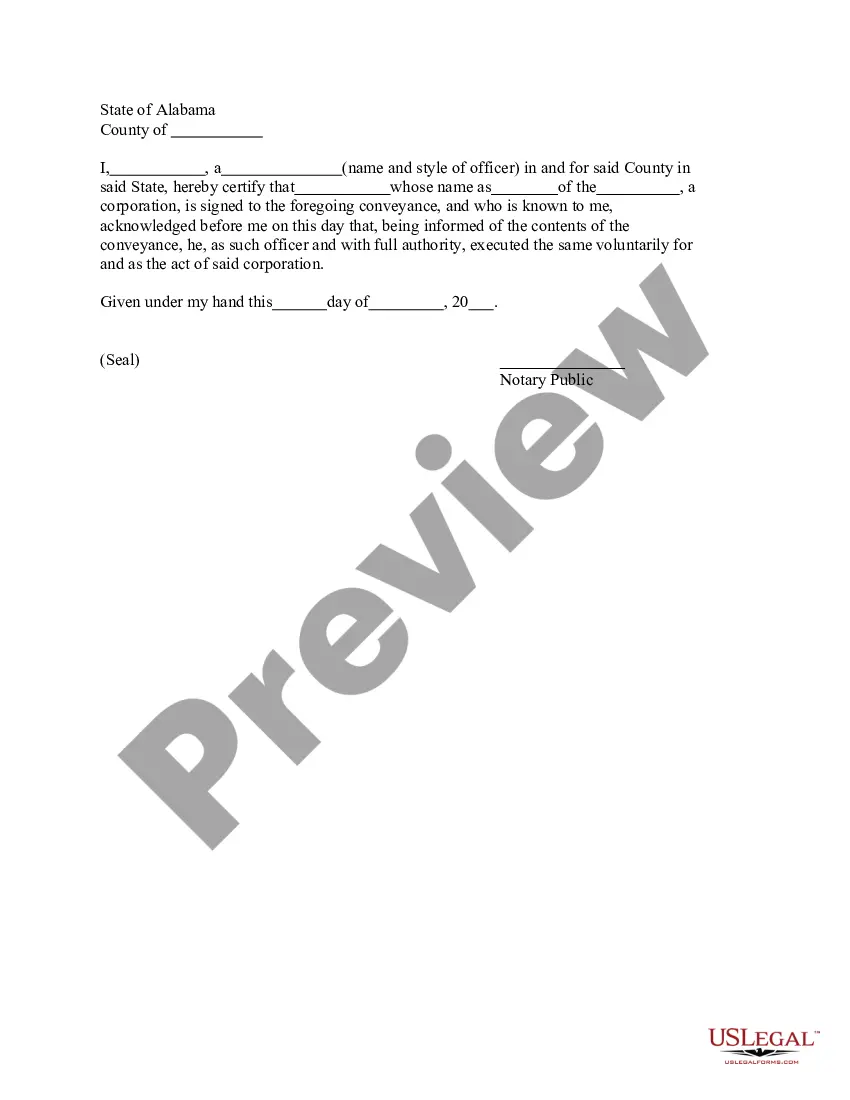

Alabama Acknowledgment for Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

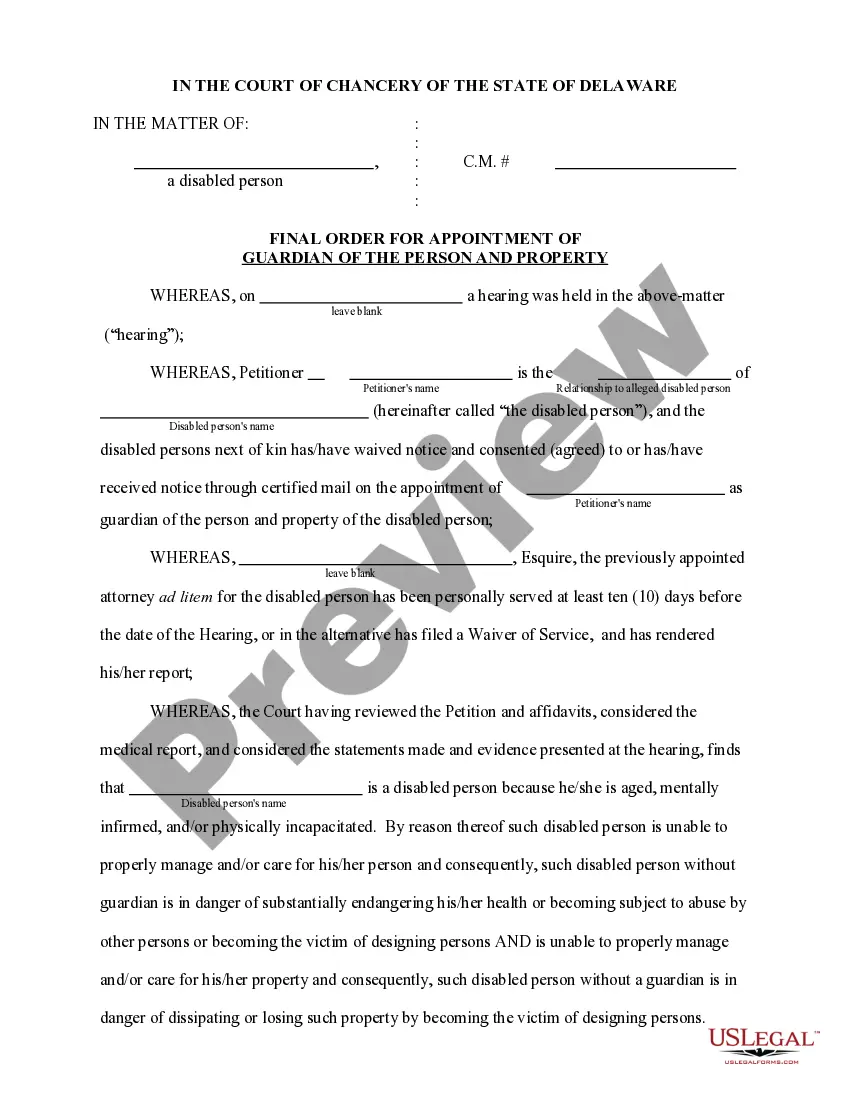

How to fill out Alabama Acknowledgment For Corporation?

Utilizing Alabama Acknowledgment for Corporation examples crafted by experienced lawyers allows you to avert troubles when completing paperwork.

Simply download the template from our site, fill it in, and request a legal expert to validate it.

This can save you considerably more time and money than searching for an attorney to draft a document from scratch for you.

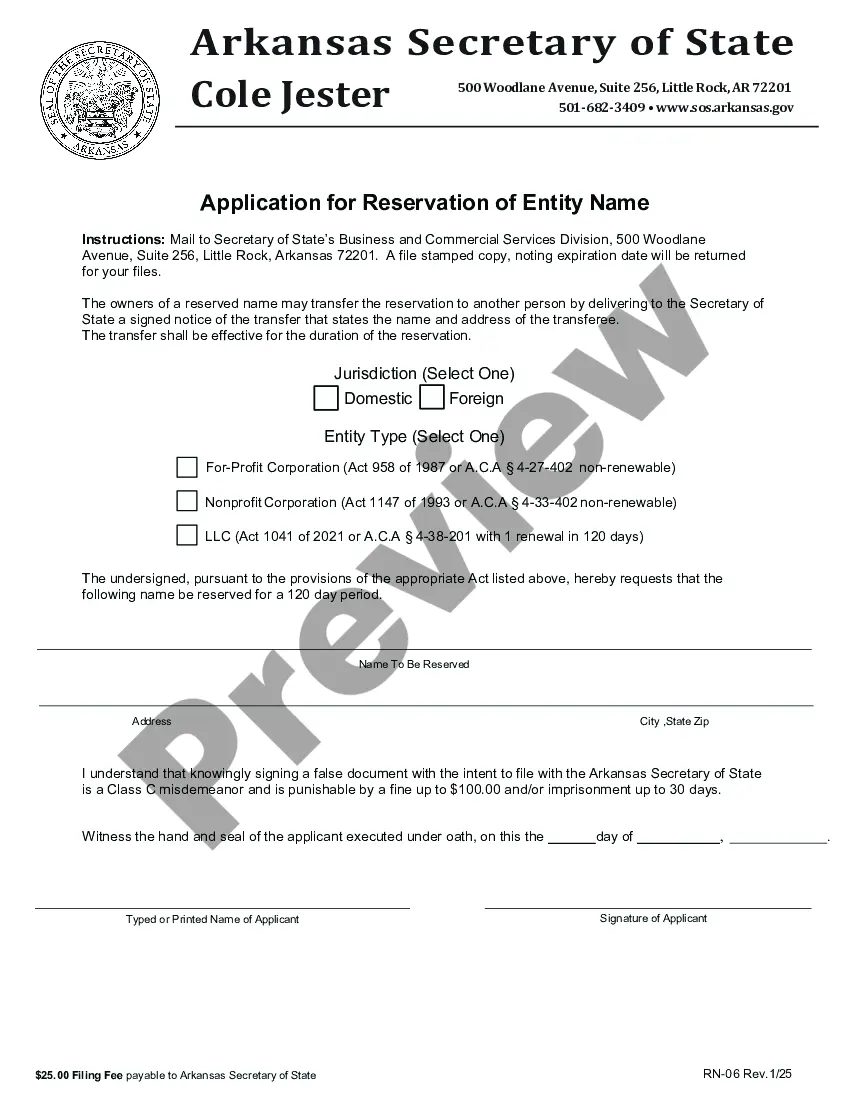

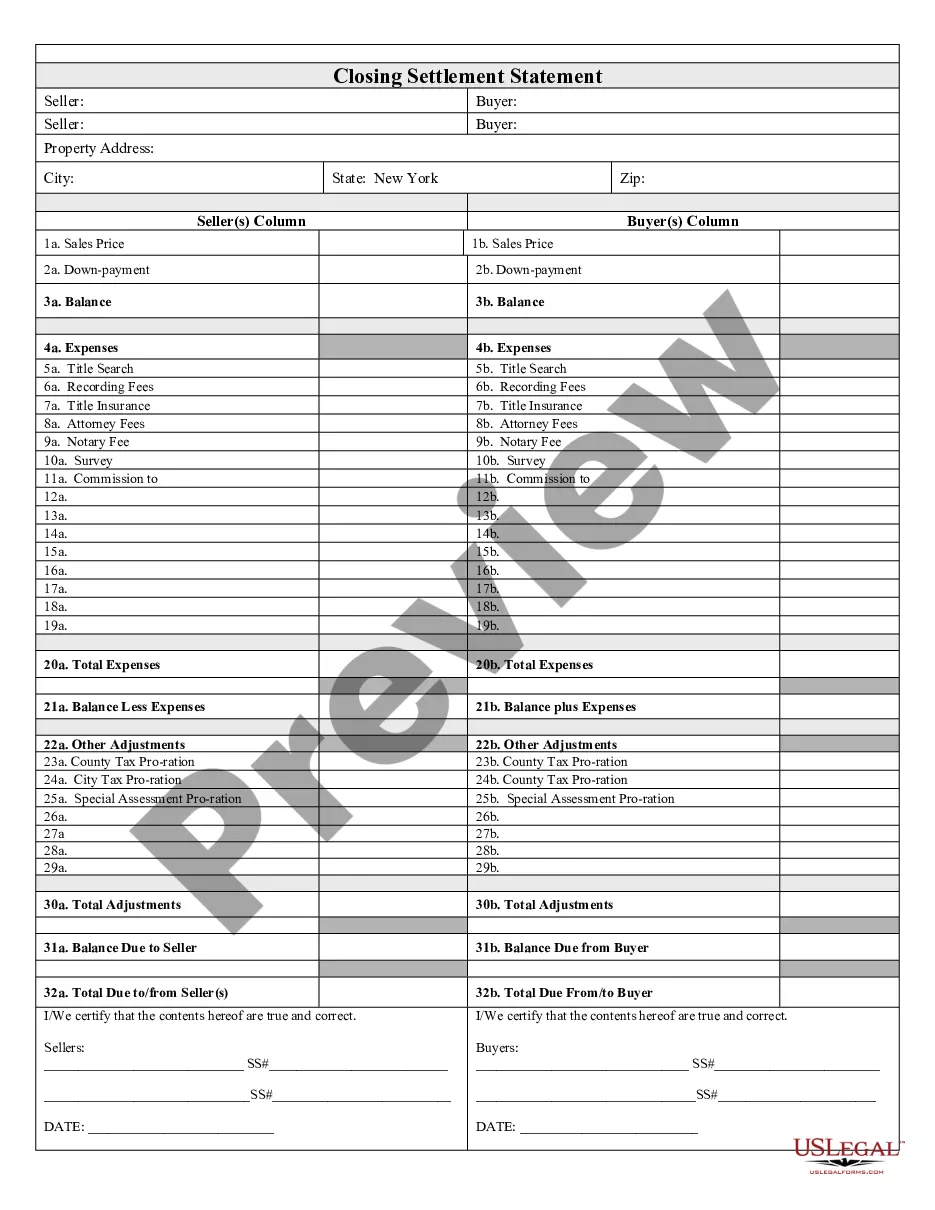

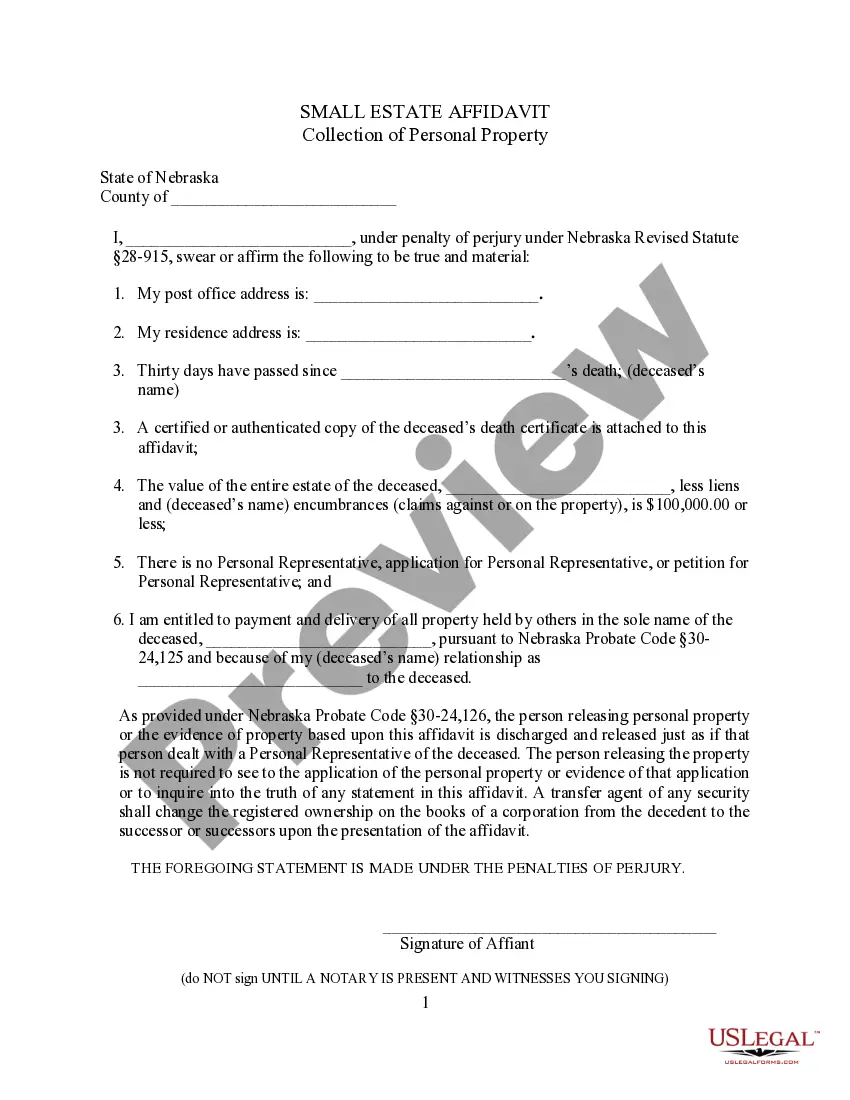

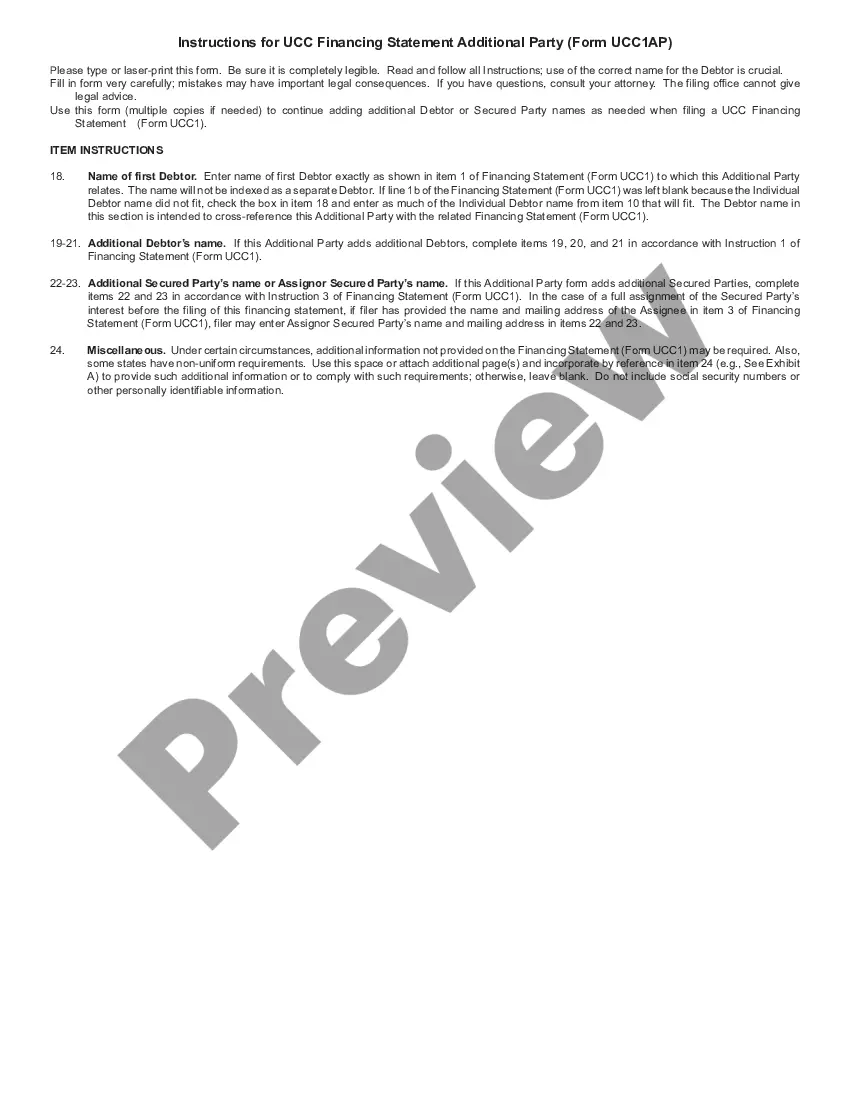

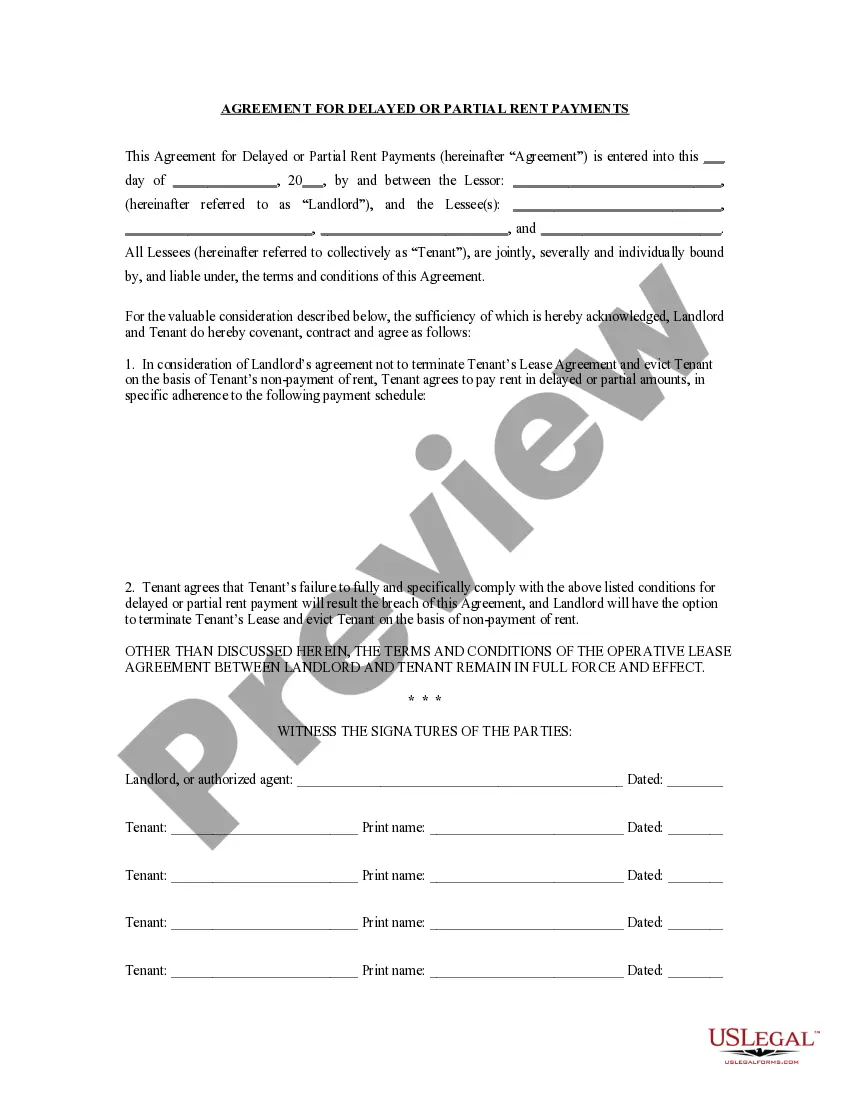

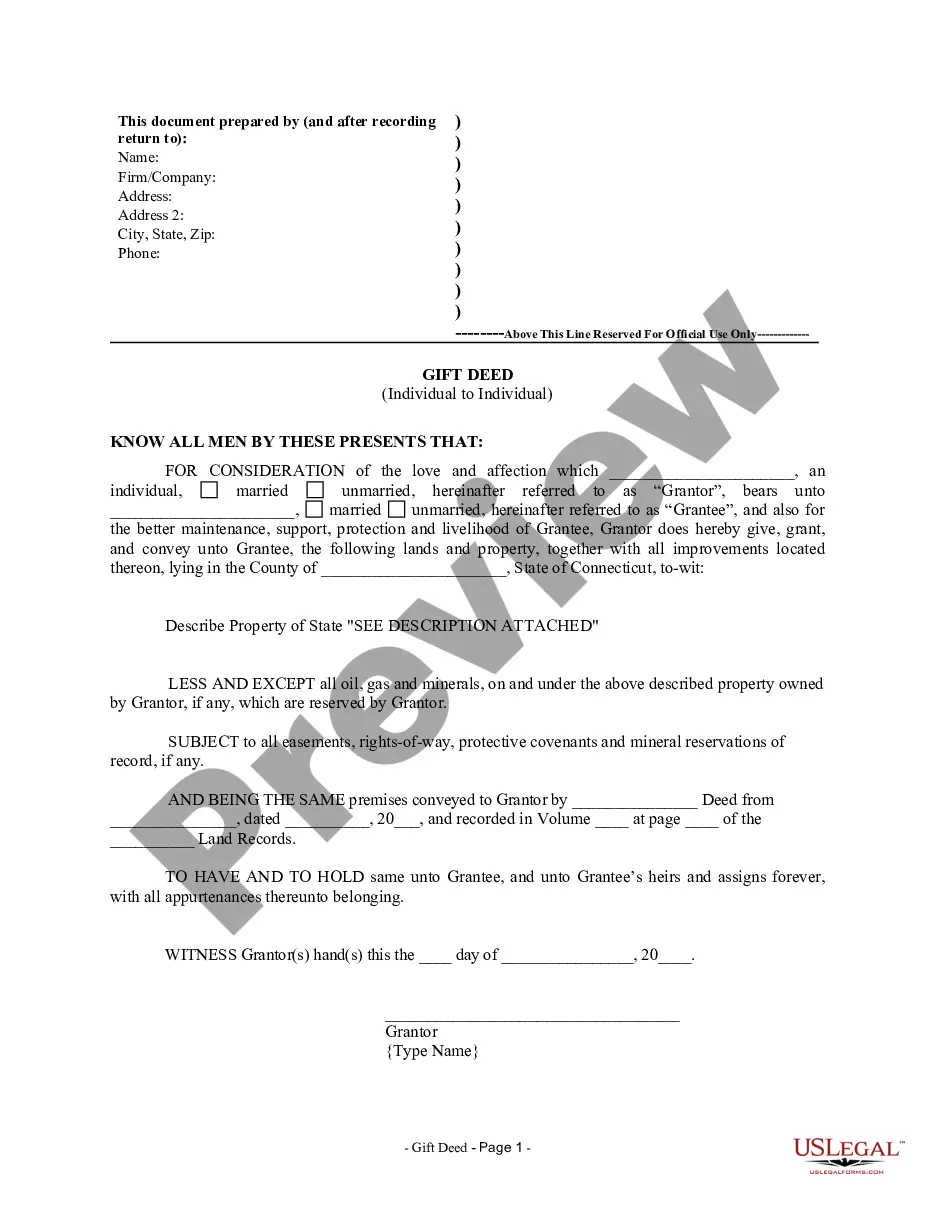

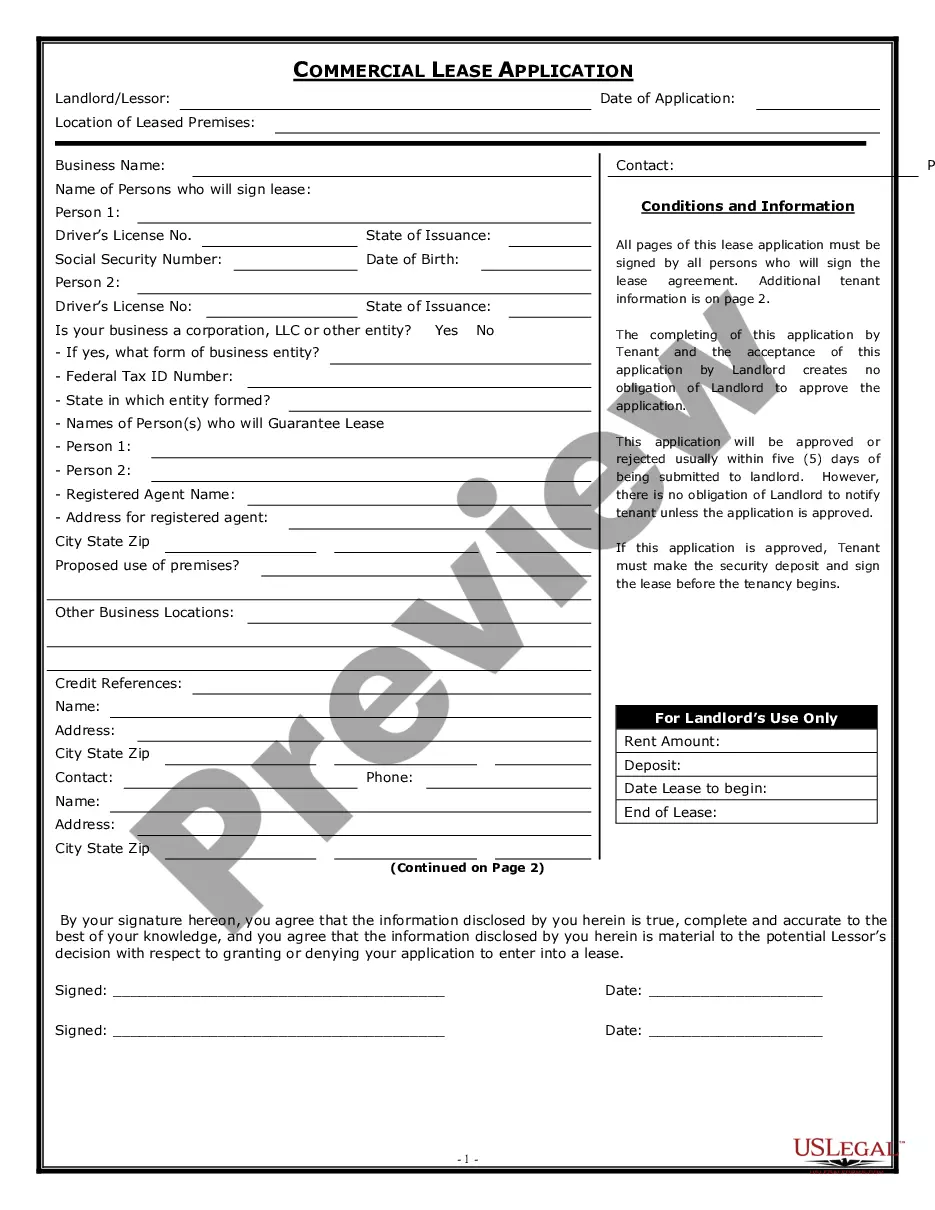

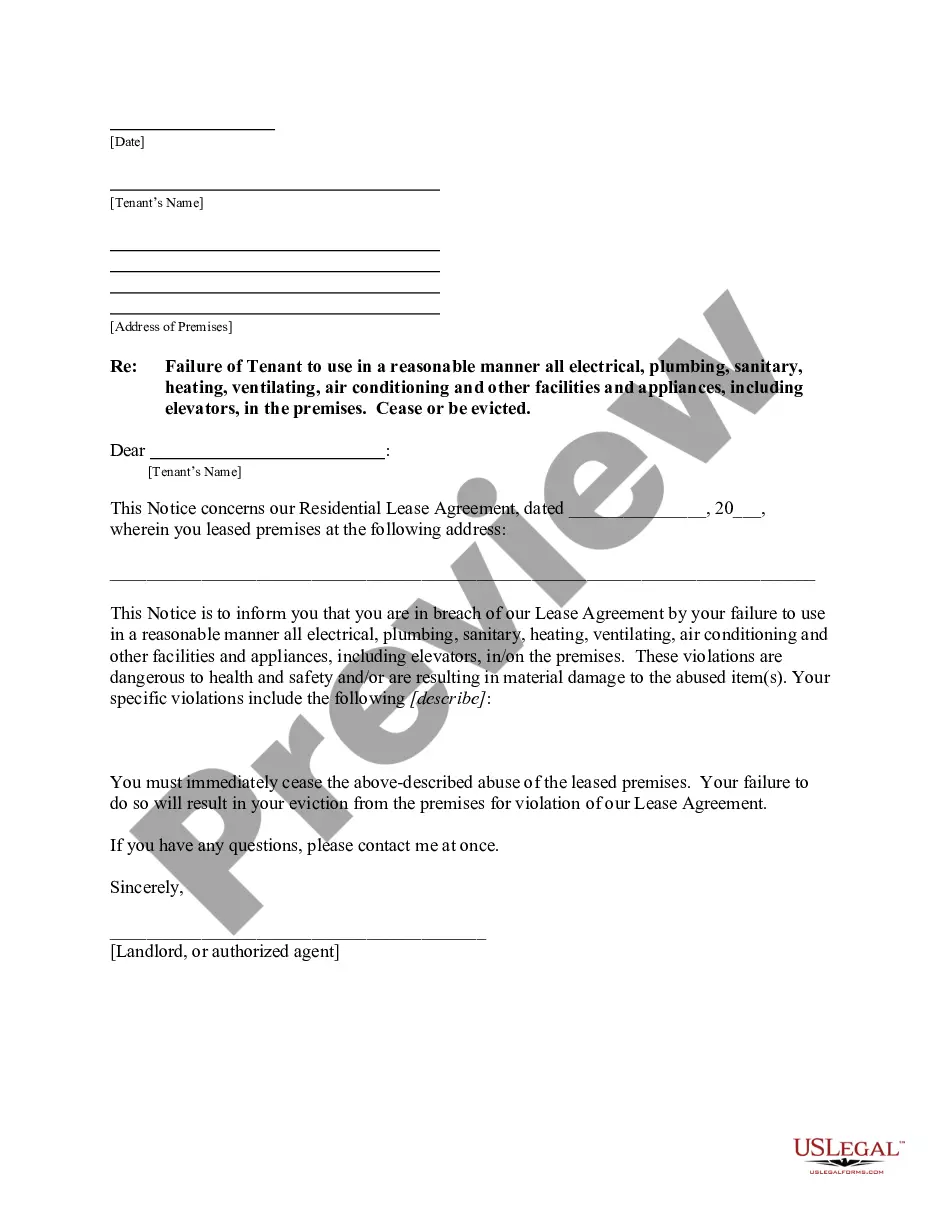

Utilize the Preview feature and check the description (if available) to ascertain whether you require this particular example, and if so, just click Buy Now.

- If you currently hold a US Legal Forms subscription, just Log In to your profile and revisit the template page.

- Locate the Download option adjacent to the templates you are reviewing.

- Upon downloading a template, you will find all of your stored examples under the My documents section.

- If you do not possess a subscription, it’s not a significant issue.

- Simply adhere to the steps below to register for an account online, acquire, and complete your Alabama Acknowledgment for Corporation template.

- Ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

Yes, Alabama requires Limited Liability Companies (LLCs) to file an annual report. This report needs to be submitted to the Secretary of State by the designated deadline to maintain compliance. Additionally, while preparing your annual report, ensuring you have the Alabama Acknowledgment for Corporation can help with the documentation process. It's essential to stay on top of these requirements to keep your LLC in good standing.

To obtain a copy of your articles of incorporation in Alabama, you can request it from the Secretary of State's office. This request can typically be made online, by mail, or in person. Having the Alabama Acknowledgment for Corporation readily available, if applicable, can assist in streamlining the retrieval process. Be prepared to provide identifying information about your corporation to facilitate your request.

Registering yourself as a small business in Alabama involves choosing a business structure and filing the appropriate documents. This may include registering a trade name and acquiring necessary licenses. You might also need the Alabama Acknowledgment for Corporation if you opt for a corporate structure. Utilizing platforms like USLegalForms can simplify the registration process and help you complete everything efficiently.

A notary acknowledgment requires the signature of the individual who is signing the document being notarized. In the context of an Alabama Acknowledgment for Corporation, this may include the corporation's president or other designated officer. This ensures that the signing is legitimate and gives legal validity to your documents. It's important to follow these steps carefully to comply with legal standards.

To register a corporation in Alabama, you need to file your articles of incorporation with the Secretary of State's office. This filing includes essential details about your corporation, such as its name and purpose. Moreover, securing an Alabama Acknowledgment for Corporation can help ensure that your documents are properly notarized and recognized. Once filed, you'll also need to fulfill any necessary state requirements to maintain your corporation.

Yes, you can start a corporation by yourself in Alabama. This process allows you to establish a legal entity that separates your personal and business liabilities. With the right documentation, including the Alabama Acknowledgment for Corporation, you can file your articles of incorporation. This is a significant step toward building your business successfully.

Deciding whether to start an S corporation or an LLC in Alabama depends on your business goals. An S Corp allows for potential tax benefits, where income is taxed at the shareholder level, while an LLC offers greater flexibility in management and fewer formalities. Consider factors like your business structure, tax implications, and administrative responsibilities when making this choice. Consulting a professional or using resources like uslegalforms could help clarify your decision.

Yes, you can set up an S corporation by yourself in Alabama, but it is important to follow the correct steps. You will need to file articles of incorporation and include an Alabama Acknowledgment for Corporation for validation. While the process can be straightforward, you may benefit from using platforms like uslegalforms, which can provide guidance and ensure you meet all legal requirements.

To start an S Corp in Alabama, you first need to register your corporation by filing articles of incorporation. Include an Alabama Acknowledgment for Corporation to demonstrate your compliance with legal requirements. After registration, you will complete Form 2553 with the IRS to elect S corporation status, ensuring your business qualifies. This step allows your income to pass through to your personal tax return, providing potential tax advantages.

To form an S corporation in Alabama, start by choosing a unique name that complies with Alabama's naming regulations. Next, you need to file articles of incorporation with the Secretary of State, including an Alabama Acknowledgment for Corporation to confirm your business structure. After that, hold an organizational meeting to adopt bylaws and issue stock. Finally, apply for S corporation status with the IRS, ensuring you meet all eligibility requirements.