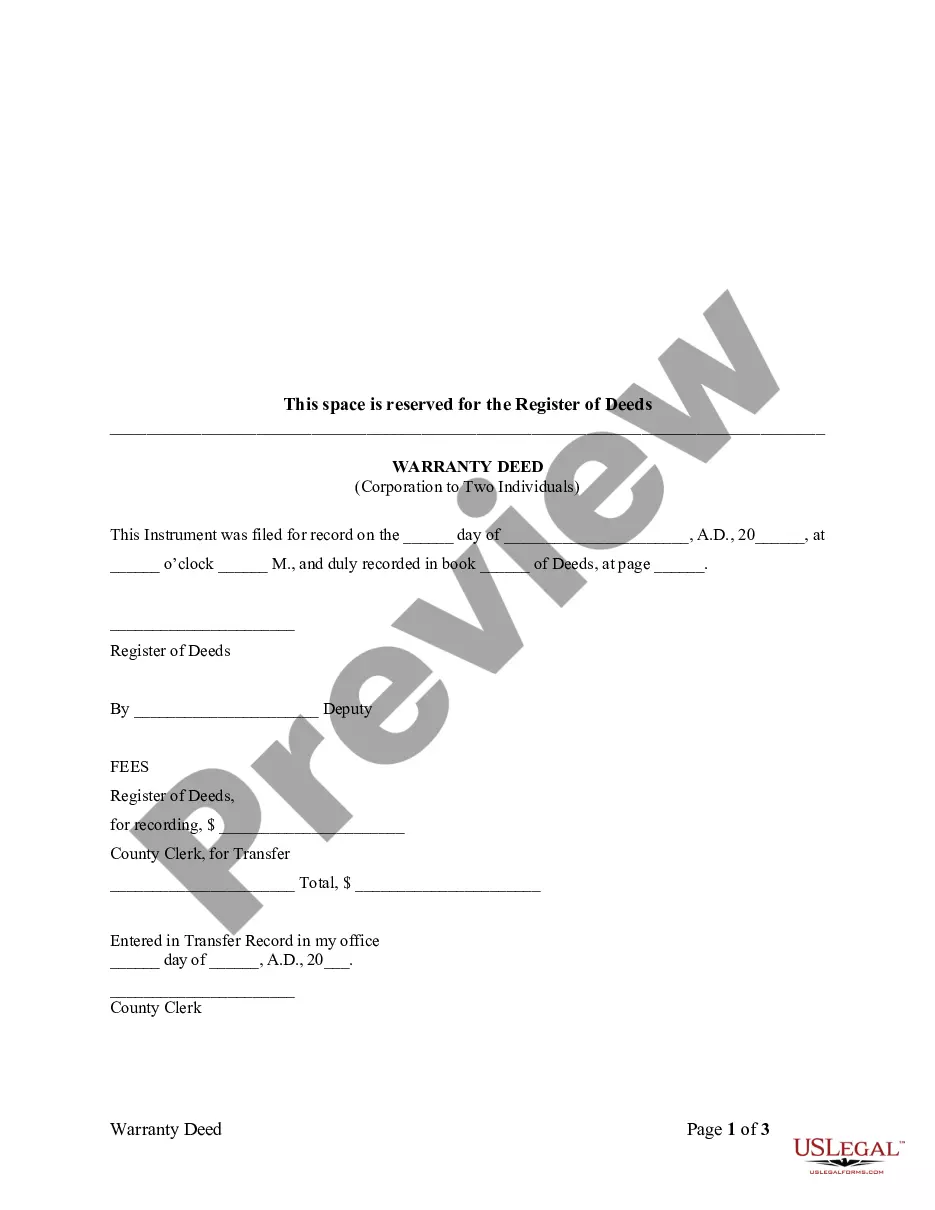

Kansas Warranty Deed from Corporation to Two Individuals

What is this form?

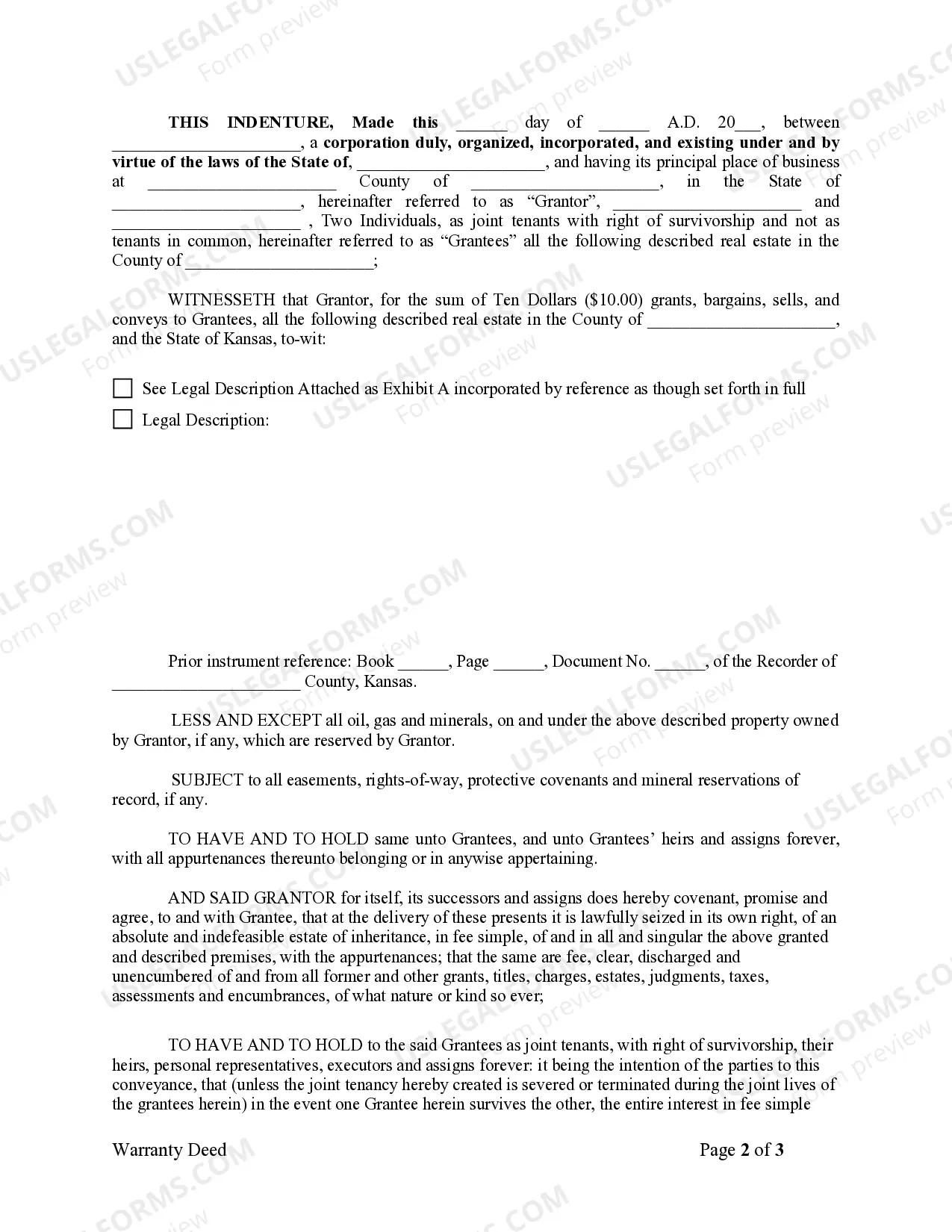

This Warranty Deed from Corporation to Two Individuals form is a legal document that enables a corporation (as the Grantor) to transfer property ownership to two individuals (as Grantees). This deed provides a warranty that the property title is clear and free from encumbrances, except for certain reservations, such as oil, gas, and minerals. Unlike other forms of property transfer, this warranty deed includes specific terms about joint tenancy and rights of survivorship, making it ideal for co-owners looking to secure their interests in the property.

What’s included in this form

- Identification of the Grantor (corporation) and the Grantees (two individuals).

- Legal description of the property being transferred.

- Statement of consideration, specifying the amount of Ten Dollars.

- Retention of oil, gas, and mineral rights by the Grantor.

- Covenant of the Grantor regarding the title's validity.

- Provision for joint tenancy with rights of survivorship for the Grantees.

When to use this document

This form should be used when a corporation is transferring real estate to two individuals who intend to co-own the property. Situations may include the transfer of property as a gift, sale, or in exchange for services. It is particularly useful when the individuals wish to ensure that ownership passes to the surviving individual in the event of one owner's death.

Who should use this form

Individuals and corporations involved in a property transfer should consider this form. The primary users include:

- Coporate representatives authorized to execute property transfers.

- Individuals looking to acquire property from a corporation.

- Real estate professionals facilitating property transactions.

How to complete this form

- Identify the Grantor (corporation) and specify its state of incorporation.

- Fill in the names of the Grantees (two individuals) as joint tenants.

- Provide the legal description of the property being conveyed.

- Include the date of the transaction and the consideration amount.

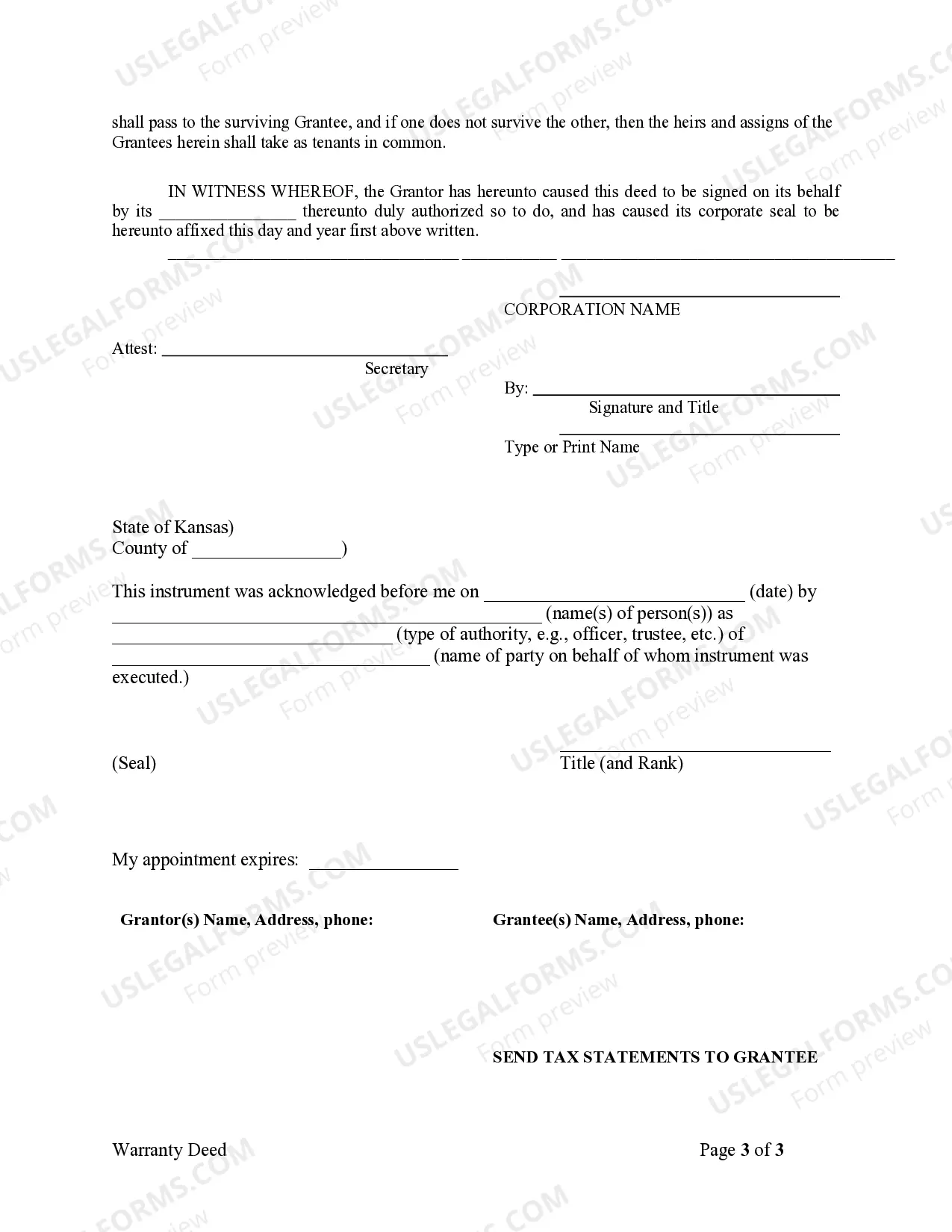

- Sign and date the document on behalf of the Grantor, ensuring proper authorization.

- File the completed deed with the Register of Deeds in the appropriate county.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the legal description of the property.

- Not properly authorizing the signatory on behalf of the corporation.

- Omitting necessary information about the oil, gas, and mineral rights reservation.

- Not filing the deed with the local Register of Deeds after completing it.

Benefits of completing this form online

- Convenience of downloading the form instantly without visiting an office.

- Editability to customize the document to specific needs.

- Reliability of using professionally drafted legal templates that comply with state laws.

Looking for another form?

Form popularity

FAQ

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.