California Affidavit- Community Property with Right of Surviorship

Description

Definition and meaning

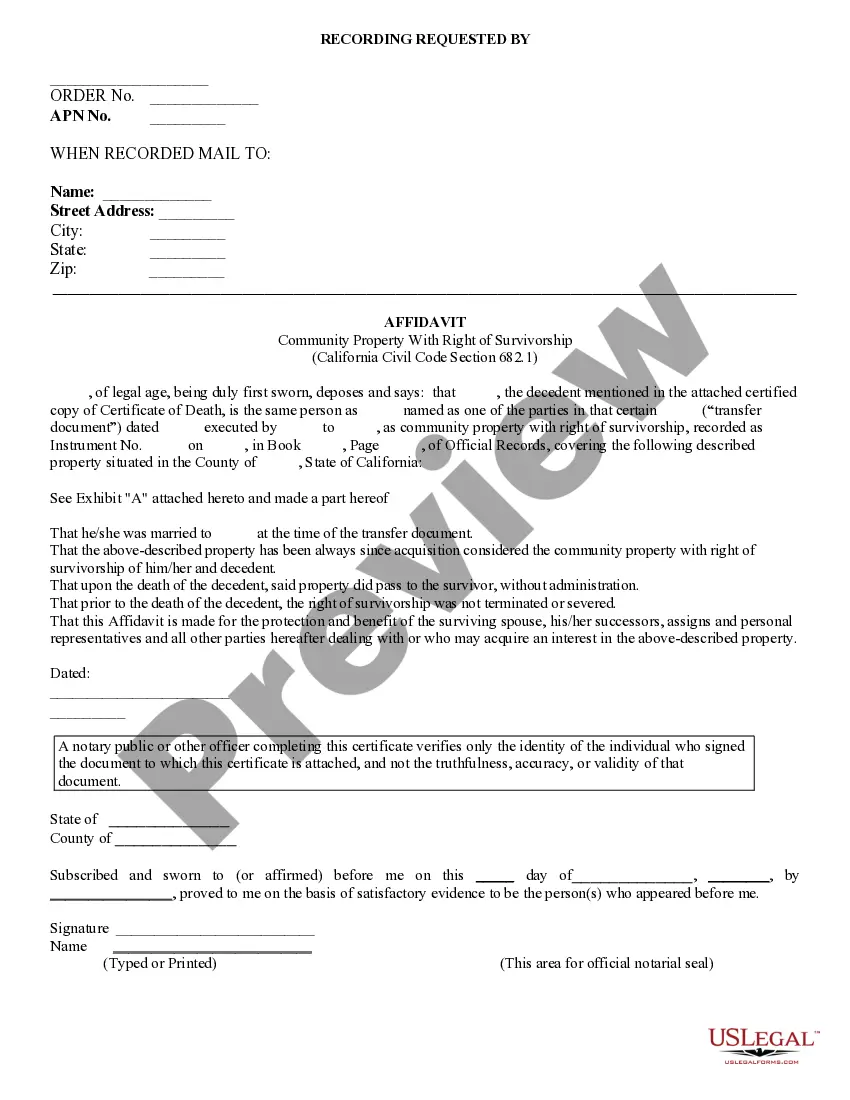

The California Affidavit - Community Property with Right of Survivorship is a legal document that confirms the ownership of property by a surviving spouse after the death of their partner. This affidavit verifies that the deceased individual was co-owner of property that is classified as community property and ensures that the property transfers to the surviving partner without undergoing probate.

How to complete a form

To complete the California Affidavit - Community Property with Right of Survivorship, follow these steps:

- Fill in the names of the decedent and the surviving spouse.

- Provide details about the property, including its legal description and location.

- Include the date and the instrument number of the transfer document.

- Sign the affidavit in front of a notary public who will verify your identity.

Ensure all information is accurate to prevent complications during the transfer process.

Who should use this form

This affidavit is essential for individuals who were married and shared property classified as community property. It is particularly relevant for surviving spouses who need to establish their ownership rights in the property after the death of their partner. If you are the surviving spouse and your deceased partner had a right of survivorship to the property, this form is necessary to confirm that right and facilitate the transfer of property ownership.

Legal use and context

The California Affidavit - Community Property with Right of Survivorship is used to simplify the transfer of property ownership following the death of a spouse. Under California law, community property automatically passes to the surviving spouse if there is a right of survivorship stated in the title. This affidavit serves as legal proof of that ownership, allowing the survivor to avoid the lengthy probate process.

Key components of the form

Essential components of the California Affidavit include:

- The names and details of both the decedent and the survivor.

- A description of the property involved.

- The legal acknowledgment of the relationship between the parties involved.

- Notary verification of the signatures and identities of the individuals signing the affidavit.

Each component provides necessary assurance of the transfer’s legitimacy.

What documents you may need alongside this one

When filing this affidavit, you may need to present several supporting documents, including:

- A certified copy of the decedent's death certificate.

- Original property deed or title document stating the property ownership.

- Any prior agreements or documents that establish the right of survivorship.

Having these documents prepared will streamline the process of retrieving and completing the affidavit.

What to expect during notarization or witnessing

During the notarization process of the California Affidavit, the notary public will require you to:

- Present a valid form of identification to confirm your identity.

- Sign the affidavit in their presence.

- Provide necessary information about the document being notarized.

The notary will then complete their section, endorsing your signature with an official seal, which will validate the form.

How to fill out California Affidavit- Community Property With Right Of Surviorship?

Drafting legal documents can be a significant source of anxiety unless you possess ready-to-use editable templates. With the US Legal Forms online repository of official documents, you can trust the forms you select, as they all comply with federal and state regulations and are validated by our experts.

Acquiring your California Affidavit- Community Property with Right of Survivorship from our service is as straightforward as 1-2-3. Existing users with a valid subscription just need to Log In and hit the Download button once they locate the correct template. Afterwards, if necessary, users can access the same document from the My documents section of their profile.

Haven't you explored US Legal Forms yet? Register for our service today to quickly and effortlessly obtain any official document whenever you need it, and keep your records organized!

- Document compliance assessment: It is crucial to thoroughly examine the details of the form you require and confirm that it meets your specifications and adheres to your state's legal standards. Reviewing your document and checking its general overview will assist you in achieving this.

- Alternative search (optional): If there are any discrepancies, navigate through the library using the Search tab at the top of the page until you discover an appropriate form, and select Buy Now when you identify the one you desire.

- Account setup and document purchase: Register for an account with US Legal Forms. After verifying your account, Log In and choose your ideal subscription plan. Proceed with the payment to continue (options include PayPal and credit cards).

- Template download and subsequent use: Choose the file format for your California Affidavit- Community Property with Right of Survivorship and click Download to store it on your device. You can print it to complete your documents manually or utilize a versatile online editor to create an electronic version more swiftly and effectively.

Form popularity

FAQ

One downside of community property with rights of survivorship is the irrevocable nature of this arrangement. Once established, it cannot be easily undone without mutual consent from both spouses. This can limit flexibility in how you choose to manage your assets over time. Understanding these implications is crucial, and utilizing tools like a California Affidavit- Community Property with Right of Survivorship can be beneficial for informed decision-making.

While community property with rights of survivorship offers many advantages, it also has disadvantages. One significant drawback is that it may expose the surviving spouse to creditors of the deceased spouse, impacting their financial security. Additionally, if the surviving spouse wishes to sell their portion, it can require the consent of the estate if it’s not managed correctly. A California Affidavit- Community Property with Right of Survivorship can help clarify these potential risks.

To file a Right of survivorship in California, you must complete a California Affidavit- Community Property with Right of Survivorship form. This affidavit requires details about the property and the ownership, and it must be signed by both spouses. Once completed, you should file this document with the county recorder's office where the property is located. By doing this, you ensure that the right of survivorship is legally recognized and enforceable.

Yes, the right of survivorship typically overrides a will in California. When property is held as community property with rights of survivorship, it transfers directly to the surviving spouse upon the other spouse's death, regardless of any directives stated in a will. This feature is important to consider when creating an estate plan, as it changes how property is passed on. Consulting with a knowledgeable advisor about a California Affidavit- Community Property with Right of Survivorship can clarify these aspects.

Yes, California law does allow community property with rights of survivorship. This legal arrangement simplifies the transfer of property upon one spouse's death, ensuring the surviving spouse automatically inherits the deceased spouse's share. To establish this type of ownership, a California Affidavit- Community Property with Right of Survivorship must be properly executed and filed with the county. This can streamline estate planning and provide peace of mind.

An Affidavit of Death allows a surviving spouse to establish that their husband or wife has died and they are now the sole owner of any property that the couple held as co-trustors.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

California Affidavit of Surviving Spouse Information Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution.

Disadvantages of community property with a right of survivorship: If a spouse dies having willed a piece of property titled as community property with a right of survivorship to someone other than their spouse, their gift may be deemed invalid.

(Revised: 01/2021) Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.