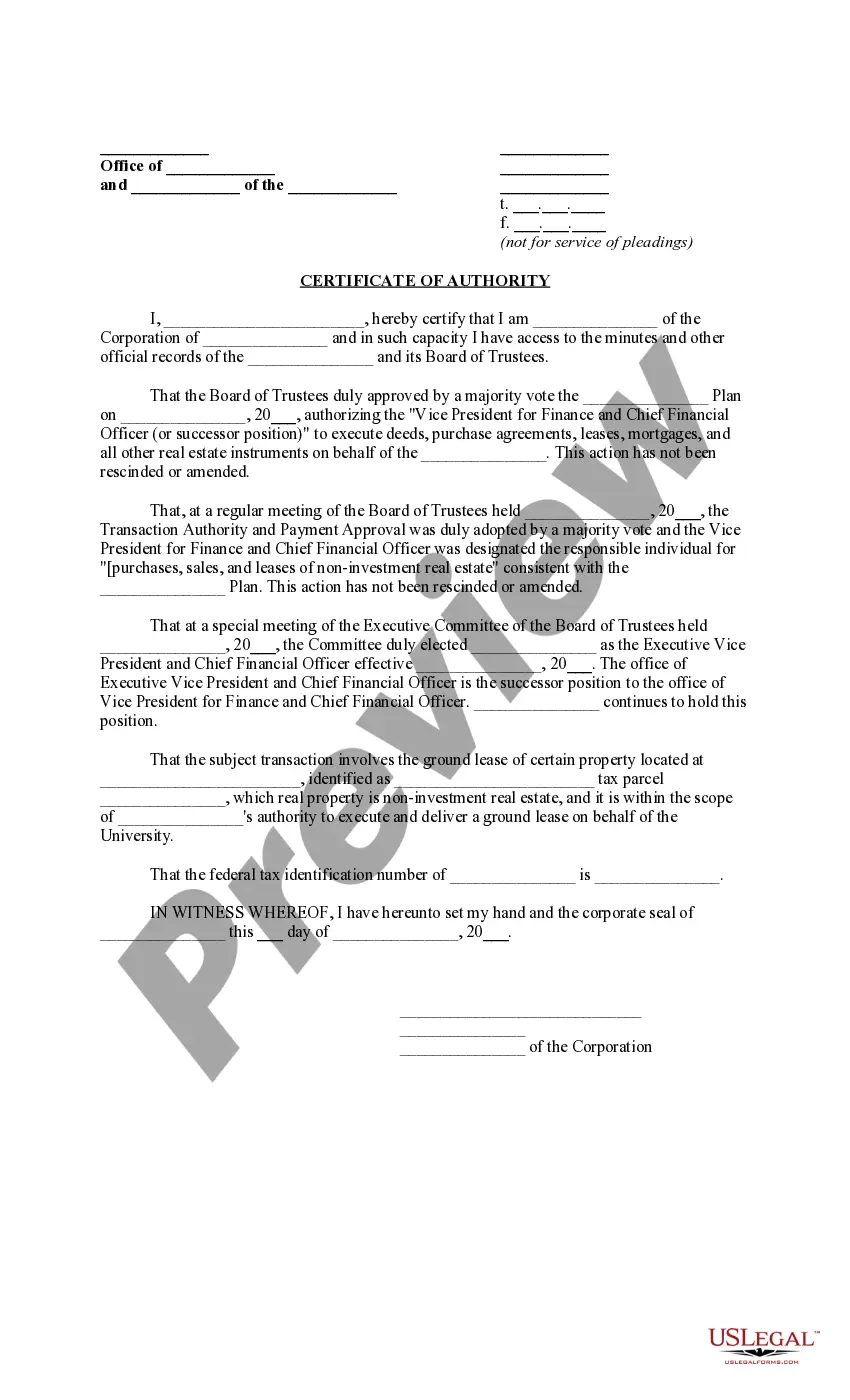

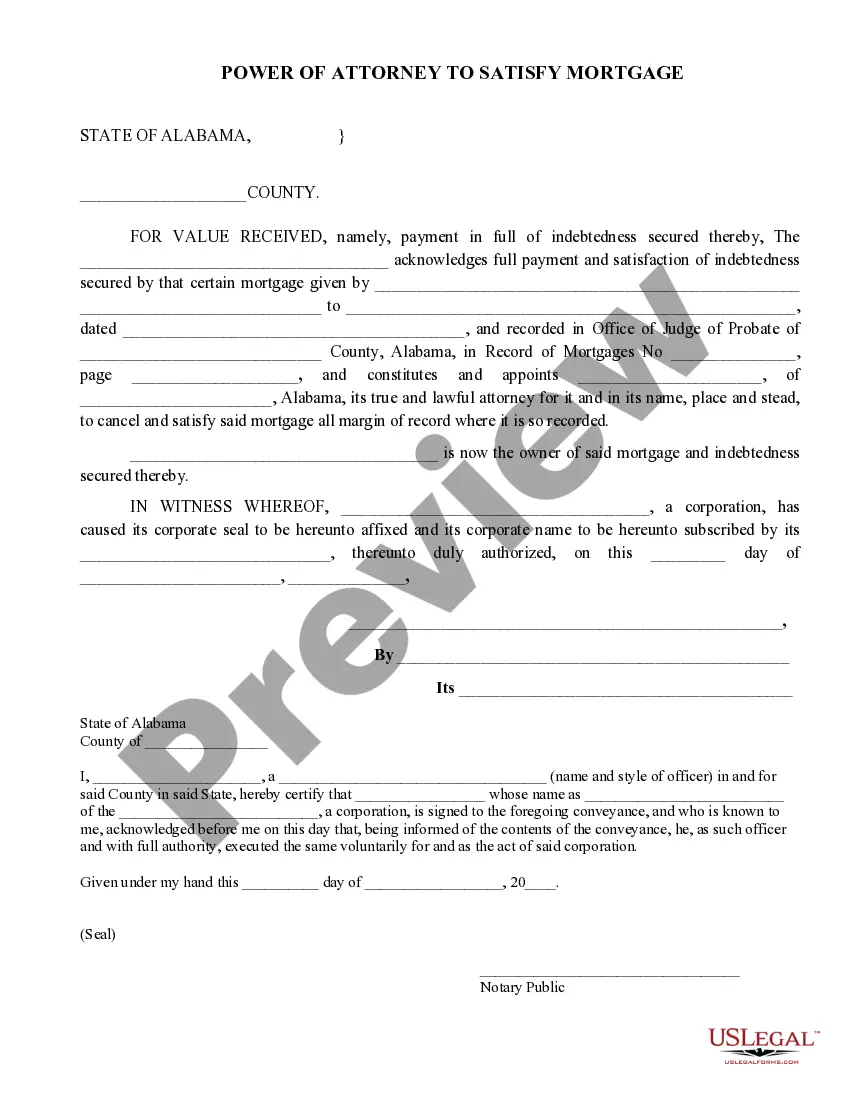

This is a sample of a Power of Attorney to Satisfy Mortgage used to acknowledge that a mortgage obligation has been satisfied and to appoint another to act on behalf of the note holder to cancel and satisfy the mortgage.

Alabama Power of Attorney to Satisfy Mortgage

Description

How to fill out Alabama Power Of Attorney To Satisfy Mortgage?

Leveraging Alabama Power of Attorney for Mortgage templates crafted by experienced lawyers enables you to evade complications when finalizing paperwork.

Simply download the example from our site, complete it, and ask a lawyer to validate it.

This can save you significantly more time and effort than having a legal expert create a document entirely from the ground up for you.

Utilize the Preview feature and examine the description (if present) to determine if you require this specific sample, and if so, just click Buy Now. Locate another template using the Search bar if necessary. Choose a subscription that suits your requirements. Begin with your credit card or PayPal. Select a file format and download your document. After completing all the steps above, you will be able to fill out, print, and sign the Alabama Power of Attorney for Mortgage template. Remember to review all entered information for accuracy before submitting or dispatching it. Reduce the time spent on document preparation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and revisit the form page.

- Locate the Download button adjacent to the templates you are reviewing.

- Upon downloading a template, you will find all your saved examples in the My documents section.

- If you lack a subscription, that’s not a concern.

- Merely follow the instructions below to create your account online and obtain and complete your Alabama Power of Attorney for Mortgage template.

- Ensure that you verify you are downloading the correct state-specific document.

Form popularity

FAQ

In Alabama, a power of attorney works by allowing you to appoint an agent to act on your behalf in various matters, including financial and legal transactions. The appointed agent must act in your best interest and adhere to the guidelines set forth in the document. When dealing with real estate, creating an Alabama Power of Attorney to Satisfy Mortgage ensures that your affairs are handled even when you are not present. For a smooth process, using uslegalforms can help you craft a suitable document.

To obtain a power of attorney for closing your house in Alabama, you need to create a document that clearly outlines your intentions and the specific powers you wish to grant your agent. This may include the ability to sign documents on your behalf related to the mortgage and property transfer. Using a platform like uslegalforms can simplify this process by providing ready-to-use templates for an Alabama Power of Attorney to Satisfy Mortgage. Ensure your document is properly notarized to increase its validity.

There are key decisions that a legal power of attorney cannot make in Alabama. These include decisions regarding your own medical treatment when you are incapacitated, making a will, and voting on your behalf. Understanding these limitations is essential when creating an Alabama Power of Attorney to Satisfy Mortgage, as it helps clarify what your agent can and cannot do. Consulting with a legal expert can provide additional insights into these restrictions.

A power of attorney in Alabama grants you the ability to designate someone to manage your financial and legal affairs when you are unable to do so. This includes managing property, making financial decisions, and handling transactions like mortgages. By using an Alabama Power of Attorney to Satisfy Mortgage, you can ensure that your real estate dealings proceed smoothly, even if you are unavailable. Understanding your specific permissions is vital for effective decision-making.

In Alabama, the principal who granted the power of attorney has the authority to revoke or override it at any time. Additionally, a court may also intervene if it determines that the agent is acting against the principal's best interests. If you have concerns about your Alabama Power of Attorney to Satisfy Mortgage, it’s crucial to understand these rights. Always seek legal advice for personalized guidance.

In Alabama, a power of attorney remains valid until the principal revokes it, the principal passes away, or the purpose of the power of attorney has been fulfilled. This flexibility allows you to create an Alabama Power of Attorney to Satisfy Mortgage needs effectively. For real estate transactions, you may want to specify an expiration date to ensure clarity in your documents. Always consult with a legal professional to meet your specific requirements.

No, a power of attorney does not need to be filed with the court in Alabama unless it involves specific transactions such as real estate dealings. However, filing might be beneficial for clarity and to validate the document when dealing with financial institutions. If you are navigating complex transactions related to your Alabama Power of Attorney to Satisfy Mortgage, you can always refer to platforms like uslegalforms for guidance and assistance.

In Alabama, you can revoke a power of attorney by drafting a written revocation that clearly states your intention to cancel the existing power of attorney. Ensure that you sign and date this revocation, and provide copies to both the designated agent and any relevant third parties. This step is vital to maintain control over your legal affairs, especially regarding your Alabama Power of Attorney to Satisfy Mortgage.

To supersede a power of attorney in Alabama, you need to create a new power of attorney document. Make sure that the new document explicitly states that it revokes any prior power of attorney. Additionally, inform any institutions or individuals who hold the old power of attorney. This ensures clarity and eliminates any confusion regarding your Alabama Power of Attorney to Satisfy Mortgage.

A Power of Attorney cannot make decisions regarding the principal's personal care, including health care decisions unless explicitly stated. Additionally, you cannot alter a principal’s will or make any changes to their estate plan. Lastly, any decision that requires court approval cannot be made by a Power of Attorney, emphasizing the importance of understanding your limits, especially in matters related to an Alabama Power of Attorney to Satisfy Mortgage.