District of Columbia Satisfaction of Judgment

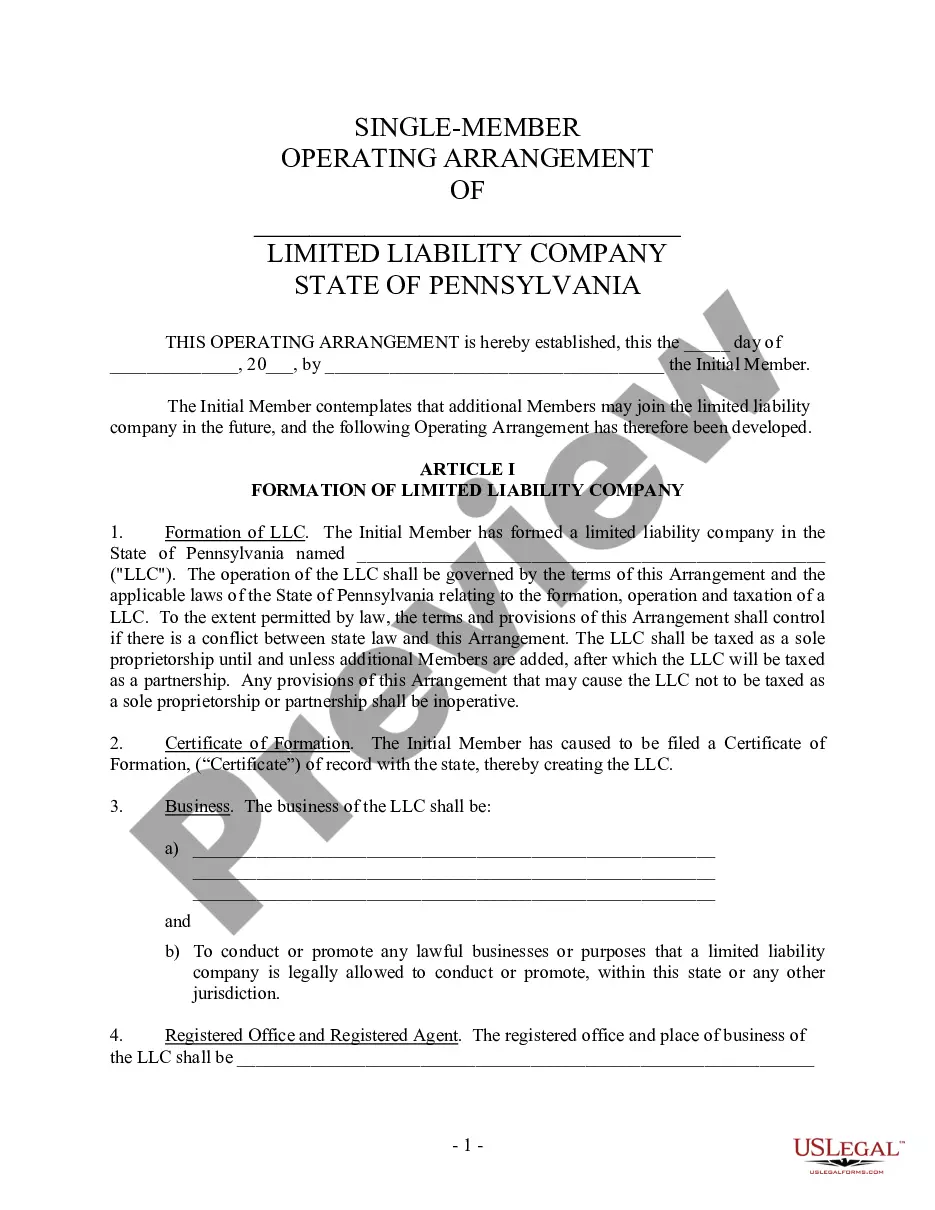

Overview of this form

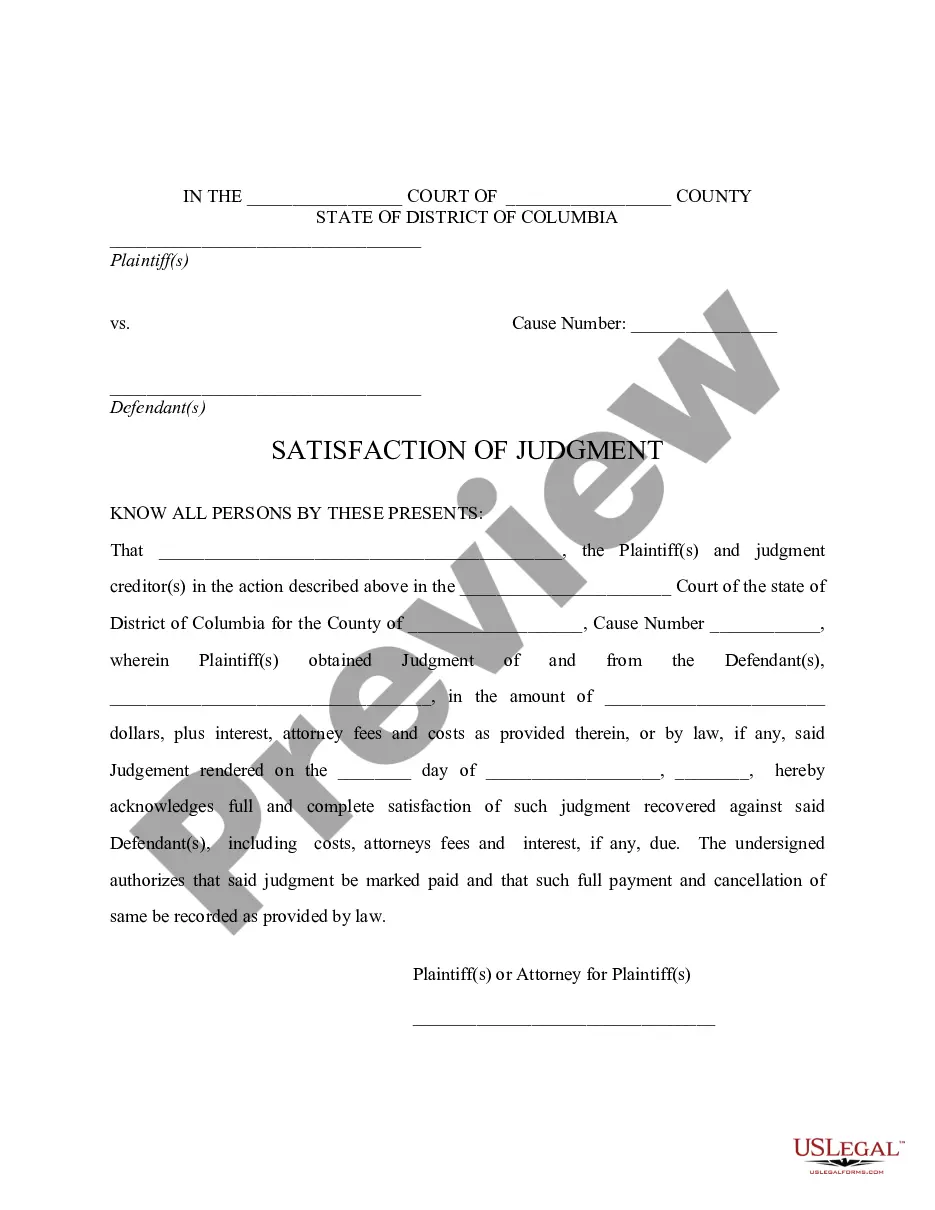

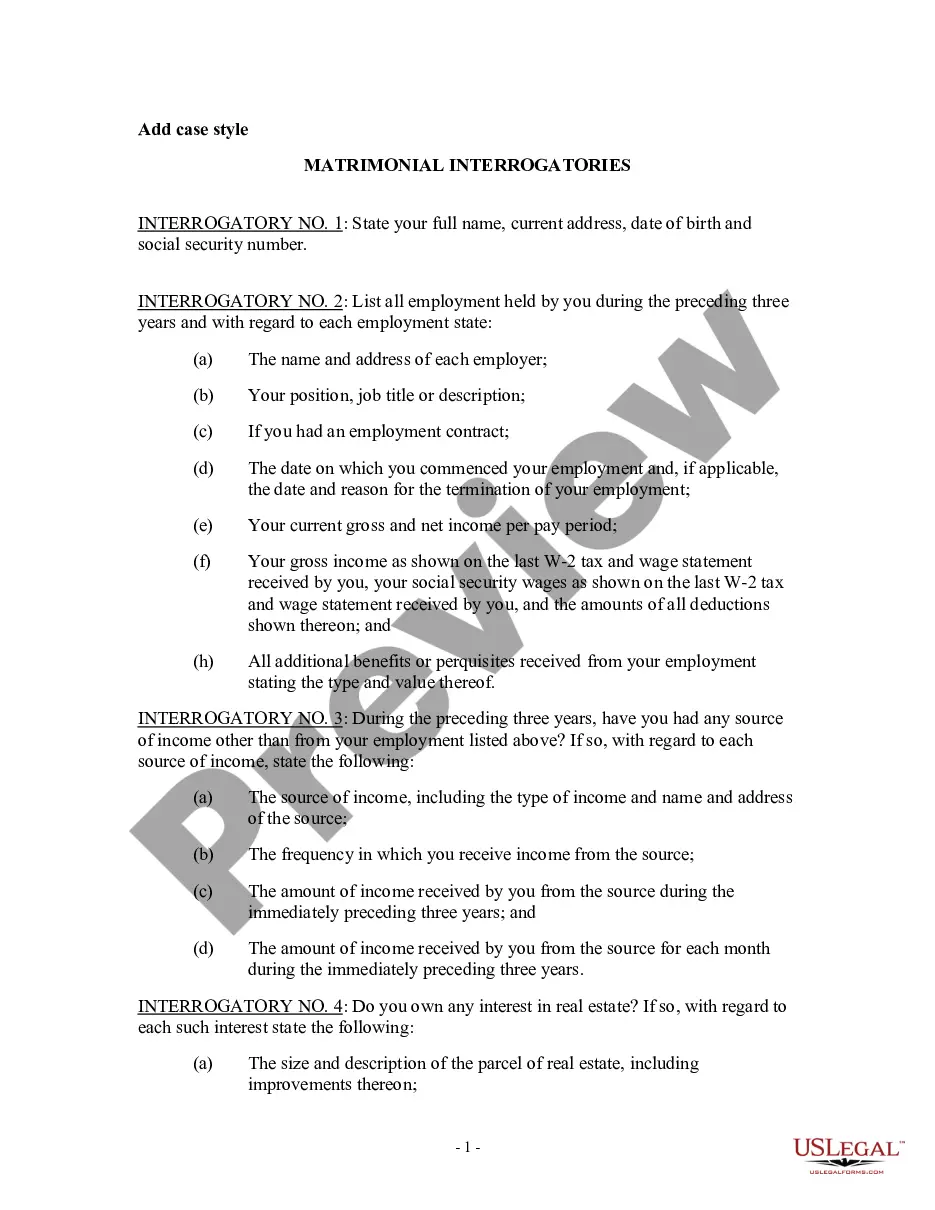

The District of Columbia Satisfaction of Judgment is a legal document that certifies a judgment has been fully paid, including fees, costs, and interest. This form acknowledges the completion of the debtor's obligation to the creditor and requests that the court records indicate the judgment has been marked as satisfied.

Main sections of this form

- Identification of the court, county, and parties involved (plaintiff and defendant).

- Details of the judgment such as the cause number and the amount paid.

- Acknowledgment section signed by the plaintiff or their attorney.

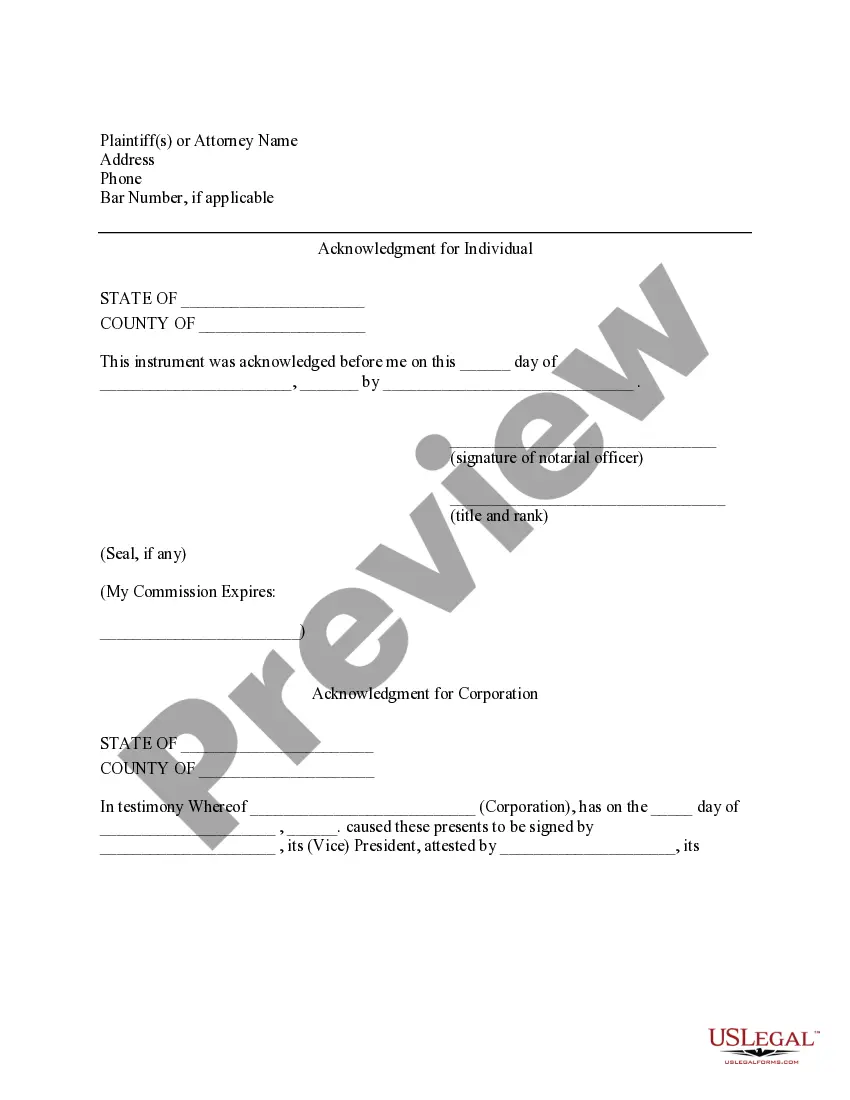

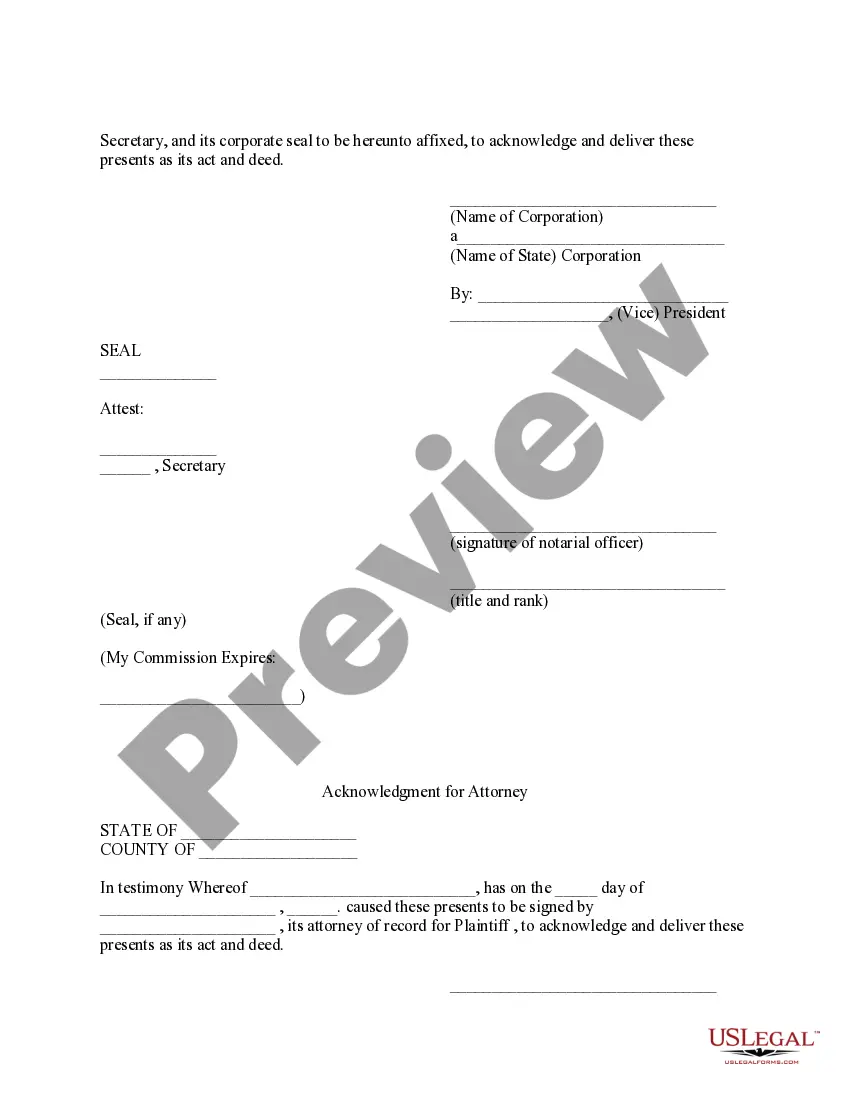

- Notarial acknowledgment for individuals or corporations.

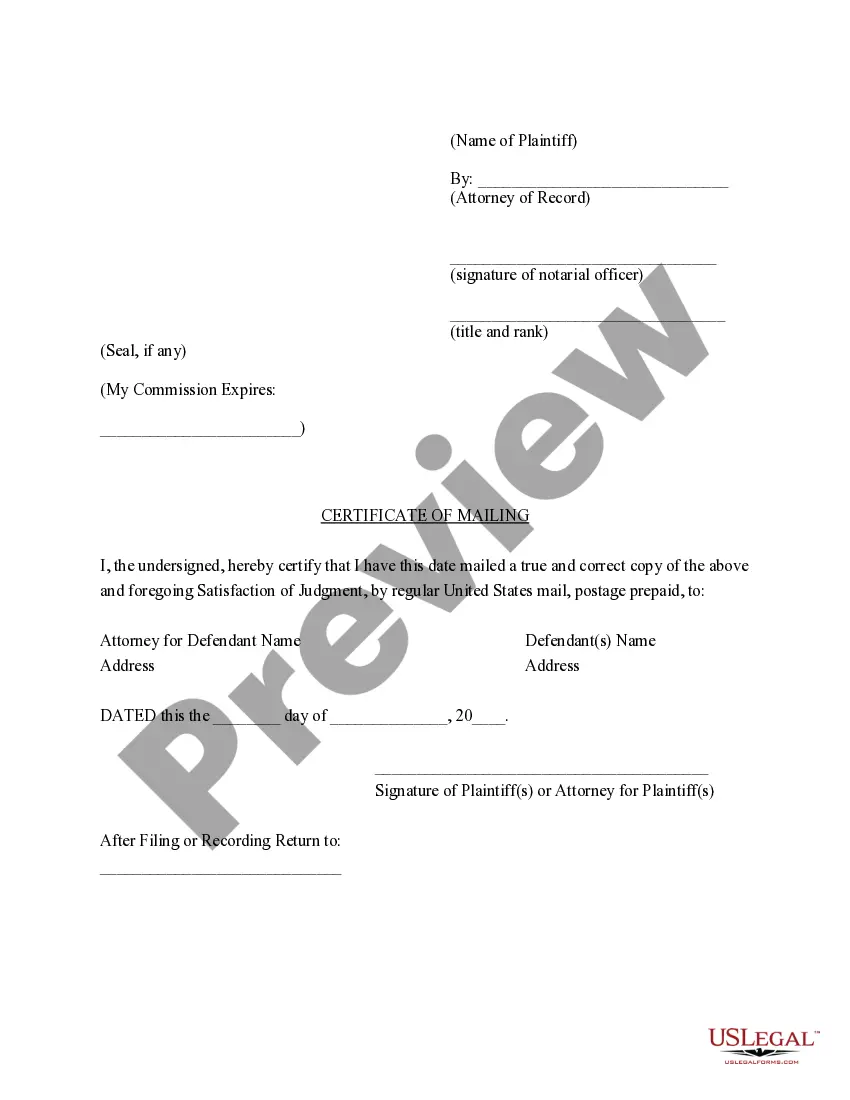

- Certificate of mailing to confirm that the form was sent to the defendant or their attorney.

When to use this form

This form should be used when a judgment creditor (the plaintiff) has received full payment from the debtor (the defendant) for a court-ordered judgment. It is essential to use this form to confirm that the debt is settled, which can help prevent any future disputes regarding the judgment.

Intended users of this form

- Judgment creditors who have received full payment of a judgment.

- Attorneys representing judgment creditors seeking to acknowledge satisfaction of the judgment.

- Corporations that have had a judgment paid in full and need to formally acknowledge this.

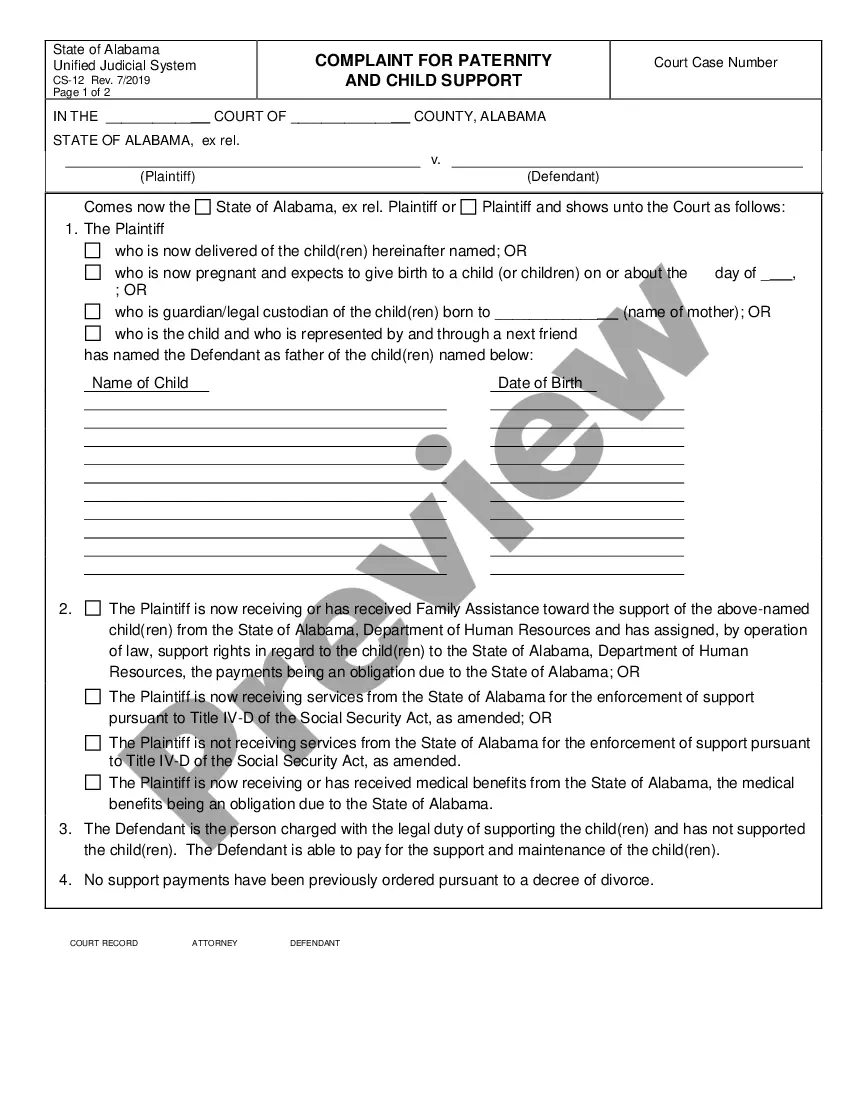

Completing this form step by step

- Identify the court and county where the judgment was issued.

- Fill in the cause number and details of the judgment.

- Acknowledge that the judgment has been paid in full, including all fees and interest.

- Sign the form as the plaintiff or have an attorney sign on your behalf.

- Ensure notarization is completed as required before submitting the form.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to include all required signatures, especially if an attorney is involved.

- Not providing the correct court information or cause number.

- Omitting the notary acknowledgment if required.

- Not mailing a copy to the defendant or their attorney as confirmation.

Benefits of using this form online

- Conveniently download and complete the form from home.

- Forms are drafted by licensed attorneys, ensuring compliance with legal standards.

- Easy access to edits and updates as necessary before finalizing the document.

- Save time by bypassing traditional legal office visits.

Summary of main points

- The Satisfaction of Judgment form is essential for confirming that a judgment has been paid.

- Accurate completion and notarization of the form are critical for legal validity.

- This document plays a vital role in preventing future disputes regarding the judgment.

Form popularity

FAQ

In Washington, D.C., the statute of limitations on judgments generally lasts for 12 years. This time frame indicates how long a creditor can enforce a judgment through legal means, which is crucial when dealing with the District of Columbia Satisfaction of Judgment. After this period, creditors may lose the ability to collect on their judgments. If you need to ensure compliance with this statute or require forms for judgment collection, USLegalForms can provide the necessary tools.

Yes, D.C. does have a long arm statute, which allows it to exert jurisdiction over individuals or entities outside its borders under certain conditions. This statute is essential for cases involving the District of Columbia Satisfaction of Judgment, as it helps establish whether a court can enforce a judgment against someone who resides elsewhere. Knowing how the long arm statute works can significantly impact your legal strategy. For more information and necessary legal forms, visit USLegalForms for tailored support.

Section 12 309 of the DC Code details the limitations regarding the enforcement of judgments in Washington, D.C. Specifically, it establishes the time frame within which a judgment must be enforced, which is critical in the context of the District of Columbia Satisfaction of Judgment. Understanding this section helps parties know their rights and obligations after a judgment is issued. If you find yourself needing to navigate these regulations, USLegalForms offers helpful resources and templates.

DC Code 12 310 pertains to the process of confirming judgments in the District of Columbia. It outlines the steps required to ensure that a judgment has been satisfied, which means fulfilling the terms of the judgment. This code plays a crucial role in the field of District of Columbia Satisfaction of Judgment, providing clarity to both creditors and debtors about their responsibilities. If you need assistance understanding how this code affects your situation, consider using USLegalForms for easy access to forms and guidance.

To collect a judgment in DC, start with locating the debtor's assets, such as wages or bank accounts. You may file for enforcement actions based on the District of Columbia Satisfaction of Judgment, which includes garnishment or levies. Persistence is key, and utilizing tools from platforms like US Legal Forms can offer the support you need as you pursue collection.

In the District of Columbia, a judgment typically remains valid for 12 years. However, it can be renewed if necessary. It's crucial to keep track of this timeline to ensure that you can enforce the District of Columbia Satisfaction of Judgment within its validity period. Resources like US Legal Forms can help you manage deadlines and ensure compliance with renewal processes.

To collect on a judgment in DC, you must first determine the debtor's assets. You can use legal mechanisms such as wage garnishment or bank levies to enforce your claim. It’s essential to follow the rules related to the District of Columbia Satisfaction of Judgment to ensure your actions are legally sound. US Legal Forms offers detailed templates to assist you through each step of the collection process.

Filing an acknowledgment of satisfaction of judgment involves completing specific court forms and submitting them to the clerk's office. You'll need proof of payment or an agreement with the creditor to accompany the forms. Using platforms like UsLegalForms can simplify this process, providing you with the necessary documents to efficiently handle your District of Columbia Satisfaction of Judgment.

To remove a satisfied judgment from your credit report, you must first ensure that the creditor has filed a satisfaction of judgment in the court. After this, you may need to dispute the judgment with credit reporting agencies if it still appears on your report. Taking these steps will aid you in clearing your record and stabilizing your credit standing.

A judgment can significantly impact your credit score and make it harder to secure loans or credit. Typically, a judgment stays on your credit report for seven years, signaling to lenders that you have not met your financial obligations. Addressing the judgment through a District of Columbia Satisfaction of Judgment can help repair your credit over time.