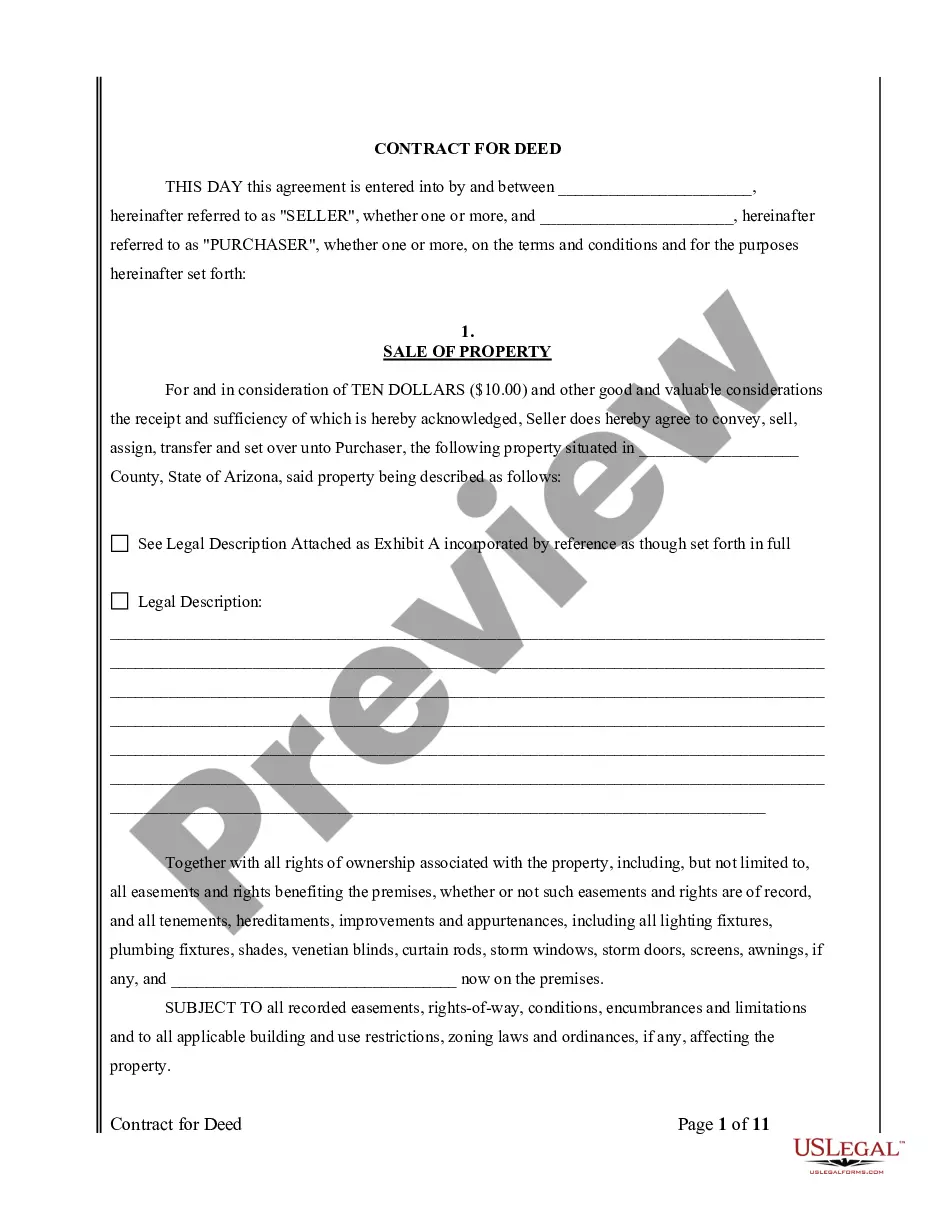

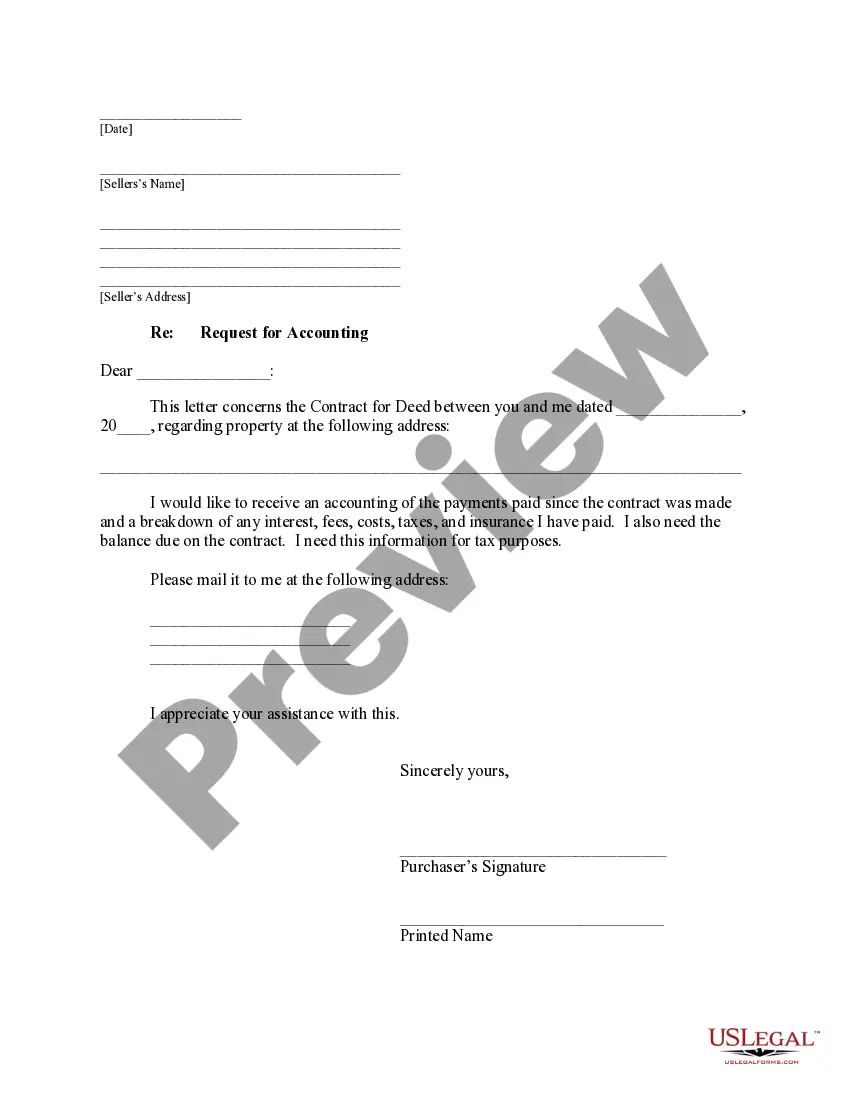

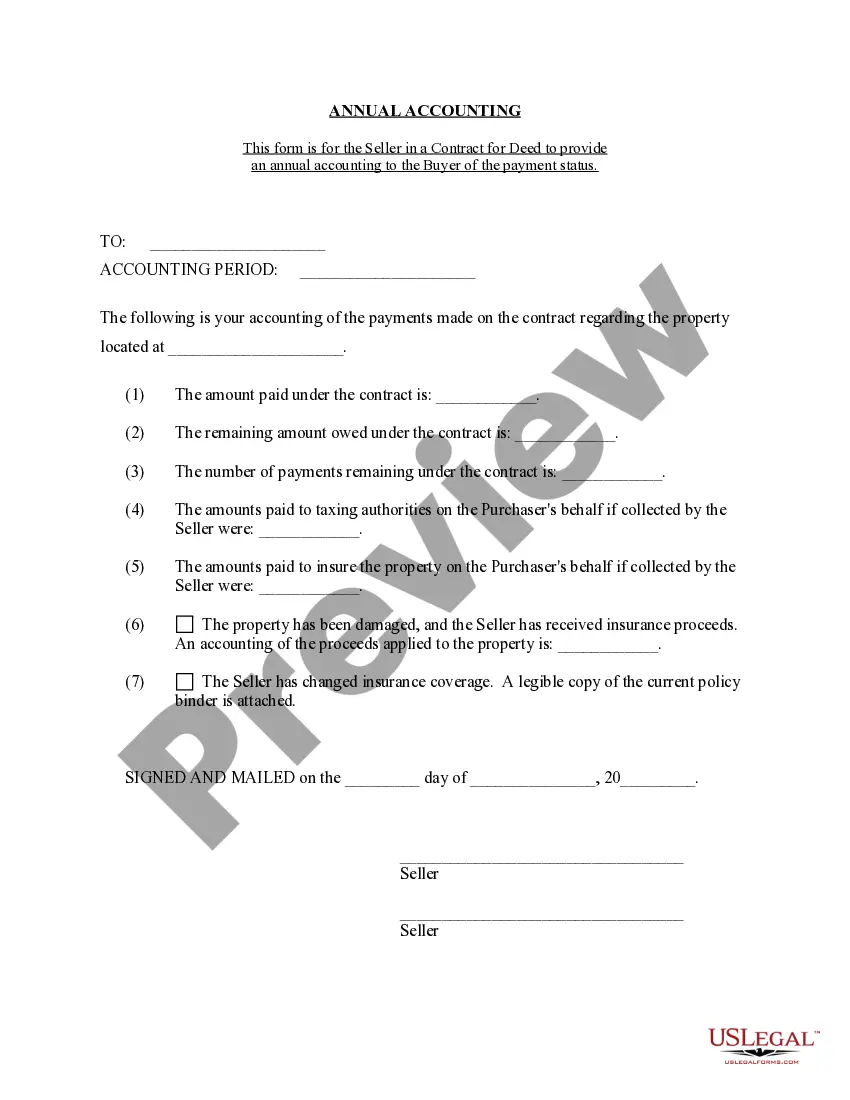

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Arizona Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Arizona Contract For Deed Seller's Annual Accounting Statement?

Utilize US Legal Forms to acquire a printable Arizona Contract for Deed Seller's Annual Accounting Statement.

Our court-approved forms are crafted and consistently updated by expert attorneys.

Ours is the most comprehensive Forms repository online, offering affordable and precise templates for clients, attorneys, and small to medium-sized businesses (SMBs).

US Legal Forms offers a vast array of legal and tax templates and bundles for both business and personal requirements, including the Arizona Contract for Deed Seller's Annual Accounting Statement. More than three million users have successfully used our platform. Choose your subscription plan and access high-quality forms in just a few clicks.

- Verify that you have the appropriate template for the required state.

- Examine the document by reviewing the description and using the Preview feature.

- Click Buy Now if it’s the template you are looking for.

- Create your account and make payment through PayPal or via credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Utilize the Search field if you wish to locate another document template.

Form popularity

FAQ

A valid contract in Arizona requires mutual agreement, lawful purpose, and consideration exchanged between parties. It must also be in writing if it involves significant financial transactions. For those utilizing the Arizona Contract for Deed Seller's Annual Accounting Statement, ensuring compliance with these requirements can help avoid disputes and facilitate a smooth transaction.

Yes, Arizona is considered a deed state. This means that property transfers often involve deeds, making it important for sellers and buyers to understand the process. An Arizona Contract for Deed Seller's Annual Accounting Statement will reflect accurate details of the transaction under the prevailing state laws and practices.

Signing a contract as a deed provides a higher level of assurance for the parties involved. It demonstrates a serious commitment and often includes essential details regarding the terms and conditions. For those dealing with an Arizona Contract for Deed Seller's Annual Accounting Statement, having a deed can help clarify responsibilities, especially when payments are involved.

In Texas, property taxes are typically the responsibility of the buyer in a contract for deed arrangement. However, the specifics can vary depending on the terms outlined in the contract. Having clear agreements in place helps in avoiding disputes, making the Arizona Contract for Deed Seller's Annual Accounting Statement an important document for both sellers and buyers.

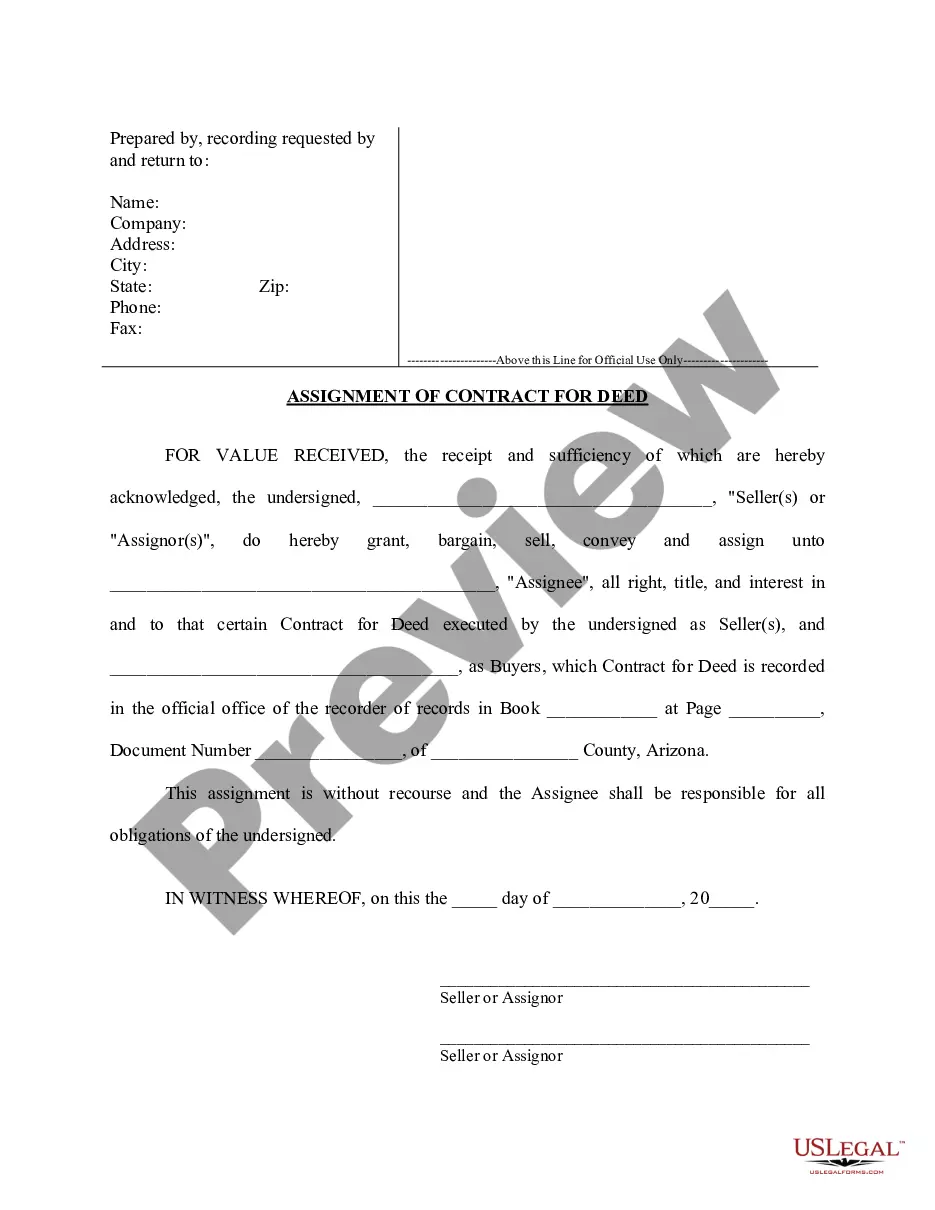

Contracts are not always freely assignable. Many agreements include restrictions on assignment to protect the interests of the parties involved. It's essential to review the contract terms carefully, especially for agreements like the Arizona Contract for Deed Seller's Annual Accounting Statement, to understand any limitations that may apply.

The assignment of rights in Arizona refers to transferring one's legal rights under a contract to another party. This process typically requires the consent of all parties involved unless otherwise stated in the contract. When dealing with an Arizona Contract for Deed Seller's Annual Accounting Statement, understanding these rights helps in ensuring proper management and compliance.

Yes, a seller can back out of a real estate contract in Arizona under certain conditions. If the buyer defaults or if both parties agree to terminate the contract, the seller may be able to withdraw. However, it’s vital to consider potential legal ramifications and financial obligations, including those related to the Arizona Contract for Deed Seller's Annual Accounting Statement.

In Montana, a contract for deed serves as a method of financing for purchasing property. The buyer makes payments directly to the seller while the seller retains the deed until the contract is completed. This arrangement often includes terms reflecting the responsibilities of both parties, which is crucial for transparency, particularly when preparing an Arizona Contract for Deed Seller's Annual Accounting Statement.

Some contracts contain specific clauses that prohibit assignment, known as anti-assignment clauses. Additionally, contracts that involve personal services or require the unique skills of a party generally cannot be assigned. In the context of real estate, understanding the implications of these clauses can ensure clear communication, especially when dealing with an Arizona Contract for Deed Seller's Annual Accounting Statement.

In Texas, the property owner is responsible for paying property taxes, which can include the buyer when they occupy the property under a contract for deed. The seller may also bear this responsibility until the contract terms are fulfilled and the deed is transferred. It’s wise for both buyers and sellers to clarify tax obligations in their contracts. Utilizing resources like the Arizona Contract for Deed Seller's Annual Accounting Statement can help keep these financial responsibilities organized.