Georgia Warranty Deed from Individual to LLC

What this document covers

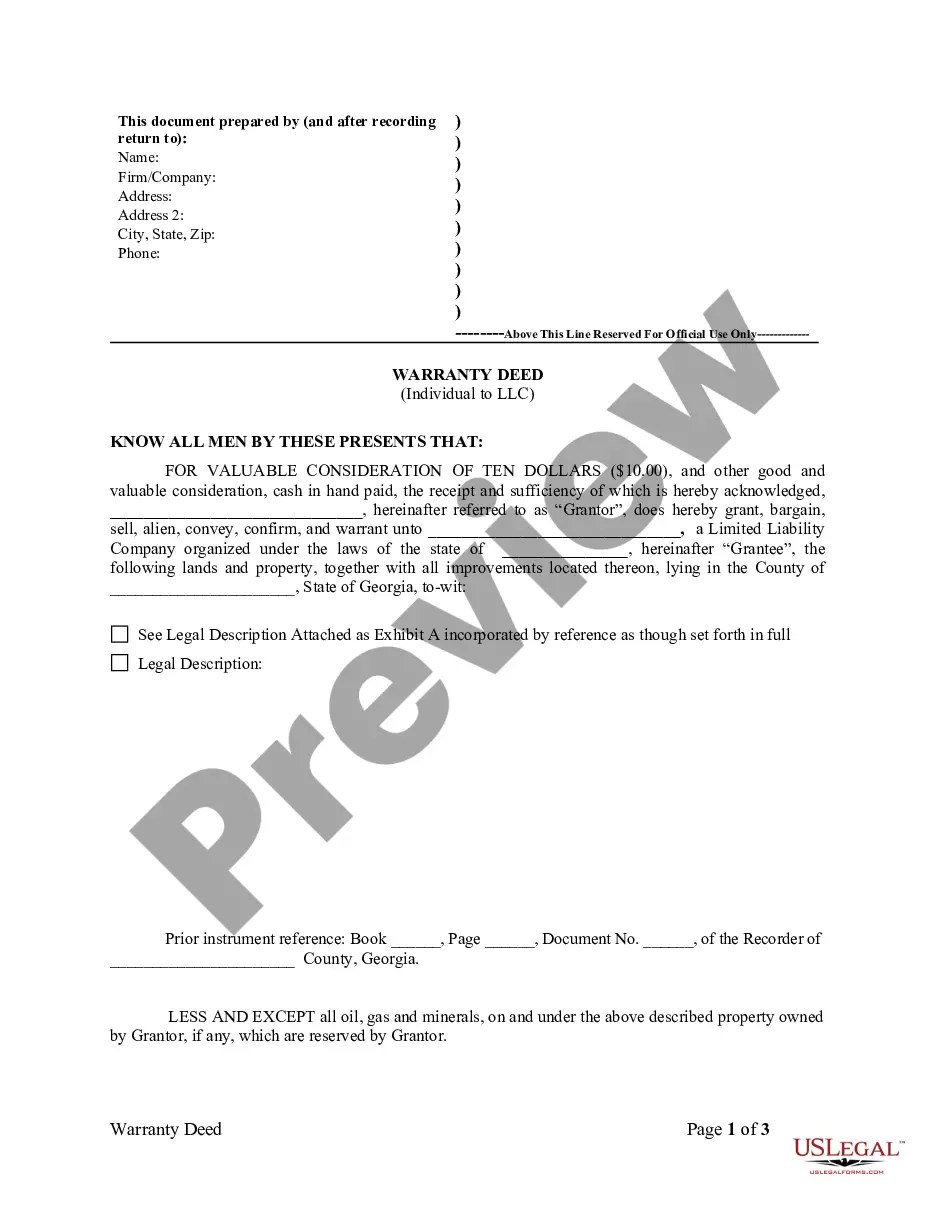

The Warranty Deed from Individual to LLC is a legal document where an individual (the grantor) transfers ownership of real property to a limited liability company (the grantee). This form ensures the grantor is conveying a clear and marketable title, free from encumbrances, except for any reservations noted. It differs from other types of deeds by specifically indicating that the grantee is an LLC, which can affect liability and financial structure regarding the property.

What’s included in this form

- Identification of the grantor (individual) and grantee (LLC)

- Legal description of the property being conveyed

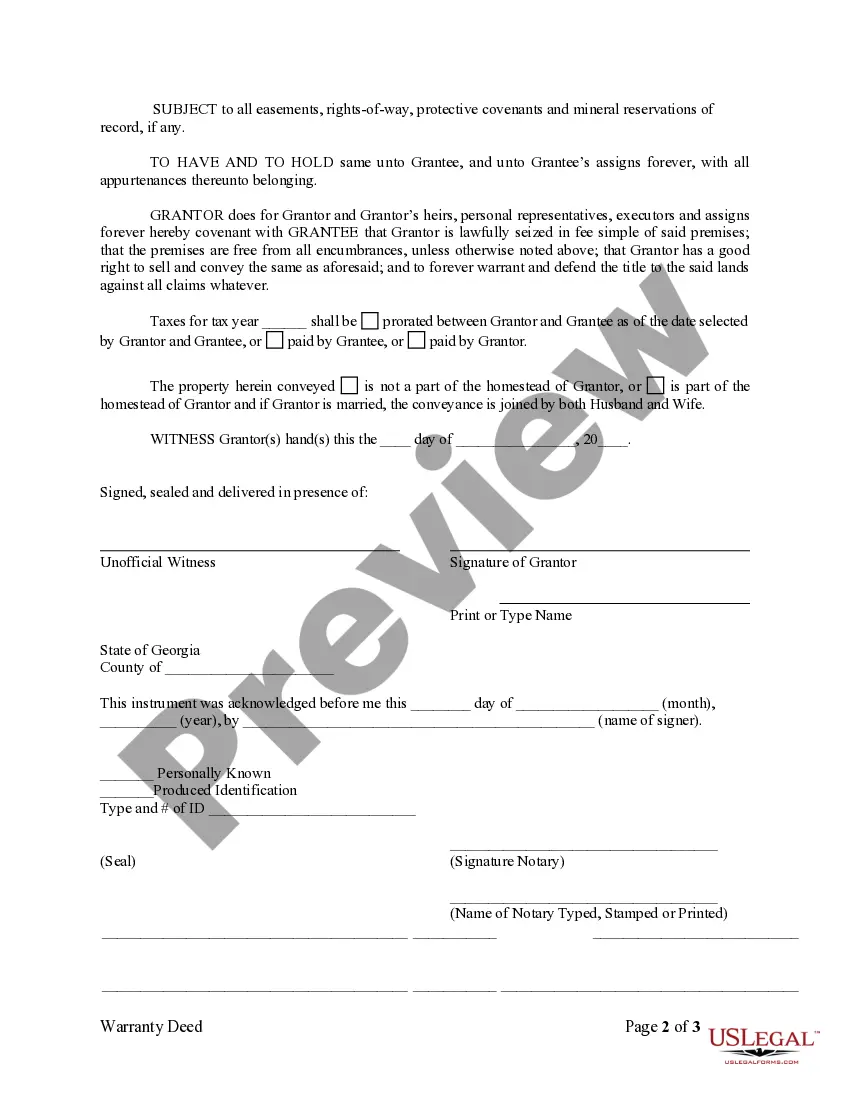

- Warranties and covenants regarding the title and encumbrances

- Provisions related to taxes for the tax year

- Signature lines for the grantor and witnesses

When to use this form

This form is typically used when an individual wishes to transfer property ownership to an LLC. Situations could include real estate investment, business restructuring, or estate planning where property is moved from personal ownership into a business structure. Utilizing this warranty deed can help protect the new ownership from future claims against the grantor's personal assets.

Who can use this document

- Individuals transferring property to their own LLC

- Real estate investors moving properties into a limited liability company

- Business owners looking to segregate personal and business liabilities

- Estate planners managing property transfers to corporations or LLCs

How to complete this form

- Identify both the grantor and grantee by entering their legal names.

- Provide a detailed legal description of the property being transferred.

- Specify any reservations, such as rights to minerals, if applicable.

- Determine how taxes for the current tax year will be handled between parties.

- Sign the document in the presence of a witness.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not specifying encumbrances clearly, leading to potential disputes.

- Omitting signatures from the grantor or the witness.

- Not addressing the handling of property taxes appropriately.

Why complete this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows you to ensure all information is accurate before finalizing.

- Prepared by licensed attorneys to ensure legal compliance.

- Secure storage of documents for future reference.

Legal use & context

- This form provides a warranty of title, ensuring the grantee receives the property free from claims.

- It can be used for both residential and commercial properties.

- Correct use of this form protects both parties in the transaction from future legal issues related to title claims.

Key takeaways

- The Warranty Deed from Individual to LLC is essential for transferring property ownership securely.

- Important components include the legal description and any encumbrances.

- This form should be used by individuals looking to protect their personal assets when transferring property to an LLC.

Looking for another form?

Form popularity

FAQ

To fill out a warranty deed form effectively for a Georgia Warranty Deed from Individual to LLC, you must gather essential information first. Include the grantor's name, the grantee's name—specifically the LLC—and the property description. Next, carefully complete the form, ensuring that all required sections are filled in accurately, including the notary section. You can simplify this process by using USLegalForms, which provides user-friendly templates and guidance for creating a Georgia Warranty Deed from Individual to LLC.

In Georgia, an attorney is not required to prepare a deed, including the Georgia Warranty Deed from Individual to LLC. However, utilizing a professional can ensure that all legal requirements are met and can prevent potential errors. If you prefer to do it yourself, platforms like USLegalForms offer comprehensive resources to assist you.

To transfer a deed from personal ownership to an LLC in Georgia, you utilize a Georgia Warranty Deed from Individual to LLC. Fill out the form with correct details and get it signed by the necessary parties. Finally, ensure that you file the deed at your local county office to update the public record.

You can transfer a deed without a lawyer by carefully preparing your Georgia Warranty Deed from Individual to LLC. Make sure to follow the state's regulations, have the deed signed and notarized, and file it at the local county clerk's office. Online platforms like USLegalForms can simplify this process by providing templates and guidance.

To transfer your property to an LLC in Georgia, you should create a Georgia Warranty Deed from Individual to LLC. This deed must contain the names of the individual transferring the property and the LLC receiving it. File the executed deed with the local county clerk to complete the ownership transfer.

Transferring a property deed in Georgia involves drafting a Georgia Warranty Deed from Individual to LLC that accurately describes the property. Next, you must have the deed signed and notarized before you file it at the local county recorder's office. This process helps ensure the change in ownership is properly recorded.

To transfer a property deed in Georgia, you begin by preparing a Georgia Warranty Deed from Individual to LLC. This document needs to include key details about the property and the parties involved. After completion, file the deed with the county clerk's office where the property is located to officialize the transfer.

Putting your property in an LLC requires drafting a Georgia Warranty Deed from Individual to LLC. You should prepare the deed with precise property descriptions and include your LLC as the new owner. After signing the deed in front of a notary, file it with the appropriate county office to complete the transfer. This method protects your assets under the LLC's legal structure.

To transfer the deed of a house to an LLC, you will need to create a Georgia Warranty Deed from Individual to LLC. Start by drafting the deed, ensuring it includes the correct legal descriptions of your property. Next, sign the deed before a notary and submit it to the county recorder's office. This process ensures that the ownership is officially updated to reflect the LLC.

Yes, you can put your house in an LLC and rent it to yourself, but this requires careful structuring to remain compliant with tax regulations. The rental payments must be at fair market value, and you should adhere to all necessary legal implications. Consulting with a financial advisor or legal expert can help ensure you're following the best practices in this situation.