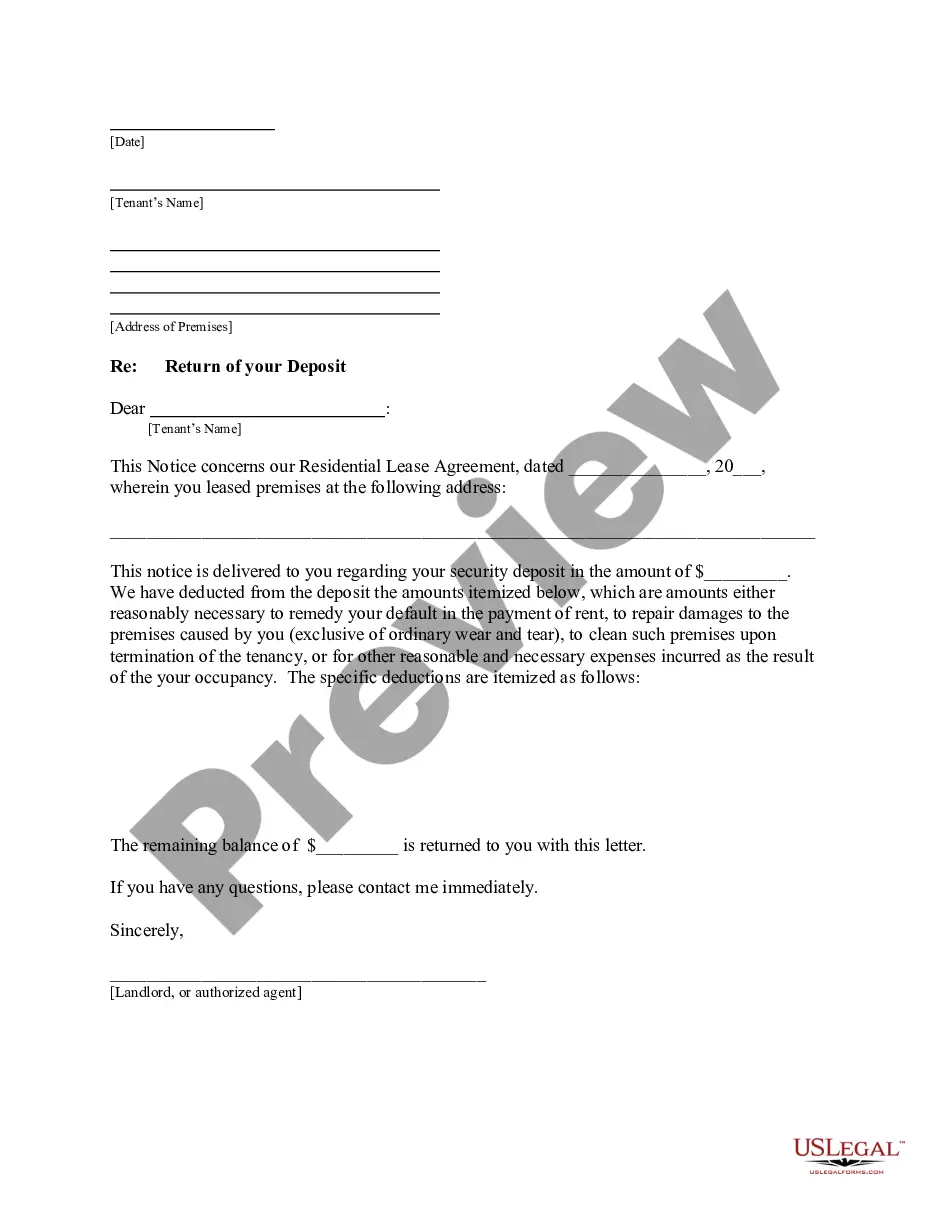

A Kansas Letter from Landlord to Tenant Returning security deposit less deductions is a formal document used by landlords to notify tenants about the status of their security deposit after a tenancy ends. This letter outlines the total amount of the security deposit, the deductions made for any damages or unpaid rent, and the remaining balance to be returned to the tenant.

How to complete a form

To complete the Kansas Letter from Landlord to Tenant Returning security deposit less deductions, follow these steps:

- Insert the date at the top of the letter.

- Clearly state the tenant’s name and their address.

- Indicate the date of the original lease agreement.

- Specify the amount of the security deposit.

- List the deductions with brief explanations.

- Calculate and state the remaining balance to be returned.

- Sign the letter and indicate your title as landlord or authorized agent.

Key components of the form

This form includes vital information for both landlords and tenants:

- Tenant's Information: Name and address of the tenant.

- Amount of Deposit: The total security deposit initially collected.

- Deductions: A detailed list of deductions taken from the deposit, including reasons for each deduction.

- Remaining Balance: The amount being returned to the tenant.

- Signature: The landlord or authorized agent must sign the letter.

State-specific requirements

In Kansas, landlords must adhere to state laws regarding security deposits. Key requirements include:

- Landlords must provide a written statement of deductions within 30 days after the lease ends.

- Landlords cannot withhold deposit amounts for normal wear and tear.

- Failure to comply may result in a forfeiture of the right to withhold any portion of the deposit.

Common mistakes to avoid when using this form

When completing the Kansas Letter from Landlord to Tenant Returning security deposit less deductions, avoid these common errors:

- Failing to list all deductions clearly and accurately.

- Not providing the correct remaining balance after deductions.

- Missing the delivery of the letter within the required timeline.

- Not signing the document or including your title.

Form popularity

FAQ

1The date that the tenant warning letter was written.2The name and the basic personal information of the tenant.3The name of the landlord or the owner of the property.4The reason why a tenant warning letter has been written.5The incident or situation that the tenant is involved in.Tenant Warning Letter Template - 8 +Free Word, PDF Format\nwww.template.net > business > letters > tenant-warning-letter-template

1Security Deposit Received: $1,000.2Interest on Deposit (if required by lease or law): $N/A.3TOTAL CREDIT (sum of lines 1 and 2): $1,000.4Itemized Repairs and Related Losses:5Necessary Cleaning:6Total Cleaning & Repair (sum of lines 4 and 5) $400.7Amount Owed (line 3 minus the sum of line 6)