Kansas Release of Lien by Corporation or LLC

Overview of this form

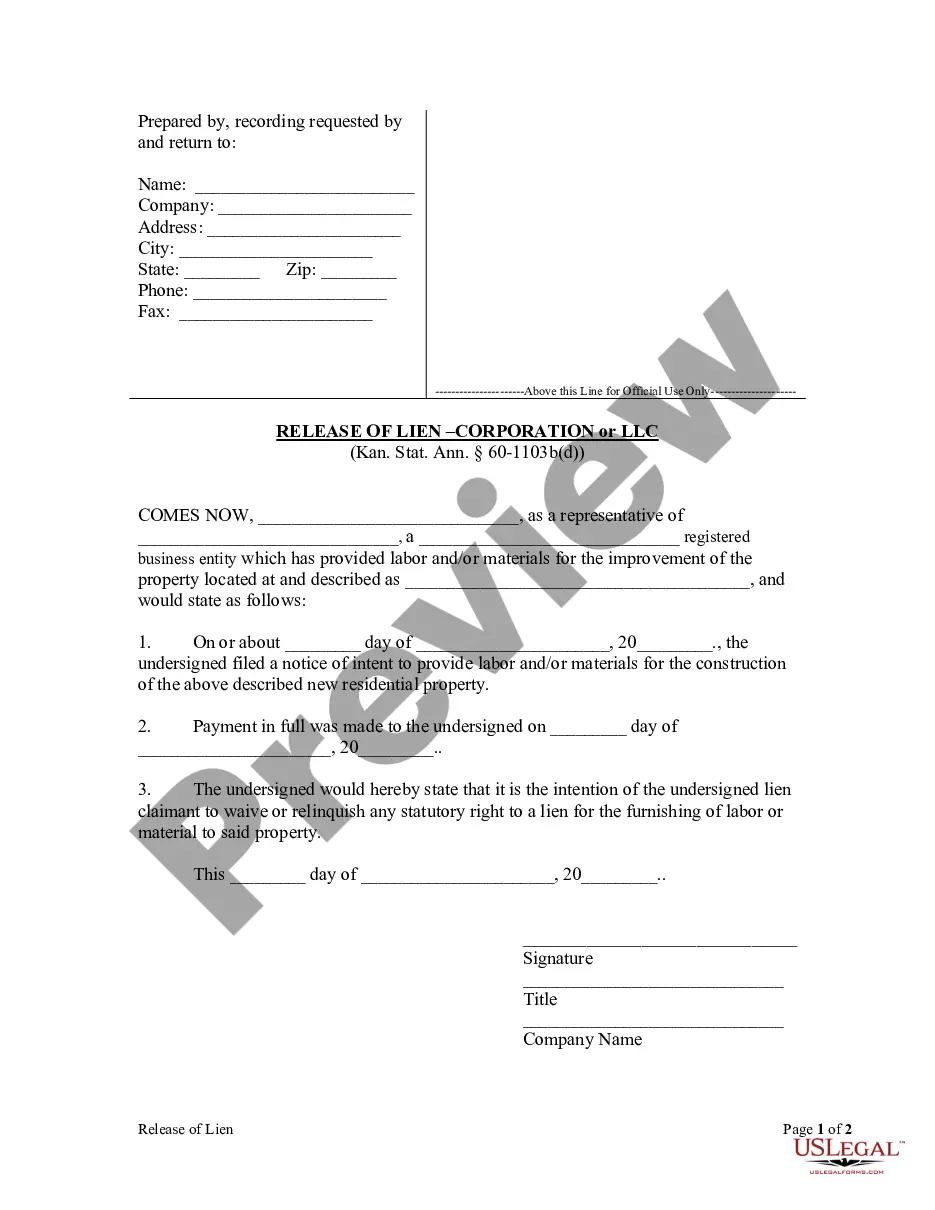

The Release of Lien by Corporation or LLC is a legal document used to formally relinquish any statutory right to a lien after receiving payment in full for labor or materials provided for property improvements. This form allows corporations and limited liability companies to notify relevant parties that their lien has been released, distinguishing it from other forms, such as notices of intent or lien claims, which assert rights rather than waive them.

Form components explained

- Name of the corporation or LLC releasing the lien.

- Description of the property associated with the lien.

- Date of the initial notice of intent to provide labor or materials.

- Confirmation of payment received in full.

- Statement of intention to waive the lien.

- Signature of the authorized representative.

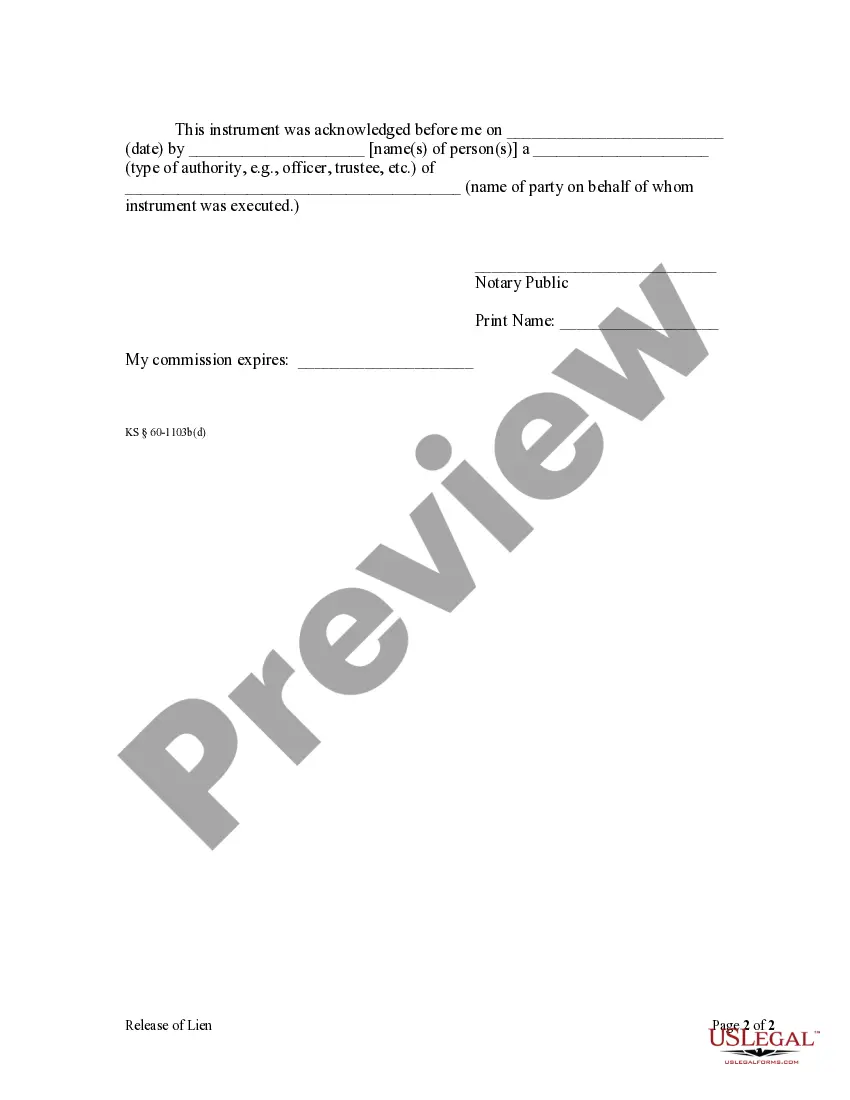

- Notarization acknowledgment section.

Situations where this form applies

This form should be used when a corporation or LLC has completed their work on a property and has received full payment. It is essential when the company needs to remove any claims they may have had on the property due to unpaid invoices for labor or materials. This helps protect the property owner's title and ensures that there are no lingering claims against the property.

Who needs this form

- Corporations that have provided labor or materials for property improvements.

- Limited Liability Companies (LLCs) that are involved in similar transactions.

- Property owners seeking to clear outstanding liens from their property titles.

- Any authorized representatives of the corporation or LLC with the authority to sign legal documents.

Completing this form step by step

- Identify the parties involved: the corporation or LLC releasing the lien and the property owner.

- Specify the property by providing a detailed description, including address and legal description.

- Enter the dates regarding the notice of intent and the date when payment was received.

- Complete the statement of intention to waive the lien.

- Obtain the signature of the authorized representative and their title, along with the corporation's name.

- Have the document notarized as required.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete description of the property.

- Not including accurate dates for when the work was completed and payment was received.

- Omitting the signature of the authorized representative.

- Neglecting to notarize the document, if required.

Benefits of using this form online

- Convenience of immediate access to the form for instant download.

- Editability allowing users to fill in the necessary details easily.

- Reliability of professionally drafted templates ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

The 2002 Kansas Legislature authorized electronic lien and title by passing Senate Bill 449, making Kansas a paperless title state. As of January 1, 2003, Kansas vehicle owners who borrow money for their cars, trucks, motorcycles, trailers and other motor vehicles will not receive printed, paper titles.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Lien releases may be faxed to (913) 715-2510, emailed to dmv@jocogov.org, or mailed to 111 S. Cherry St, Suite 1500, Olathe, KS 66061. Be sure to indicate the mailing address that the title is to be mailed to, along with a phone number in case there are questions.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.