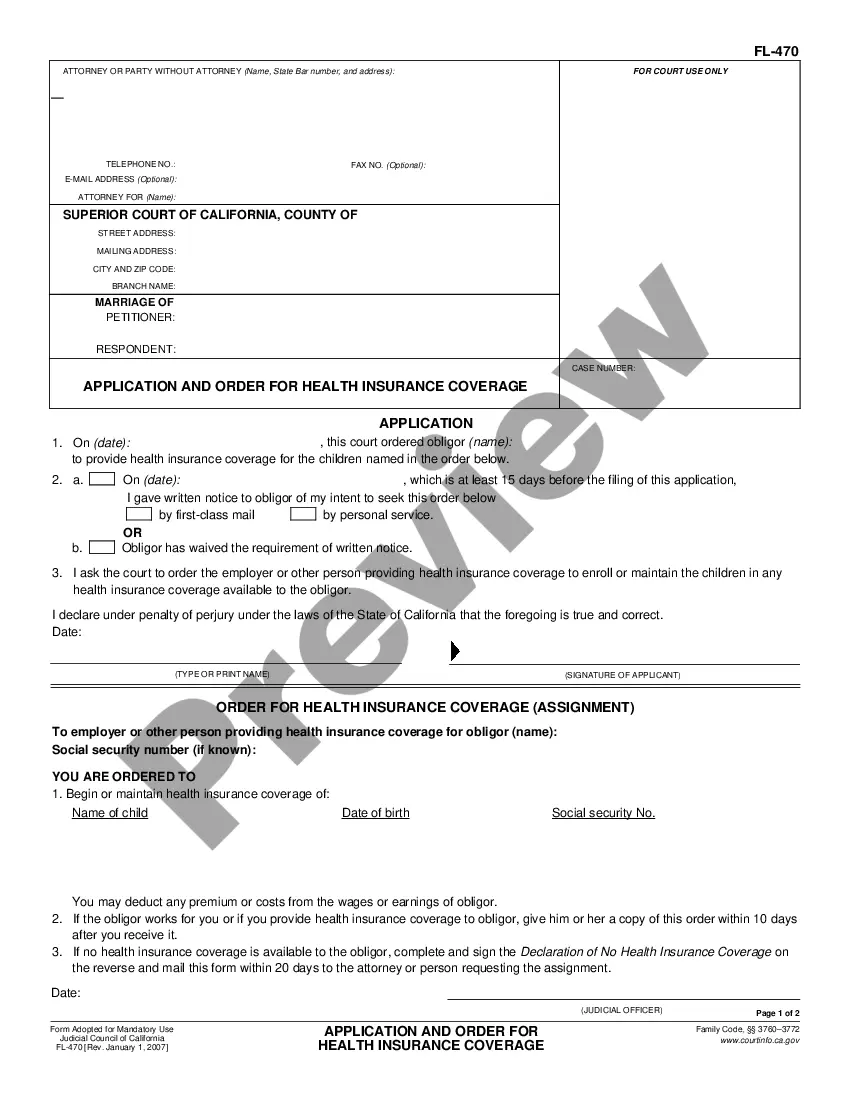

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

California Employer's Health Insurance Return

Description

How to fill out California Employer's Health Insurance Return?

If you're looking for precise California Employer's Health Insurance Return examples, US Legal Forms is precisely what you require; find documents supplied and validated by state-accredited lawyers.

Utilizing US Legal Forms not only protects you from issues related to legitimate paperwork; moreover, you save time and effort, and money!

And there you have it. In just a few simple clicks, you own an editable California Employer's Health Insurance Return. Once your account is established, all future transactions will be even smoother. With a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, whenever you need to access this template again, you will always find it in the My documents section. Don't waste your time comparing countless forms on different platforms. Purchase precise templates from a single reliable service!

- Initiate by completing your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up your account and locate the California Employer's Health Insurance Return example to address your situation.

- Utilize the Preview feature or examine the document description (if available) to ensure that the form is what you need.

- Verify its relevance in your residing state.

- Click on Buy Now to place your order.

- Select a suggested pricing plan.

- Create your account and pay with your credit card or PayPal.

Form popularity

FAQ

Even if your employer is an applicable large employer, you will only receive a Form 1095-C for that employer if you were a full-time employee for that employer for at least one month of the year or if you are enrolled in an applicable large employer's self-insured health plan, even if you are a part-time employee.

You will enter the payment amount on Form 1040 or Form 1040-A or Form 1040-EZ on the line labelled "Health care individual responsibility."

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand to verify coverage. This documentation includes: Form 1095 information forms.

Form FTB 3895, California Health Insurance Marketplace Statement, is used to report certain information to the Franchise Tax Board (FTB) about individuals who enroll in a qualified health plan through the California Health Insurance Marketplace (Marketplace).

Proving Health Insurance for Your Tax Returns. Individuals who have health insurance should receive one of three tax forms for the 2020 tax year: the Form 1095-A, Form 1095-C or Form 1095-B.You do not need to wait for the forms to file your taxes, and they do not have to be attached to your tax return.

Check the Full-year coverage box on your federal income tax form. You can find it on Form 1040 (PDF, 147 KB). If you got Form 1095-B or 1095-C, don't include it with your tax return. Save it with your other tax documents.

The insurance provider and your employer are only required to provide one Form 1095-B or Form 1095-C to the primary policyholder. If that's you, give copies to your adult children and any other people covered under your plan but file their own tax returns.

This will be shown on line 61 of your 1040 Individual Tax Return Form. The individual shared responsibility does not apply for tax year 2020. You do not need to wait for Form 1095-B to file your tax return if you already know this information. Form 1095-B is not included in your tax return.

No matter your income level, one thing is certain, you will have to report your health insurance on your 2019 taxes. Going forward, you'll have to continue to report your health insurance taxes if you live in a state with a taxable individual mandate.