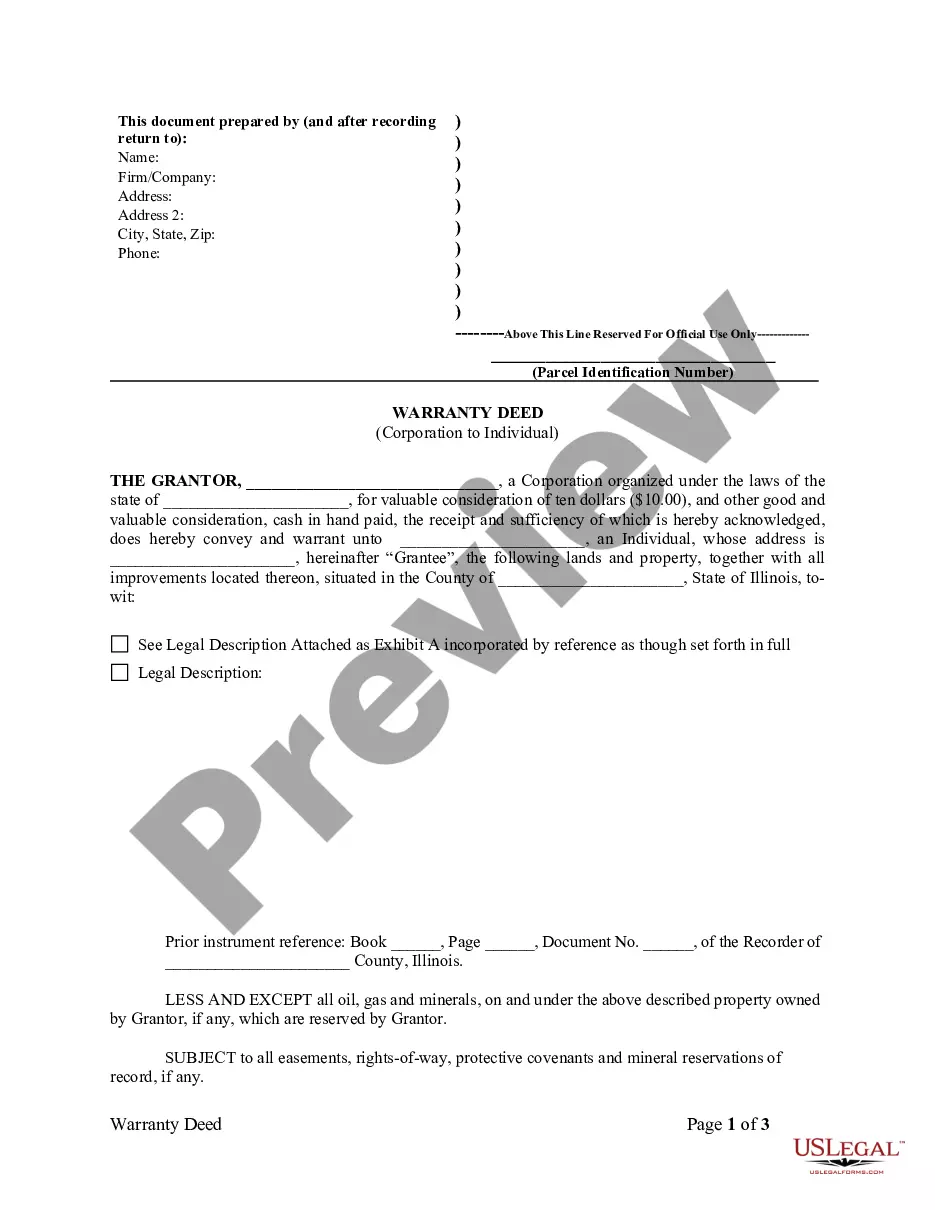

Illinois Warranty Deed from Corporation to Individual

Description

How to fill out Illinois Warranty Deed From Corporation To Individual?

Locating Illinois Warranty Deed templates from Corporation to Individual and completing them may prove to be difficult.

To conserve substantial amounts of time, money, and effort, utilize US Legal Forms to discover the appropriate sample specifically tailored for your state in just a few clicks. Our legal professionals craft each document, so you only need to fill in the details. It's that simple.

Click Log In to your account, navigate back to the form's page, and save the document. All your downloaded templates are stored in My documents and are readily available for future use. If you haven’t signed up yet, you will need to register.

You can now print the Illinois Warranty Deed from Corporation to Individual form or complete it using any online editor. Don't worry about making mistakes as your sample can be used and submitted, and printed as many times as you need. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To retrieve a valid example, verify its suitability for your state.

- Examine the example using the Preview feature (if available).

- If there is a description, peruse it to understand the details.

- Select the Buy Now button if you have located what you need.

- Choose your pricing option on the payment page and create your account.

- Decide whether to pay by card or through PayPal.

- Download the document in your preferred file format.

Form popularity

FAQ

Signing over the interest in the property, whether land or house, can be done in several ways. However, the most common instruments of transfer of property between family members are the quitclaim deed, the gift deed or the transfer on death (TOD) deed.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the Illinois land records.

The first common requirement is that the deed must be in writing and signed by the grantor(s). 765 ILCS 5/1. Generally, deeds conveying a homestead estate must also be signed by the grantor's spouse, except where one spouse conveys to the other. A few other exceptions to this rule are set forth at 735 ILCS 5/12-904.

Although it's possible to change the names on title deeds yourself, we recommend that you seek professional help from a solicitor. The value of property is sufficiently high to make it worthwhile getting the transfer right.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

There is one way you can make an IRS-approved gift of your home while still living there. That is with a qualified personal residence trust (or QPRT). Using a QPRT potentially allows you to get the residence out of your taxable estate without moving out even though you have not made a full FMV sale to your child.