California Notice of State Tax Lien

Description

How to fill out California Notice Of State Tax Lien?

If you're looking for precise California Notice of State Tax Lien examples, US Legal Forms is exactly what you need; find documents created and verified by state-certified attorneys.

Using US Legal Forms not only spares you from stress relating to legal documents; additionally, you save time and funds!

And there you have it. With just a few clicks, you own an editable California Notice of State Tax Lien. Once your account is set up, all future orders will be processed even more easily. If you have a US Legal Forms subscription, just Log In and click the Download button available on the form’s page. Then, when you wish to utilize this sample again, you will always be able to find it in the My documents section. Do not waste your time comparing numerous forms on different sites. Acquire accurate documents from one reliable service!

- Initiate by completing your registration process with your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the California Notice of State Tax Lien template to address your situation.

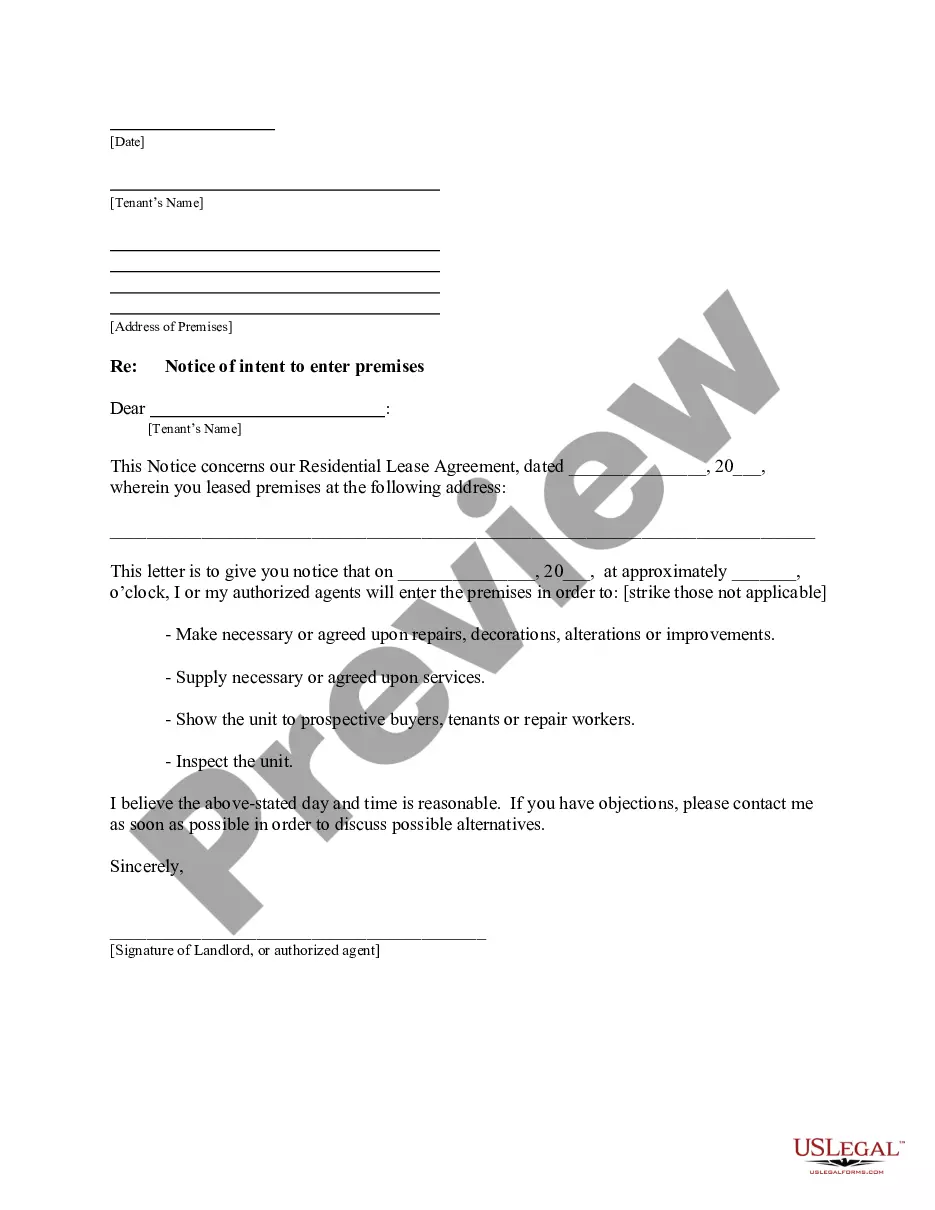

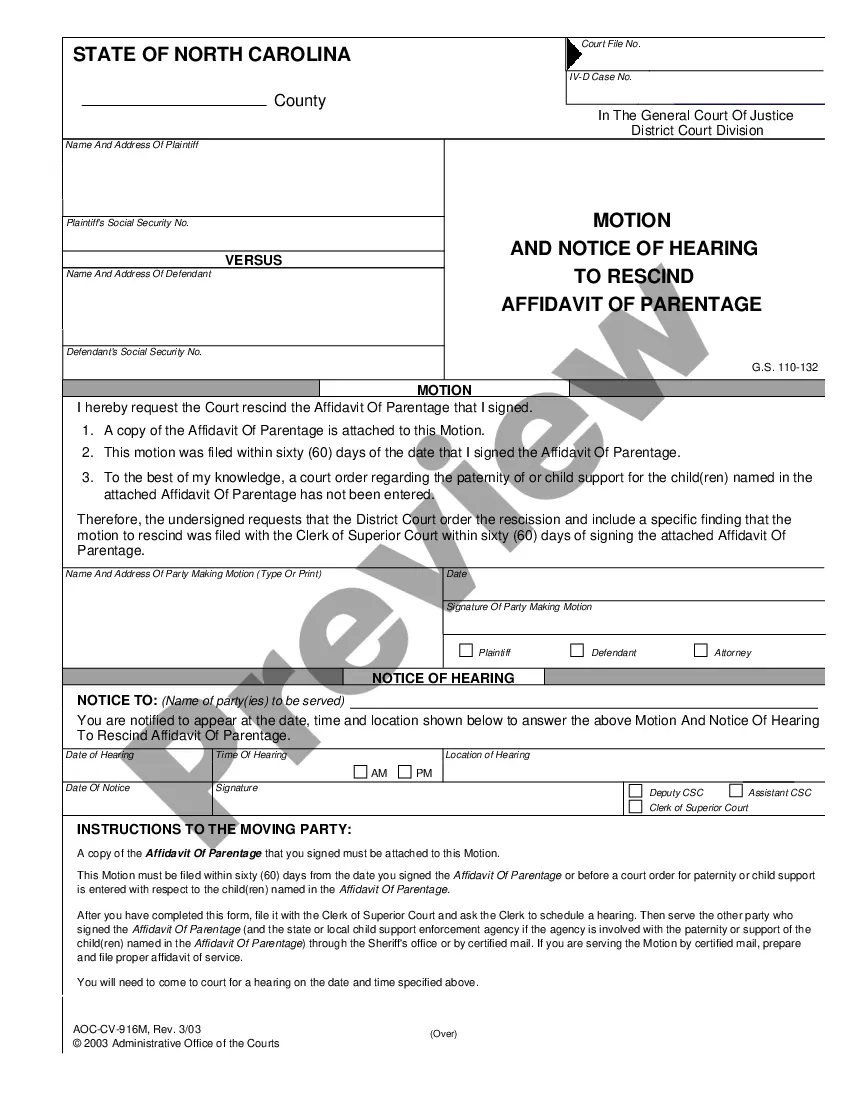

- Make use of the Preview tool or review the file details (if available) to ensure that the template is what you need.

- Verify its legality in your jurisdiction.

- Click Buy Now to place an order.

- Choose a recommended pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a convenient file format and save the document.

Form popularity

FAQ

You are typically notified of a tax lien through official documentation sent by the taxing authority, such as the California Franchise Tax Board. This notification often comes after the state has filed a California Notice of State Tax Lien against your property. Keeping your contact information updated with tax authorities can help ensure you receive timely notifications about any tax-related issues.

To find out if you have a tax lien in California, you can check with your county’s tax collector's office or search online public records. Furthermore, the state’s Franchise Tax Board maintains records of outstanding tax obligations that may lead to a lien. Services like USLegalForms can assist you in quickly obtaining the information you need about your financial standing.

To look up a tax lien in California, you can visit the local county assessor’s office or their website, where many jurisdictions post lien filings. Additionally, you can search online databases or contact a title company for comprehensive searches. Utilizing platforms like USLegalForms can simplify this process and ensure you obtain all relevant information quickly and efficiently.

Yes, in California, a lien can be placed on your home without your immediate knowledge. For example, when the state files a California Notice of State Tax Lien due to unpaid taxes, you may not be directly notified until the lien is officially recorded. It’s important to regularly check public records and stay informed about your financial obligations to avoid surprises.

Filing a California state tax amendment involves submitting Form 540X, which is specifically designed for this purpose. You will need to provide your original tax details, alongside the changes you wish to make. The California Notice of State Tax Lien might become relevant if your amended return reflects unpaid taxes. Consider utilizing platforms like uslegalforms to guide you through the amendment process smoothly.

In California, the statute of limitations for a state tax lien typically extends to 10 years. This means that the state has 10 years to collect the unpaid taxes starting from the date the California Notice of State Tax Lien is recorded. After this period, the lien may expire unless renewed, which can cause complications for both the state and taxpayers. Always stay informed about your rights concerning tax liens to avoid complications.

Investing in tax liens can be risky, including the potential for significant losses. Many investors overlook the complexities involved, such as the possibility of property redemption by the original owner. Additionally, managing tax liens often requires understanding local laws, including the California Notice of State Tax Lien. Ensure you conduct thorough research and consult with experts to navigate these challenges effectively.

To get a lien removed in California, you need to satisfy the tax obligation that caused the lien. After full payment, you can request a release by submitting the appropriate paperwork to the state tax agency. This process ensures your property isn’t encumbered by the lien any longer. Using services like US Legal Forms can simplify the documentation process and enhance your understanding of the requirements.

Removing a California state tax lien may involve paying the debt or establishing a payment arrangement with the state. Once the debt is settled, you can request a Certificate of Release of lien. It is essential to follow up properly to ensure the lien is removed from the property records. For effective strategies and templates, consider using US Legal Forms to streamline your actions.

Filling out a notice of lien requires specific details about the taxpayer and the tax liability. First, include the taxpayer's name, address, and social security number. Next, provide a brief description of the tax obligation and the date it became due. The US Legal Forms platform can assist you in obtaining the correct forms and offering detailed instructions for accurate completion.