Accounting by Personal Representative of Estate. This official probate court form is used to account to the probate court all the expenses incurred by the estate under the direction of the personal representative.

Arkansas Accounting for Personal Representative

Description

How to fill out Arkansas Accounting For Personal Representative?

Using Arkansas Accounting for Personal Representative templates crafted by experienced attorneys allows you to evade complications while filling out paperwork.

Simply download the template from our site, complete it, and request a lawyer to review it.

This can assist you in conserving significantly more time and effort than searching for a legal expert to draft a document for you.

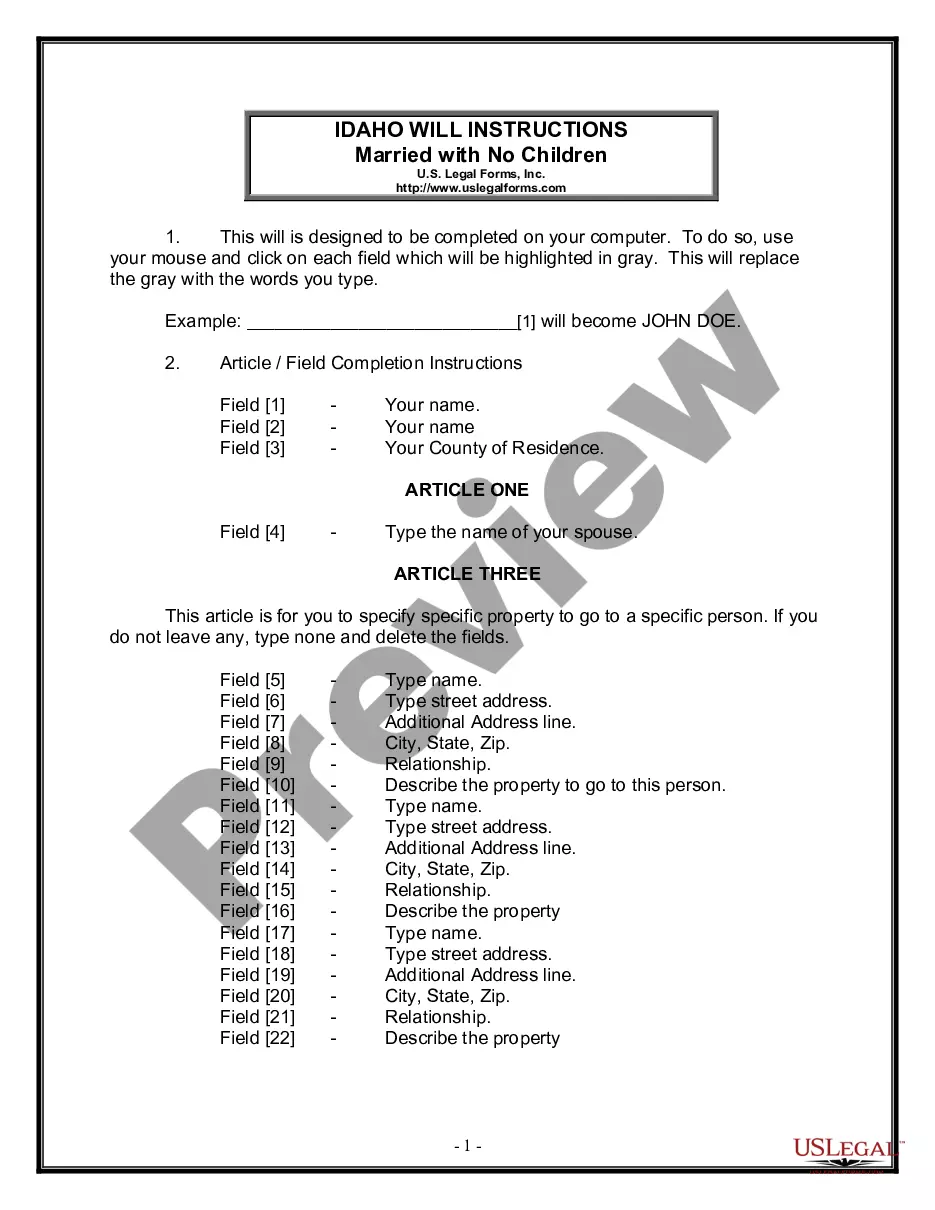

Utilize the Preview feature and read the description (if available) to determine if you need this specific template and if so, just click Buy Now. Find another template using the Search field if necessary. Select a subscription that suits your needs. Begin the process using your credit card or PayPal. Choose a file format and download your document. After you have completed all of the aforementioned steps, you will be able to fill out, print, and sign the Arkansas Accounting for Personal Representative template. Ensure to double-check all entered information for accuracy before submitting or mailing it. Reduce the time spent on paperwork with US Legal Forms!

- If you have previously purchased a US Legal Forms subscription, just sign in to your account and navigate back to the sample page.

- Locate the Download button next to the templates you are reviewing.

- Once the document is downloaded, you can find your saved samples in the My documents section.

- If you do not have a subscription, that is not an issue.

- Simply follow the step-by-step instructions below to register for an account online, acquire, and complete your Arkansas Accounting for Personal Representative template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

Administration of the estate of the deceased involves the legal process of managing a person's estate after their passing. This includes identifying assets, settling debts, and distributing what remains to beneficiaries. Proper administration prevents disputes and ensures that the deceased’s wishes are honored. Leverage Arkansas Accounting for Personal Representative for effective management and compliance throughout the administration process.

The order of inheritance in Arkansas outlines how a deceased person's assets are divided among survivors. Typically, a spouse and children inherit first, followed by parents, siblings, and more distant relatives if there are no immediate heirs. Knowledge of this order is vital when navigating estate matters. For clarity and assistance, consider Arkansas Accounting for Personal Representative to help manage and distribute the estate accordingly.

In Arkansas, the probate limit refers to the value of the estate that requires formal probate proceedings. As of now, estates valued under $100,000 may qualify for a simplified process. Understanding this limit helps you decide the best course of action for your loved one's estate. Using Arkansas Accounting for Personal Representative ensures that you remain compliant with state regulations and streamline the process.

Estate administration in Arkansas refers to the process of managing and settling the affairs of a deceased person's estate. This involves gathering assets, paying debts, and distributing the remaining estate to beneficiaries according to the law or a will. Following proper procedures is essential to avoid delays and disputes. Arkansas Accounting for Personal Representative offers tools to assist with accurate and timely estate administration.

The estate of a decedent represents all the assets and liabilities left behind by a person who has died. This includes property, personal belongings, bank accounts, and any debts. Understanding this concept is crucial in the probate process. For efficient management, look into Arkansas Accounting for Personal Representative, which can simplify estate accounting and planning.

To become an administrator of an estate after a death in Arkansas, you must file a petition with the probate court in the county where the deceased lived. You will need to include a death certificate and a list of the beneficiaries. The court will appoint you after confirming your eligibility. Utilizing Arkansas Accounting for Personal Representative can help streamline this process, ensuring that you meet all legal requirements.

The final account of the executor details all financial transactions the executor conducted while managing the estate. This account provides a transparent summary of distributions, payments, and remaining assets at the estate's conclusion. Proper Arkansas Accounting for Personal Representative is crucial here, as it ensures beneficiaries can see how assets were handled and protects the executor from potential disputes. This final documentation also plays a vital role in the probate court's approval process.

In Arkansas, not all wills must go through probate. Some small estates may qualify for a simplified process called small estate procedures, allowing personal representatives to handle affairs without full probate. However, if there are significant assets or disputes, the probate process may be necessary to ensure proper Arkansas Accounting for Personal Representative and distribution of the estate. Consulting with a legal professional can clarify if probate is needed for your situation.

When a homeowner dies in Arkansas, their property typically becomes part of the estate subject to probate. The personal representative will manage the property through the probate process, which may involve selling the home or transferring ownership to heirs. Effective Arkansas accounting for personal representative tasks is crucial in overseeing these property matters and ensuring compliance with legal requirements.

A personal representative is the individual initially appointed to manage an estate, while a successor is someone who takes over these responsibilities if the original representative can no longer serve. This might occur due to resignation, incapacity, or death of the personal representative. Knowledge of Arkansas accounting for personal representative roles aids in understanding how these transitions occur within estate management.