Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

Looking for Illinois Living Trust forms for Individuals who are Unmarried, Divorced, or a Widow or Widower without Children can be challenging. To conserve significant time, expenses, and effort, utilize US Legal Forms and find the suitable template specifically for your state with just a few clicks. Our legal experts prepare each document, so you only need to complete them. It is truly that simple.

Sign in to your account and go back to the form's page to download the sample. All your retrieved templates are stored in My documents and are accessible at any time for future use. If you haven’t subscribed yet, you need to register.

Check out our comprehensive guidelines on how to obtain your Illinois Living Trust for Individual Who is Single, Divorced, or Widow or Widower with No Children form in just a few minutes.

You can now print the Illinois Living Trust for Individual Who is Single, Divorced, or Widow or Widower with No Children template or complete it using any online editor. Don’t worry about errors in your writing because your template can be used, submitted, and printed as often as required. Try US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- To get a required template, verify its relevance for your state.

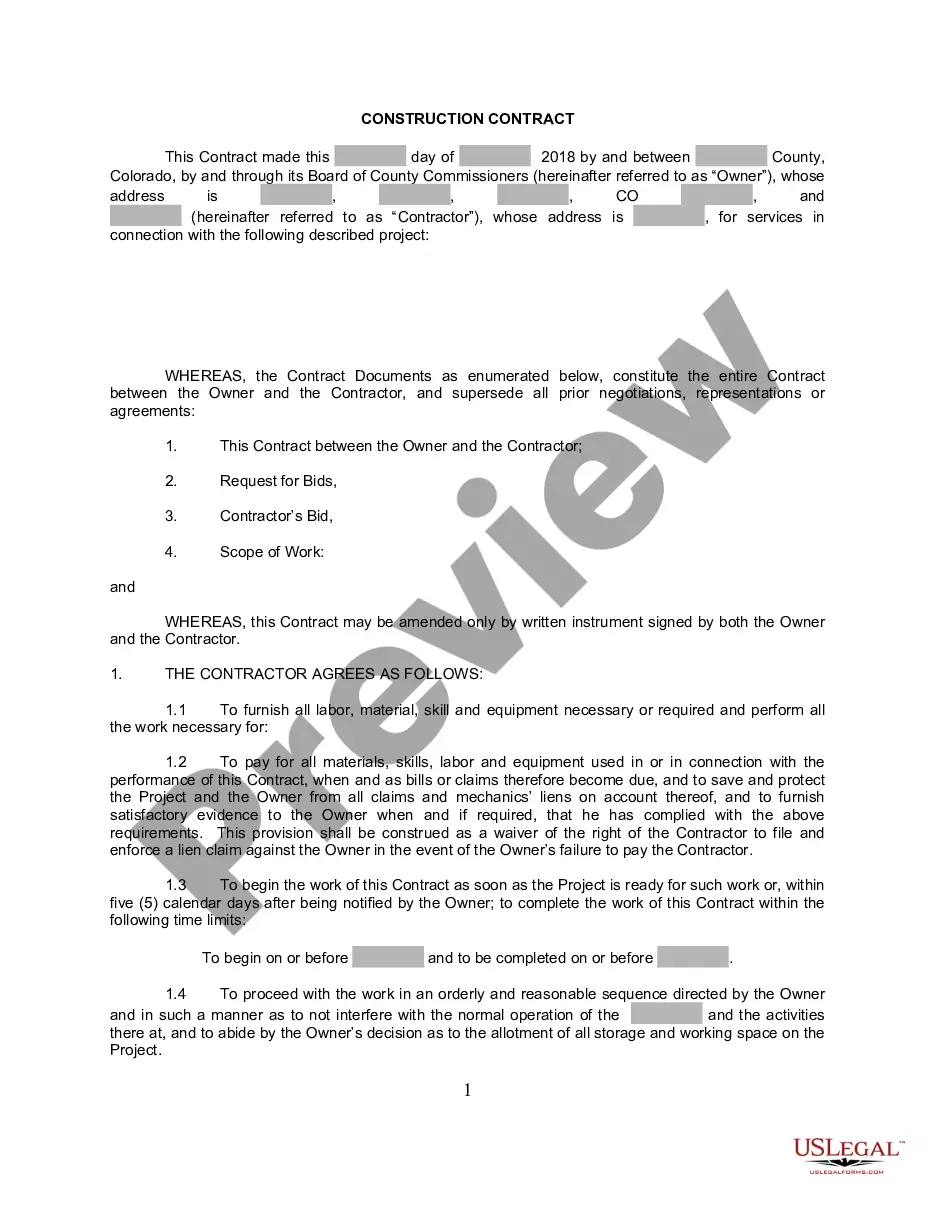

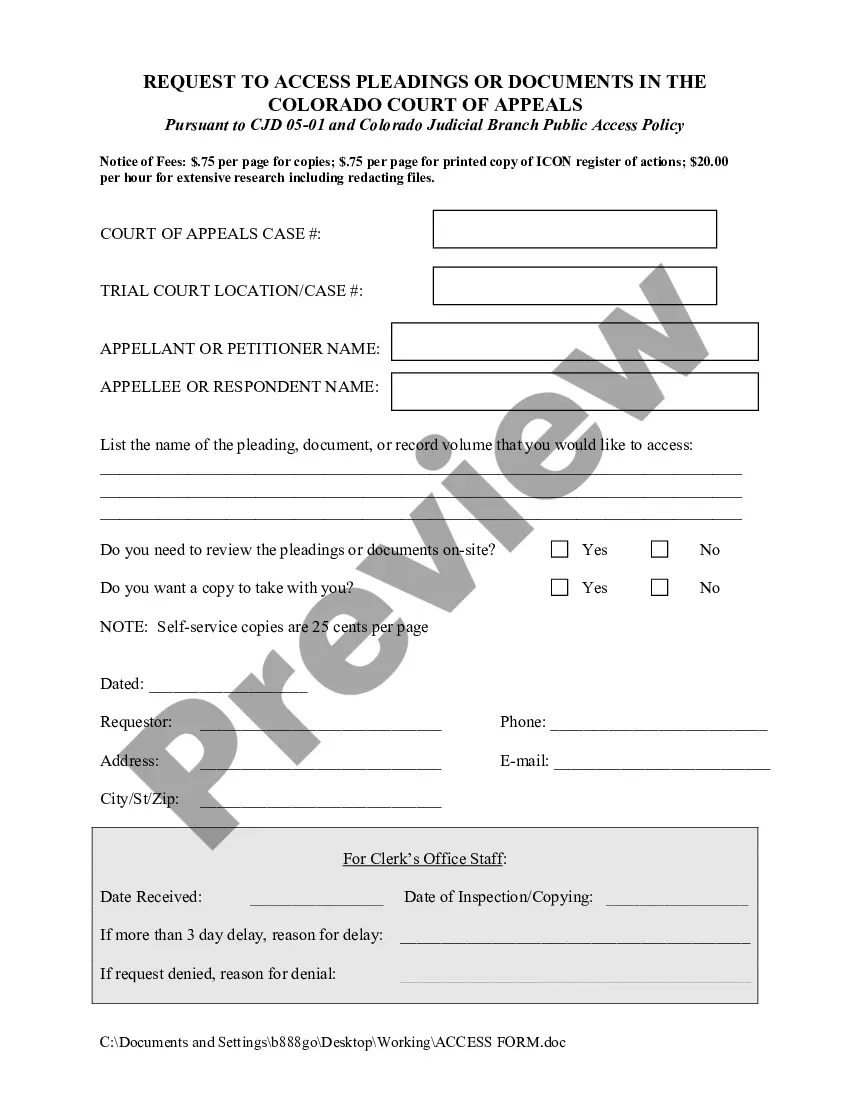

- Examine the template using the Preview feature (if available).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you have located what you need.

- Select your plan on the pricing page and create your account.

- Decide whether you would like to pay with a credit card or through PayPal.

- Save the template in your desired file format.

Form popularity

FAQ

A "living trust" (also called an "inter vivos" trust by lawyers who can't give up Latin) is simply a trust you create while you're alive, rather than one that is created at your death under the terms of your will. The beneficiaries you name in your living trust receive the trust property when you die.

Does a Beneficiary Have the Right to See the Trust? The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.

Of the trust's existence, the beneficiary's right to request a copy of the trust agreement and right to an account (within 90 days of the trust becoming irrevocable or a change in trusteeship) when a trust becomes irrevocable (within 90 days of the event) appointment of a new trustee (within 90 days of acceptance)

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.

The main purpose of a living trust is to oversee the transfer of your assets after your death. Under the terms of the living trust, you are the grantor of the trust, and the person you designate to distribute the trust's assets after your death is known as the successor trustee.

Basic revocable living Trusts may be included in a flat-fee estate planning package costing between $2,500 and $6,000. Revocable living Trusts help you bypass the costly and public probate process and can evolve into testamentary Trusts that allow you to control your assets long after you have departed this world.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.