Connecticut Afidavit of Debt

Description

Definition and meaning

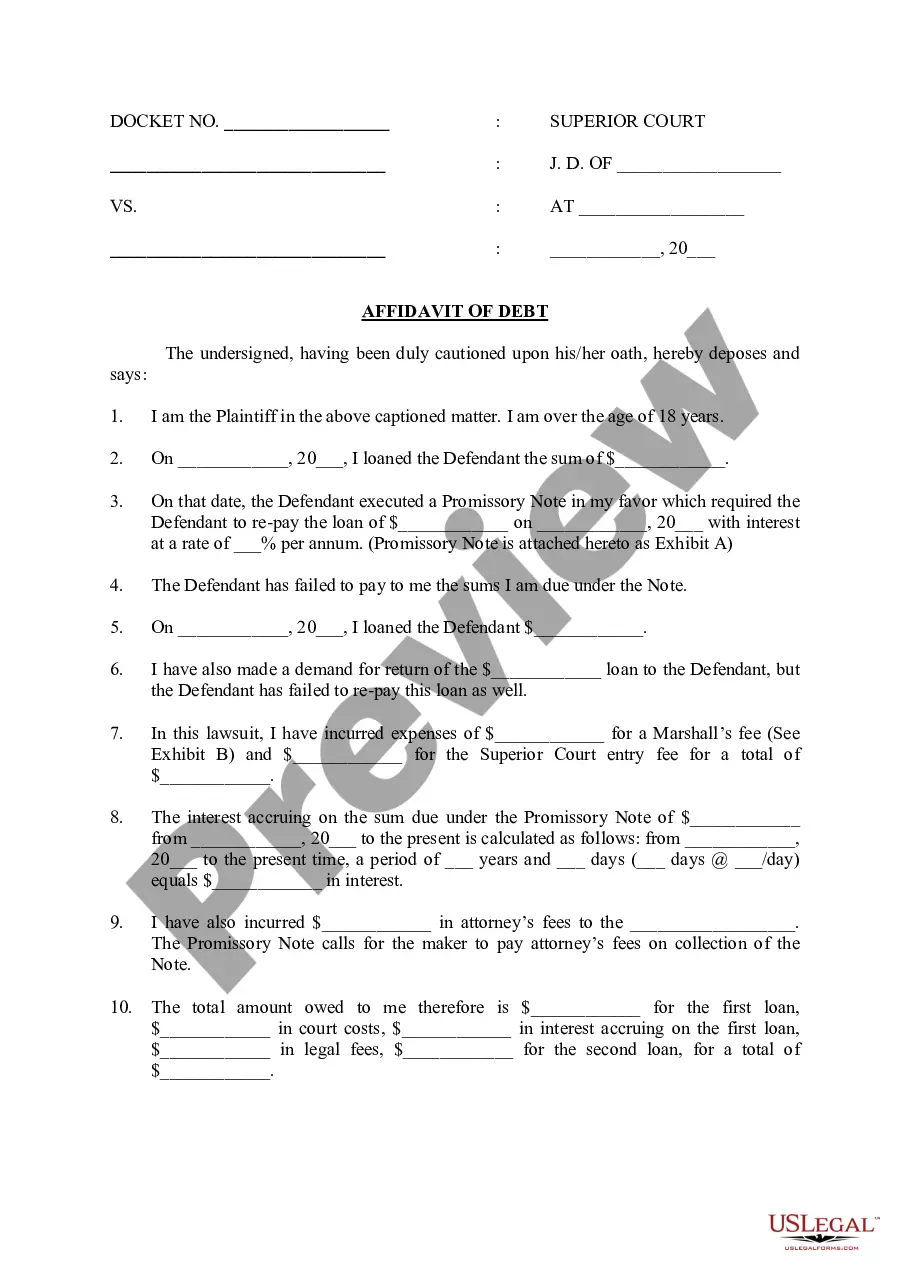

The Connecticut Affidavit of Debt is a legal document that certifies the amount of money owed by a defendant to a plaintiff. This affidavit is typically used in civil litigation cases where a creditor seeks to establish the validity of a debt in court.

How to complete a form

Completing the Connecticut Affidavit of Debt involves several key steps:

- Fill in the header with the docket number, court name, and case information.

- Provide personal information about the plaintiff and defendant.

- Detail the specifics of the loans, including amounts and repayment terms.

- Include any associated costs, such as court fees and attorney fees, to substantiate the total amount owed.

- Sign the affidavit in front of a notary public.

Who should use this form

The Connecticut Affidavit of Debt should be used by any individual or entity acting as a plaintiff in a legal case involving debt recovery. This includes creditors seeking to prove a debtor's unpaid loans in court.

Legal use and context

This affidavit serves as legal evidence in civil proceedings, demonstrating a creditor's claim against a debtor. It is critical for creditors who need to establish their right to collect debts and may be used in conjunction with other legal documents in a lawsuit.

Key components of the form

The Connecticut Affidavit of Debt includes essential components such as:

- Identification of the parties involved (plaintiff and defendant).

- Details about the loans provided, including principal amounts and interest rates.

- A summary of attempts made to recover the debt.

- Breakdown of incurred costs related to the collection of the debt.

Common mistakes to avoid when using this form

Users should be aware of common pitfalls that can invalidate their affidavit:

- Not including all relevant loan details and amounts.

- Failing to sign and date the affidavit in front of a notary.

- Providing unclear or incomplete information about incurred costs.

- Omitting supporting documents, such as promissory notes.

What to expect during notarization or witnessing

During the notarization process:

- The notary will confirm the identity of the signatory.

- They will witness the signing of the affidavit.

- The notary will apply their seal and sign the document to validate it.

This process ensures that the affidavit holds legal weight in court.

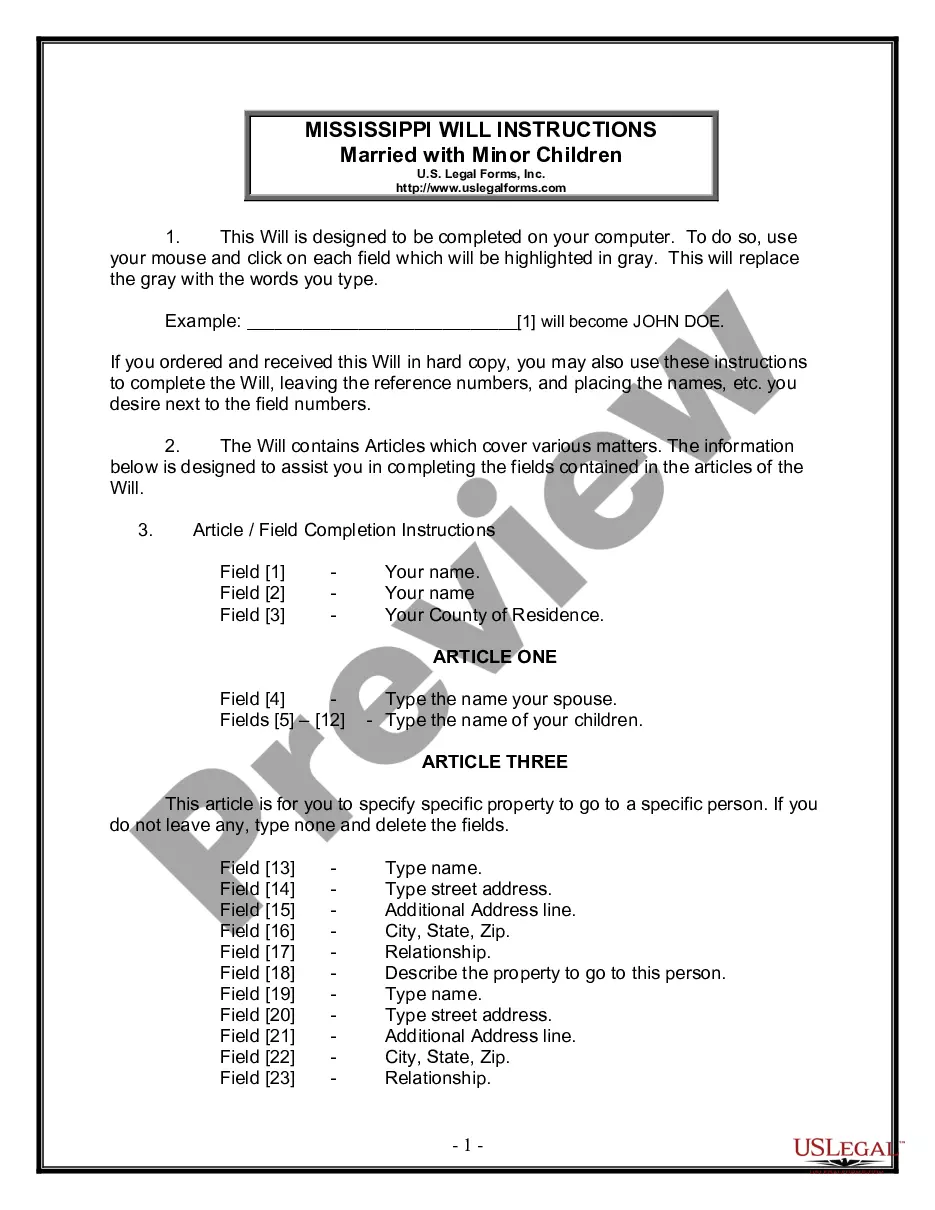

How to fill out Connecticut Afidavit Of Debt?

Utilize US Legal Forms to obtain a printable Connecticut Affidavit of Debt.

Our court-recognized forms are crafted and frequently refreshed by expert attorneys.

Ours is the most comprehensive Forms directory online and provides reasonably priced and precise templates for clients, lawyers, and small to medium-sized businesses.

Select Buy Now if it’s the document you need. Create your account and pay via PayPal or by card|credit card. Download the form to your device and feel free to use it multiple times. Utilize the Search field if you wish to find another document template. US Legal Forms provides a wide array of legal and tax templates and packages for business and personal use, including Connecticut Affidavit of Debt. Over three million users have effectively used our service. Choose your subscription plan and obtain high-quality documents within a few clicks.

- The templates are organized into state-specific categories, and some may be previewed prior to downloading.

- To download samples, users must possess a subscription and Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For users without a subscription, follow the suggestions below to easily locate and download Connecticut Affidavit of Debt.

- Verify that you have the correct template corresponding to the state it's required in.

- Examine the form by reading the description and utilizing the Preview feature.

Form popularity

FAQ

Once a Connecticut affidavit of debt is filed, several key actions may follow. The court reviews the affidavit, and if accepted, it can support the debt collector's case for recovery. The debtor may receive a notice, which initiates further legal proceedings, such as a judgment for the debt. You can stay informed and prepared by leveraging resources from US Legal Forms, which provide essential guidance throughout each step.

An affidavit is a written statement made under oath, serving as a powerful legal tool. In the context of debt collection, the Connecticut affidavit of debt functions to formally assert the amount owed and the terms of the debt. It provides a clear record for courts and parties involved, ensuring that all documentation aligns with legal requirements. Utilizing services like US Legal Forms can guide you in preparing an effective affidavit that fulfills its essential purpose.

In Connecticut, debt collectors must provide specific proof when pursuing a claim. They typically need to show an affidavit of debt that details the amount owed and the basis for the debt. This Connecticut affidavit of debt serves as a formal declaration, establishing the legal obligation of the debtor. By using a reliable platform like US Legal Forms, you can easily create an affidavit that meets all necessary legal standards.

Section 10-35 of the Connecticut Practice Book outlines the rules regarding pleadings and motions, specifically focusing on how parties can process and submit documents in court. This section is crucial for anyone navigating the legal landscape, especially in cases involving a Connecticut Affidavit of Debt. Being familiar with this section can help you adhere to regulatory requirements and ensure your documents are processed efficiently.

An affidavit of Acknowledgement of Debt is a sworn document in which a debtor confirms their obligation to repay a specific debt. This affidavit serves as valuable evidence in legal proceedings, including those involving a Connecticut Affidavit of Debt. By creating this document, both parties can clarify terms and expectations, promoting transparency and understanding.

A certificate of closed pleadings signifies that both parties have finished submitting their pleadings, marking an official endpoint for amendments. This document is critical as it helps the court streamline case management. In the context of a Connecticut Affidavit of Debt, having your pleadings closed allows you to move forward, focusing on resolution rather than procedural delays.

You should file a certificate of closed pleadings in Connecticut once all necessary documents and motions have been entered into the court record. This filing often occurs shortly before trial preparations begin, signaling that your case is ready for the next stage. By filing this certificate, you affirm your readiness in relation to your Connecticut Affidavit of Debt, which can impact the efficiency of your proceedings.

Closed pleadings indicate that both parties have submitted their claims and defenses, and no further amendments are allowed without court permission. This status is important, as it establishes the official scope of the case. Understanding closed pleadings can help you navigate your Connecticut Affidavit of Debt more effectively. Ensure you complete all documentation accurately before this point.

To serve a small claims writ and notice of suit in Connecticut, you must deliver the documents to the defendant in person or send them via certified mail. Using a professional process server can ensure proper delivery. After serving the documents, file the proof of service with the court. Following these steps correctly is crucial to your small claims case and maintaining the integrity of your Connecticut Affidavit of Debt.

Avoid writing any statements that are speculative, irrelevant, or opinion-based in your affidavit. The Connecticut Affidavit of Debt should focus solely on facts that are directly related to your financial situation. Refrain from including hearsay or second-hand information, as this can undermine your affidavit's validity. Always stick to the facts to maintain the strength of your claims and the integrity of the document.