Arizona Credit Denial - Notice

Definition and meaning

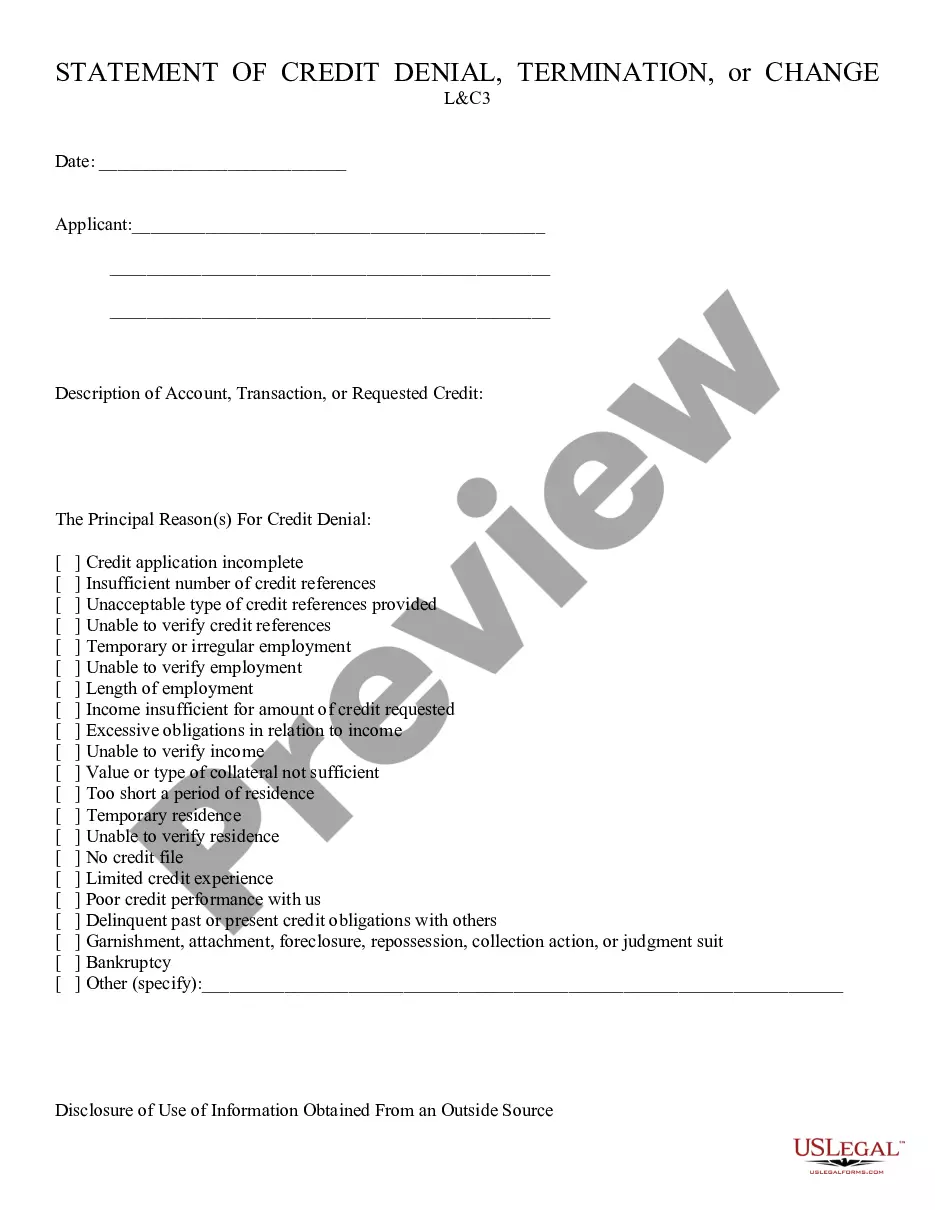

The Arizona Credit Denial - Notice is a formal document issued by creditors to inform applicants that their request for credit has been denied. This notice details the reasons for denial and the applicant's rights under the law. Understanding the terms and conditions surrounding credit applications is crucial for individuals seeking financial assistance, and this notice serves to clarify specific credit-related decisions.

How to complete a form

To properly complete the Arizona Credit Denial - Notice, follow these steps:

- Fill in the date at the top of the notice.

- Enter the applicant's name and contact information accurately.

- Specify the description of account or credit request that was denied.

- Check all relevant reasons for credit denial listed on the form.

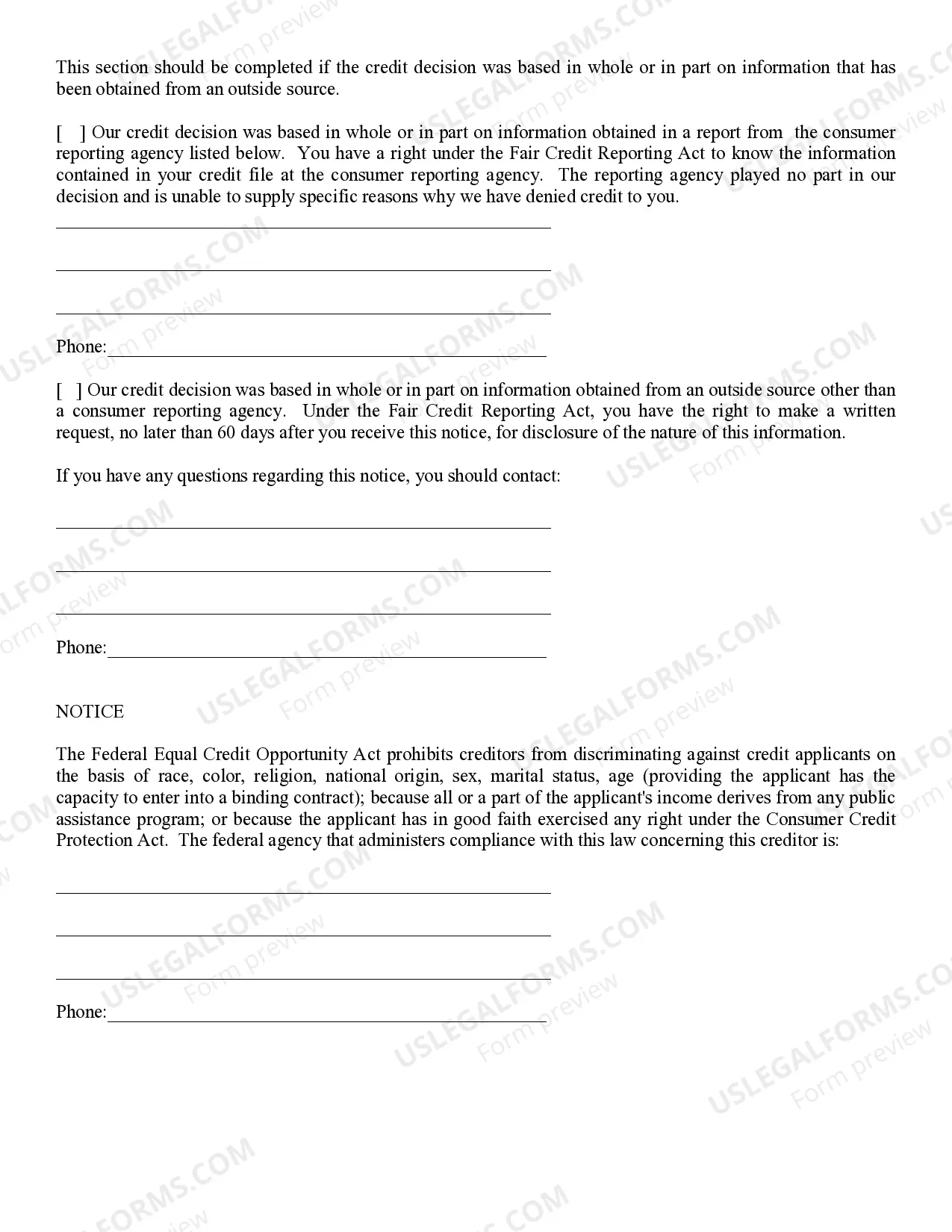

- If applicable, include the credit reporting agency information if the decision was based on external sources.

- Sign and date the notice to confirm it has been provided to the applicant.

Who should use this form

The Arizona Credit Denial - Notice should be used by creditors who have declined a credit application. This includes banks, credit unions, and other financial institutions. Individuals who have applied for credit and received a denial notice will also find this form valuable for understanding the reasons behind their application rejection.

Key components of the form

The Arizona Credit Denial - Notice includes essential components that ensure clarity and compliance, such as:

- Date: Indicates when the notice is issued.

- Applicant Information: Details of the person whose credit application has been denied.

- Description: A brief description of the credit request.

- Reasons for Denial: A checklist of potential reasons for the credit decision.

- Disclosure Statement: Information regarding the Fair Credit Reporting Act and rights of the applicant.

Common mistakes to avoid when using this form

When completing the Arizona Credit Denial - Notice, it is vital to avoid certain pitfalls, including:

- Leaving sections of the form blank, which could lead to misunderstandings.

- Failing to check all relevant reasons for credit denial, which may omit essential information.

- Neglecting to include accurate contact information for follow-up.

- Not providing the applicant with a copy of the notice.

What documents you may need alongside this one

In conjunction with the Arizona Credit Denial - Notice, creditors may need the following documents:

- A copy of the credit application submitted by the applicant.

- Any credit reports or evaluations used in the decision-making process.

- Documentation supporting the reasons for denial, such as income verification or employment records.

Form popularity

FAQ

A credit card company in Arizona generally has six years to sue you for an unpaid debt. This period begins when you default on the payment. It’s important to be aware of this timeframe, as waiting too long may affect your situation. Understanding Arizona Credit Denial - Notice could shed light on any legal actions you may face.

In Arizona, you typically have 20 days to file an answer to a summons if you were served in person, or 30 days if served by mail. Meeting this timeline is crucial to ensure that you do not forfeit your right to contest the claims against you. Note that specific cases may vary, so confirm your deadlines. Be aware of how Arizona Credit Denial - Notice may affect your timeline.

You should respond to a summons by filing your answer at the court specified in the summons document. Often, this is the court where the original complaint was filed. Additionally, you may need to send a copy of your response to the opposing party. It’s essential to keep track of these actions to comply with the Arizona Credit Denial - Notice regulations.

Filing an answer to a summons in Arizona requires preparing a document that addresses the claims made against you. After drafting your answer, you must file it with the court where the case is initiated. It's vital to ensure that you file within the designated time frame to avoid default. Consider researching Arizona Credit Denial - Notice to understand its implications.

To file an answer to a foreclosure summons in Arizona, you must prepare a written response and file it with the court. Include reasons for your defense and any counterclaims you may have. Ensure you adhere to Arizona law regarding timelines for your response. Understanding Arizona Credit Denial - Notice can also help you present your case effectively.

Responding to a summons without an attorney in Arizona involves submitting a written answer to the court. You must include the case number, your contact information, and a clear statement that you are responding to the summons. Make sure to follow the court's guidelines for formatting and filing. This process is crucial if you want to address any claims regarding Arizona Credit Denial - Notice.

The Fair Credit Reporting Act (FCRA) is a federal law that governs how consumer information is collected, shared, and utilized. In Arizona, this law provides consumers with rights regarding their credit reports, including access to their reports and the ability to dispute inaccuracies. This act also connects to Arizona Credit Denial - Notice, as it ensures you receive proper notification regarding your credit status. Understanding your rights under FCRA can empower you in financial matters.

Yes, credit repair is legal in Arizona, as long as it is conducted according to the law. A reputable credit repair company can help you address inaccuracies on your credit report. However, be cautious and research any company you consider working with. Be aware of your rights under laws like the Arizona Credit Denial - Notice to ensure you are protected during this process.

A credit denial letter is a formal notification informing you that your application for credit has been denied. This letter typically outlines the reasons for the denial and your right to dispute information if necessary. Understanding the contents of your credit denial letter is vital for your financial health. Ensure you respond appropriately, especially in light of the Arizona Credit Denial - Notice regulations.

The statutory interest rate in Arizona is set at 10% per year for unsecured loans unless the agreement specifies otherwise. This rate applies when no other rate is agreed upon. Understanding this helps you assess your contracts and manage your finances effectively. USClegalforms can aid you in clarifying your obligations regarding the Arizona Credit Denial - Notice.