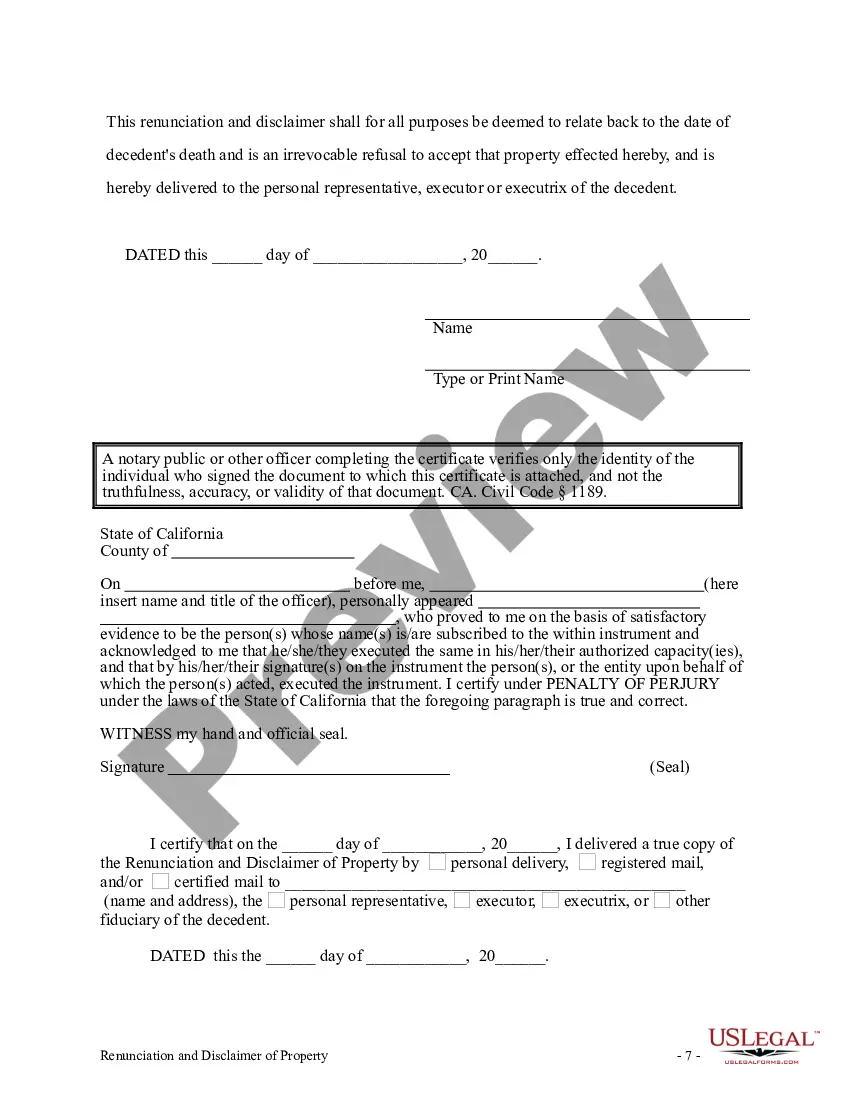

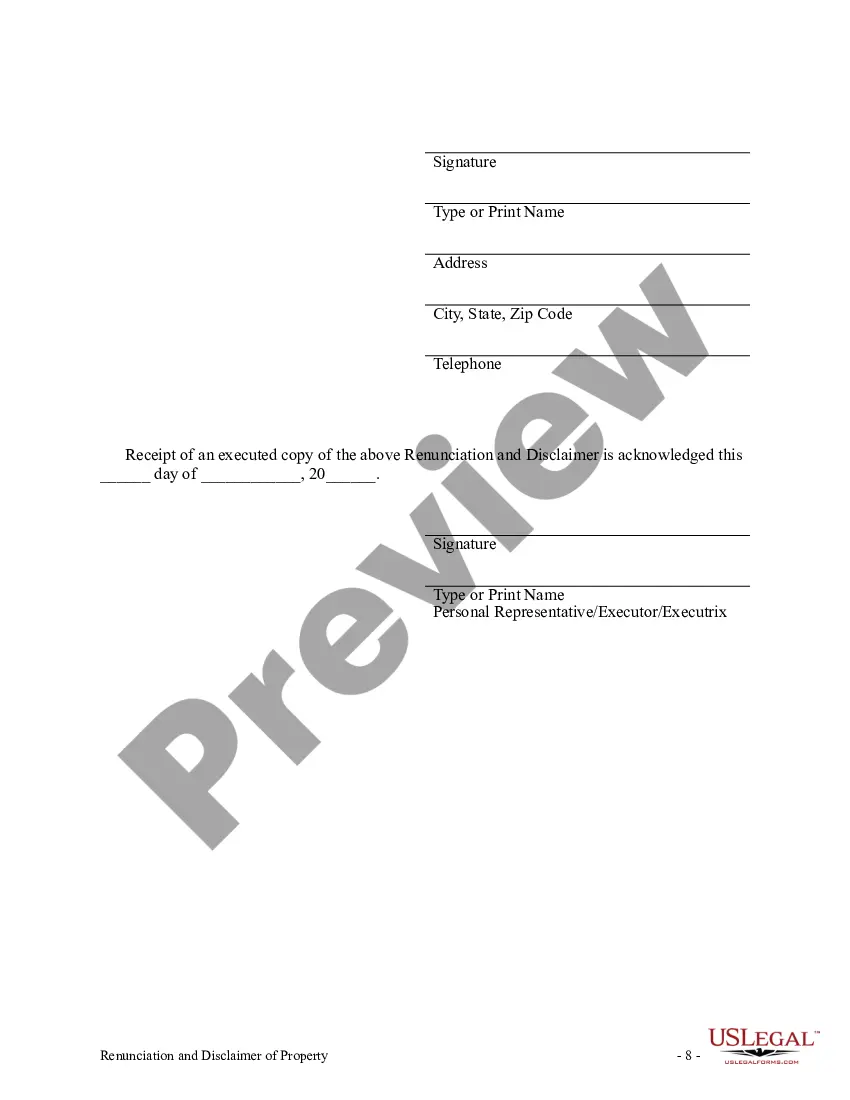

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond

Description

How to fill out California Renunciation And Disclaimer Of Individual Retirement Account, Annuity, Or Bond?

If you're looking for accurate California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond examples, US Legal Forms is precisely what you require; obtain documents created and reviewed by state-certified legal professionals.

Using US Legal Forms not only alleviates concerns regarding legal documents; you also save time, energy, and money!

And that's it. In just a few simple steps, you'll have an editable California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond. Once your account is created, future requests will be even simpler. If you possess a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, whenever you need to access this blank again, you will always be able to find it in the My documents menu. Don't waste your time browsing countless forms across various online sources. Acquire accurate copies from a single secure platform!

- Downloading, printing, and completing a professional template is much more cost-effective than hiring an attorney to do it for you.

- To begin, finalize your registration by providing your email and creating a password.

- Follow the instructions below to set up your account and access the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond template to meet your requirements.

- Use the Preview option or review the document description (if available) to ensure that the sample is what you need.

- Verify its relevance for your location.

- Click Buy Now to place an order.

- Choose a suggested pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable file format and save the document.

Form popularity

FAQ

To write a disclaimer for an inheritance, especially concerning a California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, start by clearly stating your intention to renounce the inheritance. Specify the property or account you are disclaiming and ensure your statement is in writing, properly signed, and dated. You should also meet California’s legal requirements for disclaimers, which include notifying the executor or administrator of the estate. Utilizing the US Legal Forms platform can help you find the correct forms and guidance to craft a compliant disclaimer effectively.

A probate disclaimer of interest in California is a legal tool that allows a beneficiary to refuse an inheritance during the probate process. It helps clarify and simplify asset distribution, often preventing the financial burden of taxes or unwanted responsibilities. Through the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, beneficiaries can formally convey their decision. This action can significantly impact the handling of the estate and the benefits the remaining heirs receive.

Filing probate in California without a will involves a process known as intestate succession, where state laws determine how the deceased's assets will be distributed. You must file a petition in the probate court, and the court will appoint an administrator to handle the estate. You can still utilize the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond to decline any inheritance, ensuring that distribution aligns with your intentions. Seek legal advice to navigate this intricate process effectively.

A disclaimer of interest in an estate in California is a formal refusal to accept an inheritance or gift from a deceased individual's estate. This action is crucial for beneficiaries who want to redirect assets, perhaps for tax advantages or a more balanced distribution among heirs. The California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond provides the necessary framework for making such disclaimers legally binding. Having the proper documentation is essential to avoid complications down the road.

In California, you can inherit up to $11.7 million from your parents without incurring federal estate taxes, although California does not have a state inheritance tax. The California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond can be an essential consideration if you are thinking about an inheritance that may exceed this threshold. Always consult with a tax expert to understand how the laws may affect your specific situation and ensure you are making the best financial decisions.

A disclaimer of interest in a deceased person's estate refers to the legal act of refusing an inheritance or interest in the estate. This action, guided by the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, allows a beneficiary to formally withdraw from inheriting certain assets. Such coordination helps clarify the distribution of the estate and can prevent potential disputes among beneficiaries. It is vital to ensure this disclaimer is properly documented.

Beneficiaries may choose to disclaim property for various reasons including tax implications, personal financial circumstances, or a desire for equitable distribution among heirs. Disclaiming an inheritance could prevent high estate taxes or other financial burdens. The California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond serves as a tool for beneficiaries to ensure that their decision aligns with their financial goals. It's a thoughtful step that can facilitate a better outcome for all parties involved.

To disclaim an inheritance in California, you need to submit a written disclaimer to the estate’s representative or executor. This document should clearly indicate your intention to refuse the inheritance as per the guidelines of the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond. Remember to file it within nine months of the decedent's passing to ensure compliance with legal requirements. Consulting a legal expert can guide you through this process smoothly.

If you refuse an inheritance, legally known as a disclaimer, that property will pass to the next beneficiary named in the will or the state intestacy laws. In California, the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond enables you to formally refuse your share. This can simplify the distribution process and often eliminates tax implications associated with the inheritance. It's advisable to understand the ramifications before making a decision.

To write a disclaimer of inheritance, start by stating your intent clearly in writing, acknowledging the specific asset, such as an IRA, annuity, or bond. Refer to the California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond for the necessary legal language and requirements. It is important to sign and date the disclaimer, and then deliver it to the executor of the estate or the institution managing the inherited asset to ensure it is processed correctly.