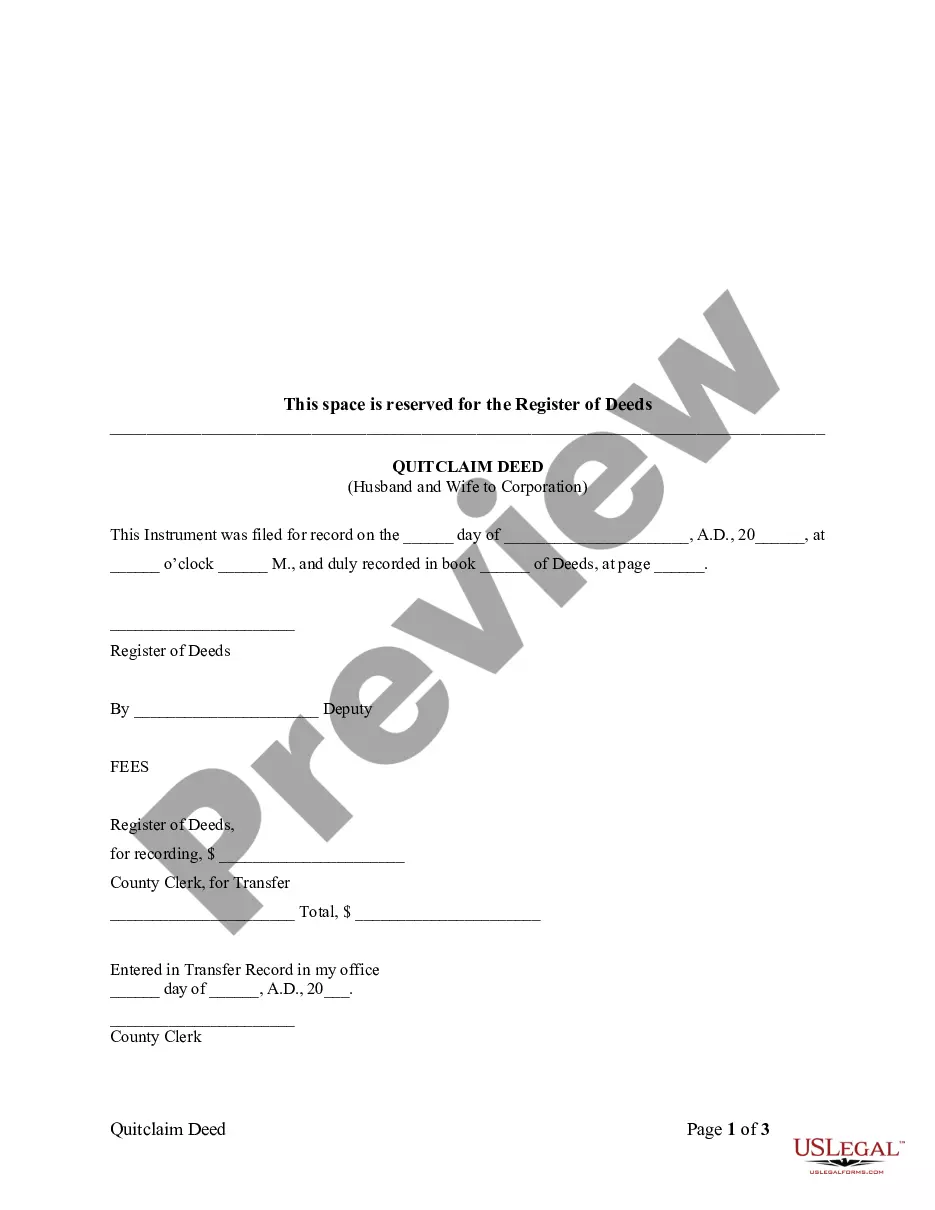

Kansas Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Kansas Quitclaim Deed From Husband And Wife To Corporation?

Looking for a Kansas Quitclaim Deed from Spouse to Company example and completing it can be a significant challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our legal professionals prepare all documents, so you only need to complete them. It's truly that straightforward.

Click Buy Now if you've discovered what you're looking for. Choose your subscription on the pricing page and create an account. Indicate whether you would like to pay with a credit card or PayPal. Save the form in your preferred format. You can print the Kansas Quitclaim Deed from Spouse to Company template or fill it out using any online editor. Don't worry about making mistakes because your sample can be used and shared, and printed as often as you wish. Explore US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the document.

- All your downloaded templates are stored in My documents and are always available for future use.

- If you haven’t enrolled yet, you should sign up.

- Check our detailed instructions on how to obtain your Kansas Quitclaim Deed from Spouse to Company template in just a few minutes.

- To acquire a valid sample, verify its legality for your state.

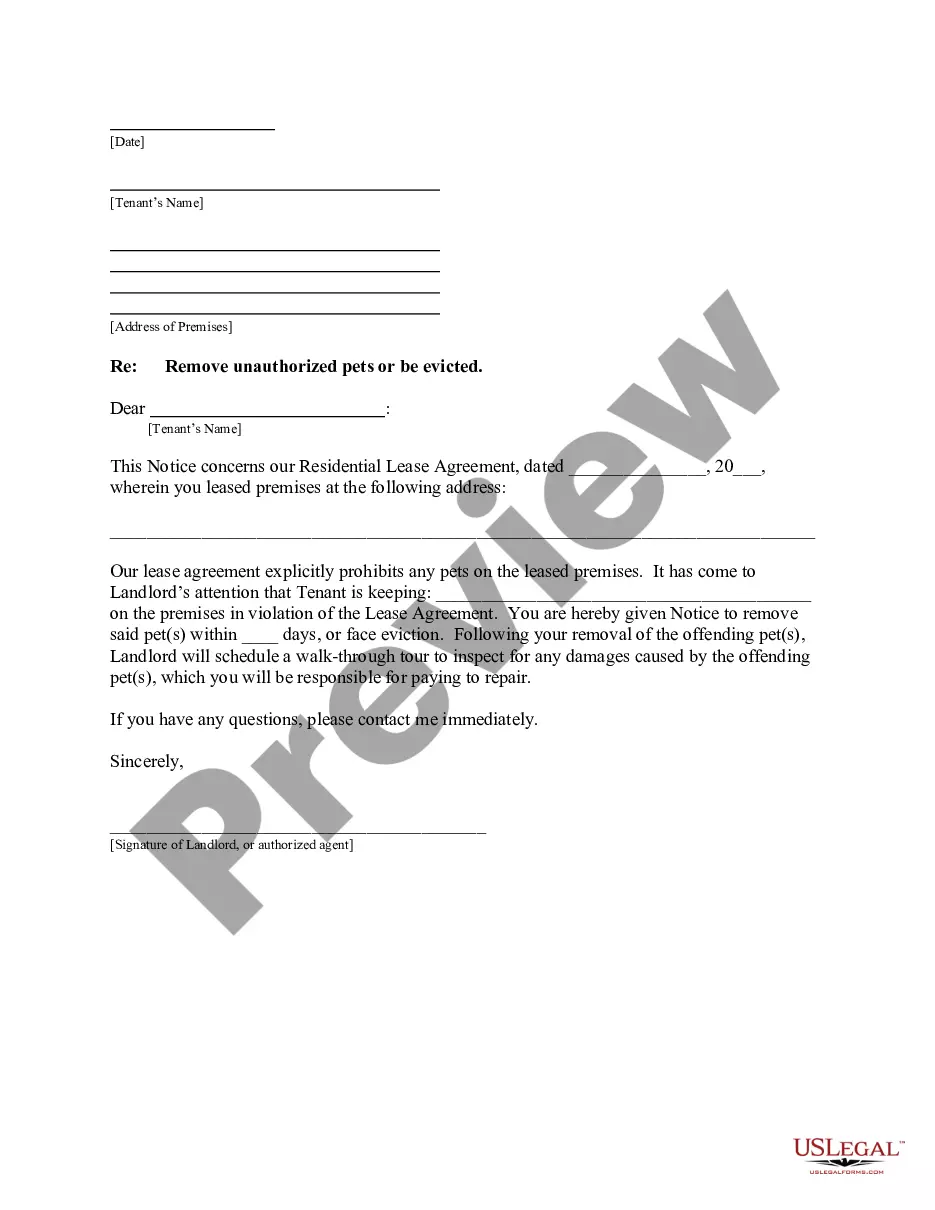

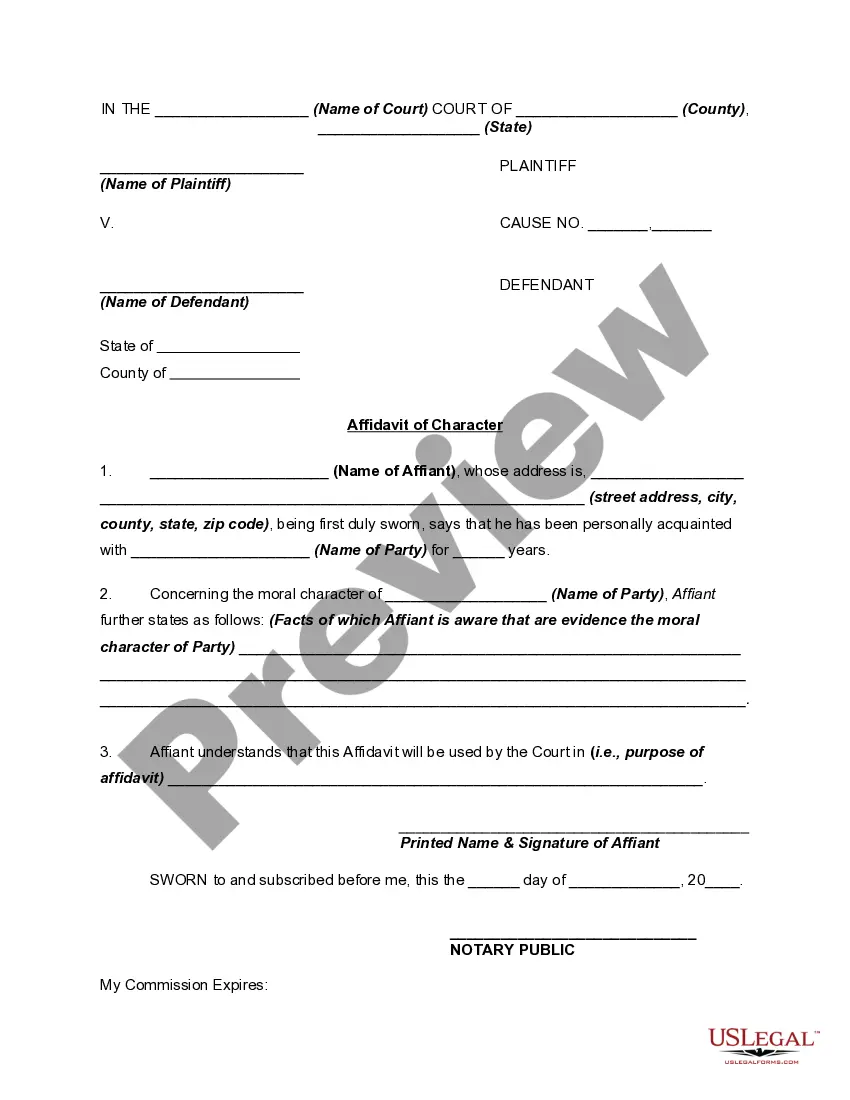

- Examine the form using the Preview option (if it’s available).

- If there's an explanation, read it to grasp the details.

Form popularity

FAQ

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.