California Satisfaction - Reconveyance of Deed of Trust by Individual

What is this form?

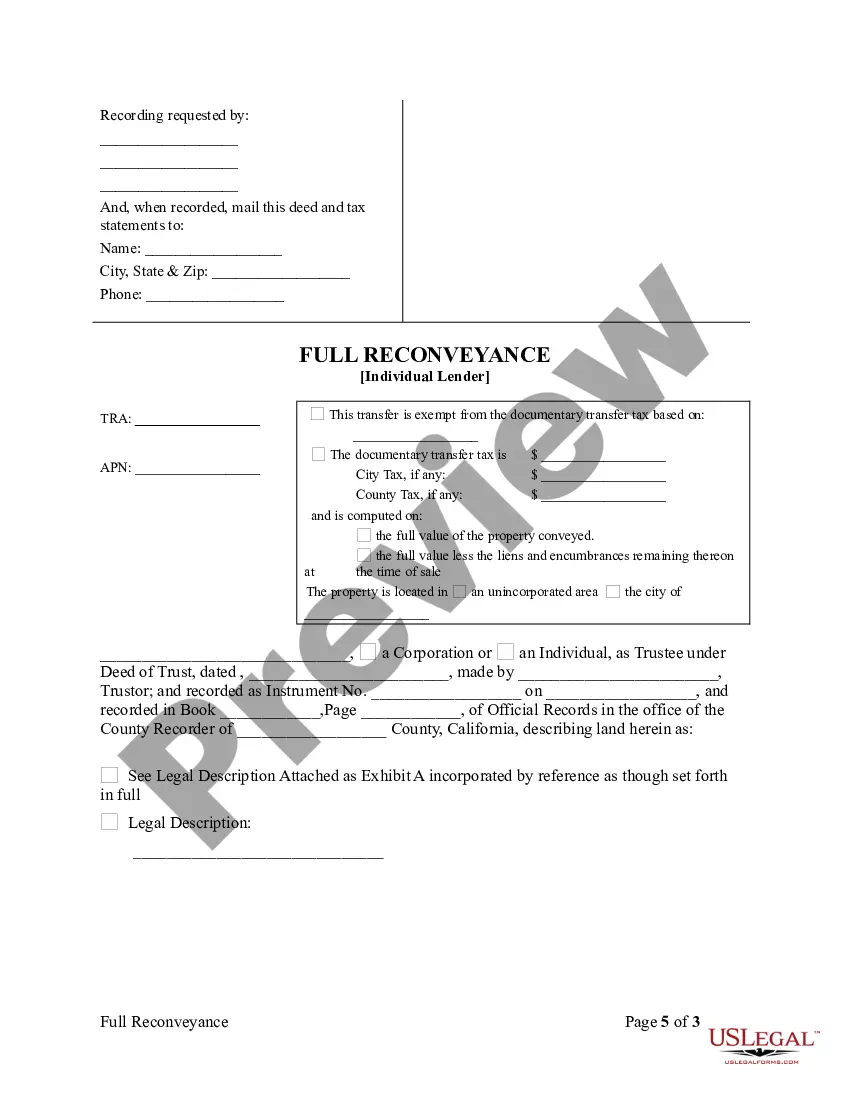

The Satisfaction - Reconveyance of Deed of Trust by Individual is a legal document used to formally release a mortgage or deed of trust in California. This form is crucial in ensuring that the property described in the deed is released from the mortgage obligation once the debt is satisfied. Unlike a standard release form, this document explicitly indicates that the mortgage has been paid off, restoring clear title to the property owner.

Main sections of this form

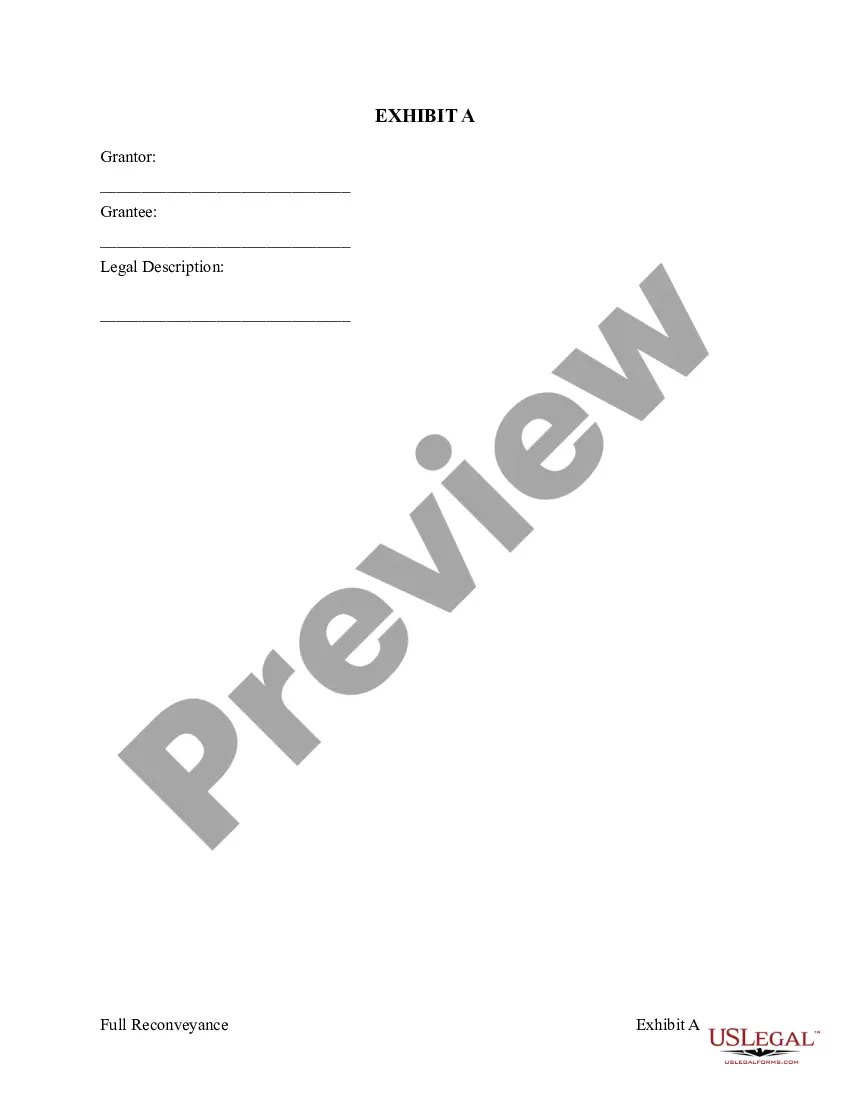

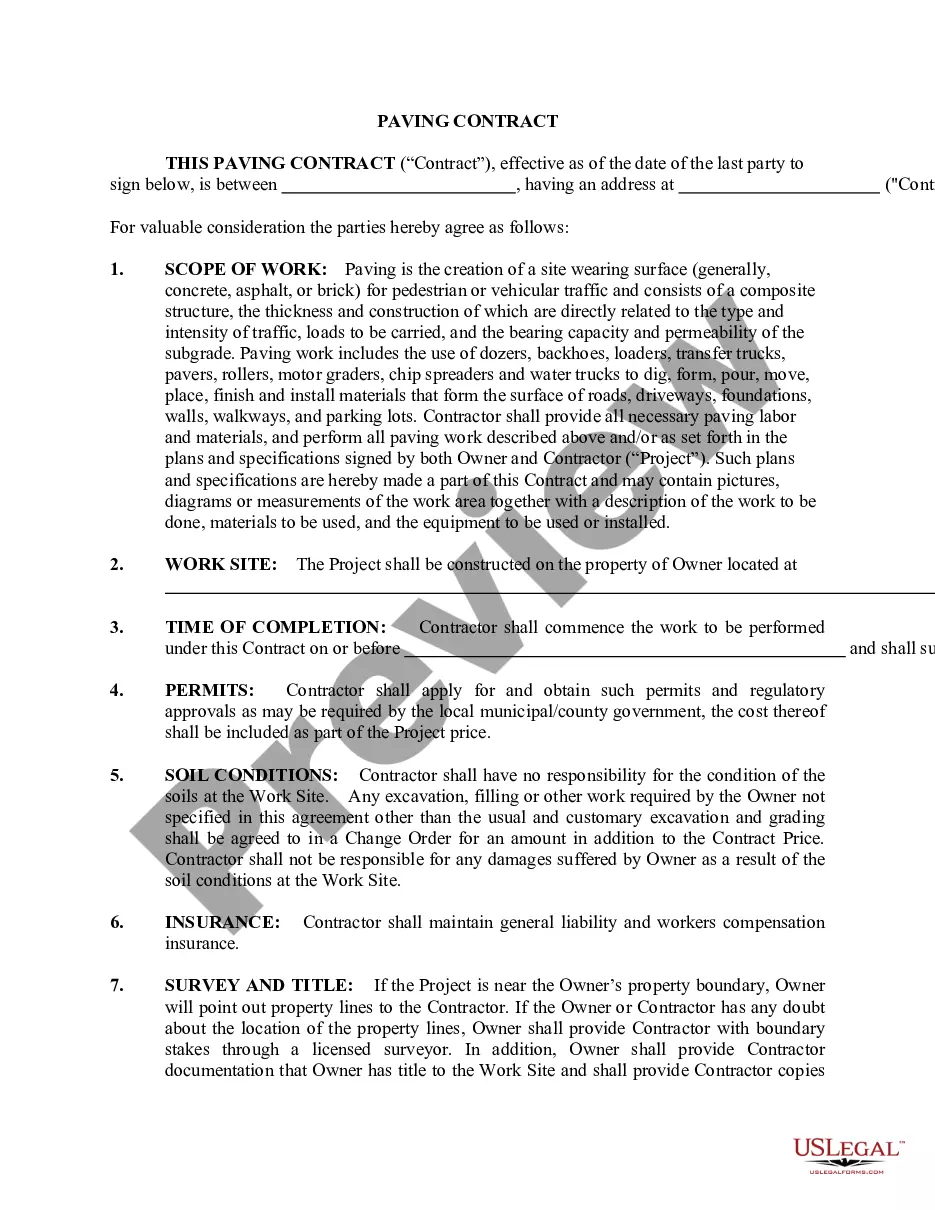

- Identification of the property being reconveyed.

- Details of the original mortgage or deed of trust, including dates and amounts.

- Statements affirming that the debt has been satisfied.

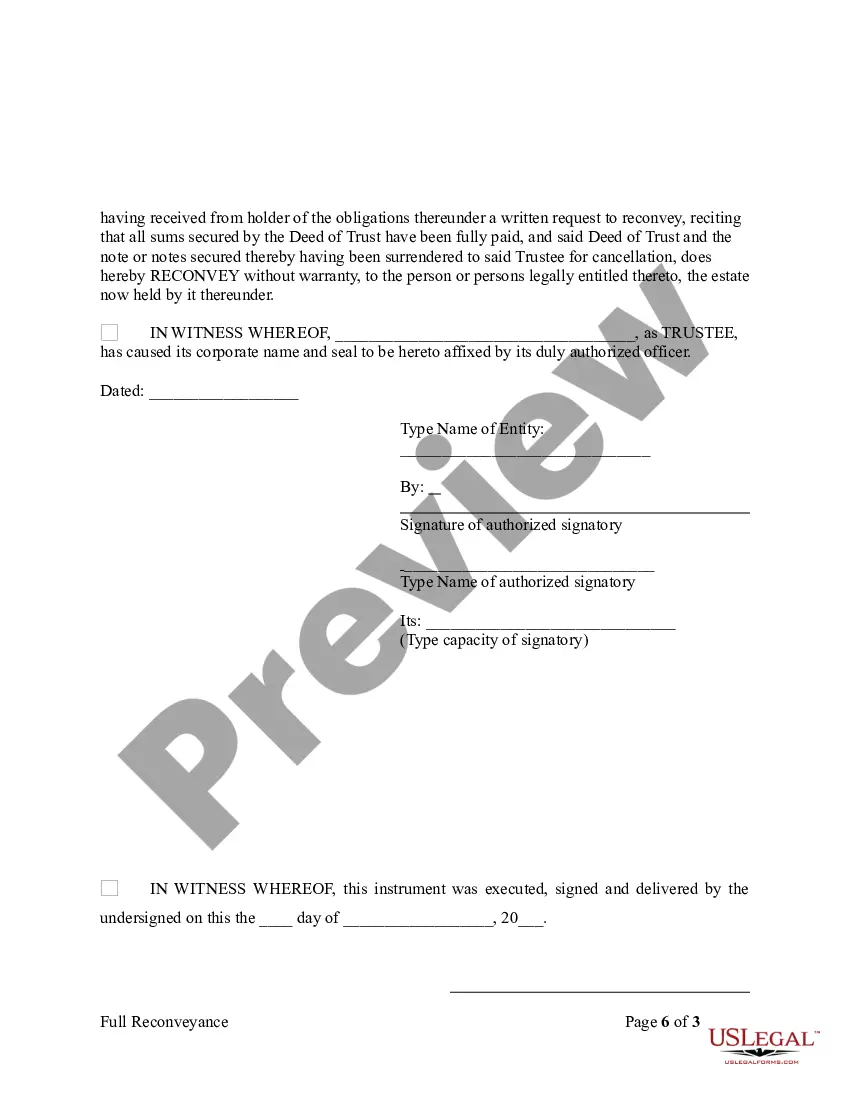

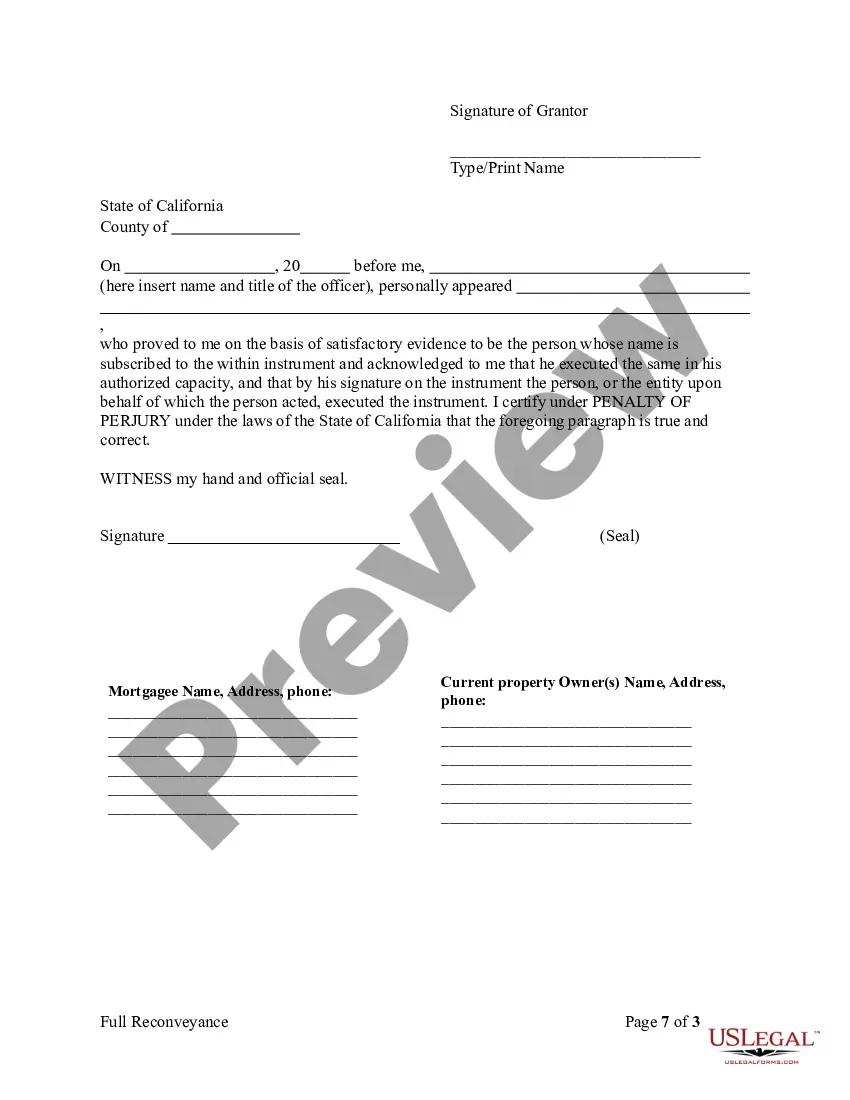

- Signature of the individual reconveying the deed in front of a notary public.

- Space to indicate any exemption from transfer tax, if applicable.

When to use this document

This form should be used when a borrower has fully repaid their mortgage or deed of trust. It is typically required when property ownership is being transferred or when the owner is seeking to clear their title after satisfying their loan obligation. Using this form helps ensure that the mortgage lien is properly released from the property records.

Who needs this form

- Property owners who have completely paid off their mortgage.

- Individuals acting on behalf of the borrower, such as trustees or legal representatives.

- Those seeking to clear a title in preparation for a sale or refinance.

How to prepare this document

- Identify and enter the parties involved in the deed.

- Clearly specify the property address and any relevant identification numbers.

- State the date when the mortgage was paid off.

- Sign the form in front of a notary public to witness the signature.

- Submit the completed form to the appropriate local recorder's office.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to notarize the document, making it invalid.

- Omitting necessary property details, which may lead to confusion or rejection.

- Not indicating the exemption from transfer tax if applicable.

- Signing without the presence of a notary public.

Benefits of using this form online

- Convenient access to the form anytime, without the need to visit a physical office.

- Editable fields allow for easy customization with necessary information.

- Reliable templates that comply with California state regulations.

- Easy download ensures you have immediate access to your documents.

Looking for another form?

Form popularity

FAQ

The time it takes to process a deed of reconveyance can vary, but it typically takes a few weeks, depending on the lender and the specific circumstances involved. Once the deed is signed and submitted to the county recorder, it will be officially recorded in that timeframe. For efficient handling of this process related to California Satisfaction - Reconveyance of Deed of Trust by Individual, US Legal Forms can be a valuable resource.

To reconvey a deed of trust in California, the lender must prepare a deed of reconveyance and file it with the county recorder. After ensuring all requirements are met and obligations fulfilled, they will sign the document to finalize the process. Using tools and resources from US Legal Forms can provide clear guidance on successfully navigating the California Satisfaction - Reconveyance of Deed of Trust by Individual steps.

A deed of trust may be considered invalid in California if it lacks essential elements, such as the signatures of the parties involved or proper acknowledgment. Additionally, failing to comply with California's recording requirements can render the deed unenforceable. Knowledge about these elements is vital for maintaining the integrity of the reconveyance process in the context of California Satisfaction - Reconveyance of Deed of Trust by Individual.

To transfer property from a trust to an individual in California, you typically need to execute a deed signing over the property to the recipient. The trustee must properly document this transfer to ensure the change is legally recognized. Engaging with platforms like US Legal Forms can guide you through the requirements for a smooth and compliant process regarding the California Satisfaction - Reconveyance of Deed of Trust by Individual.

The request for reconveyance must be signed by the lender or the authorized representative who holds the deed of trust. This is crucial because their signature signifies that the obligation has been fulfilled. If you require assistance with this, US Legal Forms provides resources for individuals navigating the California Satisfaction - Reconveyance of Deed of Trust by Individual process.

Typically, a deed of reconveyance is prepared by the lender or a designated agent. In many cases, individuals may also choose to hire a legal professional to ensure the accuracy of the document. Utilizing reliable services like US Legal Forms can help streamline this process. This is important to maintain the California Satisfaction - Reconveyance of Deed of Trust by Individual accurately.

To obtain a copy of your deed of trust in California, start by contacting the county recorder's office where the property is located. You can often find this information online, or you may need to visit the office in person. Once you have the necessary details, such as the property address and names associated with the deed, the office can help you access the document. Remember, having a copy of your deed is crucial for understanding your California Satisfaction - Reconveyance of Deed of Trust by Individual.

Transferring property out of an irrevocable trust can be complex due to the trust’s restrictions. Generally, the trustee has limited discretion, so it's important to review the trust terms. If necessary, you may consider a California Satisfaction - Reconveyance of Deed of Trust by Individual to properly address any debts associated with the property. For a smooth process, working with legal experts will provide needed guidance and compliance.

Transferring property out of a trust before death in California involves a few steps. First, the trustee must execute a deed that formally conveys the property to the desired recipient. To maintain legal clarity, ensure the California Satisfaction - Reconveyance of Deed of Trust by Individual is completed if there are existing debts. It’s advisable to consult with a legal professional to address any potential tax implications and ensure compliance with California trust laws.

In California, a trustee can sell trust property to themselves, but certain conditions must be met. Transparency is essential; the transaction should adhere to all legal requirements. Additionally, if the deed of trust has not been satisfied, it’s crucial to complete the California Satisfaction - Reconveyance of Deed of Trust by Individual process first. Always consider seeking legal advice to ensure compliance with California laws.