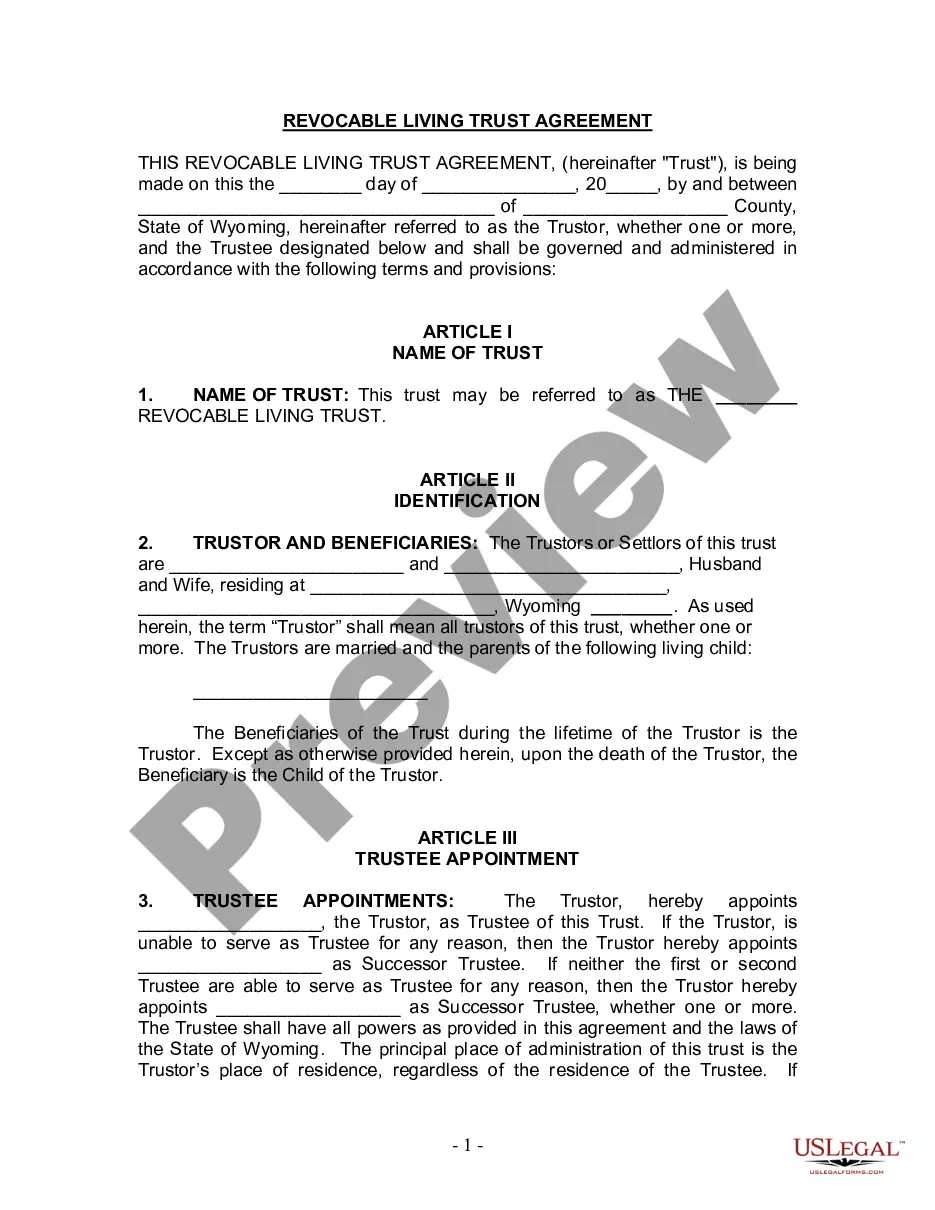

This is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Living Trust Wyoming Without Beneficiaries

Description

Form popularity

FAQ

The main downfall of having a trust is the complexity involved in its management. Trusts require careful planning and regular maintenance to ensure they align with legal requirements and personal wishes. Moreover, failing to keep the trust updated can lead to unintended consequences. However, with the right guidance, creating a living trust in Wyoming can effectively secure your assets without beneficiaries.

One downside of placing assets in a trust includes the potential costs associated with setting it up and maintaining it over time. Additionally, once assets are transferred to the trust, the grantor may feel a loss of control. It's also crucial to ensure the trust is funded properly; if not, it may not serve its intended purpose. Understanding these aspects is vital to creating a living trust in Wyoming without beneficiaries.

A trust fund can have its risks, such as mismanagement of assets or misunderstanding the trust terms. Another potential risk is the lack of flexibility; once assets are placed in a trust, accessing them may become complicated during the grantor’s lifetime. Additionally, if not properly funded, a trust can fail to achieve its goals. It's essential to navigate these risks carefully for a successful living trust in Wyoming.

Creating a living trust in Wyoming involves several straightforward steps. First, decide which assets to include and the potential beneficiaries. Next, draft the trust document, detailing the management and distribution of assets. Many find it helpful to use platforms like US Legal Forms to streamline this process and ensure compliance with Wyoming laws.

While it is possible to create a living trust in Wyoming without immediate beneficiaries, it is generally not advisable. Without beneficiaries, the purpose of a trust diminishes, as trusts are primarily designed to manage and distribute assets. However, it might serve as a way to plan for future beneficiaries. Always consider consulting legal advice to ensure your specific goals are met.

Yes, establishing a living trust in Wyoming can be a wise decision for your parents. A trust helps manage their assets, providing clear instructions for distribution after passing. This approach can also simplify the estate process and protect their legacy. With a living trust, Wyoming residents can avoid the lengthy probate process, ensuring a smoother transition for the family.

Setting up a living trust in Wyoming involves several key steps, such as drafting the trust document, naming a trustee, and transferring your assets into the trust. You can manage this process independently or utilize the services offered by platforms like US Legal Forms to simplify the procedure. A well-structured living trust ensures your wishes are respected, even when you choose to do so without beneficiaries.

If a trust has no beneficiaries, the assets may revert to the creator's estate upon their passing. This can conflict with your original intent and create additional administrative work. When considering a living trust in Wyoming without beneficiaries, it’s vital to plan for the future and determine how the assets should be handled.

Yes, a trust can technically be established without a specific beneficiary, but this situation might complicate matters. In Wyoming, setting up a living trust without beneficiaries may lead to challenges in asset distribution and could ultimately require court involvement. It's essential to consider all implications carefully and possibly seek the help of professionals.

One of the biggest mistakes parents often make is failing to clearly define their wishes within the trust. This can lead to confusion and disputes among family members later on. When establishing a living trust in Wyoming without beneficiaries, it’s crucial to outline your goals and intentions, ensuring that everyone understands how the trust operates.