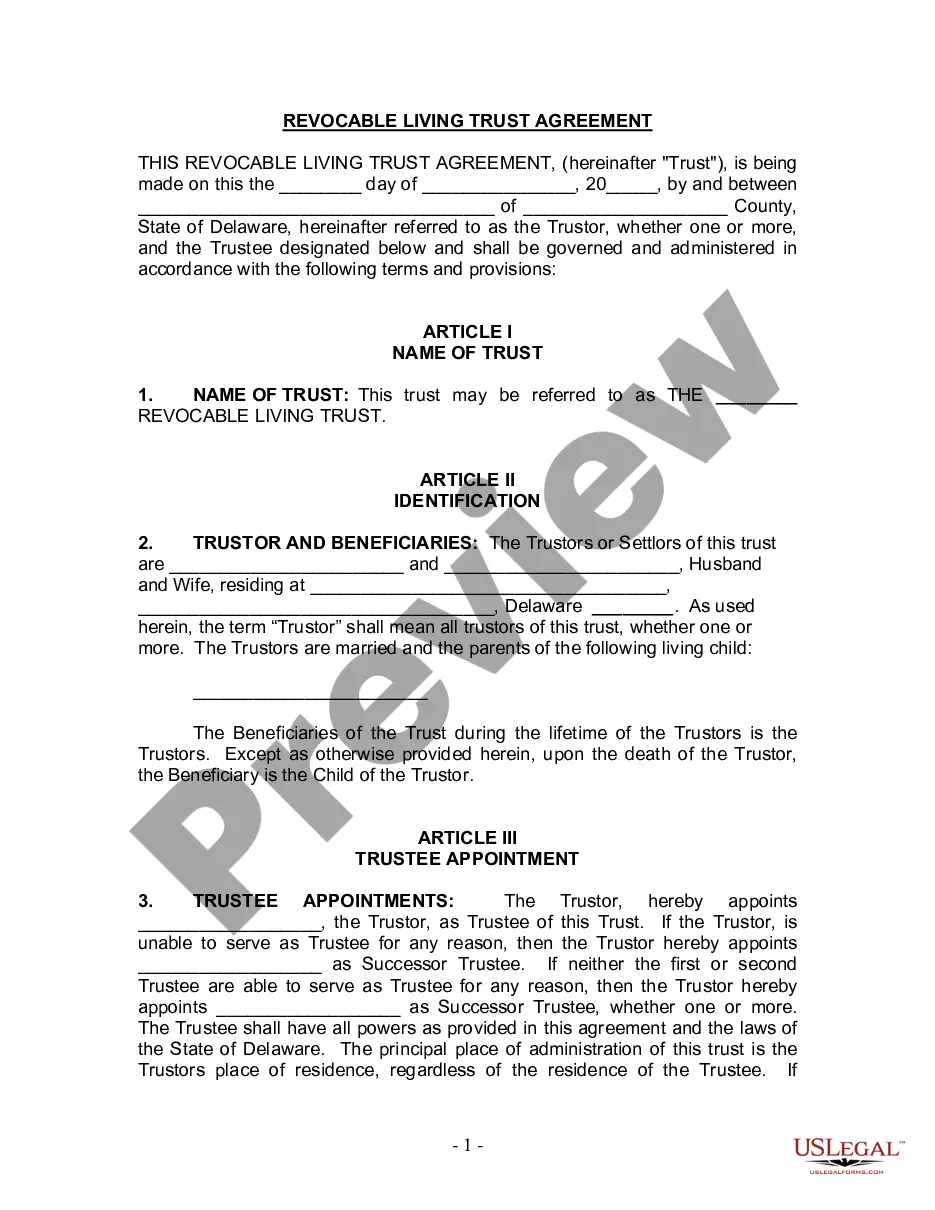

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Delaware Living Trust for Husband and Wife with One Child

Description

How to fill out Delaware Living Trust For Husband And Wife With One Child?

The greater the documentation you are required to complete - the more uneasy you become.

You can discover countless Delaware Living Trust for Husband and Wife with One Child templates online, however, you may not know which ones to rely on.

Eliminate the frustration and simplify the process of finding samples with US Legal Forms. Obtain precisely drafted papers that conform to state requirements.

Access each template you receive in the My documents section. Simply navigate there to produce a new copy of the Delaware Living Trust for Husband and Wife with One Child. Even when using well-prepared documents, it remains crucial to consider consulting your local legal advisor to verify that your filled document is correctly completed. Achieve more for less with US Legal Forms!

- Verify if the Delaware Living Trust for Husband and Wife with One Child is valid in your jurisdiction.

- Double-check your choice by reviewing the description or using the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

- Fill in the necessary information to create your account and complete the payment via PayPal or credit card.

- Select your preferred document type and obtain your specimen.

Form popularity

FAQ

Whether a husband and wife should have separate living trusts often depends on their financial goals and family dynamics. Utilizing a Delaware Living Trust for Husband and Wife with One Child encourages joint asset management while allowing for personalized provisions. However, in certain situations, separate trusts may provide peace of mind and clarity in asset management. It's wise to assess your individual needs and consult with a trusted legal professional to determine the most beneficial approach for your family.

A husband and wife may consider separate trusts to address specific financial or legal needs such as individual asset protection, debt management, or distinct distribution preferences. By utilizing a Delaware Living Trust for Husband and Wife with One Child, each spouse can maintain control over their assets while still providing for their child. This arrangement can also be beneficial in situations involving prior marriages or unique financial circumstances. Ultimately, separate trusts can offer customized solutions that align with each partner's goals.

The best living trust for a married couple often depends on individual circumstances, but a Delaware Living Trust for Husband and Wife with One Child is designed to be flexible and effective. This type of trust allows couples to decide how they want their assets divided and offers peace of mind knowing their child will benefit directly. Additionally, these trusts can simplify the estate administration process and reduce tax implications. Ultimately, consulting with a legal expert can help couples choose the most suitable trust for their unique situation.

Delaware has specific laws that govern the creation and management of living trusts. The state encourages individuals to establish trusts by offering various legal frameworks that enhance asset protection and tax benefits. Notably, a Delaware Living Trust for Husband and Wife with One Child can provide clear directives for asset distribution while also minimizing probate hassles. By understanding Delaware's trust laws, couples can confidently manage their estate and ensure their child’s future.

Setting up a Delaware Living Trust for Husband and Wife with One Child involves several key steps. First, you need to decide on the trust's terms, including how assets will be managed and distributed. Then, you should draft the trust document, which outlines these terms clearly and designates you and your spouse as trustees. Finally, it’s important to fund the trust by transferring ownership of your assets into it, ensuring that they are protected and managed according to your wishes.

Setting up a trust in Delaware typically involves several key steps. You should begin with defining your goals, then draft your Delaware Living Trust for Husband and Wife with One Child document. This includes naming your assets and beneficiaries, as well as appointing a trustee. To streamline the process, consider using uslegalforms, where you can find guided templates tailored to your needs.

Many people choose to set up trusts in Delaware because the state offers favorable laws and flexible options. The Delaware Living Trust for Husband and Wife with One Child provides privacy and avoids probate, streamlining asset distribution. Additionally, Delaware has a strong legal framework that supports the rights of trustees and beneficiaries, making it an attractive option.

To start a trust in Delaware, you need to first define your objectives and determine how the Delaware Living Trust for Husband and Wife with One Child will fit into your estate plan. After that, you can draft the trust agreement, outlining your wishes and designating a trustee. Working with an experienced attorney or using platforms like uslegalforms can simplify this process and ensure legal compliance.

Yes, having a spouse as a trustee for your Delaware Living Trust for Husband and Wife with One Child can be beneficial. It allows you to maintain control over the trust assets and make decisions together. Furthermore, this arrangement can provide security and trust between partners. It ensures both parties are actively involved in managing the assets.

Putting your house in a trust can offer many advantages for a married couple. A Delaware Living Trust for Husband and Wife with One Child protects your home from probate and eases the passing of ownership to your heirs. By doing this, you maintain control and can change the terms of the trust as your life circumstances evolve. It also provides peace of mind knowing that your assets are protected and managed according to your wishes.