Illinois Registration of Foreign Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Registration Of Foreign Corporation?

Attempting to locate an Illinois Registration of Foreign Corporation example and completing it might pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your state within just a few clicks.

Our attorneys prepare all documents, so you simply need to complete them.

Select your plan on the pricing page and create an account. Choose whether you want to pay with a card or via PayPal. Save the file in your desired format. You can print the Illinois Registration of Foreign Corporation form or fill it out using any online editor. No need to be concerned about typos because your sample can be used and submitted, and published as many times as you wish. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the document.

- All your downloaded samples are stored in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, you ought to register.

- Review our comprehensive guidelines on how to obtain the Illinois Registration of Foreign Corporation form within minutes.

- To obtain a qualified sample, verify its relevance for your state.

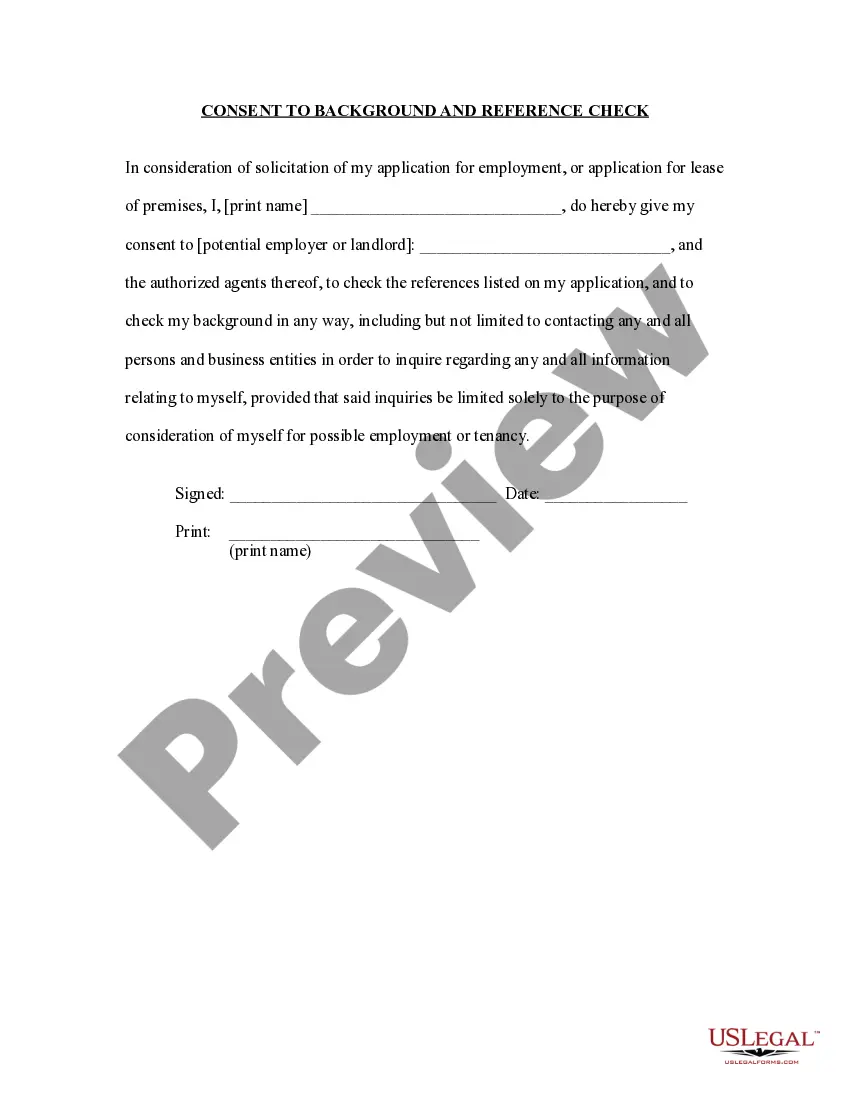

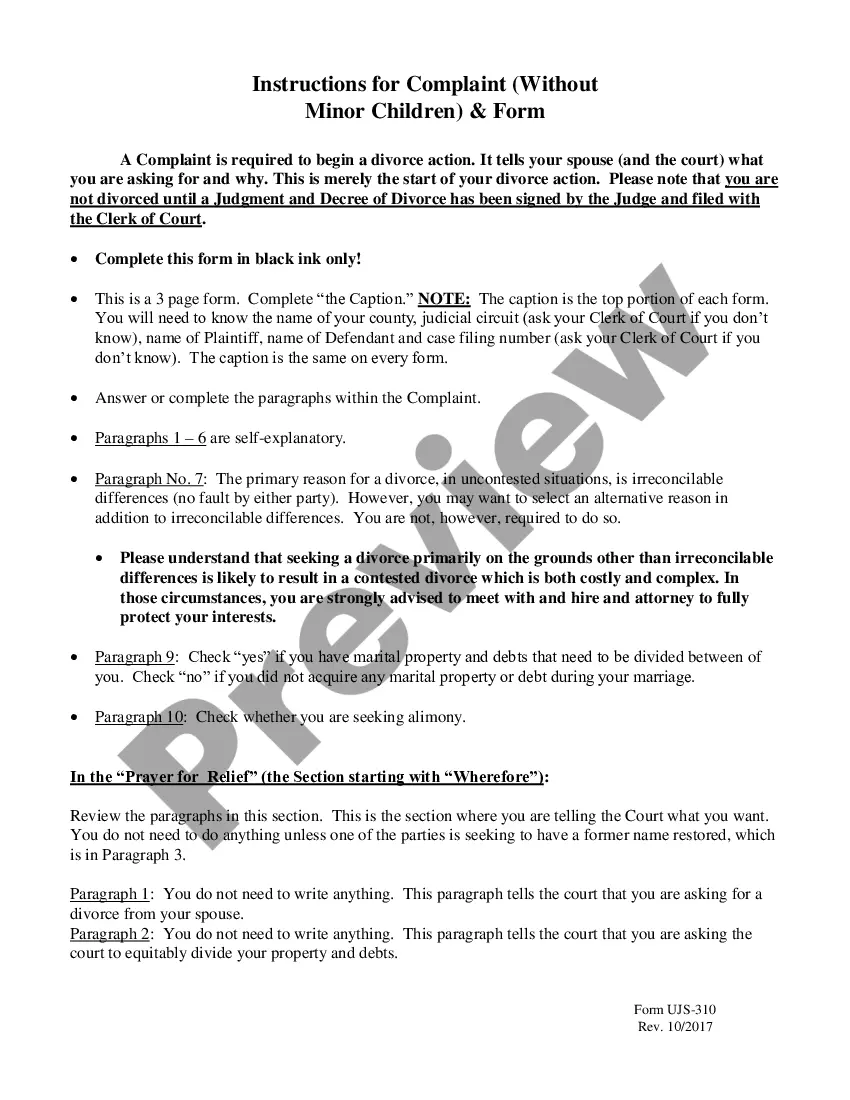

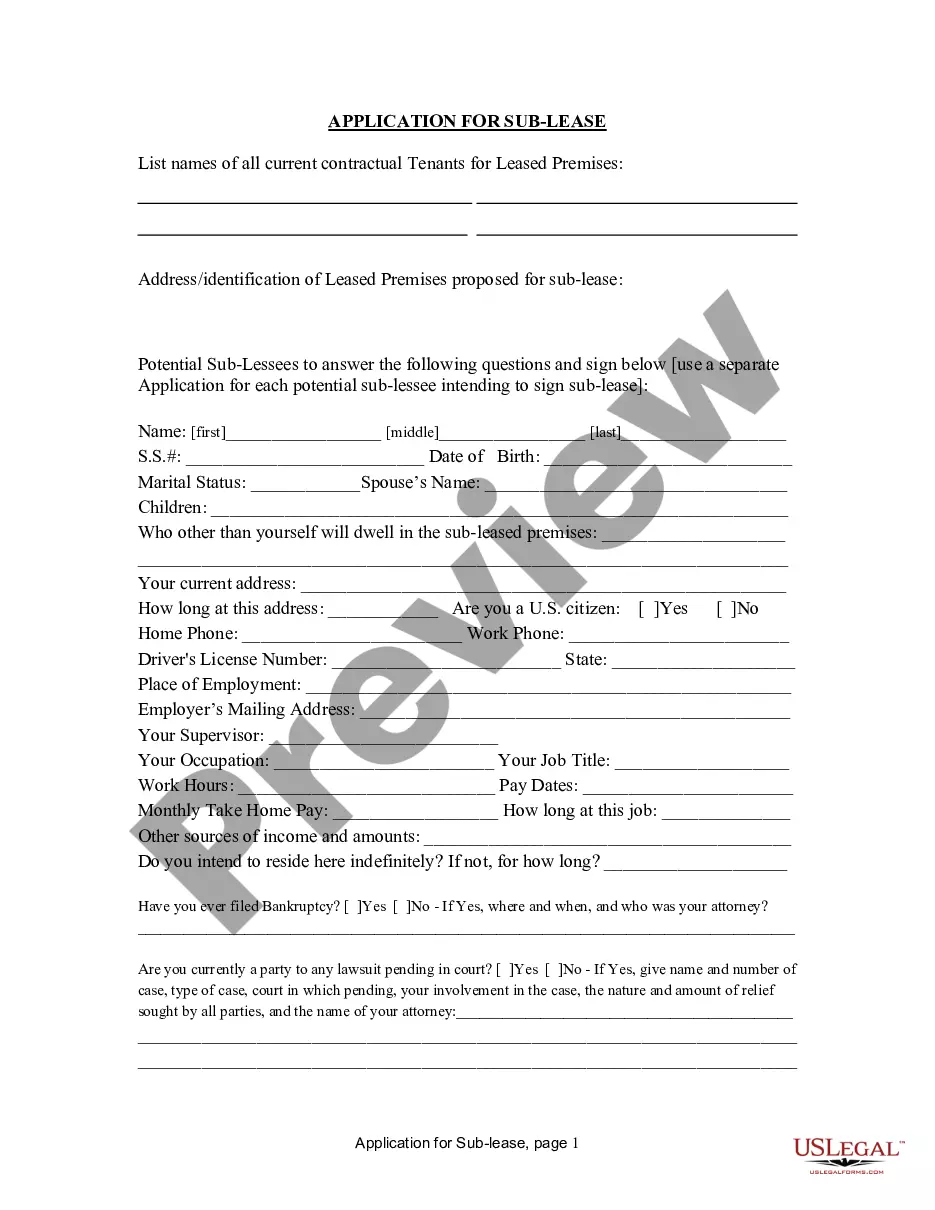

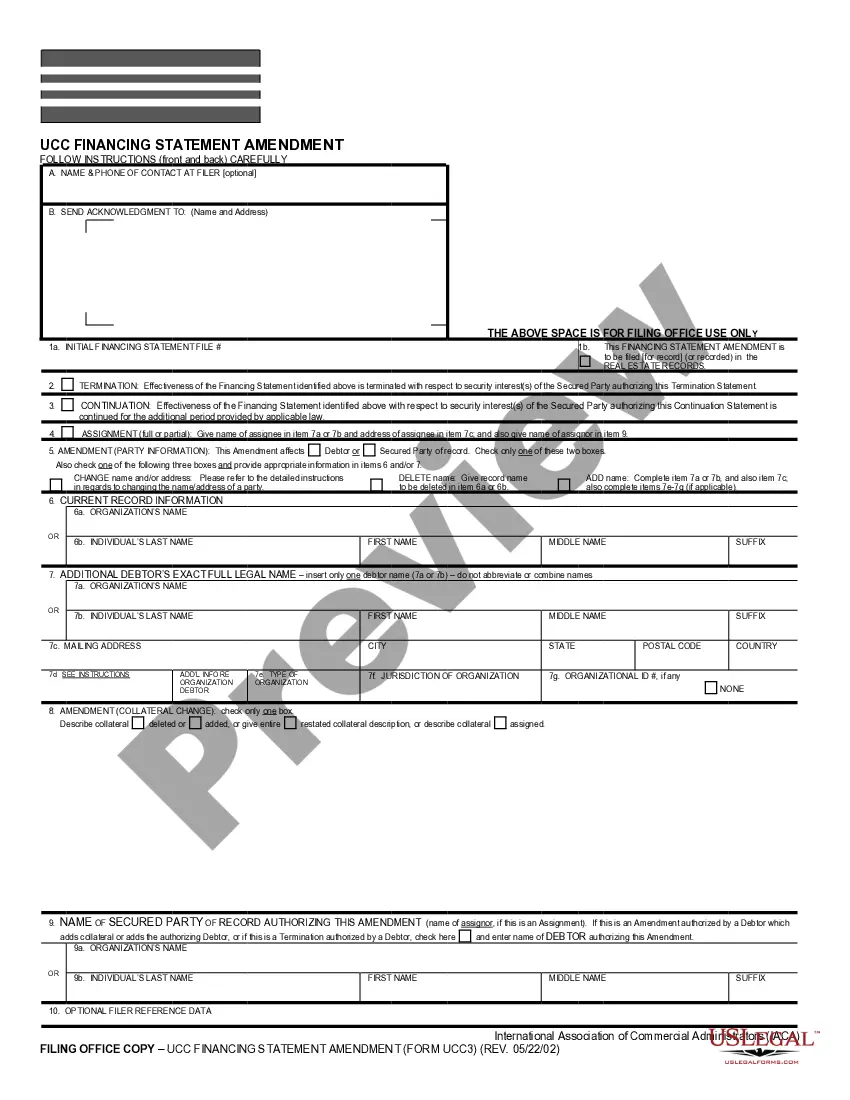

- Examine the example using the Preview option (if it’s available).

- If there's a description, read it to grasp the specifics.

- Click on the Buy Now button if you've found what you're looking for.

Form popularity

FAQ

Illinois Department Of Revenue (IDOR) In Illinois, most business are required to be registered and/or licensed by the IDOR. If you plan to hire employees, buy or sell products wholesale or retail, or manufacture goods, you must register with the IDOR.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

You must be at least 18 years old to be your own registered agent in Illinois. An Illinois street address is required and the agent must be able to accept legal paperwork delivered in person to their home or office. A registered agent can be the owner, an employee, a friend, or a nearby business.

A foreign LLC registration begins by filing an Application for Admission to Transact Business. The form is submitted in duplicate to the Secretary of State Department of Business Services. It must be accompanied by a Certificate of Good Standing or Existence authenticated in the last 60 days. Pay the Filing Fee.

A registered agent is an individual or company who is the central point of contact to receive important legal documents for a business. A registered agent is required by the Illinois Secretary of State when filing for a business entity such as a corporation, Limited Liability Company, and Limited Partnership.

Illinois state law requires all business entities to designate a registered agent. When you form your company with the Secretary of State, your filing will be rejected without a registered agent.

FAQs About California Registered Agents Yes. All CA LLCs are required to have a Registered Agent. This is mandated by the California Secretary of State.You must assign a Registered Agent when you incorporate your business through paperwork filed with the CA Secretary of State.

To register your foreign business in Illinois, you must file an Application for Admission to Transact Business with theIllinois Secretary of State (SOS). If you have a typical LLC, you will use Form LLC-45.5. If you have a a so-calledseries LLC (which are not covered here), use Form LLC-45.5(S).

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.