Indiana Timber Sale Contract

Overview of this form

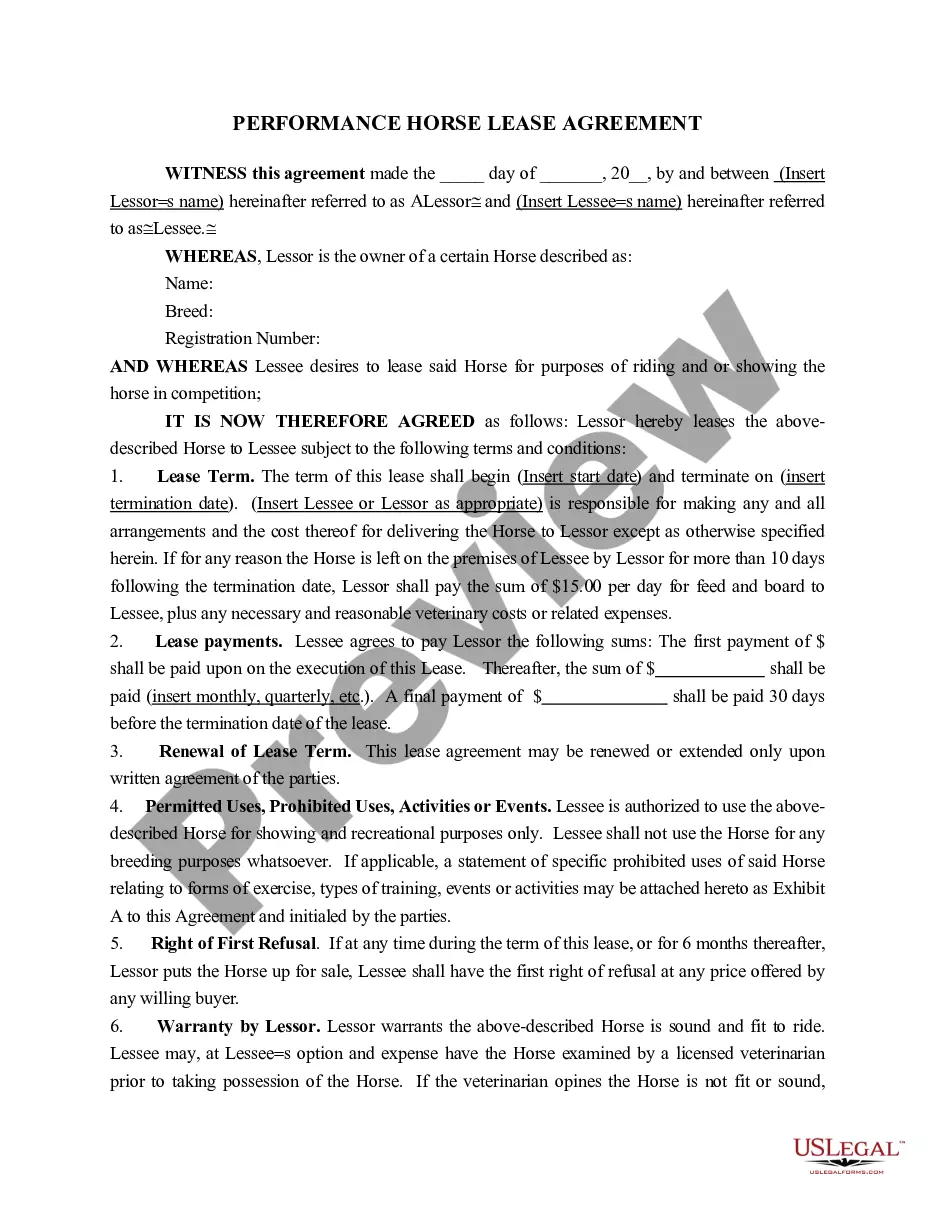

The Indiana Timber Sale Contract is a legal document designed for the sale of merchantable timber in the state of Indiana. This contract outlines the agreement between a seller and a purchaser regarding the rights to harvest timber. It specifies terms including payment structure, responsibilities, and management practices, distinguishing it from generic timber sale agreements by its tailored provisions for Indiana's legal framework.

Main sections of this form

- Identifies the seller and purchaser, including their legal entity types.

- Describes the property where the timber is located and the specific timber being sold.

- Outlines the rights granted to the purchaser regarding timber harvesting and access to the land.

- Includes provisions for compliance with good management practices and environmental regulations.

- Details the conditions for deposit returns and liability for damages during the sale.

- Includes acknowledgments for notarization for both individuals and corporations involved in the transaction.

When to use this document

This form should be used when an individual or corporation in Indiana intends to sell or purchase merchantable timber. It is particularly applicable in situations where clear terms are needed to define timber rights, payment agreements, and responsibilities for land management practices. The contract helps to establish a legal framework to minimize disputes during the timber sale process.

Who should use this form

- Timberland owners seeking to sell their timber.

- Buyers, including individuals or businesses, interested in purchasing timber.

- Legal representatives facilitating timber sales for clients.

- Land management professionals ensuring compliance with environmental regulations.

Instructions for completing this form

- Identify the parties: Fill in the names of the seller(s) and purchaser(s).

- Specify the property: Describe the property location and include details about the timber being sold.

- Enter the financial details: Indicate the total sale amount and any deposit required.

- Outline management practices: Attach or reference Exhibit A regarding timber management practices.

- Ensure signatures: Have all parties sign the contract in the presence of a notary if required.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to clearly describe the timber being sold.

- Omitting specific payment terms and conditions.

- Not including necessary management practices for timber harvest.

- Neglecting to have the form notarized where required.

Advantages of online completion

- Convenient access to a reliable, attorney-drafted form.

- Editable fields for tailoring the contract to specific needs.

- Immediate download option for fast implementation.

- Secure storage and easy access to your legal documents.

Summary of main points

- The Indiana Timber Sale Contract is essential for formalizing the sale of timber in Indiana.

- It includes detailed clauses that protect both the seller and the buyer.

- Attention to environmental management practices is critical for compliance.

- Proper completion and notarization of the form are necessary for its enforceability.

Looking for another form?

Form popularity

FAQ

If you want out of a real estate contract and don't have any contingencies available, you can breach the contract.The seller could also decide to sue you for breach of contract. Some real estate contracts have a liquidated damages clause that states the maximum the seller can keep if the buyers breach the contract.

The Contract of Sale can be prepared by a conveyancer, solicitor, or real estate agent. When the house is sold privately this task tends to go to the seller's real estate agent. You'll want to choose a real estate agent who has the experience to create a solid contract.

Federal law gives borrowers what is known as the "right of rescission." This means that borrowers after signing the closing papers for a home equity loan or refinance have three days to back out of that deal.

Find a buyer. Set a purchase price. Write up a land contract. Have it notarized. Set up a disbursement account.

No, the buyer does not have 3 days to back out. In the State of California in a real estate purchase contract there are a number of contingencies that must be met before the contract moves forward.

In an ideal world, it should take around 9 weeks from the draft contract stage until the day you exchange. But as we've covered, it's not always that simple. A lot can happen before completion day, and for a taste of what can go wrong, read our blog on why house sales fall through.

There is no automatic three day right to cancel, but most real estate contracts have other "contingencies" such as financing or inspection that would give a buyer a right to cancel for specific reasons.

Generally, the settlement period runs for about 30-90 days, although 60-day period is the most common (aside from New South Wales, where it is usually set for just 42 days).

There is a federal law (and similar laws in every state) allowing consumers to cancel contracts made with a door-to-door salesperson within three days of signing. The three-day period is called a "cooling off" period.